Right now, Highwoods Properties, Inc. (NYSE:HIW) represents a deep-value opportunity in the office leasing market. The market is basically willing to give you access to its net assets for 50 cents on the dollar. And to sweeten the deal, the price it will sell the stock at provides a safe 11.24% dividend yield; something to keep you waiting until it changes its mind about how much HIW is really worth. A get-paid-to-wait deal in essence.

What doesn’t make sense is that Highwoods is a solvent, conservatively financed, and historically profitable REIT with a portfolio in Sun Belt states. What’s the catch? Well, it’s basically that you need to go against the grain and make an investment that most investors right now are unwilling to. What I hope to accomplish with this analysis is to help you understand why you are more likely to be on the right side of this bet given the data and sound reasoning. Let’s get started…

The Market Has Made Its Statement

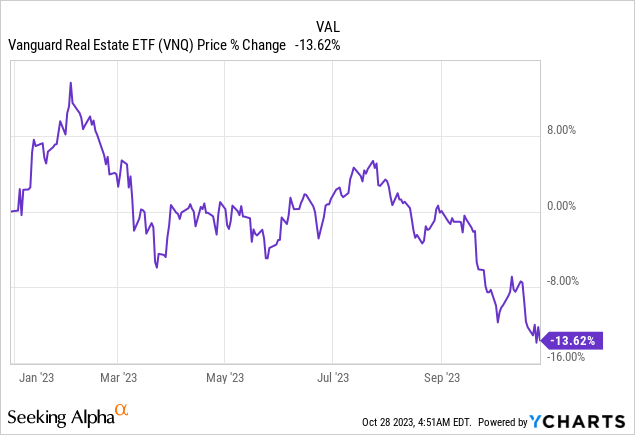

It’s not just office landlords. Real estate in general has taken a hit this year:

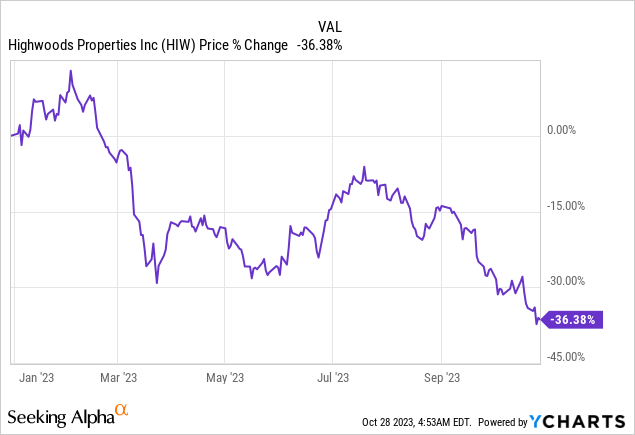

It’s just that office REITs are down 17.41% YTD; a bigger sell-off that could signal something more than just a risk-off attitude. Highwoods’ fate was even worse:

Is the market trying to say something? First, that office space is dying, and, second, that Highwoods is going to suffer a painful death? Or at least, that the future is uncertain for office space and that Highwoods is in a risky situation? All possible messages.

Either way, the market would be wrong in a major way here when it comes to many good undervalued office REITs. Highwoods is one of them and is not only likely to endure but possibly see its stock price experience a great correction once the improving fundamentals of office space hit home. Speaking of which…

Office Space Is Not Dying

Before I explain why Highwoods is well-positioned for a more reasonable reassessment of the office leasing market, I need to first demonstrate why the current outlook based on key data makes the view that office space is dying nothing more than an eye-grabbing headline.

I must of course propose a potential basis for the market’s current pessimism in order to demonstrate how unreasonable it would be. I believe the reaction is driven by usual suspects such as:

- low unemployment

- high quit rates

- low office attendance

- high vacancy

- low leasing volume, and

- oversupply concerns.

