The Thesis

After a strong 2023 drive by strong demand environment for the Blue Bird Corporation (NYSE:BLBD) product, the first three quarters of 2024 has seen strong double-digit topline growth. In my view, the company’s revenue should benefit from strong growth in EVs and higher pricing in the near term. While the longer-term demand should be driven by the federal funding of approximately $5 billion in the coming years. The company’s margin also looks good with strong pricing and continues focus on increasing operational efficiency in 2024 and beyond. The company’s stock is currently trading below its historical average, and considering a good long-term prospect, I have a buy rating on this stock.

Business Overview

Blue Bird Corporation is an American company, which together with its subsidiaries is primarily engaged in designing, engineering, manufacturing, and selling school buses and related parts across the United States, Canada, and Internationally. This company is a leading manufacturer in the school bus industry and operates mainly through two segments:

-

School Buses: In this segment, the company offers Type C (Conventional), Type D (Transit Style), and specialty buses. The company has alternate power options for its buses, such as propane-powered, gasoline-powered, compressed natural gas-powered, and electric-powered.

-

Parts: In this segment, the company provides a wide range of aftermarket parts and services for the maintenance and operation of their buses to ensure the reliability of the vehicles.

Blue Bird is known for its innovative and reliable buses, with a wide range of models to meet different transportation needs. It also has a significant presence across North America, with a strong dealer network and sales support services for its customers.

Last Quarter Performance

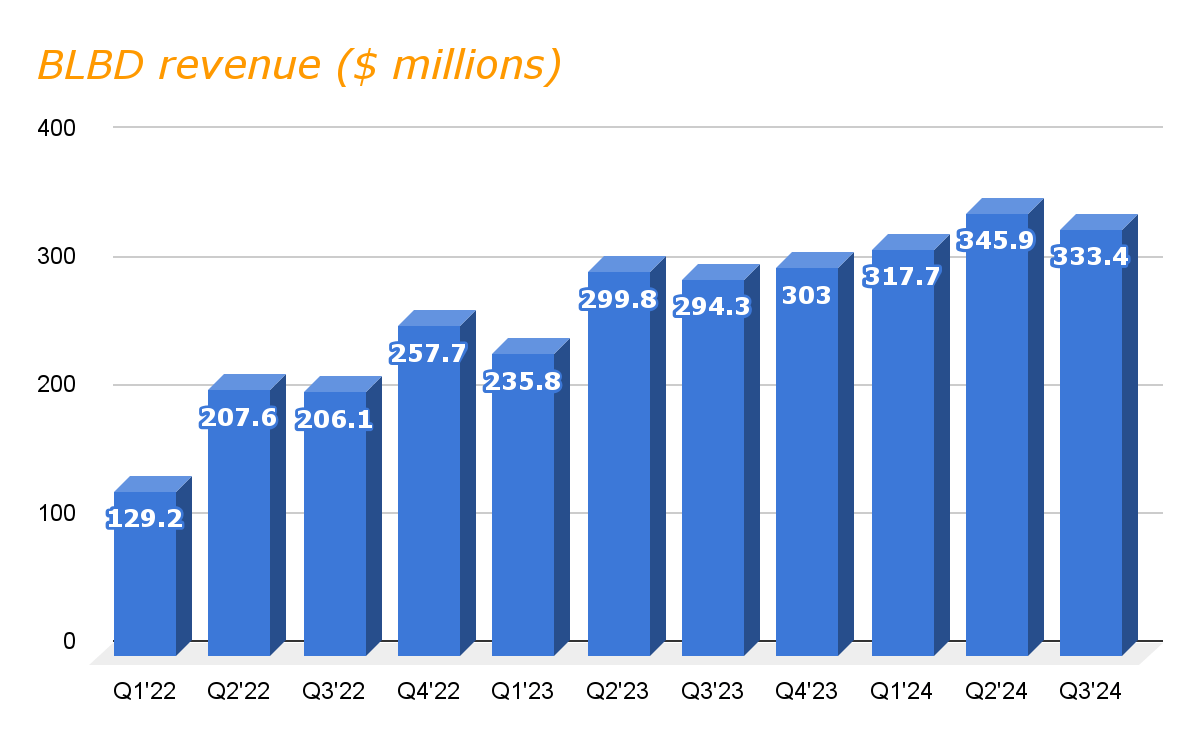

Moving into the second half of the year, the company continued its strong double-digit topline growth as demand for the company’s products remained strong. While the volume growth was almost flat year-on-year, with a growth of just 14 buses versus last year’s same quarter, the revenue growth was driven primarily through higher pricing and an improved mix of Type D and EVs. The pricing grew 13% year-on-year, which is approximately a $17,000 increase in the average sales price per bus, which resulted in a growth of 13.3% to $333.4 million in the company’s topline versus the prior-year quarter.

