We previously covered PayPal Holdings (NASDAQ:PYPL) in August 2023, discussing Mr. Market’s overreaction then as the stock sold off attributed to its declining active accounts.

We had continued to rate the stock as a Buy at that time, due to the improved upside potential, early signs of e-commerce recovery, and exemplary growth in its enterprise market.

In this article, we will be discussing PYPL’s further stock price decline by -10.65% since our previous Buy article in August 2023 and -35.3% since our first Buy coverage in April 2022, with no floor to be found.

The market sentiments remain pessimistic as well, with its reversal hinging upon the new management’s ability to turn this ship around, while convincing Mr. Market of its upward rerating.

We shall discuss further.

PYPL Continues To Deliver Profitable Growth, Further Boosted By The New Management Team

For now, PYPL has delivered an exemplary double beat FQ3’23 performance, with revenues of $7.41B (+1.7% QoQ/ +8.4% YoY) and adj EPS of $1.30 (+12% QoQ/ +20.3% YoY).

The bottom-line beat is impressive indeed, despite the sustained decline in its GAAP gross profit margins to 39% (-0.2 points QoQ/ -4.6 YoY) and operating margins of 16% (+0.6 points QoQ/ -1.1 YoY).

However, the same loss in PYPL’s active accounts has been observed in FQ3’23 again, with it declining to 428M (-3M QoQ/ -4M YoY), likely triggering further market concerns about its near-term prospects with users likely depart for its competitors.

Then again, investors may want to note that the fintech’s Total Payment Volume and Number of Payment Transactions per active accounts continue to expand to $387.7B (+2.9% QoQ/ +15% YoY) and 56.6 (+1.9 QoQ/ +6.5 YoY), further emphasizing the stickiness of its offerings to retail consumers.

Investors must also be aware of the sustained growth observed in PYPL’s enterprise segment, with Braintree “processing over $450B in volume out of an estimated $4T to $5T of global large enterprise e-commerce over the LTM,” well above the $400B reported for FY2022 (+33% YoY).

Thanks to its expanded partnerships and payment wins, we believe that it is only a matter of time for the management to slowly drive “margin expansion for Braintree,” while eventually reversing the company’s declining profit margins.

PYPL investors only need to patient for its eventual reversal, especially since the Braintree segment already captures the equivalent of 10% of the global market share by the latest quarter.

Despite Braintree’s dilutive impact on its profitability, with an overall declining transaction margin of 45.4% (-0.5 points QoQ/ -5.6 YoY), we also want to highlight the fintech’s steadily improving net cash situation to $4.8B (+23% QoQ/ -11.1% YoY), despite the $5.63B of shares repurchased over the LTM (+11.2% sequentially).

PYPL’s sustained share repurchases have already retired 90M of shares since FY2019, implying that the management similarly believes that the stock is cheap here, while returning some value to its long-term shareholders who remained despite the drastic capital losses thus far.

Combined with a refreshed management team across CEO, CFO, and CTO, we believe that sentiments surrounding PYPL’s prospects may be bottoming soon, for so long that they are able to deliver improved transaction margins, operational growth, and increased market share in the intermediate term.

For now, the new CEO’s early commentaries have proven to be promising, with a drastic restructuring likely to occur in the near term, as an attempt to boost its efficiency and consequently, drive “high-quality customer growth and profitable revenue growth:”

In order to maximize this opportunity, it will require technology consolidation and automation across the company. Simply put, our cost base remains too high, it is actually slowing us down.

As such, I am in the process of evaluating our most profitable growth priorities and aligning our resources to those priorities. We will become leaner, more efficient and more effective, driving greater velocity, innovation and impact for customers.

This is further aided by the robust e-commerce and consumer spending trends reported by Amazon (AMZN) and Shopify (SHOP) thus far, likely to enhance PYPL’s QoQ/ YoY comparison despite the uncertain macroeconomic outlook.

The bottom may be here indeed.

