It has been over a year since I have taken a closer look at Pacira BioSciences (NASDAQ:PCRX) and the company’s performance, and a brief review points to a company that is dealing with multiple challenges that have impacted their growth trajectory. As a result, the market has punished PCRX and the ticker has been hitting fresh 52-week lows. Typically, I would be hands-off and wait for the cost to be clear before I consider restarting my accumulation, however, I have been formulating a game plan for my dormant PCRX position ahead of their critical Q3 2023 earnings release on November 2nd, just in case the market wants to overreact and provide an opportunity to manage my position.

I intend to provide a brief background on Pacira BioSciences and will review their recent performance. Then, I will discuss what we should be looking for in the company’s Q3 earnings and the potential opportunities following the earnings. In addition, I will point out some key downside risks and how I plan on managing my PCRX as we head towards 2024.

Background On Pacira BioSciences

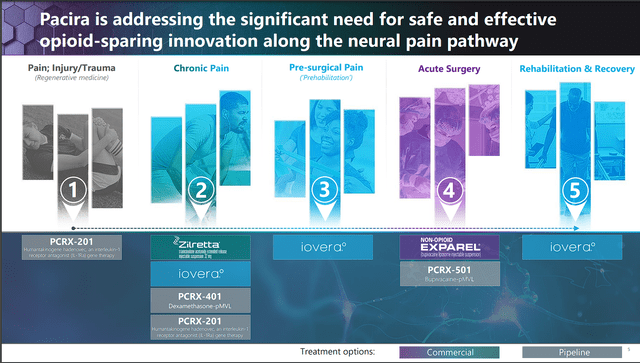

Pacira BioSciences is a leading provider of advanced solutions for non-opioid pain management and regenerative health in the United States. They offer a comprehensive range of products, including EXPAREL, an innovative injectable bupivacaine suspension enclosed in liposomes for effective pain relief. Additionally, they provide ZILRETTA, an extended-release injectable suspension containing triamcinolone acetonide for sustained discomfort relief.

Furthermore, Pacira BioSciences has introduced the iovera system, a state-of-the-art handheld cryoanalgesia device. This groundbreaking technology delivers controlled cold temperatures directly to targeted nerves, offering a non-opioid alternative for pain management.

Pacira BioSciences Pipeline (Pacira BioSciences)

Pacira BioSciences’ pipeline is filled with innovative treatments like PCRX-201 (Humantakinogene hadenovec) and PCRX-401 (Dexamethasone-pMVL), poised to revolutionize pain management approaches. Additionally, the company is at the forefront of developing a proprietary multi-vesicular liposome technology acquired through the Flexion Therapeutics acquisition. This innovative drug delivery system encapsulates medications without altering their fundamental molecular structure, thereby enhancing the effectiveness and safety of their treatments.

Recapping Q2 Earnings

Before discussing Pacira’s Q3 earnings, we need to recap their Q2 earnings to get a better understanding of why PCRX has experienced relentless selling pressure. The big EXPAREL experiencing a year-on-year $2M decrease, despite a substantial boost in sales volume. It was apparent that pricing emerged as a significant factor influencing this trend, with the 340B drug pricing program presenting an inimitable challenge for Pacira.

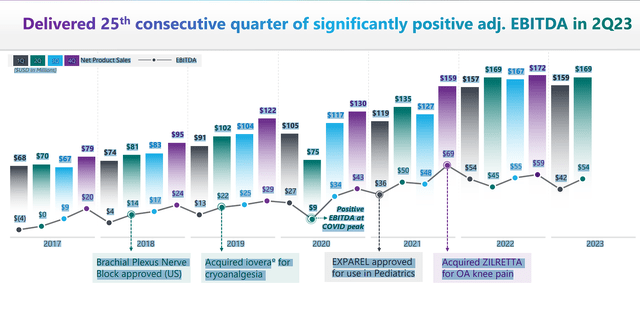

ZILRETTA and Iovera were able to muster a strong quarter sales followed suit, demonstrating an encouraging upward trajectory. Pacira reported a net income of $25.8M, reflecting strong fiscal health. This translated to $0.56 per share (basic) and $0.51 per share (diluted), indicating a solid performance across the board. The company’s adjusted EBITDA stood tall at $54.3M, showcasing operational efficiency and strategic financial management. Of note, Q2 marked 25 quarters of consecutive positive adjusted EBITDA.

Pacira BioSciences 25 Quarters Of Positive EBITDA (Pacira BioSciences)

However, the company made notable revisions downward signaling a cautious stance. EXPAREL net product sales are projected to range between $550M to $560M, down from the previous estimate of $570M to $580M. Meanwhile, ZILRETTA’s net product sales are estimated to range from $110M to $115M, revised from $115M to $125M.