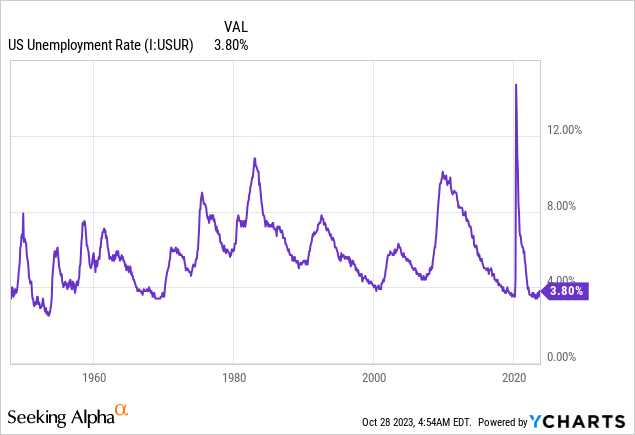

Sure, it’s not unreasonable to assume that U.S. employers are being careful in how fast they apply back-to-office policies. Unemployment is still historically very low:

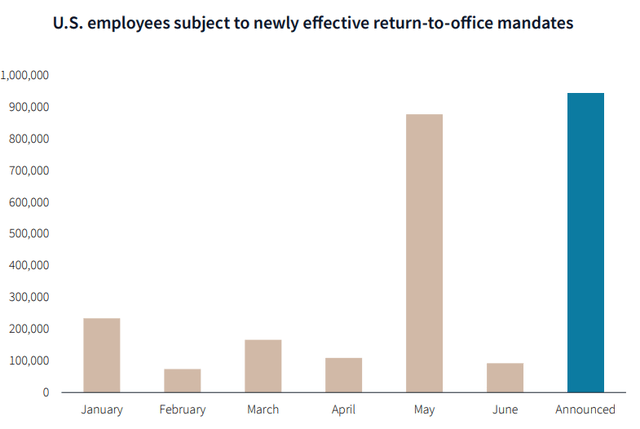

However, there is steady progress toward return-to-office policies. Based on JLL, new attendance policies that had taken effect by the end of the second quarter this year accounted for 1.5 million U.S. office-based employees. Additionally, as of the end of the second quarter, there were mandates expected to take effect through the end of the year for 1 million more. Plus, quit rates had trended down sharply in the second quarter from the mid-2022 ones.

JLL

And short-term trends are supported by the thesis that employers have had plenty of time to realize the drawbacks that come with remote work. Based on the same JLL report, lagging innovation and productivity are clearly present by the all-time low patent application volume and a persistent downtrend of business sector productivity which hasn’t been observed for over 60 years. More importantly, the evidence is also in developing research by academics which suggests serious consequences for human capital development when it comes to working remotely.

When the labor market starts losing its leverage, employers may become even more aggressive with return-to-office mandates, increasing attendance rates. By the way, there is already a ~9% increase in YoY attendance. Per JLL, re-entry rates might set a new post-pandemic record in the fourth quarter.

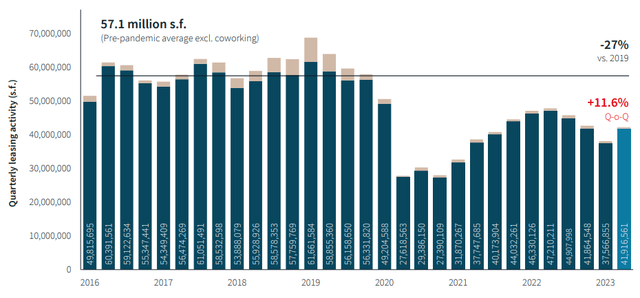

A changing trend is also observed in national leasing volume for offices which experienced an 11.6% QoQ growth, the first increase in the last four quarters:

JLL

Over the medium term, leasing activity is expected to normalize and that naturally points to an end of vacancy rate expansion and the start of its gradual decline during the next year.

