Rising interest rates have dulled this year’s AI stock boom, and we’re relatively grateful for that because it means we have the chance now to pick up shares of transformational companies off recent highs. SoundHound (NASDAQ:SOUN), in my view, is a great example of this, as the lesser-known AI company is making tremendous headway in its end-markets while getting very little recognition.

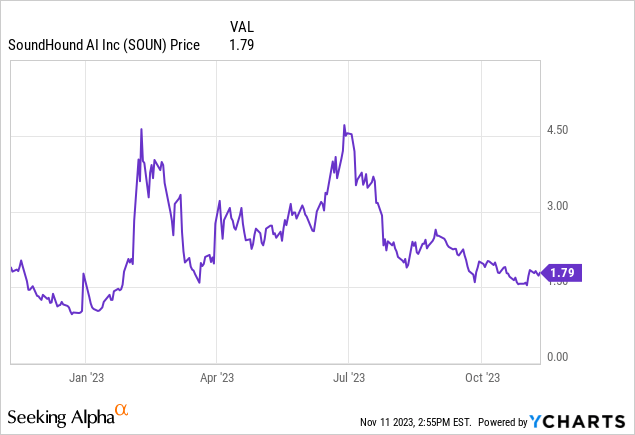

Year to date, the stock remains up nearly 40% since the start of January, though SoundHound has shed roughly two-thirds of its market value from this year’s peaks above $4.50. Though there was certainly a lot of speculative activity fueling the rally above $3, I do think there is tremendous opportunity in this stock below $2.

For investors who are newer to this stock, SoundHound is an AI platform that focuses on conversational intelligence. Its core approach lies in its self-labeled “speech to meaning” technology which translates spoken inputs directly into conversational AI – whereas it claims its competitors first have to translate speech to text, then translate that text into meaning, slowing down the process of having a natural AI interaction. SoundHound is relatively early from a go-to-market perspective with less than $100 million in annual revenue, but its primary end markets are vehicles and fast food/hospitality.

I last wrote on SoundHound in September, issuing a bullish rating on the stock on the back of a recent partnership struck with restaurant software platform Olo. Since then, the company has released strong Q3 results that showed sharp sequential growth in revenue alongside a thinning of loss margins, while SoundHound continues to make progress toward its goal of becoming profitable from an adjusted EBITDA standpoint by the fourth quarter. The stock has also continued to slide, shedding light on an opportunistic valuation.

Here is a refresher on my full long-term bull case on the stock:

- SoundHound estimates its 2026 TAM at a massive $160 billion. SoundHound’s underlying technology has a plethora of use cases, ranging from its core restaurant functions to building products alongside OEMs in the Internet of things (“IoT”) space. The company also has cited its technology advantage vis-a-vis other sound AI providers in that its technology translates “speech to meaning” in a single step, whereas many competing technologies first transcribe speech to text, then text to meaning. This gives SoundHound’s products a speed advantage versus its competitors.

- Rapid growth. Though admittedly small at a <$50 million annualized revenue scale, SoundHound is growing revenue at a rapid >40% y/y pace, which makes its relatively low valuation quite appealing for a company whose future is much larger than its present.

- Multiple routes to monetization. SoundHound can generate product revenue from integrating its technology into hardware developers’ products, as well as subscription revenue for the right to license its AI in fast food drive-throughs.

- Secular tailwinds toward automation. Especially as wage labor costs rise in the service industries, more and more companies will be interested in deploying technology to bring down labor and increase margins as much as possible.

- Blue-chip customers. Though small, SoundHound has already amassed a nice and growing roster of premier customers, ranging from Oracle (ORCL), Toast, Square (SQ), Hyundai, and Jeep. A new partnership with Olo (which we’ll discuss in this article) also gives SoundHound the capacity to expand to many more restaurants.

And at current share prices just below $2, SoundHound trades at a market cap of $430.9 million. After we net off the $96.1 million of cash and $85.0 million of debt on SoundHound’s most recent balance sheet, the company’s resulting enterprise value is $419.8 million.