Moreover, Pacira expects their non-GAAP gross margin to be between 73% and 74%, down from the earlier projection of 76% to 78%.

These revisions, particularly in EXPAREL sales, present an additional challenge to PCRX’s potential upward revaluation in the medium term.

Following the company’s Q2 earnings this risk felt palpable as investors were concerned about PCRX’s top-line numbers going forward. As a result, PCRX has been punished dropping roughly 50% over the past twelve months.

Preparing For Q3 Earnings

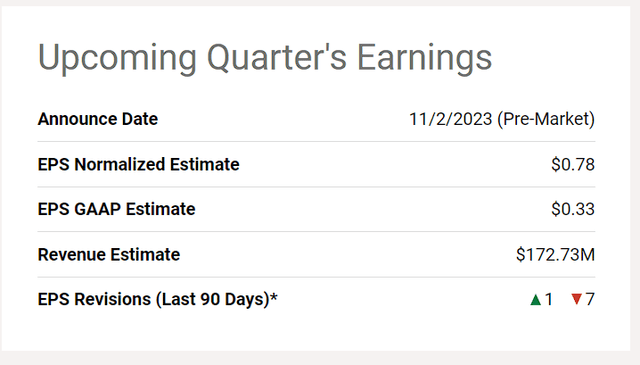

Looking ahead to Pacira’s Q3 earnings report, the Street is expecting the company to report a normalized EPS of $0.78 and GAAP EPS of $0.33. In terms of revenue, analysts are expecting Pacira to report around $172.73M.

Pacira BioSciences Upcoming Earnings Estimates (Seeking Alpha)

If Pacira hits these numbers, they would be reporting year-over-year growth for both EPS and revenue. Unfortunately, $172.73M in revenue would be roughly 3% year-over-year growth, which is clearly not what a company this size is looking for at this stage of their development. Make note, that this estimate would be the company’s 4th consecutive quarter of single-digit growth, which is not what investors are looking for in this market.

Pacira BioSciences Earnings History (Seeking Alpha)

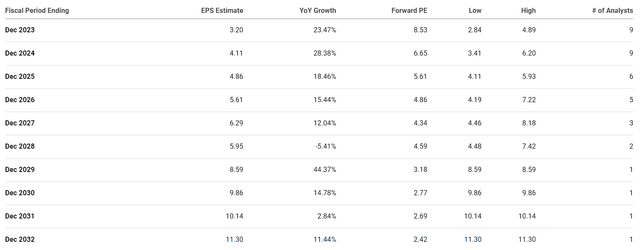

However, not everything about the Q3 earnings could be disappointing. Pacira is steadfast in its pursuit of refining gross margins, with strategic initiatives in place to bolster operational efficacy. In turn, Pacira could elicit strong EPS growth in the coming years despite marginal revenue growth.

In fact, the Street expects Pacira to report strong double-digit revenue growth over the next few years.

Pacira BioSciences EPS Estimates (Seeking Alpha)

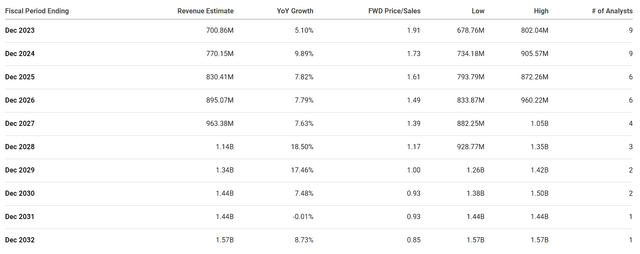

Yet, the Street is expecting the company to only report single-digit growth over the same time period.

Pacira BioSciences Revenue Estimates (Seeking Alpha)

So, I believe investors should not hyper-focus on Pacira’s Q3 revenue growth and consider the company’s EPS growth trajectory.

Growth Vs. Value

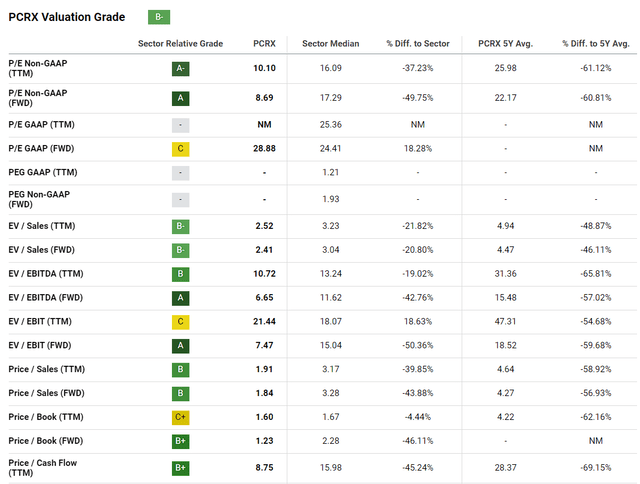

With the market currently valuing PCRX at 8.69x forward earnings and approximately 6.6x forward EV/EBITDA, the company is notably trading at a lower valuation compared to sector averages. However, this apparent discount appears justified, given the company’s softer guidance outlook.

