Thesis

I believe that the main Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) aka Google drivers of growth in the next 3-5 years will be its large language models, which will provide generative AI services to multiple businesses, along with its cloud computing division. Alphabet boasts one of the strongest balance sheets in the tech industry, characterized by minimal debt and a substantial cash reserve of $106 billion, second only to Apple (AAPL). The company’s free cash flow is expected to exceed $150 billion in the next two years, further reinforcing its impressive financial position. Alphabet recently authorized a $70 billion increase in share buybacks, highlighting its growing financial flexibility.

Gen-AI is becoming more complex

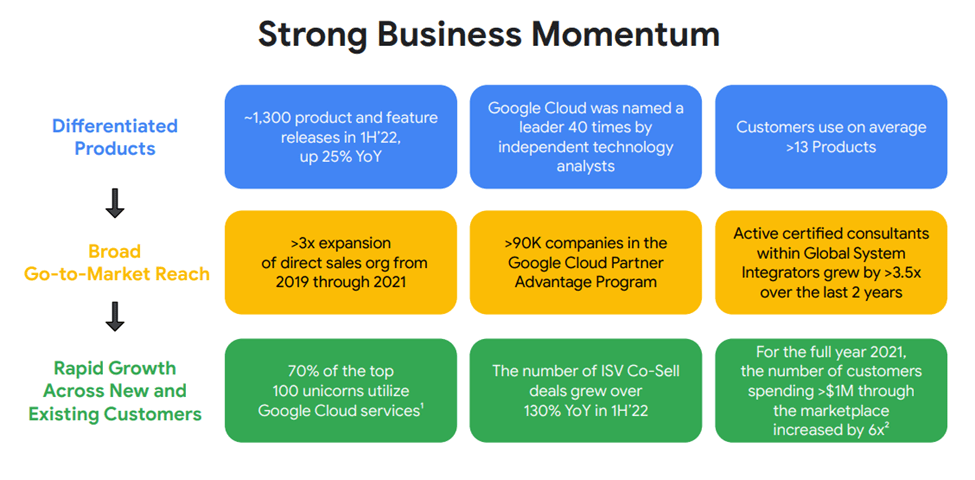

Gen-AI is becoming increasingly intricate due to the substantial growth in use cases and the rapid availability of foundational models to address them. However, deploying Gen-AI through cloud services is the most effective and efficient approach. Google’s framework aligns closely with this demand by offering a diverse portfolio of pre-trained models and solutions that cater to various use cases and domains. In this regard, Google’s approach is similar to that of AWS. However, what sets Google Cloud Platform (GCP) apart is its product-oriented approach, providing a suite of solutions, including industry-specific offerings, which simplifies the experience for customers. In contrast, AWS employs a marketplace approach, allowing customers to mix and match different technology components to create customized solutions. This Lego-like approach offers more customization but can be more complex.

Company Presentation

Strongest Balance Sheet in the Tech Space

Alphabet stands out among its largest peers for its financial prudence, characterized by minimal debt and a substantial cash reserve second only to Apple. With a net cash position of $106 billion, Alphabet leads the technology sector in financial strength. The company’s free cash flow is expected to comfortably surpass $150 billion over the next two years, further bolstering its already impressive cash-to-debt ratio and maintaining the lowest bond spreads compared to its competitors. Notably, Alphabet’s recent authorization for a $70 billion increase in share buybacks underscores its growing financial flexibility. Despite delivering strong returns, Alphabet’s exceptional balance sheet is expected to remain robust as its accelerated EBITDA generation has boosted its cash reserves to $120 billion.

Alphabet’s conservative financial approach has yielded arguably the best financial profile in its class, and this is unlikely to change in the near future, even in the face of challenges such as top line growth and legal issues. Google’s parent company maintains a resilient business profile, supported by 2023 consensus revenue projections of $255 billion and EBITDA of $122 billion. Financial flexibility remains a cornerstone of its strategy, evident in its substantial negative net leverage and the stark contrast between its $13 billion in bonds and $106 billion in cash, alongside $78 billion in free cash flow. Alphabet’s credit ratings of Aa2/AA+ are underpinned by its dominant position in online search and its negative net leverage. Despite significant increases in shareholder returns and capital expenditures, the company’s credit outlook remains stable.

Buyback and Dividends

While Alphabet’s management hasn’t signaled a shift in its dividend policy, there have been notable changes in the language used in its annual 10-K filing. These changes occurred in February 2020, and were reiterated in the second quarter of this year, which could potentially pave the way for the introduction of a dividend. In contrast, the 2019 language explicitly stated that the company did not anticipate offering cash dividends in the foreseeable future. In its most recent 10-K filing, Alphabet maintained the language indicating that it regularly assesses its capital structure, including capital returns. Furthermore, in April, Alphabet’s board authorized the company to buy back up to $70 billion of its stock, with $52.3 billion available for repurchases as of September 30.

