PubMatic (NASDAQ:PUBM) reported fairly soft results in the third quarter, but fourth quarter guidance was solid and management commentary on the earnings call was upbeat. This, along with an improvement in free cash flows, appears to have helped move the stock significantly higher.

Monetized impression growth is driving PubMatic’s results at the moment, although this is still being offset by CPM weakness. Despite current headwinds, the company remains confident in its long-term opportunity, supported by new logo additions and a deepening of relationships with existing publishers and buyers. PubMatic also recently introduced supply path optimization and commerce media solutions which will support the business going forward.

While the near-term outlook for the company appears to be improving, and PubMatic’s stock is still attractively priced, the company’s competitive position is unclear. Given the importance of infrastructure, and increasingly data, to SSPs it is reasonable to question whether PubMatic’s lack of scale is a disadvantage. I previously highlighted some of the issues with PubMatic’s business, while suggesting that its valuation could result in attractive returns. With digital advertising markets apparently strengthening, or at least stabilizing, this has proven to be the case so far.

Market

While an argument could be made that digital advertising markets have bottomed and that adtech companies should be seeing accelerating growth, performance across the industry is currently highly variable. PubMatic has suggested that it is currently seeing solid transaction growth, which is being offset by soft CPMs. In part, transaction growth is probably being driven by buyers consolidating ad spend across a smaller number of platforms.

Longer-term, the market for SSPs is expected to expand at a healthy pace, but there are questions around how competition will evolve. In the past SSPs have provided fairly commoditized services, and there is heavy overlap in the product portfolio of companies like PubMatic and Magnite (MGNI).

Scale is one potential differentiating factor, particularly if the market becomes more concentrated, as is expected. SSPs need infrastructure that can support high-speed transaction capabilities at scale, creating economies of scale. In addition to general market growth, header bidding has led to a significant increase in the number of ad impressions that need to be processed and analyzed in real-time. For example, PubMatic’s platform processed approximately 159.1 trillion ad impressions in 2022, a 72% increase YoY. SSPs also provide customers with data that helps them to optimize their business, potentially providing an additional source of economies of scale. While PubMatic is relatively large, it is significantly smaller than some SSPs, which could be a disadvantage.

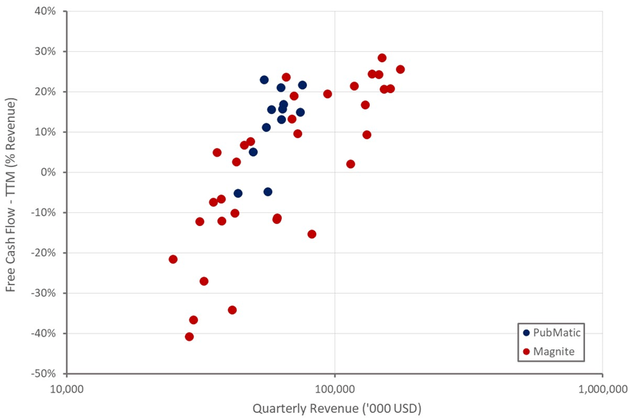

Figure 1: PubMatic Free Cash Flow (source: Created by author using data from company reports)

CTV

While CTV presents a large long-term opportunity for SSPs, its potential has yet to be realized as buyers are currently focused on private marketplace and programmatic guaranteed transactions. Nearly a third of PubMatic’s revenue now comes from PMP transactions, a 10% increase YoY. This growth is being driven by CTV, where ad spend is still moving from linear TV and PubMatic is rapidly increasing its publisher base. Ad spend should continue to move from linear TV to CTV though, and in time towards biddable programmatic as buyer behavior evolves.

PubMatic recently announced an expanded partnership with FreeWheel, a leading CTV ad server owned by Comcast. This partnership aims to provide a direct path for buyers to access FreeWheel’s premium CTV inventory through PubMatic’s Activate solution.

Supply Path Optimization

The macro environment continues to be a driving force behind SPO, as buy-side companies seek maximum return on ad spend. PubMatic has now thrown its hat into the ring with Activate, an SPO solution that the company has been working on over the past 18 months. Activate enables buyers to execute non-bidded direct deals on CTV and premium video inventory through PubMatic’s platform. Activate is designed to accelerate the transition of non-programmatic insertion orders for CTV and online video into non-bidded programmatic buying transactions.

Activate was launched in May, and in the first six months, PubMatic has built a pipeline of over 50 advertisers, agencies and campaigns. Activate was recently launched in the Asia Pacific region. Total activity from SPO deals grew to 45% in the third quarter, partly aided by Activate.

Commerce Media

Privacy changes are forcing innovation in the adtech industry, and commerce media is one beneficiary of this. PubMatic’s Convert solution expands its business into commerce media and increases its TAM by 10 billion USD. Convert addresses use cases like sponsored listings, audience extension and deal ID generation. This helps large commerce businesses manage inventory and consumer data in one system which brands can access. PubMatic’s pipeline of Convert opportunities has grown 40% over the past three months.