BLBD revenue (Research Wise)

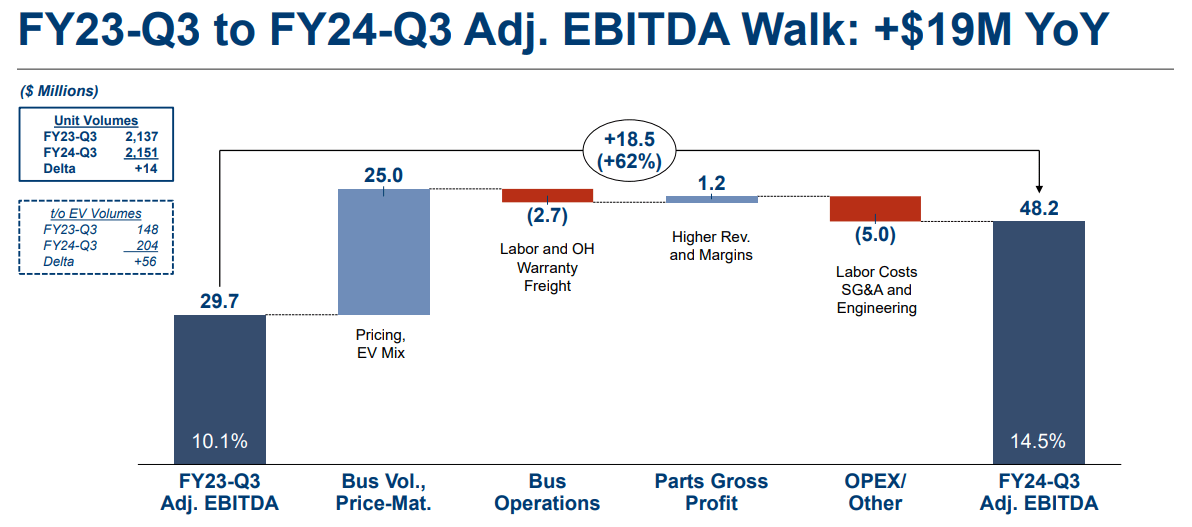

Strong price realization also helped the company’s margin during the quarter, which along with benefit from a strong mix of higher margin Alternative Powered Vehicles resulted in a year-on-year jump of about 440 bps in the company’s adjusted EBITDA margin reaching 14.5% during the third quarter of 2024. Labor and material costs, however, increased during the quarter, partially offsetting the benefits from strong pricing and a favorable mix. EBITDA growth during the quarter also benefitted the company’s bottom line performance as the company adjusted EPS more than double to $0.91 from just $0.44 a year ago, beating the consensus estimates by $0.40 in the third quarter of 2024.

BLBD EBITDA Y/Y comparison (Company presentation)

Outlook

After a strong 2023, BLBD is heading toward another amazing year with decent double-digit topline growth in the first three quarters of 2024, with growth in the mid-teen in the last quarter. I expect this strong growth to continue as market demand for the company’s school buses continues to be very strong. This, along with increasing order share favorable pricing, should fuel topline growth for the company in the quarters ahead. The company’s backlog levels are also strong, currently worth about $775 million as of the third quarter of 2024, and reflecting over 5200 buses.

In the last quarter, order bookings for EVs, which are a part of the alternative power mix, grew by 38%, leading to an EV order backlog of 567 units, which is worth about $180 million, which is an 11% year-on-year increase. In my opinion, this strong backlog level should drive sales growth for the company in the quarters ahead. While the overall demand remains for EVs remains strong, the company is reducing its EV sales outlook by about 100 units primarily due to the timing of EPA (Environment Protection Agency) orders and requested delivery timing, which should give headwinds to the Q4 2024 sales.

