I last upgraded CrowdStrike Holdings, Inc. (NASDAQ:CRWD) stock in late August 2023 as I assessed buying sentiments returning to the leading endpoint security leader. CRWD has outperformed the S&P 500 (SPX) (SPY) over the past three months, as it re-tested the levels last seen in August 2022. Over a 1Y basis, CRWD posted a remarkable total return of 53%, underscoring the market’s confidence in its robust business model and leadership.

The company is scheduled to report its fiscal third-quarter or FQ3’24 earnings release on November 28. Bullish sentiments have been lifted ahead of the earnings scorecard, as investors likely anticipate a more robust forward outlook. Accordingly, management updated its medium- and long-term financial forecasts at a recent September conference.

CrowdStrike upgraded its subscription gross margin outlook to a range of 82% to 85%, significantly above its previous modeling of 77% to 82%. In addition, it also lifted its adjusted operating margin outlook to a midpoint target of 30%, up markedly from its previous midpoint target of 21%. Given the significant improvement in its profitability outlook, I’m not surprised that CrowdStrike increased its midpoint free cash flow or FCF outlook to 36% from its previous midpoint target of 31%.

Therefore, the company’s high-growth momentum has translated into impressive bottom-line growth metrics, suggesting the company has a sustainable competitive advantage.

CrowdStrike telegraphed its ambition to reach an ARR outlook of $10B over the next five to seven years. The company posted an ARR of $2.93B at its fiscal second-quarter earnings release, suggesting CrowdStrike expects durable growth to underpin its expanded TAM moving ahead. Accordingly, management stressed that the cybersecurity TAM will increase from the current $100B to $225B by CY28.

Given CrowdStrike’s leadership in endpoint security, it’s well-primed to continue expanding its capabilities and modules in cloud security. Management recently highlighted its impressive record as an ISV with Amazon Web Services or AWS. Accordingly, the company was the first ISV “founded for the cloud to exceed $1 billion in software sales through AWS Marketplace.”

Bolstered by first-party data from its cloud-native platform, the company has a significant network effect moat as it acquires more customers, providing it with even more valuable data to protect its customers. As such, I expect CrowdStrike’s moat to be highly sustainable, even as it faces competition from SASE or other legacy vendors.

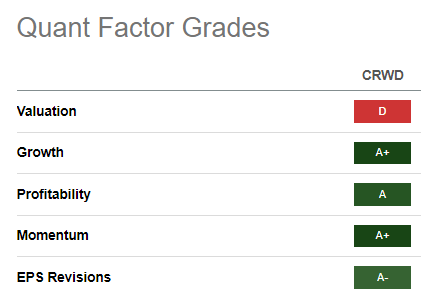

CRWD Quant Grades (TradingView)

CRWD has “A” range factor grades in four categories rated by Seeking Alpha Quant. As such, I believe CRWD remains a highly favorable cybersecurity play for investors looking for a pure-play cloud-native market leader. It’s widely considered a best-of-breed company with a durable growth strategy underpinned by the secular opportunity in cybersecurity.

However, its “D” valuation grade remains a concern. Its forward EBITDA multiple of 57.1x suggests significant optimism could have been priced in at the current levels.

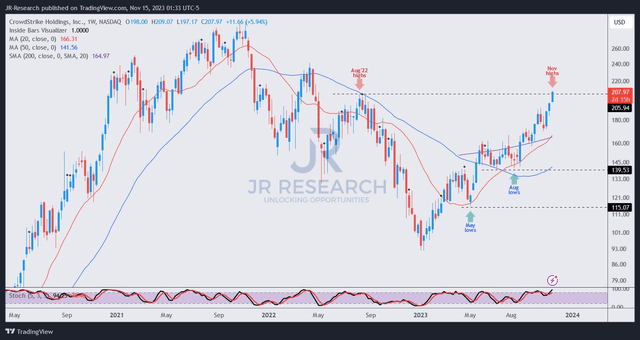

CRWD price chart (weekly) (TradingView)

I didn’t assess red flags in CRWD’s price action even as it re-tested its August 2022 highs. In other words, while a pullback in CRWD is more than welcome to shake out recent buyers, I don’t see a need to be unduly worried at this point.

Despite that, with CRWD’s recent surge, investors could afford to be patient, particularly if they already have heavy exposure to CRWD. I don’t encourage buyers who haven’t gained exposure to the stock to chase its recent upward surge, and they should remain patient to buy on its next significant dip.

Rating: Downgraded to Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Read the full article here