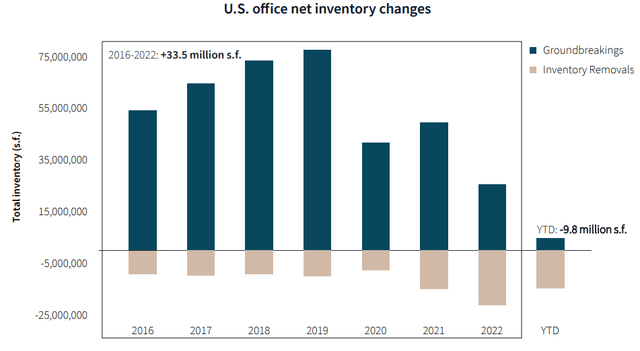

Last, the U.S. recently experienced a record volume of office property conversions, redevelopments, and demolitions. For context, consider that during the period of 2000-2019, the average office space that was removed from inventory for conversion, redevelopment, and demolition per year was 6.6 million sqft. This volume increased to a record 14.9 million sqft of office space removed in 2021 and to 21.1 million sqft in 2022. Now, get this; in only the first half of 2023, there were already 14.7 million sqft of office space removed from the market. Coupled with a downtrend in groundbreaking, the threat of oversupply is gradually getting removed from the picture as well:

JLL

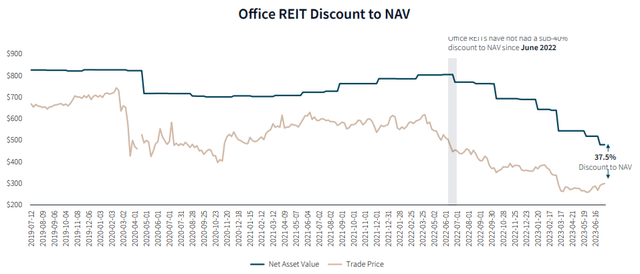

It’s quite clear that the current discount to NAV for office REITs cannot be easily justified:

JLL

Sure, for some REITs in unattractive markets, the pessimism can be reasonable. But the market has thrown the baby out with the bathwater when it comes to Highwoods and now I’ll explain why…

Attractive Locations and Tenants

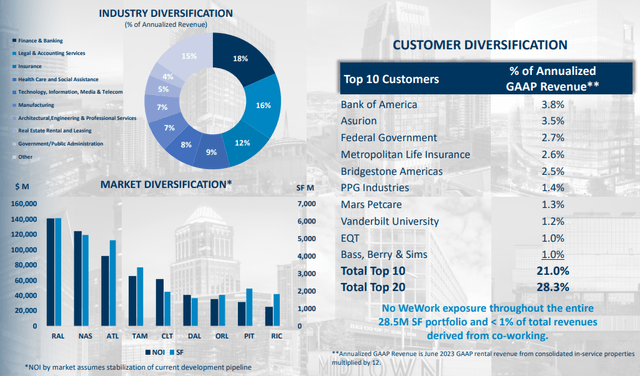

Founded in 1978 (incorporated as a REIT in 1994) and headquartered in Raleigh, North Carolina, Highwoods owns, develops, acquires, and leases properties in Atlanta, Charlotte, Dallas, Nashville, Orlando, Raleigh, Richmond, and Tampa, with a focus on the best business districts (BBDs).

As of June 30, 2023, Highwoods owned or had an interest in 28.5 million rentable square feet of in-service properties. It also had 1.6 million rentable square feet of office properties which were under development, as well as development land with approximately 5.2 million rentable square feet of potential office buildings.

As you can see in the image below, the bottom left chart shows that the company is well diversified across the states it manages properties in, both based on sqft and NOI:

HIW Presentation

The same is true when it comes to the industries its tenants are in; it’s also good to see that most of the revenue comes from financial institutions, banks, law and accounting firms, as well as insurance, as opposed to tenants in Information Technology that can be more flexible when it comes to work-from-home policies and to which the hybrid system is most likely to apply.

Additionally, its top 10 major tenants don’t account for a lot of the REIT’s revenue (21%). Moreover, the top tenants include a bank, the federal government, and insurers.

A Long-Term Trend of Operating Performance Growth

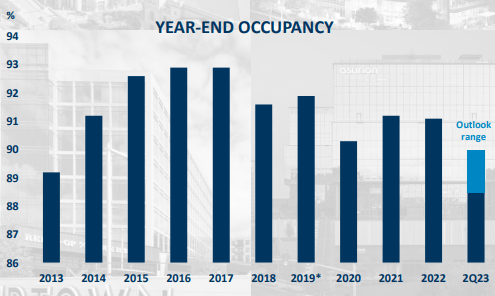

As expected of an office REIT these days, occupancy for Highwoods was at 89% as of the end of the second quarter and 88.6% as of the end of the third one. While two-thirds of all U.S. office buildings were recently reported as more than 90% leased, this isn’t historically too much lower for the company:

HIW Presentation

Both the current rate and its undecisive trend can be alarming in regard to the REIT’s profitability, but it’s not the only driver you should assess (especially when it represents the normal for many other office REITs right now). Tenant retention, another good measure of efficiency, helps the company to not have to rely on new leases to offset expiring ones and preserve its revenue stability.

