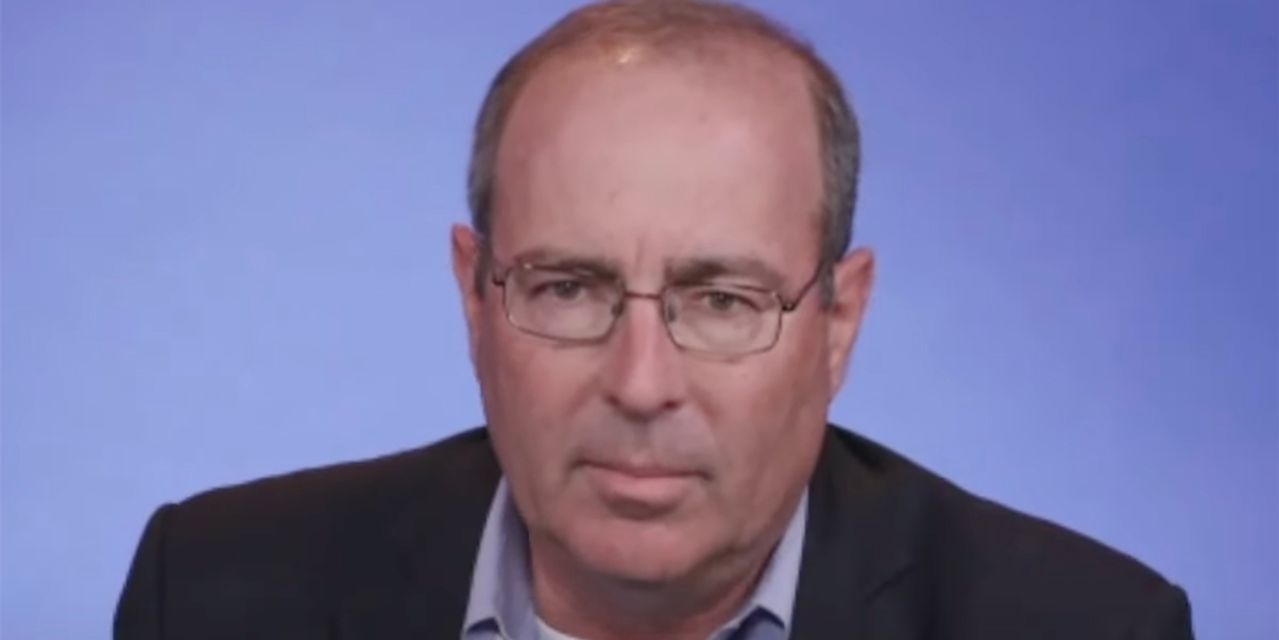

The October employment report showed a “gradual lessening” of the job market that would be welcome by those who want the Federal Reserve to stop raising interest rates, said Richmond Federal Reserve President Tom Barkin on Friday.

“What we saw today was data that showed a gradual lessening of the job market. I think that’s what those who would like to not see another rate hike would want to see,” Barkin said, in an interview on CNBC.

Barkin ducked questions about whether he thought the Fed might be done raising interest rates.

“I don’t prejudge” what the Fed might do, including at its next meeting in December 12-13, Barkin said.

“We just got out of the last meeting,” he said.

“Do you feel you have done enough?” Barkin was asked. “What I would say is we want to be done with inflation,” he answered.

The Richmond Fed President, who will be a voting member of the Fed’s interest-rate committee next year, said there has been a disconnect between what he is hearing from his contacts and the data.

Some companies still think they have market power to raise their prices. Others have taken a step back, he said.

He said he doesn’t think consumer spending is as frothy as implied by the 0.7% gain in September retail sales.

Barkin said the prospect of interest rate cuts was “a ways off, in my mind.”

U.S. stocks

DJIA

SPX

were higher Friday and 10-year Treasury yield

BX:TMUBMUSD10Y

dropped again on hopes in the market that the step-down in job growth in October would keep the Fed on the sideline until next year when the central bank could start cutting its policy rate.

Read the full article here