YieldMax COIN Option Income Strategy ETF (NYSEARCA:CONY) is a covered call fund that sells options on Coinbase (COIN) in order to generate monthly income. The fund has an annualized distribution yield of 52% based on the distributions it has made so far (only two).

Distribution Yield of CONY (YieldMax)

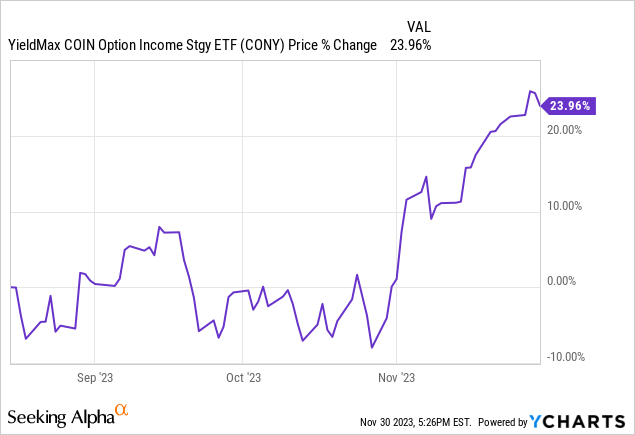

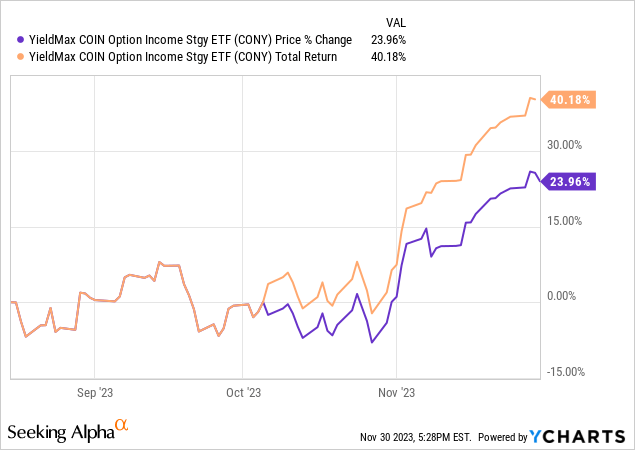

This might be the best-performing YieldMax fund this year because its NAV is up 24% despite making two large distributions. It’s very rare for covered call funds to see this kind of climb when their distribution rate is so high.

Combining the NAV gains with the large distributions it made so far, CONY had total gains of 40% in its short existence of only 3 months.

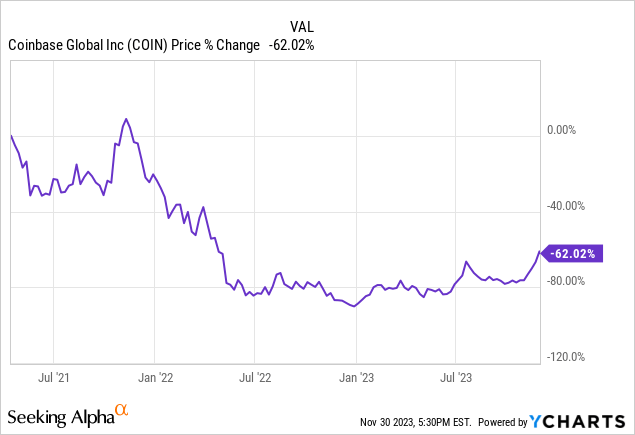

This looks very encouraging but keep in mind that this is a single-stock based ETF and its performance relies heavily on the performance of its underlying stock which is COIN. This is a very volatile stock that has had some very sharp ups and downs during its short 2-year history, and it’s down 62% from its IPO date even though it’s up 250% year to date.