In the third quarter of 2023, Highwoods renewed leases with prior tenants for about 502,955 sqft, while new leases accounted for 152,105 sqft. For context, 2,317,237 sqft worth of leases would expire in 2023 as reported in the 10-K filed in 2022; the 3Q23 renewals alone annualized would cover the largest portion of the expiring ones.

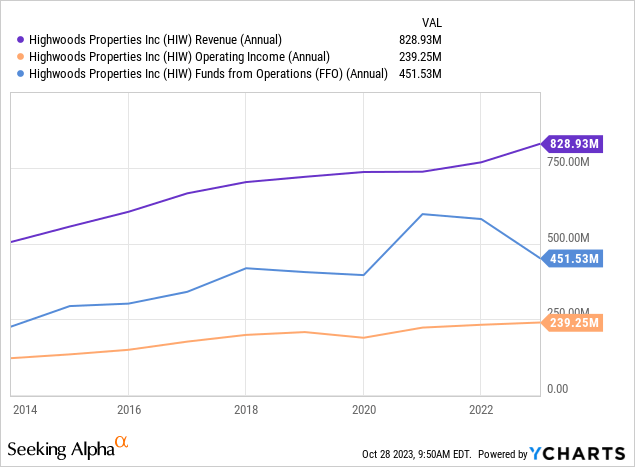

Before I move on to recent operating results, I also need to note that the company’s profitability has been growing in the last 10 years, developing an upward trend that is sure nice to see when it comes to office REITs:

More recent results are also good. The latest quarterly figure annualized reflects a 6.48% growth from the last 3-year average. Similarly, last quarter’s cash NOI annualized represents an 18.16% growth from the 3-year average figure. However, due to a decrease in operating cash flow as implied by the lower Q3 FFO annualized figure when compared to the previous two fiscal years, AFFO marked an insignificant increase of 1.91%.

Low Leverage, High Liquidity

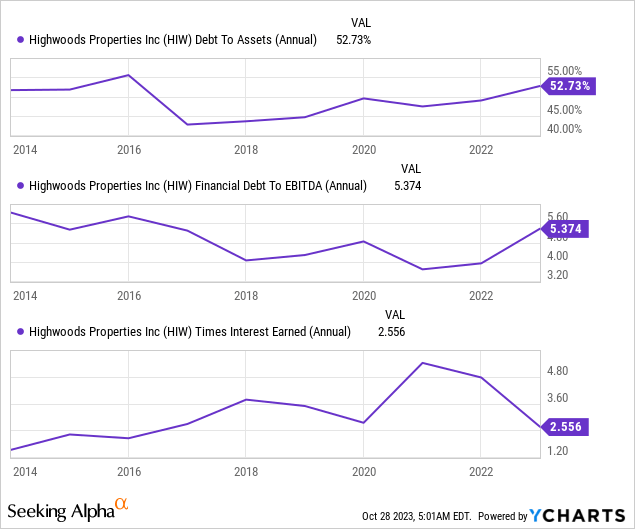

Calling Highwoods a sufficiently solvent company is an understatement. With a total debt to total assets ratio of about 50%, Debt to EBITDA at 5.4x, and earnings covering interest payments about 2.5 times, this is a conservatively financed and liquid REIT.

Moreover, I appreciate the absence of any definite trend in the last decade to indicate these metrics may deteriorate:

As of September 30, 2023, its financial debt consisted of mortgages, notes, and preferred units, netting $3.24 billion. About 79% of it is unsecured, providing Highwoods with plenty of financing flexibility. Additionally, the unsecured portion had a weighted average interest rate of 4.31% and the secured one of 4.23%, both relatively low these days. Last, 77% of the debt had a fixed rate and 23% was variable, which makes the average interest rate of the total amount less likely to change materially if things get worse in the near term.