Connect

Digital advertising is in the process of transitioning from targeting using third-party cookies to first-party identity based on consumer opt-in, or other privacy compliant solutions. There are a range of companies developing new identity solutions and PubMatic’s Connect aims to simplify the implementation and management of these products. Connect already supports dozens of global data providers and nearly 75% of impressions on PubMatic’s platform have alternative targeting signals attached.

Financial Analysis

PubMatic’s revenue in the third quarter was 63.7 million USD, roughly a 1% decline YoY. This result was driven by solid impression volume growth offset by weak CPMs. For example, PubMatic processed nearly 56 trillion impressions in Q3 2023, a 33% increase YoY. Performance through the quarter was uneven though. July was challenging, but impressions accelerated through the quarter and were above expectations in August and September. CPMs stabilized from July onwards.

Omnichannel video revenues were down approximately 4% YoY due to the soft July. As a percent of total revenue, omnichannel video revenues increased to 33%. CTV revenue declined 3% YoY. Display revenues were 67% of total revenue and declined 4% YoY. Display results were negatively impacted by Yahoo’s technology transition. PubMatic’s Q3 revenue growth excluding Yahoo owned and operated inventory increased in the low single digit percentage range. It is expected to take several quarters for PubMatic to ramp Yahoo monetization as they migrate their inventory to a new technology stack.

October revenue grew in the single digit percentage range YoY, with both omnichannel video and display revenues increasing. Despite a solid start to the fourth quarter, PubMatic remains cautious on brand advertising spend due to the macro environment. Q4 revenue is currently expected to increase 5% YoY, including the impact of the Yahoo transition. This outlook is based on an assumption of stable CPMs and resilient general market conditions.

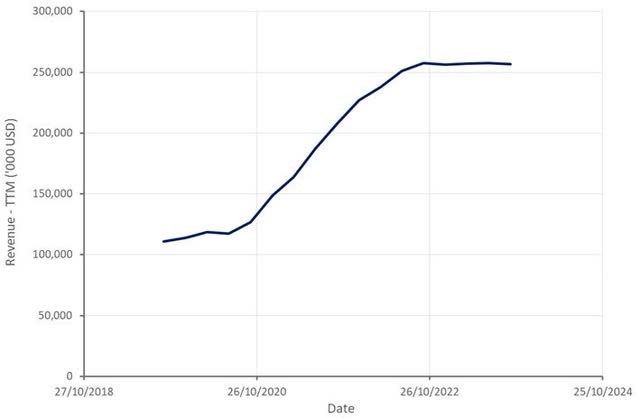

Figure 2: PubMatic Revenue (source: Created by author using data from PubMatic)

The number of active publishers on PubMatic’s platform increased 11% YoY in the third quarter, with PubMatic now monetizing inventory from over 1,750 global publishers and app developers.

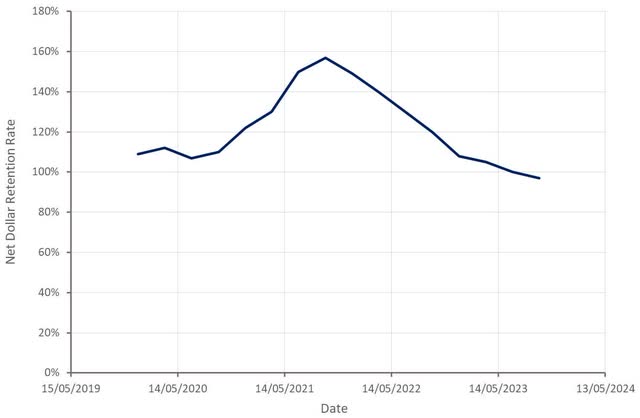

PubMatic’s net dollar-based retention rate declined to 97% for the trailing twelve-months ended September 30, 2023. With CPMs expected to stabilize, this metric should begin to rebound in coming quarters.

Figure 3: PubMatic Net Dollar Retention Rate (source: Created by author using data from PubMatic)

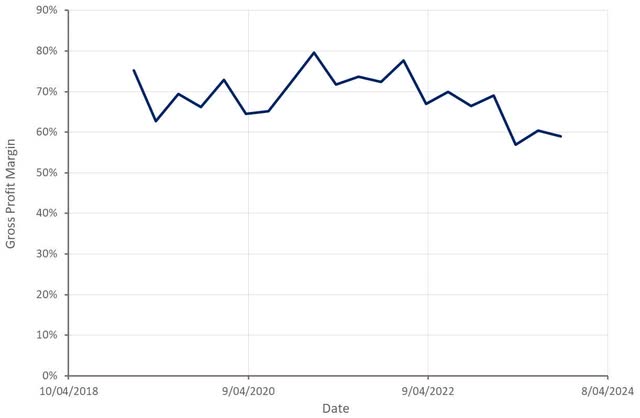

Despite a substantial reduction in cost per transaction, PubMatic’s gross profit margin continues to fall as a result of weak CPMs. PubMatic continues to focus on infrastructure efficiency, which should see gross margins begin to rebound once CPMs stabilize. PubMatic suggested that cost of revenue in the fourth quarter would be flat sequentially, which would result in a meaningful improvement in gross profit margin if growth meets expectations.

