Accenture plc (NYSE:ACN) is a professional services company focused on IT services and consulting. Its services are available on a broad global base, with very few geographies not represented by the company. It is based in Ireland.

Its market cap is almost $196B. My thesis at Accenture is simple: to be the picks and shovels of any technological transformation. In this way, Accenture benefits from the technological changes that occur in the world, but with much smaller investments. As we have seen so far, technological disruptions, far from harming it, have benefited it.

Business Model

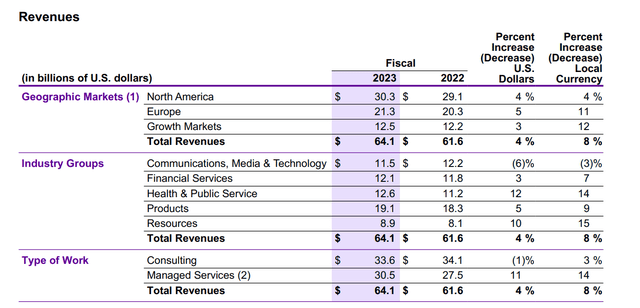

Accenture’s income is divided almost 50%-50% between consulting services and outsourcing services. Most consulting contracts are short-term (12 months or less) since they are finite and specific projects, while outsourcing contracts do have a longer duration. These outsourced services help clients transition to cloud and managed security services and are typically a more repetitive and recurring than consulting. 50% of its income comes from North America, a fact that makes sense, since it is the country with some of the best companies in the world. As we can see in the photo taken from its annual report, it serves a multitude of different industries.

Source: Accenture`s annual report

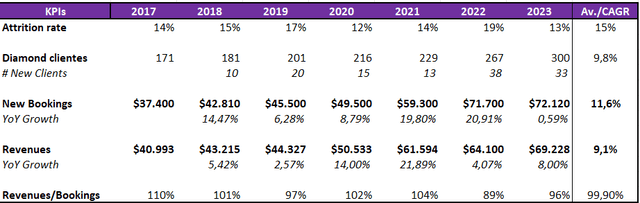

Three other KPIs to pay attention to are the attrition rate, which is the company’s employee turnover rate. It is calculated as the number of employees who leave the company during a given period of time, divided by the total number of employees at the beginning of that period. The lower the better, and we already see that in 2023, the percentage has dropped from 19% to 13%. The IT industry is very competitive and all companies need engineers, this makes it difficult to compete for their services and they end up getting into a salary war. It is not surprising that labor expenses are the largest in the company and are included in consulting expenses.

The second would be the Diamond Clients. These are clients that generate more revenue for the company. To be considered a Diamond Client, you must generate more than $100 million in revenue for Accenture and have a relationship of 5 years or more. Some of these companies are Salesforece (CRM), Adobe (ADBE), AWS… They have grown at a CAGR of 9.8% over the last 6 years. The more diamond clients there are, the more recurring, resilient, stable and less discretionary Accenture’s sales will be, since the financial health of these companies can be trusted and they need Accenture’s services to optimize their business and be at the technological forefront.

Finally, you have to monitor the number of New Bookings of the company, and compare the percentage of sales with respect to these. We see that new bookings have grown at a CAGR of 11.6% compared to 10% of sales. New Bookings are the value of new and renewed contracts that the company has won in a given period of time. It is important to see a positive trend, since it will be an indicator of future sales.

Source: Author’s representation

The Picks and Shovels of Any Technological Transition

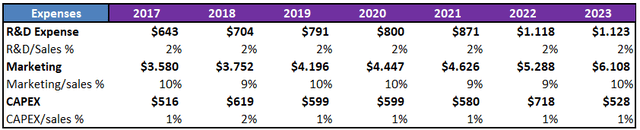

The good thing about the nature of Accenture’s business is that it benefits from any technological innovation, with a minimal investment compared to whoever invents it. They are the picks and shovels of these transitions, having much less expense and nullifying the risk of failure. They already did it in 2020, when they invested $3B for the transition to the cloud (2020 annual report page 6), a move identical to the one they made in 2023, with another investment of $3B spread over 3 years to improve and implement AI in their business model and power, as well as that of its clients (2023 annual report page 10). In addition, AI will benefit consulting firms, since it will eliminate repetitive tasks, greatly increasing productivity per worker, requiring fewer engineers and therefore, cost savings and improved margins. In the table below we can see the company’s expenses in different branches of the business and how it benefits from its large scale, since, despite being considerable amounts in absolute terms, in relative terms, they do not represent a large percentage of company sales. Accenture (13% between R&D, marketing, and CAPEX expenses).

Source: Author’s representation

Moats

Scale and expertise: the fact of being able to operate globally and in so many industries makes it a source of knowledge and constant improvement for the company, being able to share knowledge acquired in other industries. Operating at a global level means that it can be aware of more specific situations in different parts of the planet and adapt to it. In addition, this gives it access to greater capital and opportunities to make acquisitions globally.