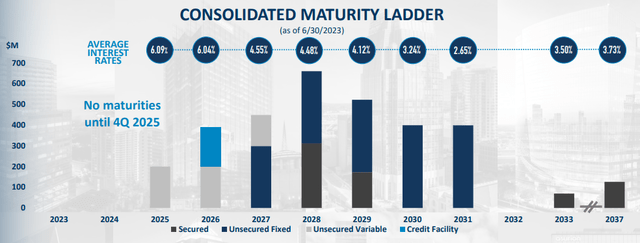

While the interest is attractively low, cautious investors will likely want to check for potentially higher rates from refinancing. However, there are no maturities until the end of 2025:

Investor Presentation

And with the average interest being approximately 6% concerning both the debt maturing in 2025 and 2026, the expectation for higher cost is naturally pushed out to 2027. But even then, it’s highly unlikely that interest rates will be as high in 2027 as today based on the consensus expectation that we have approached or approaching the end of the rate hike cycle and the Fed is going to start cutting rates in 2024.

So, even when attempting to assess the long-term scenarios, Highwoods looks pretty good regarding its cost of debt. Maturities are also well-laddered up to 2031.

A High but Safe Dividend Yield and a Huge Discount to NAV

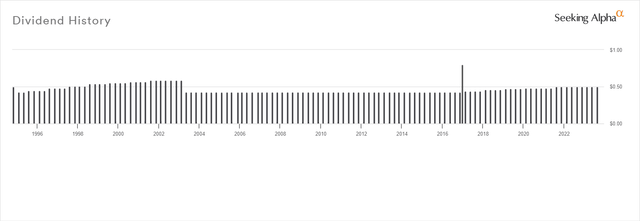

Highwoods currently pays a quarterly dividend of $0.50 per share and its forward yield comes at 11.24%. Though investors should be skeptical of high yields, they’re often so scared that they miss the big picture. This REIT’s yield is mostly a result of a falling price and not a relatively high and unsustainable distribution.

I believe the payout here to be safe for three reasons. First, the company has cut the dividend only once in the past and that was back in 2003:

Seeking Alpha

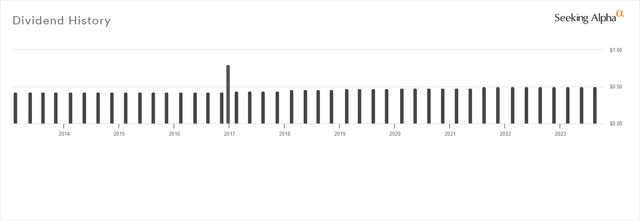

Second, it has been consistently increasing it for 6 straight years:

Seeking Alpha

Third, its payout ratio based on FFO is at 53.69%. And if we want to be conservative, the ratio based on AFFO reaches 91.13%, still manageable. Even though cash flow may have suffered lately, as we observed above this is not representative of the REIT’s historical performance and future prospects support the expectation of improvement.

All in all, the reluctance to cut the dividend for about two decades, the persistence in growing it in the more recent past, and the adequate liquidity even when accounting for the high maintenance CapEx supported by a strong growth trend and good prospects make the distribution safe and the current yield sustainable.

What is unsustainable here is the price in my view. Highwoods and its four closest dividend-paying competitors (DEI, SLG, JBGS, CDP) together offer an average yield of 8.22%. As the market starts appreciating the high and safe dividend yield of 11.24% that Highwoods currently offers, an increasing price per share will start narrowing this margin.

An even higher upside is represented by the REIT’s forward FFO multiple currently at 4.78; a comparison to the multiples of the 5 most relevant office REITs based on market capitalization makes this quite clear:

Just to close the gap between the REIT’s current P/FFO ratio and the average, the stock price would need to nearly double.

This upside is also validated by the 10.97% implied cap rate HIW is trading at. A more appropriate but conservative rate would be around 7% (6.97% implied cap rate for REITs and 6.38% cap rate for single-tenant office properties). And considering 1) the Sun Belt focus of HIW and 2) the fact I assumed no growth for cash NOI, this may prove even more conservative in the future; as we’ve observed above same-store cash NOI has grown significantly.