Figure 4: PubMatic Gross Profit Margin (source: Created by author using data from PubMatic)

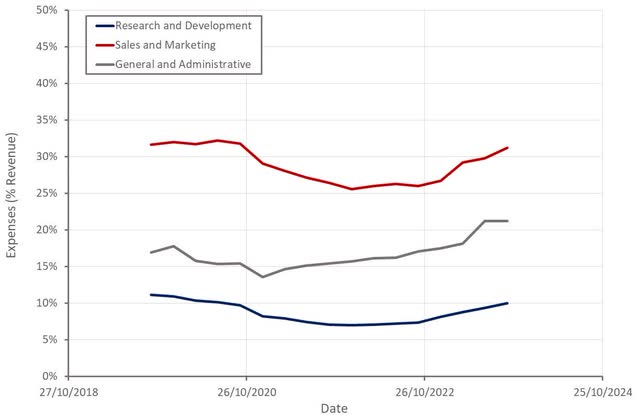

PubMatic’s operating profitability has been under pressure in recent quarters due to a combination of:

- Falling gross profit margins

- Flat revenue

- Rising operating expenses

While PubMatic’s operating expenses will likely rise further as the company continues to invest in growth, management commentary suggests a return to profitability in Q4.

Figure 5: PubMatic Operating Expenses (source: Created by author using data from PubMatic)

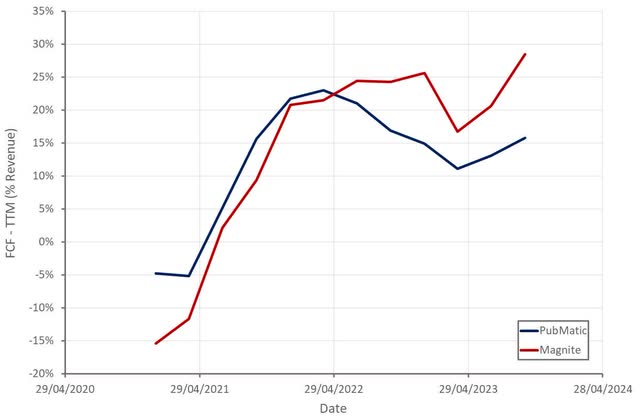

In the face of solid impression growth, PubMatic has still been able to pull back on CapEx, supporting an improvement in free cash flow generation. Free cash flows should continue to move as margins move higher and PubMatic returns to growth.

Figure 6: PubMatic Free Cash Flow (% Revenue) (source: Created by author using data from PubMatic)

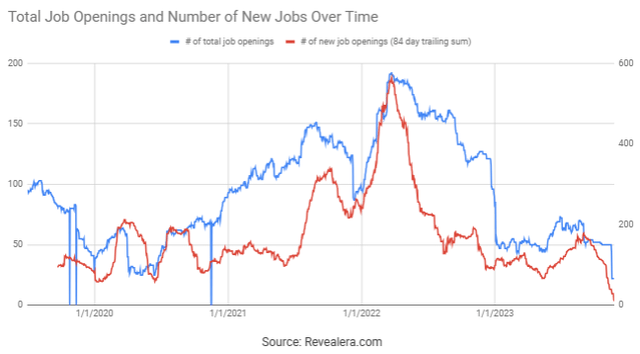

While most of the available data suggests that PubMatic’s near-term prospects are improving, hiring data could be a warning sign. The number of PubMatic job openings has fallen sharply in recent weeks, which often occurs when a company’s performance dramatically weakens.

Figure 7: PubMatic Job Openings (source: Revealera.com)

Conclusion

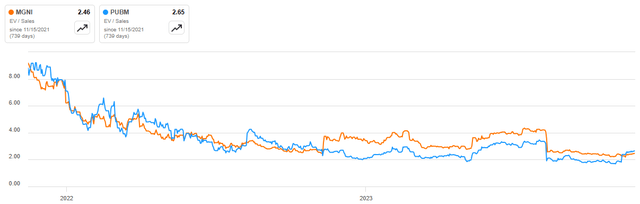

After its post-earnings bounce, PubMatic is now trading more in line with Magnite based on a revenue multiple. It should be noted that Magnite’s cash flow margins are currently much better, although this is offset by the company’s weaker fourth quarter guidance.

Independent of the relative valuation of PubMatic and Magnite, both companies appear attractively priced given that they are returning to profitability, generating substantial free cash flow and have solid growth prospects. This must be weighed against the fact that SSPs have generally had a tenuous competitive position in the past. There are forces in the market that could change this, but at this stage, investing in SSPs remains a speculative endeavor.

Figure 8: PubMatic EV/S Multiple (source: Seeking Alpha)

Read the full article here