Listen below or on the go on Apple Podcasts and Spotify

Sir Jim Ratcliffe closes in on buying a 25% stake in the team. (0:15) Housing market shows surprising strength. (1:45) AT&T to launch standalone cybersecurity business. (3:20)

This is an abridge transcript

Out top story so far

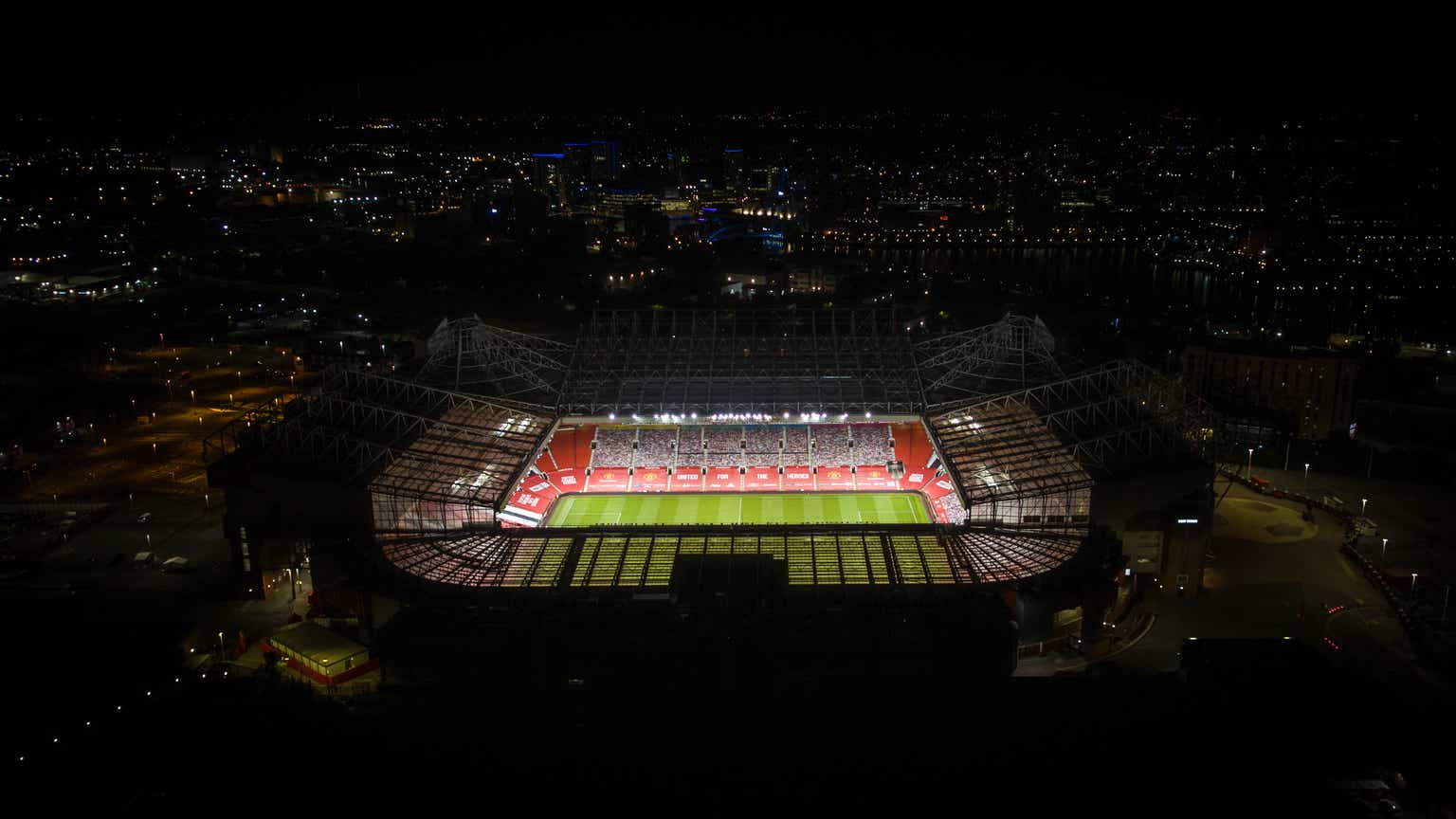

The final whistle may be at hand in the long-running Manchester United deal saga.

Manchester United (MANU) shares surged following reports that British billionaire Sir Jim Ratcliffe is close to acquiring a minority stake for about $33 a share.