Pacira BioSciences Valuation Grade (Seeking Alpha)

Still, Pacira BioSciences remains on a positive trajectory in the realm of pain management. Armed with a robust portfolio, a fertile pipeline, and a solid financial footing, Pacira is poised to help redefine pain management for patients across the globe.

Yes, we would like to see Pacira report explosive revenue growth, but failure to meet the Street’s previous expectations should not result in the ticker being punished as if it is a speculative tech play that has a broken model and is still years off from clearing a profit. Honestly, I am willing to see if the market wants to continue to discount a ticker because it is fixated on top-line growth in an economic environment that is not conducive to expansion. Meanwhile, the ticker is already trading at a discount compared to its peers, despite Pacira’s ability to bank profits, and is positioned to be one of the leaders in their industry.

Downside Risk

While Pacira’s future appears promising, it’s imperative to acknowledge the inherent uncertainties. Pacira is still subject to a multitude of factors including economic conditions, regulatory approvals, and market acceptance. These variables underscore the complexity of an investment in PCRX. Any setback in these areas will almost certainly result in a negative impact on the share price and possibly the company’s long-term outlook.

In fact, the 340B drug pricing program has already hurt Pacira’s pricing and earnings. As a result, I am considering removing PCRX from the “Bioreactor” growth portfolio which is now in the Compounding Healthcare “Bio Boom” speculative portfolio. In addition, I am also considering downgrading my PCRX conviction level to 2 out of 5.

Our Takeaway

Although I am bullish on Pacira BioSciences over the long term, I am still looking at this ticker with a discerning eye due to the substantial challenges that exist in a dynamic market environment. A comprehensive understanding of the company’s financial landscape and pipeline potential does point to growing intrinsic value. So, I believe there is a case for buying PCRX at a discount following the company’s Q3 earnings.

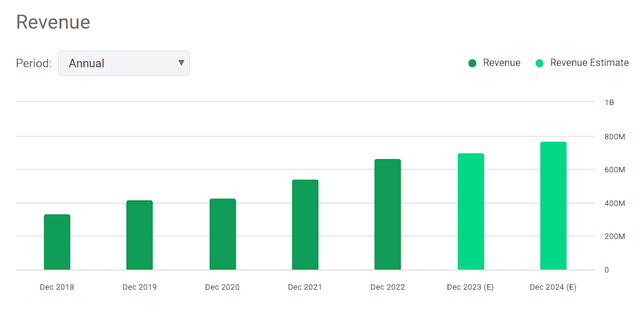

Pacira BioSciences Annual Revenue (Seeking Alpha)

Still, Pacira is still projected to report nominal growth… Consequently, a failure to hit the Street’s expectations and record growth, I will be forced to relegate PCRX to the “Bio Boom” speculative portfolio.

My Plan

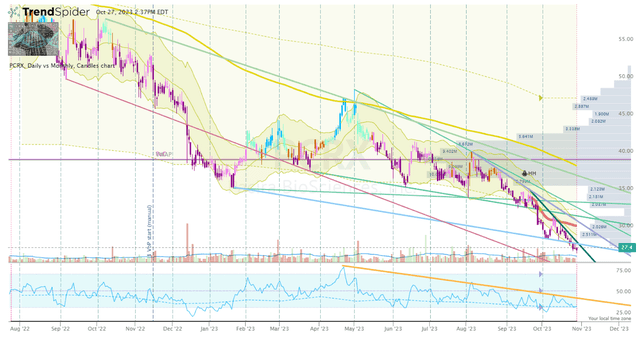

Currently, PCRX is trading around $27.50 per share, which is well below my previous “Buy Threshold” of $56 per share. In fact, PCRX is trading below my previous Buy Target 1 and Buy Target 2.

PCRX Daily Chart (Trendspider)

So, in my view, the ticker is trading at a discount for its previous growth prospect. Nevertheless, those prospects are now in question, so, I am adjusting my Buy Threshold and Buy Targets to account for the ticker’s existing state of affairs.

Read the full article here