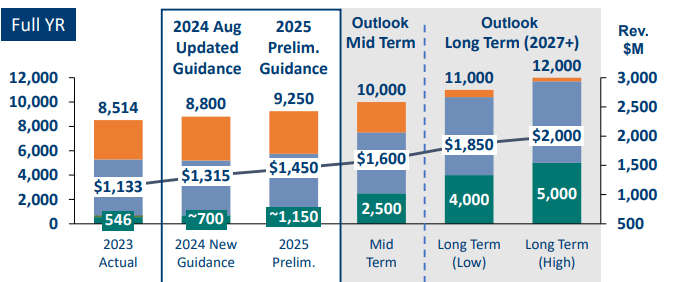

BLBD Guidance (Company presentation)

The company’s demand outlook for the near term looks promising, thanks to strong pricing and an improving mix of alternative-powered vehicles. While the near term looks good, the company is well-positioned to benefit significantly from federal funding for clean and environment-friendly school buses. The EPA, which is an agency, that is providing significant funding to support the adoption of electric and propane school buses under its EPA five-year clean school bus program has allocated $5 billion for electric and propane buses with approximately $4 billion still available to be injected in the coming quarters. In 2023, under this program, EPA offers about $2 billion through two rounds of approximately $965 million and $940 million each. Although the latest round of fund allocation under this program is a lottery-based rebate, the company is expecting to win approximately 30% of these orders or 1900 buses. If the company’s prediction holds true, then this should significantly boost the company’s sales for FY25 as deliveries of these units are expected to be starting mid-2025.

In addition to this, the IRA (Inflation Reduction Act) has also allocated $650 million for electric-powered buses. In my view, this industry is set to get a significant amount of investment in the coming years to continue supporting clean bus adoption. Considering BLBD’s strong market position with a strong presence across North America, the company’s topline should benefit from this funding beyond 2024.

Furthermore, the company is also focusing on its future expansion plan to address the expected rising demand in the longer term. The company has also been awarded an $80 million grant by the Department of Energy to increase the EV and overall production of their Type D buses, which should help the company in expanding its single shift capacity of school buses from 10,000 to 14,000 buses annually, which should support the company in dealing with anticipated demand growth in the coming year, leading to topline expansion in the longer term.

Valuation

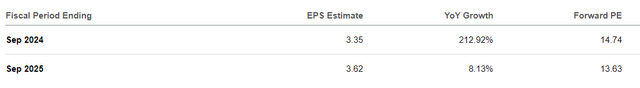

In the past year, the BLBD stock has given approximately 150% returns to its investors as the company’s topline and bottom line continued its strong performance throughout the year. Currently, the company’s stock is trading at a Non-GAAP forward P/E ratio of 14.74, based on the FY24 EPS estimates of $3.35. For FY25, with EPS estimates of $3.63, the stock forward P/E is 13.63. On comparing with the five-year average P/E of 30.25x, the company’s stock appears to be at a notable discount of over 50%.

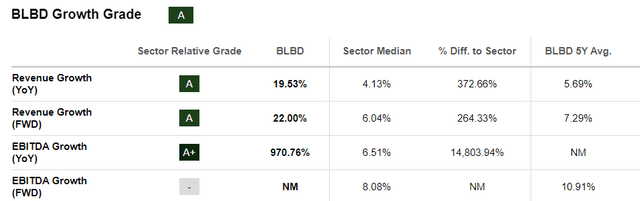

BLBD Eps estimates (Seeking Alpha) BLBD growth grade (Seeking Alpha)

I expect the company’s revenue to continue its strong growth further in the coming quarter as demand remains strong for the company’s buses. This should result in volume growth, which, along with benefit from high pricing and improved mix of higher margin category, should help the company in its margin growth in 2024 and beyond. As we can see in the chart above, the company’s margin performance has outperformed the sector median by a significant difference, as the company is strongly positioned in the school bus industry. I expect the company’s margin to continue to grow steadily in the coming quarters and achieve its 15% long-term EBITDA margin target, which should also drive the company’s bottom line leading to further enhancement in the company’s stock valuation in the future.

Risk

The company’s profitability has increased significantly in the recent quarters, which has benefited the company’s bottom line as well, with the last quarter’s adjusted EPS more than doubling from the last year’s quarter. My thesis is built upon the expectation that the company should continue this strong performance further, leading both margin and bottom line growth. However, if the company’s topline growth falters, this could lead to volume deleverage in the coming quarter, negatively impacting the margins. Such topline and margin weakness then could put pressure on the company’s bottom line, resulting in deterioration in the stock valuation, potentially leading to poor stock performance.

Conclusion

As we discussed above, the company’s stock is trading at a discount to its historical averages. I am expecting the growth across both top and bottom line to continue further as the demand environment remains strong, and the company continues to focus on improving operation performance. The long term also looks promising; therefore, I would suggest buying this stock at the current levels.

Read the full article here