Investment summary

I give CDW Corp. (NASDAQ:CDW) a buy rating despite the near-term weakness because I see two strong catalysts ahead that should drive growth acceleration as CDW moves past FY24. Specifically, I think the near-term catalyst is going to be the PC refreshment cycle in 2H24, and over the medium-term, growth will be supported by demand for AI PCs and AI-related implementations.

Business Overview

CDW sells IT products and services to businesses of all sizes. According to its factsheet, CDW offers more than 100,000 products from more than 1,000 brands, including both hardware and software products. Segment-wise, revenue is split between three main segments. Total corporate, where CDW sells to businesses, is the largest revenue contributor (52% of revenue); public, where government and healthcare customers are included here, is the second largest revenue contributor (35% of revenue); and others represent 13%.

A very tough macro environment for the near-term

I expect the tough macro environment to continue putting pressure on CDW near-term performance. This dynamic can be well seen in 1Q24 performance, where revenue saw a decline across all segments with total revenue down 4.5%, making the 6th straight quarter of decline. This was also the third consecutive quarter that CDW missed consensus expectations, suggesting that underlying conditions remain a lot worse than what the market is expecting. My guess is that the current macro-overhang will persist, leading to longer sales cycles and project pushouts as clients give priority to cost-cutting initiatives and those with a quick return on investment (ROI). Management guidance also clearly reflects this macro headwind, as they lowered FY24 EPS growth to low single-digits vs. prior guidance for mid-single-digit growth.

The bright side, though, is that CDW isn’t seeing project cancellations—just increased budget scrutiny and project pushouts. This, in my opinion, will lead to pent-up demand, which is good news for CDW because it could mean strong growth acceleration for the company once it gets past this downcycle. The question is when the cycle will turn, and I believe there are two major catalysts that will drive this recovery.

2 strong catalysts ahead

The first catalyst is the PC refreshment cycle, which is expected to occur sometime in 2H24. The impact on CDW is that each additional PC (business workstation) creates multiple sales opportunities for CDW as the user would likely need certain computer peripherals (mouse, cables, keyboard, etc.) and software (business applications, cybersecurity, etc.) to go along with it. In fact, there are already early signs of this happening, as CDW saw stronger than expected PC demand in 1Q across all end-markets, driven by aged device refreshes and Win 11 upgrades.

Furthermore, there is one more underlying catalyst within this refreshment cycle that could further propel this cycle’s growth, and that is the increasing availability of AI PCs. My view is that it is only a matter of time before AI PCs represent the majority (IDC estimated 60% of PC shipments worldwide by 2027) of the market, in particular for business use cases, as businesses look to leverage AI in every aspect of their business in order to improve productivity and effectiveness. The constraint today is availability. Microsoft just announced the first batch of Copilot Plus AI PCs a few days ago. As availability ramps up, this could unlock the demand for AI PCs, which have higher price points than conventional PCs (pricing tailwinds for CDW).

Looking forward, I expect PC refresh momentum to continue into 2Q24 and beyond, with demand for AI PCs supporting the medium-term growth outlook.

The second catalyst also relates to AI. I believe the world is still in the early innings of the generative AI opportunity. What this means is that customers are still in the experimentation stage, testing out whether Gen AI can actually meet their use case. The risk of dealing with Gen AI is also going to be a hurdle for businesses to invest in this emerging technology, especially with data security risks (80% of companies say data security is the top issue). Top it off with the macro uncertainty, which means that this potential demand is unlikely to translate into revenue anytime soon.

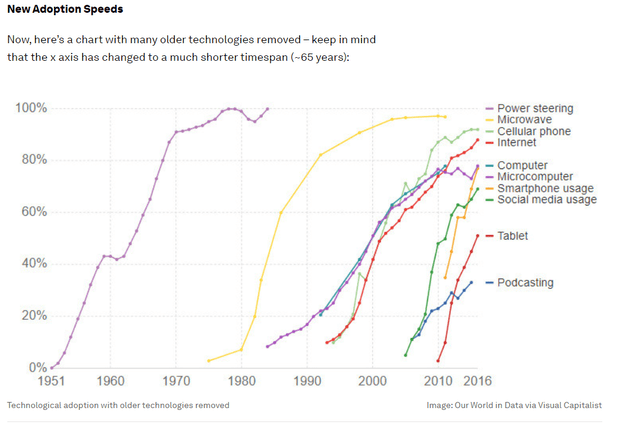

Our World in Data

However, I believe these issues are eventually going to get sorted out, similar to previous emerging technologies eventually getting adopted (a good example is the internet), and at a rapid pace. The matter of fact is that general AI can significantly improve the productivity of a company, and I believe every business owner is going to find a way to leverage this. In a recent CIO tech poll done by Foundry, it was noted that while budgets are still tight, the main focus is on AI. Therefore, given CDW’s broad portfolio of products and solutions (a search on “AI” on the CDW website shows more than 500 results that are related to services, software, services, storage, etc.), I expect generative AI to eventually become a tailwind to growth as customers move from evaluation to implementation.

The difficulty is pinpointing the timing of inflection. I am pretty confident that this is not going to help drive CDW growth in the next few quarters, but over the medium term, I see this becoming a major growth driver.