The deal, which has yet to be finalized, could be announced as soon as Monday, although the timing could slip, according to Sky News. Ratcliffe’s Ineos Sports is expected to acquire 25% of both the listed A-shares and the B-shares that hold greater voting rights.

The latest update comes after reports last month that the Glazer family, which owns the famed soccer club, favored Ratcliffe’s bid for a minority stake over a rival bid from Qatari investors. The Glazer family owns 69% of the soccer club.

If the deal goes through, Ratcliffe is expected to provide additional funding for much-need stadium and facilities upgrades and take over decision-making for all sporting matters, including player transfers and contracts.

On Wednesday, Man United announced that CEO Richard Arnold was stepping down and football director John Murtaugh could be next.

In today’s trading

The markets are fairly quiet to close out the last full week before the holiday season.

The major averages are mixed, but the S&P (SP500) looks set to notch its third-straight winning week. It went into today’s open up more than 2% for the week.

The 10-year Treasury yield (US10Y) is back around 4.45% after slipping below 4.4% earlier for the first time since September.

Before the bell, latest housing figures showed some surprising strength. Housing starts and building permits for October both rose unexpectedly.

Kieran Clancy of Pantheon Macro says: “This is the second straight increase in housing starts, but they are still some 13% below the recent peak in May.”

“The monthly numbers are extremely noisy, but the rebound in construction activity which began towards the end of last year is flattening, as the rollover in rents is causing a pull-back in multi-family construction, and the latest drop in mortgage demand weighs on single-family construction plans.”

Among other active stocks

Li Auto (LI) rallied after the Chinese EV stock was picked to be a component of the Hang Seng Index. The Hang Seng family of indexes was tracked by passively-managed funds with $57.6 billion of assets under management globally at the end of last year. Li Auto will join the index on December 4.

Altamira Therapeutics (CYTO) surged after the therapeutics developer announced a partial spinoff of its subsidiary Altamira Medica for a cash consideration of around $2.3 million. The company made a deal with a Swiss private equity investor to sell a 51% stake in Medica, whose key asset is Bentrio – an FDA-approved drug-free OTC nasal spray used for the treatment of allergic rhinitis.

Fisker (FSR) announced that it delivered 107 vehicles on November 16 to represent over $7.5 million in revenue. The EV maker said it achieved the milestone by executing a new distribution strategy intended to rapidly increase global sales and deliveries of the Fisker Ocean SUV.

In other news of note

AT&T (T) plans to create a standalone managed cybersecurity business — an approach that will allow it to keep offering managed security services while focusing on its core connectivity business.

The telecom giant will build a joint venture with a capital investment from Chicago-based WillJam Ventures. The standalone business will contain “select security software solutions, associated managed security operations and security consulting resources.”

AT&T will retain an ownership stake and board representation in the business. Financial terms weren’t disclosed, but AT&T expects the transaction to close in the first quarter of 2024.

Looking to Seeking Alpha’s Weekly Dividend Roundup

This week’s dividend activity included increased payouts from Sun Life Financial (SLF) and Noble (NE) as well as declarations from companies like Clorox (CLX) and Nike (NKE).

Looking to next week, companies like Johnson & Johnson (NYSE:JNJ) and Marriott (NASDAQ:MAR) will see the ex-dividend dates for their upcoming dividend payments.

Wrapping up the week in the Wall Street Research Corner

The story of the week is the dovish Fed pivot.

But Deutsche Bank reminded investors that there were six previous occasions where that anticipation of a Fed turn has been dashed.

Those six times were:

November 2021 – The Omicron Covid-19 variant appears, and investors doubt how fast central banks can hike.

Late February through early March 2022 – Russia invades Ukraine, and the Federal Reserve starts hiking with a 25 basis points rather than 50 basis points.

May 2022 – Investors were concerned about multiple growth risks, including rate hikes, China’s zero-Covid strategy and the Russia-Ukraine conflict

July 2022 – Increased expectation of an imminent global recession with the July CPI report showing a fall in prices for the first time since May 2020.

Late September through early October 2022 – Turmoil in the UK government and bond market leads markets to price in more rate cuts for 2023.

March 2023 – The banking turmoil after SVB’s collapse.

Strategist Henry Allen says: “In many respects this echoes what occurred in the early 2010s following the Global financial crisis, when there were expectations that rates would rise, but we saw that repeatedly postponed until the Fed eventually did hike in December 2015.”

“So, with markets pricing a pivot for a seventh time, it’s worth considering whether the conditions are actually in place for that to happen.”

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here