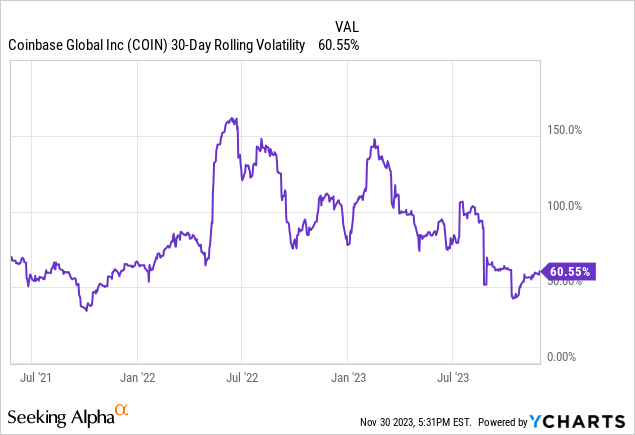

Volatility is the bread and butter of a covered call fund, and it can determine how much yield one can get from a fund because covered call funds harvest volatility and that’s where the yield comes from. When it comes to volatility, this COIN is highly volatile. Since having its IPO 2.5 years ago, COIN’s 30-day volatility dipped below 50% only twice, and both of these instances were short-lived. During the last 2.5 years, the stock’s volatility ranged from 50% to 150% with most of the time spent in 60s and 70s. Compare this to VIX which is basically the implied volatility of the S&P 500 index (SPY) which ranged from 12 to 35 during the same time and averaged 19. This means selling options on COIN can generate 3 to 6 times as much premium as selling options on the index, but it also comes with a price.

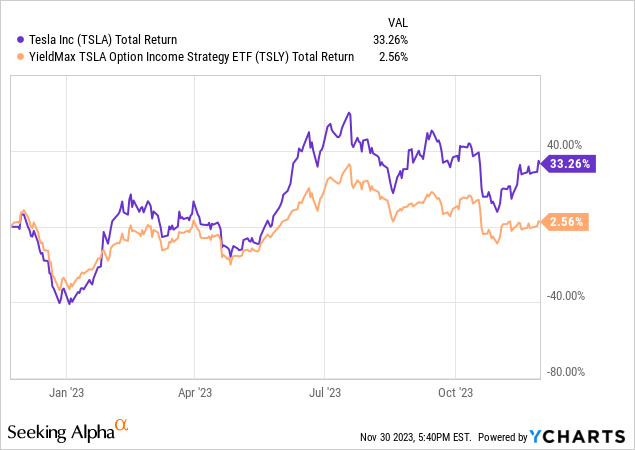

We all saw what happened to another YieldMax fund TSLY (TSLY) when it was harvesting Tesla’s (TSLA) volatility. The fund suffered some large losses when TSLA crashed and didn’t participate in most of the upside when the stock recovered quickly, which means it got left behind as it was barely flat in a year when TSLA was up 33%.

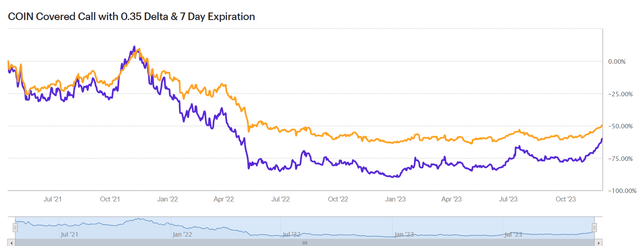

I did a back-testing of what would happen if you sold weekly covered calls on COIN at the time of the stock’s IPO using E-Trade’s (MS) back-testing tool. I used weekly options with a delta of 0.35 (about 5-10% out of money) which is the strategy used by the fund so far (which is subject to change since this fund is actively managed). The results showed that although this strategy would have outperformed simply buying and holding COIN, it would still have negative overall results. Harvesting volatility is great when things are going great, but it can quickly turn against you if you are not sufficiently hedged.

Back-Testing of COIN Covered Call Strategy (E-Trade Back Testing Tool)

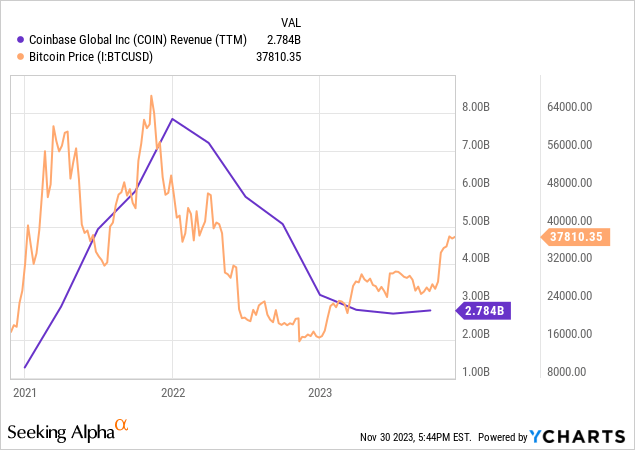

Now let us take a look at COIN, which is the underlying stock of CONY. This is a company whose performance is strongly correlated with Bitcoin (BTC-USD). One might as well say that this fund indirectly writes covered calls on Bitcoin. When Bitcoin and other cryptocurrencies perform well, so will Coinbase. When there is less appetite for cryptocurrencies, COIN’s revenues also seem to suffer significantly. This means that if you are feeling bearish about Bitcoin (and cryptos in general), this may not be the best fund for you. If you are bullish on cryptos in general, this could be a good fund to harvest their volatility.