Valuation

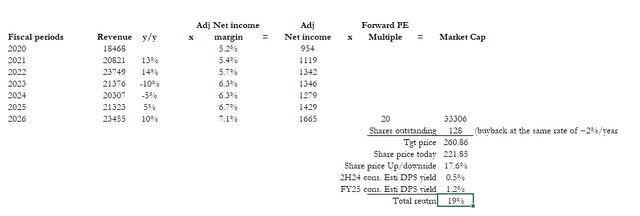

Source: Author’s calculation

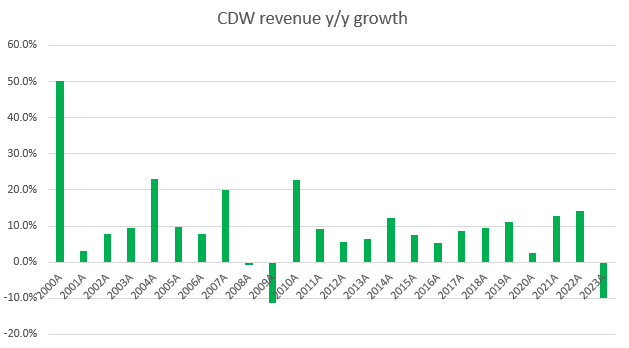

In the near term, I believe the tough macro environment is going to continue putting pressure on CDW growth, which means FY24 is likely to be a negative year as well. However, the start of the PC refreshment cycle in 2H24, along with more AI PC becoming available, should push growth to positive numbers in FY25/26, supported by a recovery in macro conditions (inflation rates are currently moving in the right direction). Post FY25/26, businesses gearing up their deployment for AI-related solutions and hardware should continue to support growth. If we look at CDW revenue growth historically, it has never seen more than two years of consecutive growth decline, and I think this coincides with my expected timeline for growth to recover in FY25.

My forward expectations for CDW are for -5% growth in FY24, positive 5% y/y growth in FY25, and 10% y/y growth in FY26. The basis for this outlook is that in FY24, the macro situation is clearly bad, but the 2H24 PC refreshment timeline should cushion part of this headwind. As such, FY24 growth should be of a smaller magnitude than FY23. FY25 growth is expected to recover gradually as some of the macro headwinds may spillover. FY26 should see a full growth recovery to the historical ~10% range.

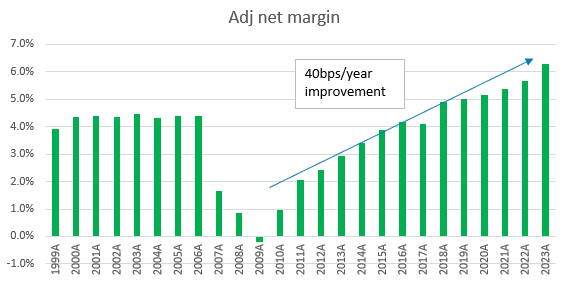

Source: Author’s calculation

In terms of earnings expectation, I used adj earnings because that is what management is guiding for, and the market is valuing CDW based on adj earnings (CDW current share price at the time of writing is $231.57 and forward adj (normalized) EPS estimate is $10.12, which equates to ~23x). For conservative sake, I assumed flat margins for FY24 as I expect revenue growth to be negative (albeit FY23 saw net margin improvement despite -10% growth). In FY25 and FY26, I expect net margins to grow at the same pace as they did over the past decade, at 40 bps per year.

Source: Author’s calculation

The market is currently valuing CDW at 21x forward PE (+1 stdev of CDW past the 5-year trading range), which I think is because of the expected recovery in FY25. In my model, my assumption is for CDW to trade at 20x forward PE, the average of the past 5 years, because I don’t expect growth to further accelerate past 10%. Attaching this multiple translates to an implied market cap of ~$33.3 billion.

I have also included capital returns into my total return calculation because over the past few years, CDW has been returning capital to shareholders via share buybacks and dividends. Using the same rate of share buyback (2%/year) and consensus expected DPS yield, I expect a total return of ~19% (share price upside of 17.6% and ~1.7% from dividends).

Risk

A big risk is the timing of growth recovery, as the current macro headwinds could last a lot longer, thereby putting more pressure on businesses willingness to increase their budget for tech spending. The bigger implication is that this will likely push back the timeline for the PC refreshment cycle as businesses look to further sweat out current assets.

Another thing that I am afraid of is the amount of debt sitting on CDW’s balance sheet. As of 1Q24, the business has a net debt position of ~$4.8 billion. In the worst-case scenario, if a similar decline that CDW saw in FY09 (EBITDA fell by 22%) happens again (which could be due to many reasons, such as a major global recession if a full-blown conflict happens in the Middle East), CDW might be forced to cut buybacks and dividends as the leverage ratio goes up.

Conclusion

Overall, despite near-term headwinds from the macro environment, I am giving CDW a buy due to two key catalysts. The first is the PC refresh cycle expected in 2H24, and the second being demand for generative AI. While the exact timing of this inflection point is uncertain, I believe CDW’s broad product portfolio positions them well to capitalize on these two catalysts. The key risks to this thesis are the potential for a prolonged economic downturn delaying the PC refresh cycle and CDW’s debt levels.

Read the full article here