Switching Costs: its 100 largest clients have been with Accenture for more than 10 years (2023 annual report page 22). This makes sense, since it provides exceptional services, which do not represent large expenses for the companies that buy them, but would pose big problems if they had to change consulting firms. In the end, over time Accenture manages to know better and adapt more quickly to companies’ problems, something that other consulting firms would have to learn from scratch until they began to truly help them. The costs that a consulting firm entails for the company are not great compared to the benefits they can give them.

Network Effect: It has a direct relationship with scale. The more companies you help, the more data and knowledge you acquire, making it possible to provide new services to new companies and sectors. It’s a virtuous cycle in which the company becomes better over time.

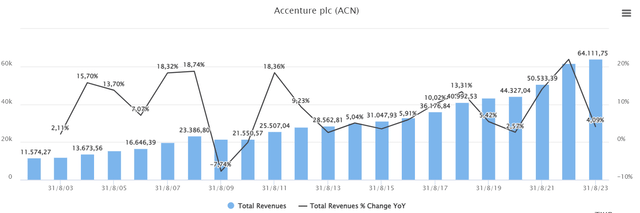

Resilience: despite the cyclical nature of the sector, expenses on IT consulting are not canceled; they are postponed. Even so, Accenture has only managed to decrease its sales in 2008 and 2009. This speaks volumes about the critical services it provides. Furthermore, the more the technology develops and the faster the world develops, Accenture’s services will become even more important.

Source: Tikr

Capital Allocation

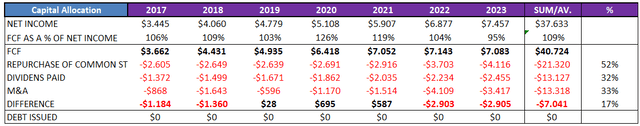

In addition to investing in R&D and marketing, Accenture uses its FCF to buy back shares, distribute dividends and do M&A. For dividend lovers, the current yield is 1.38% and has increased at a rate of 10.33% in the last 10 years. I see no reason why the growing trend should not continue in the future. I would like to have seen a little more opportunistic capital allocation, buying back heavily when the stock is cheap and paying out higher dividends when it is not. The M&A part is usually a recurring part as well, but in such a fragmented company, it is normal for large companies to carry out the consolidation process. Due to a capital allocation that has not been outstanding and the constant practice of M&A, Accenture’s ROIC has decreased from 41% in 2017 to 26% in 2023. The good thing is that the reinvestment rate stands at an incredible 53 percent, so the generation of value by investing in the business itself is high.

Source: Author’s representation

Competence

Accenture is in a sector highly competed by small firms dedicated to personalized IT services, but above all by the well-known “Big Three” McKinsey & Co., Boston Consulting Group, Inc., and Bain & Co.- McKinsey & Co: is a private company that provides services to sectors such as commodities, natural resources, technology and media. Says it serves 80 of the 100 largest industries in the US.- Boston Consulting Group, Inc. is also private, serving large and medium-sized companies, non-profit companies and government agencies. Specialists in the financial and industrial sectors- Bain & Co: another private company that operates in 90% of the sectors of the economy. As you can see, being private companies, we cannot compare their figures with those of Accenture, which makes it difficult and increases the uncertainty if we talk in terms of competition.

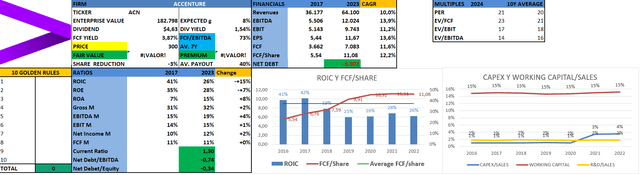

Financials

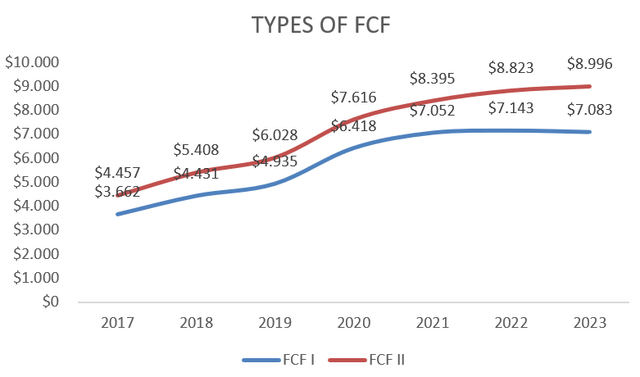

When we take a look at Accenture’s figures, we can see high CAGR rates in all its figures. Some returns that have compressed over the years, although for the reasons that we have discussed in the previous section. We can also see slight margin expansion and a net cash position of almost $9B. I am going to make a subsection. Depending on how we calculate the FCF, we will have very different results. If we take stock options into account, the FCF margin is 11%, while if we do not take them into account, this rises to 14%. It depends on the investor, which one he wants to use.

Source: Author’s representation

An item that may catch our attention is the high percentage of Working Capital over sales (15%). The company has to make the investments, hire people, design the project, before carrying it the projects for its clients. This is why accounts receivable end up piling up on the balance sheet, while accounts payable are much smaller. One way of making cash that smaller consultancies such as Nagarro (OTCPK:NGRRF) does, is factoring. Factoring is a process through which a company sells its pending invoices to a factor, which is a financial institution or a factoring company. In exchange, the factor pays the company a cash advance for the value of the invoices, less a commission. Accenture does not say anything about this in its annual report, but considering that it operates without debt, but receives payments as it achieves goals in its projects, it is possible that it does.

