We previously covered Jackson Financial Inc. (NYSE:NYSE:JXN) in September 2023, discussing its bright prospects ahead, attributed to the consistently improving profitability metrics and healthier balance sheet, despite the uncertain macroeconomic events thus far.

The highly competent management also introduced new annuity products to attract new consumers, well balancing the stagnant sales for variable annuity and fixed annuity products at a time when the US Treasuries had been immensely popular.

Combined with the robust dividend thesis, we had rated the JXN stock as a Buy then.

In this article, we shall discuss why our previous two Buy rating have been highly rewarding, with JXN offering an immense total return of +76.67% since our first June 2023 coverage, well eclipsing the SPY at +7.84%.

Despite so, we maintain our conviction that the stock is still undervalued compared to its peers and the sector, with it likely offering excellent dual pronged returns over the next few years, namely capital appreciation and dividend income.

JXN Remains Inherently Undervalued, Despite The Immense Rally Thus Far

For now, JXN has reported a double beat FQ3’23 earnings call, with revenues of $2.6B (+534.1% QoQ/ -12.1% YoY), adj operating earnings of $315M (+11.3% QoQ/ -16.2% YoY), and adj operating earnings per share of $3.80 (+13.7% QoQ/ -11.2% YoY).

Part of the tailwind is attributed to the growing demand for its Registered Index-Linked Annuity [RILA] sales of $807M (+49.1% QoQ/ 43.5% YoY), well exceeding the sales of fixed annuity at $76M (-33.9% QoQ/ -32.1% YoY).

It is apparent that the JXN management has effectively improved its policy issuance and underwriting thus far, with the RILA segment already offering increased economic offset by up to 10% from equity risks relative to the Variable Annuity/ Guaranteed segment.

This is despite RILA only comprising $3.84B (+22.2% QoQ/ +105.3% YoY) or the equivalent 6.8% (+1.3 points QoQ/ +3.6 YoY) of its funds by the latest quarter, with the “continued momentum” likely to further offset risks ahead.

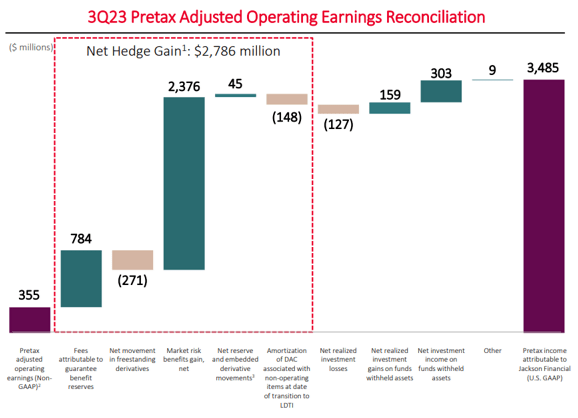

JXN’s FQ3’23 Pretax Adjusted Operating Earnings

Seeking Alpha

JXN’s increased Net Hedging gains of $2.78B (+155% QoQ/ +261% YoY) has also partly contributed to its improving Pretax Adjusted Operating Earnings of $3.48B (+138.3% QoQ/ +71.4% YoY) and adj operating earnings in FQ3’23, as discussed above, thanks to the elevated interest rates.

On the one hand, we must highlight that this number remains dynamic since its hedging programs are generally for the long-term, with the moderation in interest rates likely to bring forth fluctuations in its derivatives on a QoQ/ YoY basis.

On the other hand, we may see JXN’s hedging performance stabilize from FQ1’24 onwards, attributed to the recently established “affiliated Michigan captive insurer, Brooke Life Reinsurance Company”:

The transaction is anticipated to mitigate the impact of the cash surrender value floor on Jackson’s total adjusted capital, statutory required capital, and risk-based capital ratio, as well as to allow for more efficient economic hedging of the underlying risks of Jackson’s business. This outcome will serve the interests of policyholders by protecting statutory capital through avoidance of non-economic hedging costs.

For now, the expansion in JXN’s profitability has directly contributed to its healthier balance sheet, with nearly $1.4B of cash and liquid securities (+40% QoQ/ +75% YoY), exceeding its targeted minimum liquidity buffer of 2x annual holding company fixed expenses.

Combined with the higher Estimated Risk Based Capital [RBC] ratio above its target range of 425% and 500%, we believe that the annuity company remains more than able to meet the regulatory capital requirements, no matter the tightened and/ or normalized market conditions.

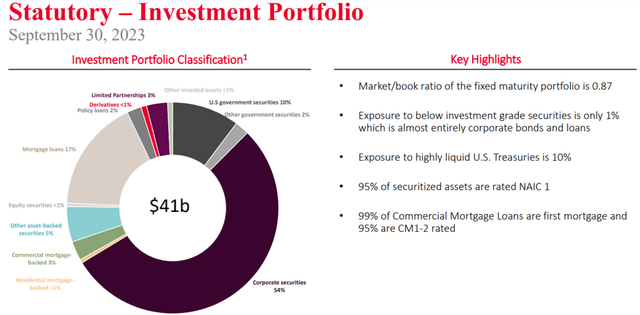

JXN’s Statutory Investment Portfolio

JXN

In the meantime, we believe that JXN’s intermediate term prospects remain excellent, attributed to its well diversified investment portfolio with only 1% of its invested assets termed as below investment grade securities, mostly comprising corporate bonds and loans.