Due To Its Oversold Status, PYPL Has Become A Battleground Stock

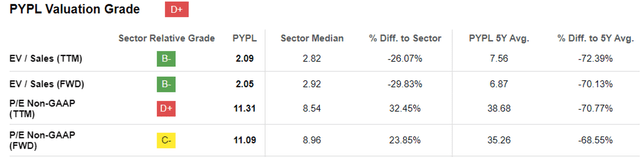

PYPL Valuations

Seeking Alpha

For now, PYPL’s FWD P/E valuation has been further moderated to 11.09x, down from its 1Y mean of 14.12x, hyper-pandemic peak of 66.96x, and 3Y pre-pandemic mean of 32.26x.

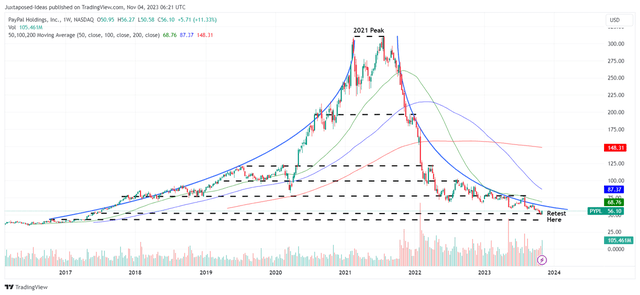

The same has been observed in its price chart, with all of the hyper-pandemic gains already lost and the stock temporarily bouncing off its May 2017 support levels of $52s, after the exemplary FQ3’23 earnings call.

However, we believe that the end of PYPL’s correction may be near, with a floor likely set at $44.71, based on its FQ4’23 EPS guidance of $1.36, its first three quarters’ EPS of $3.63, and the most conservative FWD P/E valuation of 8.96x (based on the sector median).

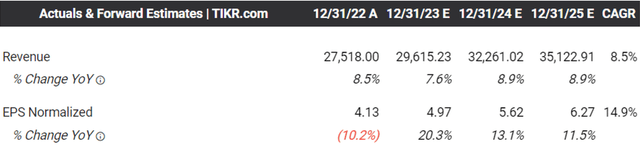

The Consensus Forward Estimates

Tikr Terminal

In addition, the consensus still estimates that PYPL may generate a more than decent top and bottom line growth at a CAGR of +8.5% and +14.9% through FY2025, with its trend only normalizing from the previous CAGR of +16.8% and +18.4% between FY2016 and FY2022, respectively.

For now, depending on individual investor’s conviction, we believe there may be three outcomes moving forward, namely the bear, neutral, and bull case scenarios.

Bear case: Based on the consensus FY2025 adj EPS estimates of $6.27 and a further moderation in its FWD P/E valuation to sector median of 8.96x, it appears that the stock may continue to trade sideways over the next few years, based on our bear case Long-Term Price Parget [LTPT] of $56.17.

Neutral case: If the stock’s FWD P/E holds at current levels of 11.09x, its upside potential is still excellent at +23.9% to our neutral LTPT of $69.53.

Bull case: Assuming that the stock’s valuations is rerated closer to the pre-pandemic ranges, (we will be referring to a more conservative pre-pandemic lows of 22x) we may see a bull case LTPT of $137.94, implying a more than doubled upside potential from current levels.

For now, it is evident that PYPL has unexpectedly turned in a battleground stock, with many other tech giants similarly entering the intense fintech war, on top of the numerous acquisition rumors circulating the market over the past few years.

The stock’s lower lows and lower highs since the 2021 peak also suggest a lack of bullish support, especially given the drastic loss of -81.1% of its value.

So, Is PYPL Stock A Buy, Sell, or Hold?

PYPL 7Y Stock Price

Trading View

Nonetheless, as long-term shareholders ourselves, we maintain our conviction that PYPL offers a value buy opportunity for investors with higher risk appetite.

This is especially given the obvious exponential regression curve observed in the stock’s upward rally during the hyper-pandemic and subsequent plunge over the past few quarters, with the selloff likely to come to an end in the near term.

We believe that many of the weaker hands have also sold off their positions, leaving only those with higher convictions. As a result of its potential “Meta Moment”, we maintain our Buy rating on the PYPL stock.

Naturally, investors that add here must be comfortable with moderate volatility while having a long-term investing trajectory, since its eventual recovery remains speculative with the stock market sentiments still pessimistic.

Only time may tell if the new management may right the ship, while convincing Mr. Market of its upward rerating.

Read the full article here