Bank of Montreal Overview

Several months ago I journeyed to the Canadian north, figuratively, of course, to cover Bank of Montreal (NYSE:BMO), also commonly known as just “BMO.” Since my hold rating in early August until today, the stock has fallen just around 6%.

In today’s note, I’ll be applying an updated and simplified methodology, to see if the rating changes.

Some quick facts on this company, for readers less familiar, are that it calls itself the 8th largest bank in North America by assets, has about 13MM customers, and covers a range of banking solutions including personal/commercial/global/investment banking.

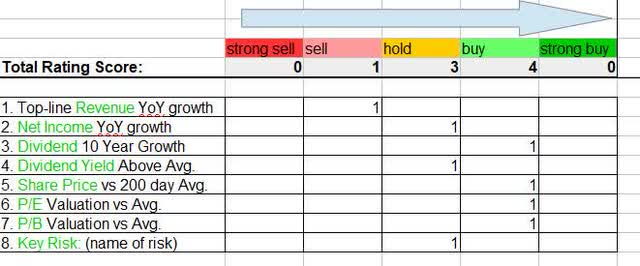

Total Rating Score

BMO – score matrix (author analysis)

Based on the score total in today’s note, I’m rating this stock a buy, although trailing close behind would have been a hold rating.

This is an upgrade from my August rating of hold.

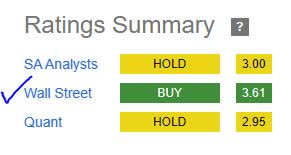

Comparing my rating to the consensus on Seeking Alpha today, my rating this time is aligned with the consensus from Wall Street:

BMO – rating consensus (Seeking Alpha)

Rating Methodology

My simplified and straightforward 8-point approach focuses on a few core areas such as revenue and earnings growth, dividend income opportunity, undervaluation opportunity, a share price presenting a value-buying potential, and identifying a key risk of the company as well as its potential impact to an investor.

Top Line Revenue YoY Growth

I am looking for any positive revenue growth on a YoY basis, and here is what I found:

For the quarter ending Oct 2023, the firm saw $5.7B in total revenue vs $7.57B in Oct 2022, a nearly 25% YoY decline. Also, all of the last 3 quarters saw lower revenue than in Oct 2022, so perhaps a larger trend, when looking at the income statement.

So, in this category, I am adding a point to the “sell” side of my score matrix.

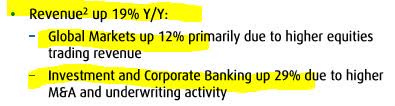

One business segment I want to call out is BMO Capital Markets, which has impressive revenue results according to the company presentation:

BMO – capital markets revenue (company quarterly results)

In addition, although BMO is a Canada-based company, it does quite a bit of business in the U.S., and more positive news is that they saw 44% YoY revenue growth in their U.S. personal and commercial bank, with net interest income up 45%:

BMO – US results (company quarterly results)

Looking ahead, I expect the high interest rate environment to continue to drive strong revenue, but I think we should also consider improvement to equity markets as well this year that I expect to continue, which could benefit their trading desk. For example, the momentum of the S&P 500 index (SP500) has shown a 1-year price return of nearly 13%.

Net Income YoY Growth

I am looking for any positive net income growth on a YoY basis, and here is what I found:

On the earnings front, $1.16B in net income for Oct 2023, vs $3.29B in Oct 2022, a 65% YoY decline. However, the quarter saw improved earnings vs. the prior three quarters, according to the income statement.

So, in this case, I will be middle-of-the-road and add a point to the “hold” section of my score matrix.

Keep in mind that BMO had acquired Bank of the West and so it also impacted its last quarterly results.

According to the quarterly earnings release, “the inclusion of Bank of the West results in the current quarter decreased reported net income by $317 million.”

Across some of its business segments, BMO Wealth Management’s “reported net income was $262 million, a decrease of $36 million or 12% from the prior year,” while its core Canadian personal and commercial banking saw improved earnings “due to higher net interest income driven by higher balance growth and margins, and higher non-interest revenue, partially offset by higher expenses and a higher provision for credit losses.”

Looking ahead, I expect as the current elevated interest-rate environment remains, it will continue to benefit interest income but also impact interest expense.

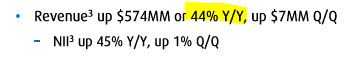

Dividend 10-Year Growth

I am looking for dividend 10-year growth trends, and here is what I found:

BMO – dividend growth 10 yrs (Seeking Alpha)

When comparing the annual dividend in 2013 of $2.87 vs. that of 2022 of $4.19, we can see a 46% growth in this 10-year period.

Here I will give it a point in the buy category of my matrix, especially since they are now paying $1.12/share on a quarterly basis, which I think is a pretty solid dividend income opportunity.

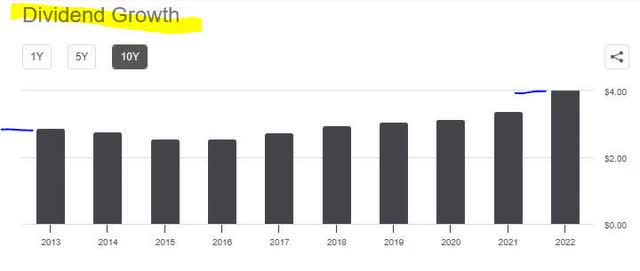

Dividend Yield Above Average

I am looking for a dividend yield above its sector average, and here is what I found:

BMO – dividend yield vs peers (Seeking Alpha)

For my dividend-oriented readers, I created the chart above, which compares the dividend yield (trailing) of 5.10% vs. four other peers. For my peers, I picked large Canada-based banks.