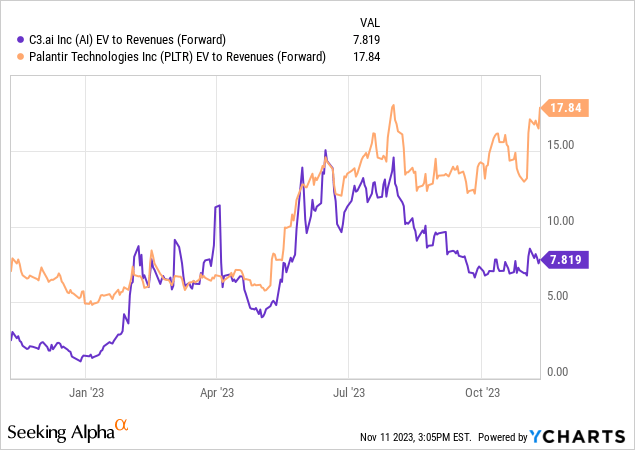

Meanwhile, for next fiscal year FY24, Wall Street analysts are expecting SoundHound to generate $74.1 million in revenue, representing 62% y/y growth. While that y/y growth rate looks aggressive (compared to <20% revenue growth in the most recent Q3), it actually may look modest from a sequential perspective: the company has guided to $16-$20 million in revenue in Q4, or ~90% growth at the midpoint. There’s not tremendous seasonality in this business, so quartering ~$18 million in revenue for a full year would get us to $72 million in revenue alone – assuming very little sequential growth from Q4. In other words, this is a company still at the forefront of its large market opportunity with many different partnerships and customers in the pipeline – its forward opportunity is still vast. Nevertheless, taking consensus estimates at face value, SoundHound trades at just 5.7x EV/FY24 revenue.

Meanwhile, we can see in the chart below that other AI stocks like C3.ai (AI) and Palantir (PLTR) trade at vastly larger multiples:

The bottom line here: stay long and buy the recent dip in SoundHound.

Q3 download

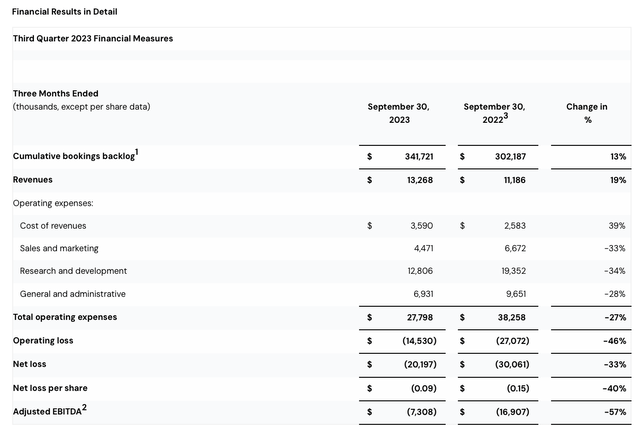

Let’s now go through SoundHound’s most recent quarterly results in greater detail. The Q3 earnings summary is shown below:

SoundHound Q3 results (SoundHound Q3 earnings release)

SoundHound’s revenue grew 19% y/y to $13.3 million, ahead of Wall Street’s expectations of $12.8 million (+14% y/y). Revenue also grew 52% sequentially, demonstrating SoundHound’s ability to monetize recent deals and partnerships in its pipeline.

One major development in the quarter is an expanded partnership with Samsung to build new drive-thru displays at White Castle locations. The company is now well-penetrated into White Castle’s midwest storefronts, with an eye toward expanding in the Southwest. The company also went live with its Olo partnership, so the 77k restaurants using Olo software are now also able to leverage SoundHound technology.

Growth in the quarter was also driven by success in the auto vertical, as OEMs are producing more units with SoundHound technology embedded. Management also noted that the company has been successful at pushing price increases per unit in this vertical.

We note as well that SoundHound’s cumulative backlog (which has not yet been recognized as revenue) grew 13% y/y to $341.7 million, representing the long-term nature of SoundHound’s pipeline (this is roughly 5x the size of next year’s consensus expectations for revenue).

Per CFO Nitesh Sharan’s remarks on the Q3 earnings call regarding pipeline development:

This quarter, we ended with $342 million in cumulative bookings backlog, up 13% year-over-year. We’ve added customers across industries such as in automotive, telecommunications, IoT, including coffee machines, printers and TVs, just to name a few.

In total, we have certain contracts that span up to 10 years, representing an average contract length of roughly 6.5 years and as I’ve stated before, these are back-end weighted. These bookings, which mostly correspond to Pillar 1 are derived from committed customer contracts and reflect revenue we expect to realize.

Within these existing contracts and more broadly with those partners, we have massive upside and we continue to add new customers every quarter […]

With solely the brands we have signed to-date, at scale and full deployment across these customers’ groups, we would now have over 4,500 locations and well over $25 million in ARR. Combined with the rapidly growing pipeline of larger customers, we expect and continue to look for ways for this to accelerate even more in the future.”

Meanwhile, adjusted EBITDA losses also shrunk -57% y/y to -$7.3 million, as the company leveraged data center economies of scale alongside cost cuts, with total opex falling -27% y/y. To me, the combination of a hyper-growth AI company that is also adjusted EBITDA positive (as SoundHound expects to be in Q4) will be a powerful combination that the market won’t ignore.

Key takeaways

With the twin forces of both a large expected TAM plus a large backlog worth several years of revenue, alongside strong sequential revenue growth in the near term, there’s a lot to like about SoundHound at just <6x forward revenue. Use this dip as a buying opportunity.

Read the full article here