It’s been just under a month since I recommended investors steer clear of Sturm, Ruger & Company (NYSE:RGR), and in that time the shares are down about 17% against a gain of about 2% for the S&P 500. While that’s gratifying on some level, I feel the need to review the name again to see if it makes sense to buy at current levels. After all, a stock trading at $45 is, by definition, a less risky investment than the same stock when it’s trading at $54. I’ll make this determination by looking at the recently published financials, and by looking at the valuation. Additionally, I want to put this in the context of the risk free rate. I’m increasingly of the view that risk free investments are more compelling at the moment, and I want to see if the return potential of Sturm adequately compensates investors for the risks associated with buying this stock.

We’re all busy people, and I am absolutely obsessed with making the lives of my readers as enjoyable as possible. These two facts have led me to put a “thesis statement” paragraph at the beginning of each of my articles. This allows my busy readers to get in, get the gist of my thinking and get out, thus saving them the time it would take to read a 1,400 word screed from yours truly. You’re welcome. I think Sturm Ruger is a fine company, and this is one of the most sustainable dividends I’ve seen. The problem, from my point of view, is the relative valuation. In a world where you can earn 4.65% risk free, why would you buy a stock like this that hasn’t seen its dividend grow over the past decade? It’s possible that stockholders will outperform Treasury Note holders over the next decade, but all of that outperformance would come from capital gains. That’s a relatively risky proposition in my view, and for that reason I’ll not be adding to my position here.

Financial Snapshot

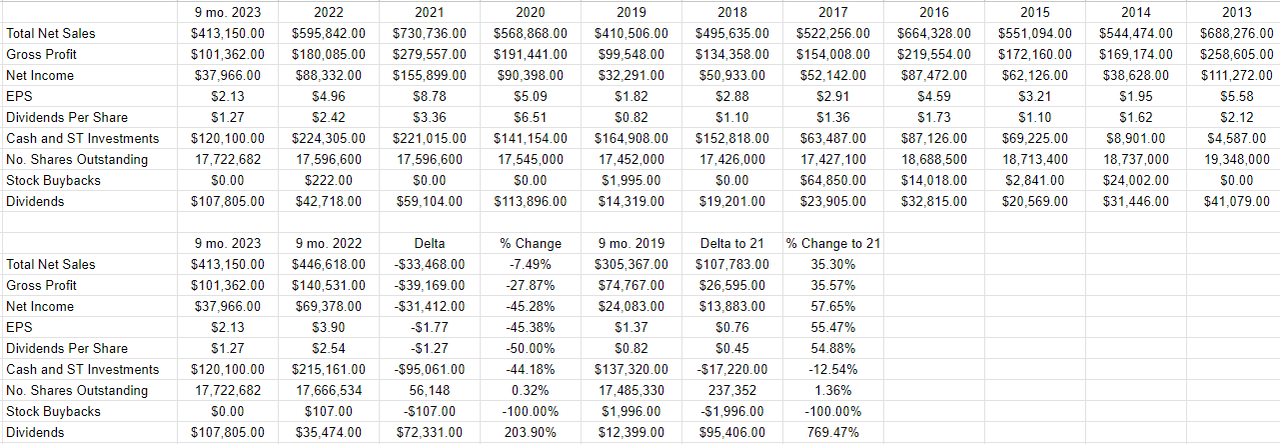

Relative to the same time last year, the latest financial results haven’t been great in my estimation. Revenue and net income were down by 7.5% and 45.25% respectively. Additionally, the coffers have been drained, with cash and short term investments lower in 2023 by $95 million, or about 44%. On the plus side, management has rewarded shareholders by paying out an enormous $107.8 million in dividends, which was about 2.8 times net income generated over the same time period.

When we cast our eyes back to the pre-pandemic era, things look less dire in my estimation. For instance, revenue and net income were higher by 35% and a whopping 58% compared to the same period in 2019. So, things may appear softer in 2023, but that’s only in comparison to 2022, which was a relatively decent year. In sum, I’d say that, when taken in the historical context here, results have been in line. Additionally, since this is nearly the definition of a sustainable dividend provider, I’d be happy to buy more shares at the right price.

Sturm Ruger Financials (Sturm Ruger investor relations)

The Stock

My regulars know that I like to buy shares when they are as cheap as possible. The reason for this is that cheaper shares offer a great combination of lower risk and higher return potential. Cheaper shares are lower risk because any bad news is already “priced in.” This means that if a stock that the market is pessimistic about issues some new bit of bad news, no one pays much attention as the company has simply met expectations. In this case, the shares don’t drop too much in price. If, on the other hand, a stock that’s been down in the dumps releases some better than expected news or results there’s what I call a “prodigal son” effect, which often drives the shares higher. I like “lower risk, higher return” potentials, so I want to buy shares when they’re cheap.

Regulars also know that I measure “cheap” in a few ways ranging from the simple to the more complex. On the simple side, I look at ratios, and I like to see a stock trading at a discount to both its own history and the overall market.

