The U.S. Bureau of Labor Statistics posted a seemingly perfect Consumer Price Index (“CPI”) inflation report that sent the major indices higher. At the time of writing, the Dow Jones Industrial Average Index (DJI) had added over 500 points. The S&P 500 Index (SP500) gained enough points to trade at around the 4,500 level, while the NASDAQ Composite Index (COMP.IND) added over 300 points. The breadth of the bullish rally puts the bears on notice. The Russell 2000 (IWM) gained 4.30% while stocks achieved an advance to decline of 81.5% against 11.1% (per Finviz data).

The CPI headline that inflation is hitting zero is a cause for celebration. It suggests that consumers may be finally getting a break. However, readers who are skeptical about the perfect Goldilocks report should dig into the details. The report further validates Fed Chair Jerome Powell’s on allowing monetary policy to show up in the economy. Powell mentioned that again after the policy meeting on Nov. 1, 2023.

Why Inflation is Zero

The Consumer Price Index indicated zero inflation month-over-month in October. Readers will counter that absent inflation is impossible. This is due to the aggregated inflation rate of 23.48% since January 2020. By comparison, the CPI reports monthly and year-on-year changes. Over the last 12 months, the all-items index increased by 3.2%, excluding seasonal adjustment.

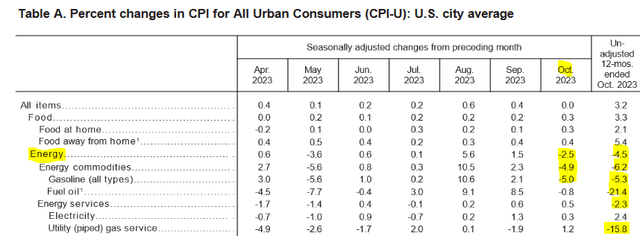

The report benefited immensely from oil prices falling to prices not seen since July when WTI crude traded at around $80 per barrel. Since then, WTI crude peaked at almost $94/bbl, and slumped to $75.33 on Nov. 8, before inching higher. Energy prices are responding to the lack of news in the Ukraine/Russia war, the conflict in the Middle East, and the economic slowdown in China. As a result, the energy index fell by 2.5% over the month.

Thanks to the 5.0% fall in the gasoline index, it more than offset the increase in other energy component indexes. In the table below, I highlighted the energy items that fell in the month and unadjusted for the year. Fuel oil and utility (piped) gas services fell the most in the last 12-months.

BLS

The report benefited from a decline in prices for lodging away from home, used cars and trucks, communication, and airline fares. The stock market punished investors who ignored the falling prices of airlines and used vehicles. For example, value investors who bought American Airlines Group Inc. (AAL) lost 20.5% of their investment in the last quarter. Spirit Airlines, Inc. (SAVE) is a special case. It lost 42% in the last month. Markets cast doubt on its merger with JetBlue Airways Corporation (JBLU).

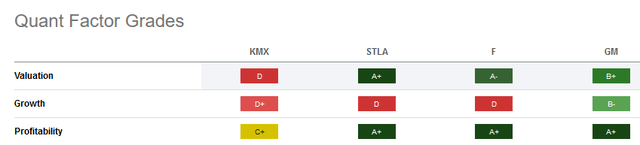

In automotive, short sellers who have a 10.5% short float on CarMax, Inc. (KMX) are ahead. They correctly bet that the used vehicle seller could not sustain its pricing power as it increased its inventory. Although KMX stock is bouncing back to $68, up from the $60 low last month, it faces severe headwinds. General Motors Company (GM), Stellantis N.V. (STLA), and Ford Motor Company (F) apparently settled a wage deal with the union. This will hurt the automotive market further. Those firms will resume vehicle production, increasing supply at a time when consumers are unwilling to pay Covid-era prices.

Seeking Alpha

In the table above, CarMax stock has the worst grades.

In the communications sector Verizon Communications Inc. (VZ) and AT&T Inc. (T) shares rebounded. After posting strong cash flow, shareholders are less worried that they will have trouble servicing their debt.

Food Prices Rise

The food index increased by 0.3% in the month. This adds to the 0.2% increase in September. Specifically, four of the six major grocery store food group indexes increased in the month. The CPI noted, “the index for meats, poultry, fish, and eggs rose 0.7% in October as the index for beef increased 1.2% and the index for pork rose 1.3%.”

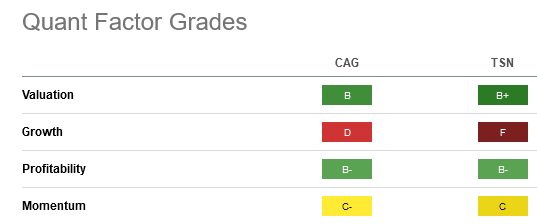

Investors who bought food stocks like Conagra Brands, Inc. (CAG) or Tyson Foods, Inc. (TSN) are down 27% and 24%, respectively. Similarly, consumer defensive stock PepsiCo, Inc. (PEP) has yet to recover fully, even after posting strong results. The Coca-Cola Company (KO), on the other hand, posted strong free cash flow and is on the rebound.

Below: CAG and TSN stock have good value and profitability, offset by weak growth and momentum.

Seeking Alpha

Among the food stocks, Mondelez International, Inc. (MDLZ) enjoyed the sharpest V-shaped recovery. Markets price stocks based on future results, so the guidance raise fueled the confectionary and food supplier’s rally.

Below: MDLZ stock has a buy rating. Invest in companies that may pass higher prices to consumers.

Seeking Alpha

The CPI report reported the index for cereals and bakery products increased by 4.2% in the year. General Mills, Inc. (GIS) and Kellanova (K) have yet to recover. Still, management has yet to prove that Kellanova’s split from Kellogg’s will increase shareholder value. Both stocks are down YTD:

Seeking Alpha

Shelter Prices Rise

The continued rise in the shelter index is a glaring issue for the Fed. This was the largest factor in the monthly increase in the index for all items, less food and energy. It increased by 0.3% in October, adding to the 0.6% rise in the previous month. Rent prices rose by 0.5%. The index for motor vehicle insurance increased again in October, up by 1.9%. In September, it gained 1.3%. While unhappy insurance customers might cancel their policies with The Allstate Corporation (ALL) because of higher prices, the stock is a winner. Companies that are able to raise prices will enjoy higher profits.

Below: the grades are a warning that investors are paying a premium for Allstate.

Seeking Alpha

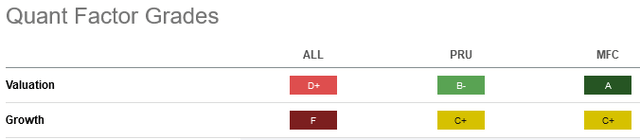

ALL stock is up by 30.5% from its 52-week low. Similarly, Manulife Financial Corporation (MFC) and Prudential Financial, Inc. (PRU) are some of the insurance stocks rising after the CPI report.

Fed Reaction

The Federal Reserve’s next policy meeting is on December 12-13. The CPI report for November is on Tuesday, Dec. 12, 2023. Assuming ongoing pressure on energy prices, investors should anticipate another market-friendly CPI report. However, the two inflation reports will give the Fed flexibility in its interest rate messaging. Expect the Fed to keep interest rates at 5.0% for a few quarters. When CPI falls more dramatically, only then will Powell switch to a more dovish tone.

In that time, the S&P 500 should trade in a wide range of 3,800 to 4,570 that benefits traders. Long-term investors have the choice of increasing cash, money market funds, bonds, some growth stocks, and income-generating securities.

Read the full article here