But even based on a 7% cap rate, NAV comes at $43.24 per share, representing a 142.94% upside from the current price of $17.8 per share.

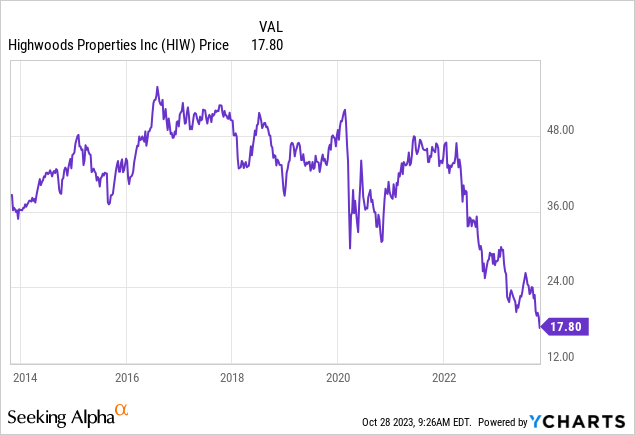

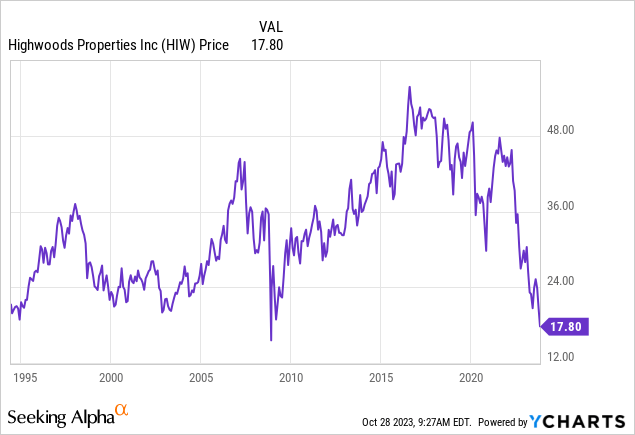

Though when the fundamentals are good and a margin of safety is present I don’t really care about whether the stock price has even been as high as NAV, many investors do. So, for what it’s worth, in the past 10 years, $40 to $50 per share has been familiar territory for HIW:

To the contrary, it hasn’t traded as low as it is today since 2008, making $17.8 per share a historically low and rare price tag:

So there you have it. Before we wrap it all together, I would like to note a few risks you should know before you invest…

Risks

The first main risk I should mention comes from the possibility of another rate hike by the Fed by the end of the year. If interest rates rise again, this may apply more pressure on HIW. On the bright side, it would be most likely the last hike of the cycle, with potential cuts starting in 2024.

Another thing that personally always concerns me, which is also unrelated to HIW, is opportunity risk. If the upside is not realized within a reasonable time frame, you may realize an opportunity cost related to your annual return target. REITs can be slow growers and that makes this risk even higher in my opinion. In this situation in particular though, it’s at least comforting that 1) the current dividend yield of HIW is high enough to offset such cost and that 2) the upside is also adequately high to decrease this risk significantly; I would be more worried about just a 20% upside these days.

A last important risk relates to the office property market. Regardless of how overblown the danger that comes with owning office REITs is, all you need for a volatile ride is the market to keep overestimating this danger until the WFH situation stabilizes. That being said, volatility translates into risk only if you are likely to sell at the wrong time, an action for which lack of conviction is a major motivator; something that I hope I helped you build by now with this article.

Last Thoughts

I also want you to know that I am not sure $17.8 per share is the bottom. While a Reuters poll had 90 out of 111 economists anticipating the Fed to maintain the rate within the 5.25%-5.50% range in November, 91 of them also expect that rate cuts might be delayed until the second quarter of 2024, at the least; it’s possible more pressure is on the way until we see that first cut.

Therefore, I intend to dip my toes in a few days with a small position and keep buying up to ~$38 per share. I also aim to keep track of HIW and report in the comments below anything that’s worth reporting. If something materially alters my thesis (price increases to a level I am not comfortable with for instance), I will make sure to follow up with a new article.

If you have any questions, want to comment on something, or just let me know if this analysis was useful, don’t hesitate to reply below and I’ll get back to you shortly. Thank you for reading!

Read the full article here