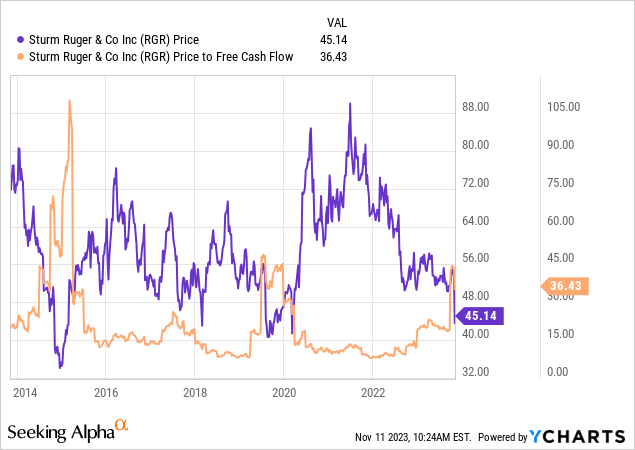

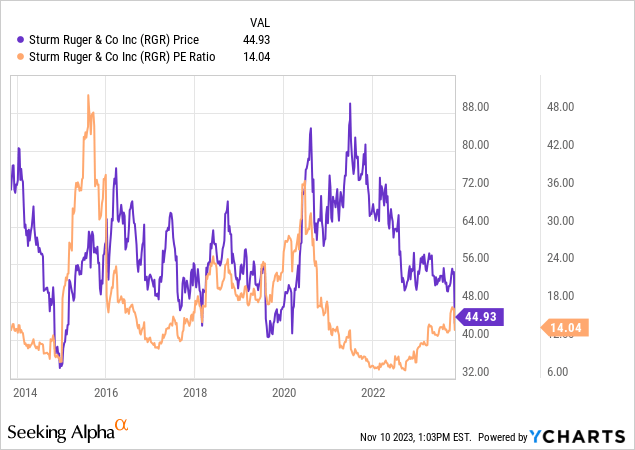

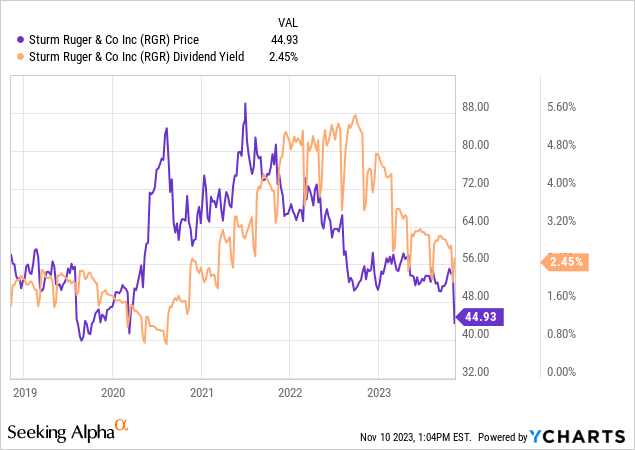

When I last reviewed Sturm Ruger, the shares were trading hands at a price to free cash flow were trading at about 19.65 times, the PE was about 14 times, and the dividend yield was sitting around 2.8%. In spite of the price drop, things haven’t really improved much in my view. PE and the dividend yield have hardly budged, and the price to free cash flow has spiked higher to about 36.4 times.

In spite of the recent price drop, the dividend yield remains about 220 basis points below the risk free rate. So, this is a fine company, but it is, by definition, more risky than the 10 Year Treasury Note in some significant ways. The latter, for instance, guarantees repayment, and you’re on a perfectly predictable repayment schedule. That level of clarity simply doesn’t exist with any stock, even one as great as Sturm.

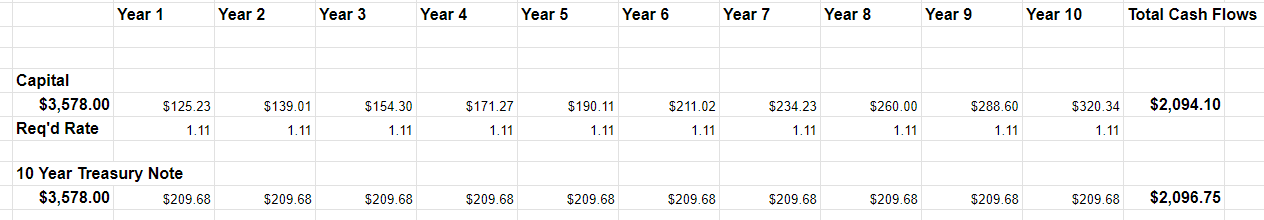

I wanted to calculate the amount by which the dividend would need to grow to match the cash flows from the stock and the Treasury Note, so I calculated the amount by which the dividend would need to grow to match the cash flows from the stock and the Treasury Note. I took the liberty of writing my results in a table, and I present the table below for your reading pleasure. If you’re not favourably disposed toward reading a table, I’ll just write the answer here. In order for Sturm shareholders to generate the same cash flows as the Treasury Note holder over the next decade, the dividend will need to grow at a CAGR of about 11%. I know that the company has lavished shareholders with the occasional special dividend over the past several years, but we need to remember that the dividend hasn’t grown over the past decade. I don’t mind this approach, as I think it’s more sustainable. The implication of the strategy are plain in the current environment, though. Shareholders will need to rely on capital gains to make up the delta between the stock and Treasury, and that may be challenging given where valuations are at the moment.

Comparison of Stock and Treasury cash flows (Author calculations)

Given the above, I’ll hold my position in Sturm Ruger, but won’t be adding to it anytime soon. If rates on the Treasury Note fall, and/or if the yield on the stock rises, I’ll review again. At the moment, though, the relative risk reward characteristics of this stock doesn’t excite me too much.

Read the full article here