Of this peer group, Bank of Nova Scotia (BNS) aka Scotiabank came out the leader with a 6.85% dividend yield, while BMO was somewhere in the middle of the pack.

So, if picking based on getting the maximum yield possible, I would do better with BNS or CIBC (CM).

From this study, I would give BMO a neutral score in my score matrix, as a +5% yield is really great, but some peers have a better one.

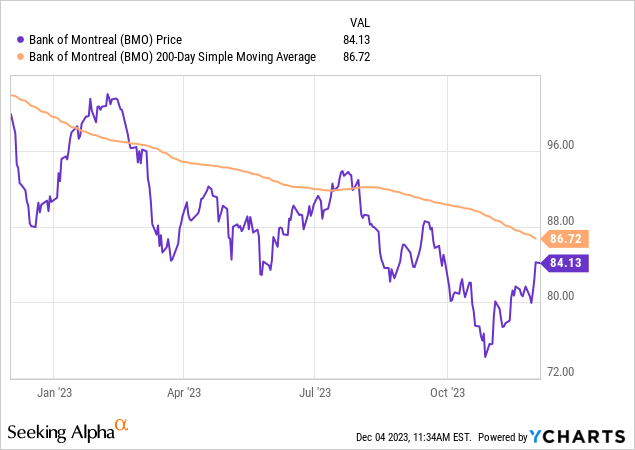

BMO Stock Price vs. 200-day Average

My portfolio strategy prefers dip-buying opportunities when the share price falls below the 200-day simple moving average, so here is what I found:

As of trading on Monday morning, the price hovered around $86.72, a little over 3% below the 200-day simple moving average.

Although a better dip opportunity exists this fall, I think it still presents a buying opportunity when also considering the +5% dividend yield.

Bank of Montreal P/E Valuation vs. Average

I am looking for an undervaluation opportunity when it comes to price-to-earnings, and here is what I found:

From valuation data, I can see that the forward P/E ratio is 10.40, around 3% above its sector average.

I think what is driving this multiple is the spike in the share price while the earnings have declined. However, I will call this a justified multiple of 10.4x earnings because it is only slightly below the sector average, the share price is still trailing its 200-day average, and earnings have improved vs. the last three quarters.

So, another point goes into the buy side of my score.

Bank of Montreal P/B Valuation vs Average

I am looking for an undervaluation opportunity when it comes to price-to-book value, and here is what I found:

The forward P/B ratio is 1.13, also around 3% above the sector average.

In tying this valuation to the equity on the balance sheet, to see a connection, we can see that total equity /book value went up to $55.5B in the last quarter, vs $52.1B in Oct 2022, a 6.5% YoY improvement to equity.

Considering that equity has improved, and the share price, even though it has rebounded, is still well below the 200-day moving average, I would call this a justified valuation at 1.13x book value. So, it gets a point in the “buy” side of my score matrix.

Key Risk

As an investor and analyst, I find it relevant to analyze risk as well, and here is one key risk of this company I identified:

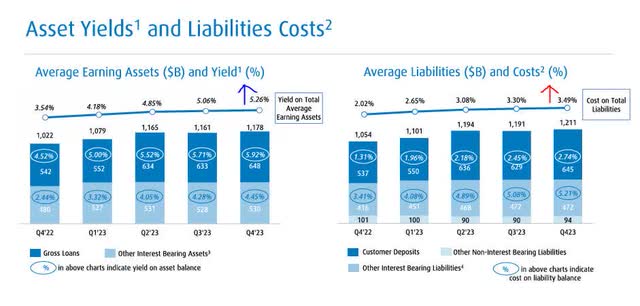

As a major part of its business model is to earn interest income from loans it writes, and bonds/fixed-income assets it holds in its portfolio, it must face the challenge of balancing that with the cost incurred from interest-bearing deposits it holds for customers.

Since rates are impacted largely by decisions from central banks like the Fed, we can see in the chart below how the rising rate environment has both benefitted this bank, but also driven costs up as well.

BMO – interest margin (BMO quarterly results)

If you correlate this period with the income statement, you can see that total interest income jumped to $11.24B in the last quarter vs. $6.7B in Oct 2022, a 68% increase. At the same time, total interest expense jumped to $7.69B vs. $3.9B in Oct 2022, a 97% increase.

Looking forward, I have to refer to CME FedWatch, which predicts a 99% chance the Fed will hold rates steady after its Dec. 13th meeting, and a 50% probability it will reduce rates after its March 2024 meeting. So, I am on the fence about the interest-rate risk for this bank since it seems like a double-edged sword, hence I am putting a point in the hold section of my score matrix.

Wrap-Up

To summarize today’s note, I am upgrading BMO to a buy, from my prior hold rating.

Positives driving this bullish sentiment are a +5% dividend yield along with a $1.12 per share payout, share price trading below the 200-day average, and reasonable valuation metrics.

Some challenges remaining are a decline in income and revenues, as well as an increasing squeeze on interest margins, as both the yield on earning assets has gone up but so have the costs of their interest-bearing liabilities.

This is a solid bank with lots of brand name recognition in the U.S. and Canadian financial markets, and a large scale. It is also well-diversified across multiple business segments.

If I were trading this, I would add it to a portfolio of diversified bank stocks from the U.S., UK, and Canada, with an eye towards averaging +5% or better dividend yields in my portfolio, along with the steady quarterly cashflow to the portfolio.

Read the full article here