Most importantly, with JXN trading way below its book value of $111.74 (+12.7% QoQ/ +4.1% YoY), we believe that its current levels still look attractive enough for value and income oriented investors, despite the immense rally since the May 2023 bottom.

Readers must also note that the management has been consistently using its robust balance sheet to create value for existing shareholders. This is attributed to the LTM dividend payouts of $211M (+4.9% sequentially) and retirement of its share count to 82.82M (-1.93M QoQ/ -5.08M YoY/ -11.64M since the demerger).

The Lifting Macro Sentiments May Also Trigger Further Tailwinds In JXN’s Upward Rerating

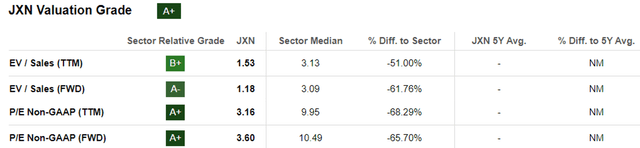

JXN Valuations

Seeking Alpha

Perhaps these are the reasons why JXN’s FWD P/E valuations of 3.60x has improved, compared to its 1Y mean of 2.34x and historical mean of 2.07x. For now, readers must also note that JXN’s valuation is still drastically discounted against its previous parent company, Prudential (PRU) at 8.78x and the sector median of 10.49x.

Thanks to the lifting market sentiments after Powell’s dovish commentary and the “Fed signaling a pivot by 2024,” we may finally see JXN’s valuations re-rated nearer to its peers.

This is especially since a normalized macroeconomy may allow the annuity company’s derivatives to play out more predictably, while reducing its volatility assumptions and risk margin.

With JXN still commanding one of the top ten spots in the US annuity sales on a YTD basis, we believe that the company will benefit from the increasing demand for RILA products, with the LIMRA Annuity Research already expecting the “record-high sales to continue into 2024 with nearly +10% growth projected.”

The annuity company’s long-term prospects remain bright as well, with Research And Markets projecting a robust expansion in its TAM from $259.97B in 2023 to $298.70B in 2026 with a CAGR of +4.74%.

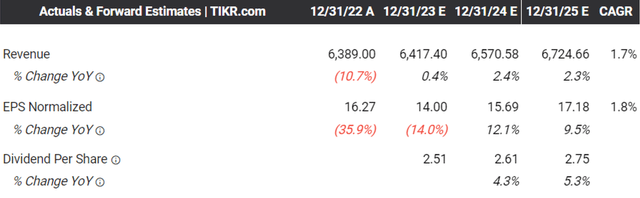

The Consensus Forward Estimates

Tikr Terminal

In addition, based on the consensus FY2025 adj EPS estimates of $17.18 and a moderate P/E of 8x, there appears to be an excellent upside potential of +168.6% to our long-term price target of $137.40.

If anything, JXN’s dividend investment thesis remains more than safe, based on its 1Y Dividend Coverage Ratio of 5.59x and TTM Free Cash Flow Yield to Dividend Yield Ratio of 28.83%, compared to the sector median of 2.63x and 3.68%, respectively.

This is on top of the tempting forward dividend yields of 4.85% and the consensus forward estimates of its Dividend Per Share growth at a CAGR of +4.67% through FY2025. Otherwise, its preferred stock offers a handsome yield of 8% as well, well exceeding the US Treasury yields currently between 3.91% and 5.38%.

These promising factors imply JXN’s excellent dual pronged returns over the next few years, attributed to capital appreciation and dividend income.

So, Is JXN Stock A Buy, Sell, or Hold?

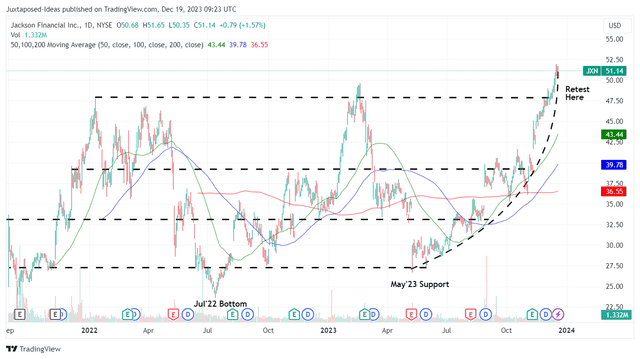

JXN 2Y Stock Price

Trading View

For now, the JXN stock has rallied immensely by +78% since the May 2023 support, with it appearing to chart new 52-week/ all-time highs after breaking out of its 50/ 100/ 200 day moving averages.

Interestingly, while many dividend stocks have normally been corrected ex-dividend dates, it appears that JXN has sustained its upward momentum, with it likely to hold on to its recent gains, thanks to the inclusion to the S&P SmallCap 600 from September 2023 onwards.

As a result of its attractive long-term risk/ reward ratio, we maintain our Buy rating for the JXN stock, though with no specific entry point since it depends on individual investor’s dollar cost averages and risk appetite.

Given its relatively young history since the demerger in 2021, bottom fishing investors may consider observing its movement for a little longer, before adding after a moderate pullback for an improved margin of safety, preferably after establishing $47 as its new floor.

Read the full article here