Source: Author’s representation

Valuation

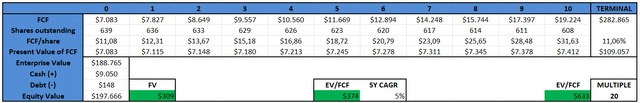

To value Accenture, I will use an inverse DCF, to try to find out the growth rate that the market is discounting with respect to the current price. With a discount factor of 10%, and a terminal growth rate of 3%, cash flows are expected to grow at a rate of 10.5%. I see this growth as feasible, especially if we take into account the tailwinds that Accenture and the industry in general have. Although in times of economic difficulties, we have already seen that consulting expenses can be postponed, sooner or later they will have to be incurred to ensure innovation and the survival of their clients.

On the other hand, I have calculated the FCF taking the stock options into account, which for my taste are very high (23.76% of the net income on average over the last 7 years). If we were to exclude them from the calculation (there are many investors who do) the growth rate that the market would be discounting would be only 7%, something completely achievable for the company. In any case, I prefer to be conservative in my calculations and take them into account. That is why I rate Accenture as a hold.

Source: author’s representation

Risks

A risk that could be attributed to many companies in the sector, but which we have already seen that Accenture weathers well, is its cyclicality. As we have already said, IT spending is postponed, but not canceled. Thanks to having Tier 1 clients with a lot of financial capacity, Accenture is more protected from the economic cycle than smaller rivals.

Another could be competition. In Europe there are many small IT companies that are responsible for creating custom software for their clients, something Accenture does not do. It can also be difficult to follow the “Big Three” because, as they are private companies, we cannot see how they are evolving or which one is gaining market share.

Lastly, is acquisition risk. We have already seen that it is a common practice at Accenture, but I don’t like that ROIC is decreasing so much and Goodwill is increasing so much (it has tripled in 7 years). This could mean that the synergies are not being as strong or that you are paying too much for them. In any case, in a complicated economic environment in which smaller players may suffer, it can be a good sea to fish for discount companies.

Other Important Graphs

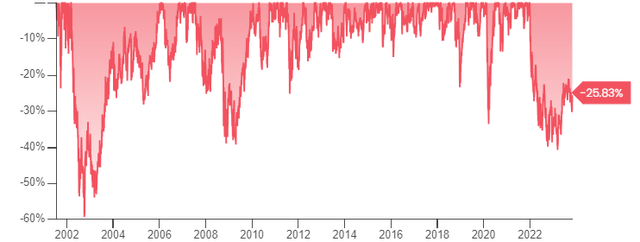

In March 2023, Accenture experienced its largest drawdown from highs since 2002.

Source: Stratosphere.io

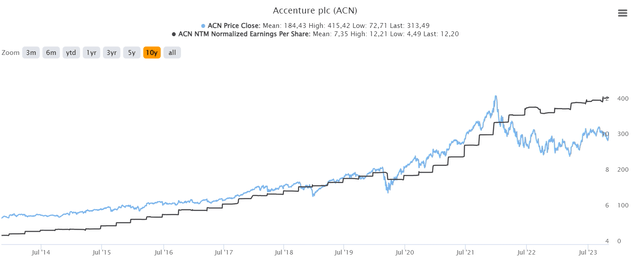

There is currently a large GAP between EPS growth and the share price. We already know that in the long term, these tend to converge. The question is whether EPS will fall, or on the contrary, the share price will tend to rise. I bet on this one.

Source: Tikr

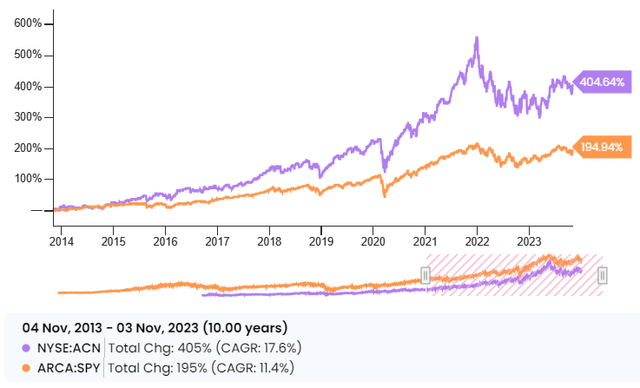

Accenture has clearly outperformed the S&P500 during the past 10 years.

Source: Stratosphere.io

Conclusion

As we have seen, Accenture is in a privileged position to surf any wave of technological innovation that the world experiences. Its scale allows it to provide feedback on its knowledge and capabilities, as well as have Tier 1 clients (diamond clients). It will be important to monitor the evolution of bookings. I would like capital allocation to be better, it is something that can be achieved, but it requires commitment from management. As we have already seen, it depends on what FCF we use, the company may be cheaper, but since I like to take stock options into account when calculating it, I rate Accenture as a Hold.

Read the full article here