This weekend, the unexpected firing of OpenAI CEO Sam Altman, and his rapid hiring by Microsoft

MSFT

Almost every industry has seen discussion around AI and its potential benefits over the course of the year, thanks to a reignition in interest caused by the launch of OpenAI’s tentpole generative AI product ChatGPT. First launched in November 2022, with the updated GPT-4 and a premium version that included API support made available in March 2023, ChatGPT has since been incorporated into several platforms, including Microsoft search engine Bing. It has also seen the rise of several competitors, including Google’s Bard.

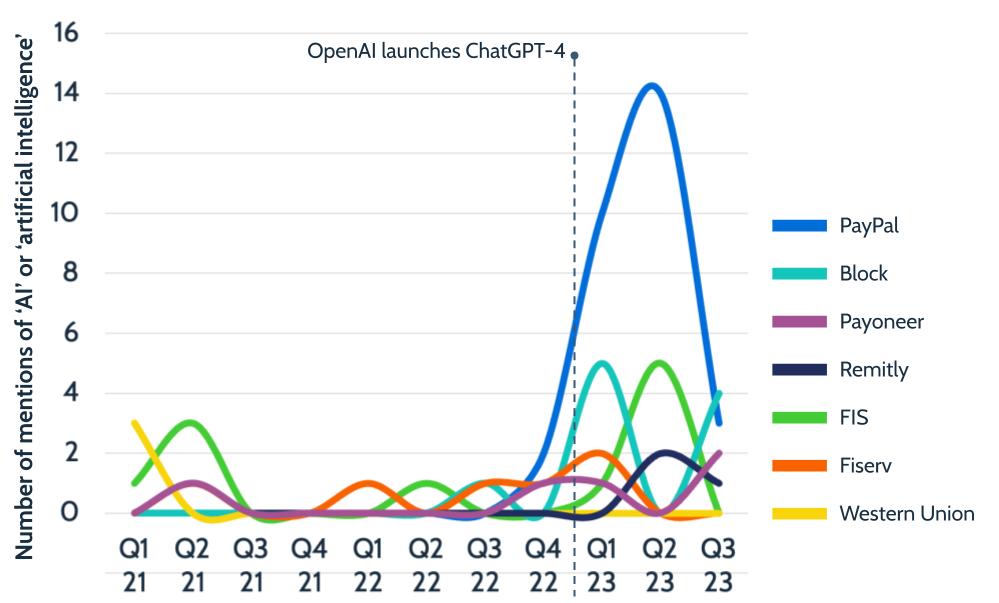

For cross-border payments, the AI story has been fairly typical of many industries. While earlier forms of the technology have long been widespread for industry applications in areas such as fraud prevention and KYC, generative AI was a sudden arrival that represented a new potential frontier. Initial responses to ChatGPT were, as with many tech and tech-adjacent industries, very enthusiastic and somewhat frantic.

Many scrambled to find a business enhancing-use for the technology, concerned that if a competitor cracked it before they did it would spell a significant long-term disadvantage, before enthusiasm cooled. As we entered the latter part of the year, engagement with generative AI became calmer and more measured – reflected in more nuanced and less aspirational industry discussion – and businesses began to explore the genuine potential benefits of the technology.

Now ChatGPT has reached its first birthday, it’s clear there is a long way to go before the true impacts of the technology will be felt and that while it certainly has benefits, generative AI is not the panacea that some felt it might be just months ago.

How cross-border payments companies are using artificial intelligence

Behind the scenes, most fintech companies are likely to have some long-term projects that involve generative AI, either as a primary focus or as an assistive tool to reduce repetitive tasks and automate time-consuming processes. However, when it comes to current applications that are openly used, the space is relatively divided.

Among remittance and money transfer players, publicly shared use of any form of AI is relatively scarce, with the technology generally not seeing significant interest within the space. However, among payment processors, there has been more use of the technology.

This is reflected by my own company’s analysis of mentions of the term in public company earnings calls. Major remittance player Western Union

WU

By contrast, payments processors see greater numbers of mentions and while these can vary significantly by quarter, there has been a marked uptick since the launch of ChatGPT-4. PayPal

PYPL

FIS

How frequently example cross-border payment companies mention AI in earnings calls

Cross-border payments players who are engaging with AI are largely exploring its use in the customer service and sales spaces. Payoneer, for example, is exploring integrating “the benefits of generative AI at the top of the funnel” as well as throughout the company’s operations, said CEO John Caplan when I spoke to him earlier this month.

Meanwhile, Block CEO Jack Dorsey told investors that using and growing with AI was the company’s “number three priority”. He said this meant “increasing the probability of positive outcomes for sales, customer service, which is focused a lot on retention and sales within the ecosystem, and also marketing”, as well as creating operational efficiencies.

Such efficiencies are also a focus for PayPal, which made multiple references to AI across several projects, although incoming CEO Alex Chriss highlighted generative AI’s potential to “further connect our merchants and consumers together in a tight flywheel” in particular.

The future of AI in payments

While AI, and in particular generative AI, is already being explored in cross-border payments, the process is only beginning to be explored, and significant benefits are unlikely to be felt beyond fringe areas for some time.

Just as the AI industry is facing upheaval as it develops and grows, the use of the technology is still finding its way into the payments space, and the potential, limitations and opportunities are being slowly uncovered by iterative processes and experimentation.

With much of this work going on behind closed doors, the true picture of development in cross-border payments is likely to only be observable retrospectively some time from now. However, it is clear that those who are prepared to make space for long-term research and development in this area now are likely to see greater gains in the future.

As we move into 2024, AI is not going away, although with years of development ahead, retaining a measured approach to the technology will help ensure companies retain the stamina for the long-haul.

Read the full article here