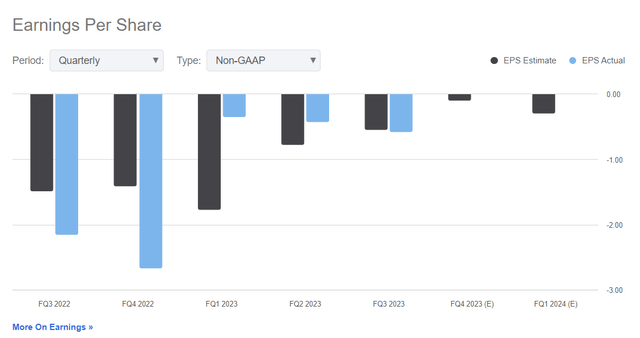

One of the biggest challenges with COIN is that the company is struggling to achieve profitability. Analysts see the company posting smaller losses in coming quarters but still no profits on the horizon. During bull markets, investors don’t seem to mind that a company isn’t profitable, but this can easily change when the tide turns like it did in 2022 and those companies that failed to generate profits got hit the hardest.

Profitability of COIN (Seeking Alpha)

How do you even hedge a position in CONY? Well, CONY doesn’t have an options chain, so you can’t just buy CONY puts as a hedge. You could buy puts on COIN, but they would be very expensive for the same reason CONY has such a high dividend yield in the first place: the volatility is too high. If you bought COIN puts a year out at a strike price of $100 (which is $25 below the current price) you’d be out $22 per contract which is very costly and your breakeven price on these puts would be $78.

COIN Option Chain (Seeking Alpha)

You can also buy a put spreads instead of put contracts and these could also offer you a level of protection which will be more limited. For example, a put spread of $100-$80 would offer you some protection and cost about $7 per contract as opposed to $22 per contract. A put spread will offer you only a limited protection, so you might need to buy as many contracts as needed to cover your full position. For example, if your position size is $5,000, and you bought a put spread that’s $25 wide (such as $100-$75 spread), it will only offer you protection up to $2,500 at most (minus the price of the contract). This would cover about 50% of your total position size of $5,000 so you might want to get 2 contracts for full coverage of $5,000.

There is another method that can offer you not only limited hedging, but also additional income and let you benefit from the expensiveness of COIN options. You can sell call spreads that are significantly out of money. For example, currently COIN trades at $125 and if you sold $160-165 spread 6 months out, you’d generate about $1.15 per contract. Selling 10 such contracts would give you an additional income of $1,150 and protect your $5,000 position from a downside of 23% (or boost your income by 23%). If the stock moved too high too fast, this position could turn into a loss unless you were able to roll it out to a later date and higher price though. If you applied this type of “hedging” you’d have to watch your position very closely to make sure that your hedges aren’t working against you.

Remember, this fund can offer a very high yield because COIN has high volatility, but this can also work against you when things go south because the same high volatility that gives you high premiums also makes it expensive to hedge your position. After all, it goes both ways.

I would actually say that the best hedge is diversifying and keeping a small position. If CONY makes up 50-60% of your entire portfolio, you will have to find a way to hedge but if this fund only makes 2-3% of your total position, you won’t need to lose sleep over hedging because even if the entire position goes bust, you won’t be losing much. The way I personally play YieldMax ETFs is that I buy equal amounts of each ETF which gives me good coverage of big tech stocks, then I hedge the entire position using QQQ put spreads which are way cheaper than individual stock puts. This way, I don’t need to find hedges for each specific position but a hedge for the entire package since I am already diversified.

In conclusion, I would hold CONY but make sure that it’s a small component of a well-diversified portfolio or find a way to hedge the position so that I won’t lose sleep over it. I wouldn’t sell or short this fund at the moment, as its good performance can continue for a while.

Read the full article here