After increasing its authorization for stock buybacks in conjunction with its first-quarter earnings, Alphabet still has over $50 billion available for buybacks. This positions the company to enhance returns for shareholders, especially given the limited activity in mergers and acquisitions and the absence of dividend payments. Alphabet’s engagement in M&A has been infrequent, and despite the possibility of a decline in full-year consensus revenue by up to 10% this year, the company is expected to allocate minimal capital to acquisitions due to the persistently high regulatory barriers. Despite these circumstances, Alphabet’s financial strength and flexibility have remained largely unaffected by its relatively low M&A activity. In the past two years, the company has used less than $10 billion in cash for acquisitions.

Valuation

Tens of billions of dollars in annual free cash flow, coupled with well more than $100 billion of cash on hand and a best-in-class equity-to-debt ratio, are supportive of Alphabet’s stellar balance sheet. The boom in artificial intelligence will likely propel big-tech fundamentals well beyond historical highs, enhancing financial flexibility and providing support for tens of billions of investment spending and M&A. With Microsoft, Alphabet, Amazon.com, Meta, and even Alibaba expected to generate annual free cash flow ranging from $20 billion to $70 billion, downside risk remains low across the software and services subsector even as spending and shareholder returns increase.

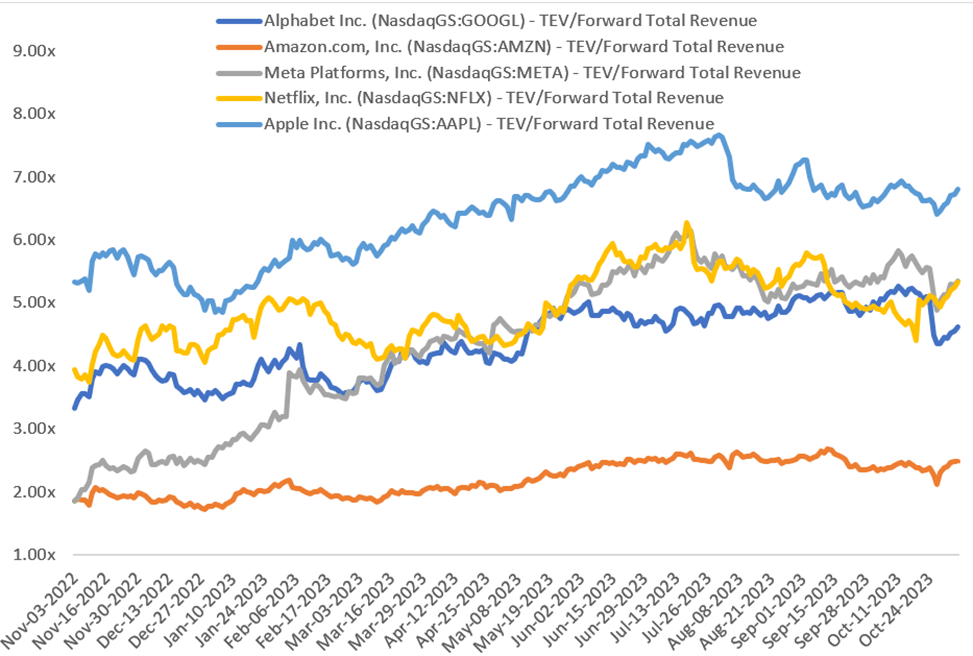

As per Capital IQ, on an EV/Rev basis, GOOGL’s multiples of 4.6x on FY24 estimate, are approximately in line with the average for the FAANG group. GOOGL is trading above AMZN, but well below AAPL, Meta Platforms (META), and Netflix (NFLX), on the basis of EV/estimated Rev. I think GOOGL is undervalued based on comps, and hence assign a buy rating to the stock.

Capital IQ

Conclusion

I believe that Google will experience significant growth in the next 3-5 years driven by its large language models, which will offer generative AI services to various businesses, along with its cloud computing division. Gen-AI demand is booming, and Google offers a diverse range of pre-trained models and solutions tailored to various use cases and industries. Alphabet’s financial strength is noteworthy, characterized by minimal debt and a substantial cash reserve of $106 billion, second only to Apple. GOOG’s projected free cash flow is expected to surpass $150 billion in the next two years, further underscoring its strong financial position. I remain bullish on the company and assign a buy rating to the stock.

Read the full article here