U.S. consumers can’t seem to shake the feeling that their dollars don’t go as far as they used to.

Wages are outpacing inflation. The economy is growing. Investors are pre-emptively celebrating the end of the Federal Reserve’s interest-rate hikes. But consumers are still in a rotten mood — and most are placing the blame on high prices.

Consumers expect inflation to speed up over the next year, according to the University of Michigan’s most recent measure of consumer sentiment — even though the rate of inflation actually slowed throughout 2023, from 6.4% at the start of the year to 3.2% in October.

It’s a disconnect that has puzzled experts: How can consumers be so pessimistic in the face of such good economic data? Or to put it another way, if the economy is doing so well, why do Americans still feel so bad?

One economist has her own theory.

“People anchor to their recent experiences, and they anchor to individual numbers,” said Constance Hunter, a senior adviser at Macro Policy Perspectives, LLC, an economic research firm. “That’s altering perceptions.”

According to Hunter’s hypothesis, consumers’ perceptions of inflation are shaped by two factors: first, that the cost of individual segments of their own budgets has shot up over the last few years, and second, that most people are still using the prepandemic economy as a comparison point.

It’s difficult to say with absolute certainty what’s driving discontent among consumers. But Hunter suspects these biases serve as “anchors” for economic perceptions, shaping people’s outlook even when the data offers an alternative picture.

“It’s probably not conscious,” she noted.

Breaking down the disconnect

Hunter posits that people’s perceptions of inflation hinge partially on singular instances of sticker shock that have an outsize impact on their broader economic outlook.

That’s especially true for nonnegotiable expenses, Hunter said.

Take car insurance, for example. The price of coverage has seen a cumulative increase of 33% since February 2020, about an 8% annualized increase.

“You have to have insurance to drive a car,” Hunter said. “If you don’t know why [the price] has gone up so much, and you’re not sure if it’s going to go up next year, then of course you’re going to be worried about inflation.”

Americans also may still be wincing at inflation because they’re comparing current prices or their current wages to a prepandemic standard that has since shifted drastically, Hunter said.

“People are anchoring to before the pandemic, because it kind of froze time, in a way,” she said.

The money illusion

Hunter’s thinking connects back to an economic theory first posed in the early 20th century that states that most people don’t take into account the effects of inflation when evaluating their own wealth.

The theory, called the money illusion, states that people tend to view their income in nominal rather than real terms.

For example, someone may receive a 2% wage increase during a year in which prices also increase 2%. That person may perceive themselves as having more money to spend, despite the fact that in real terms, their purchasing power stayed the same.

“We’re all subject to it,” Hunter said.

That phenomenon can also work in the other direction — and that’s what may have happened over the last few years, as prices shot up while wages initially lagged.

Does it matter?

So Americans are gloomy about the state of the economy. But does that actually matter in the broad scheme of things — especially when it comes to monetary policy?

Not really, Hunter said.

”What will matter to the Fed is what the data actually prints, not what people are anchored to,” she said.

It’s an old economic adage: Pay attention to what consumers do, rather than what they say. And recent data indicates they’re still spending — and likely planning to spend through the holidays — at decent levels.

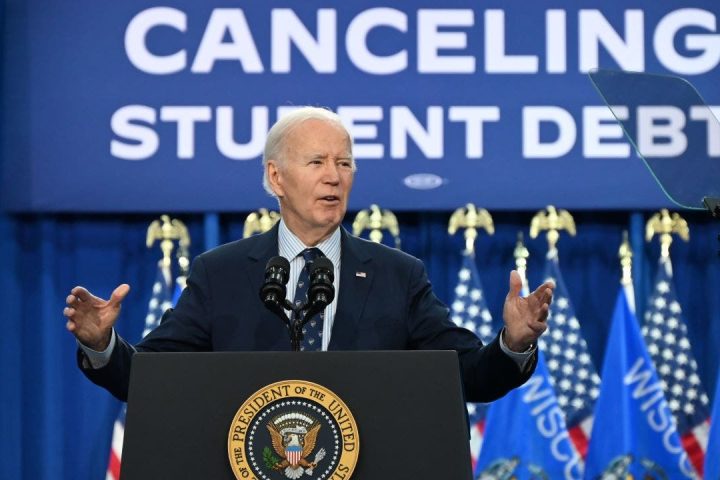

Consumers’ economic pessimism may prove to be more of a political problem. President Joe Biden will likely have to confront questions on the campaign trail this year about whether his Bidenomics policy agenda has left voters feeling better off.

But such sentiment is often split along party lines, Hunter noted.

“During the Trump years, Democrats had significantly worse sentiment, then Biden gets elected and it’s exactly reversed,” she said. “If it weren’t [inflation], it would be something else causing the political bifurcation.”

How long might it take until consumers finally start feeling less pessimistic about higher prices? Hunter estimates it will be six months to a year.

“I think when you’re talking about people’s experiences and what they’re anchoring to, it’s going to take time,” she said. “They need to feel it.”

Read the full article here