Investment Thesis

Palo Alto Networks, Inc. (NASDAQ:PANW)’s stock has tanked almost a 30% after the 3Q FY2024 earnings results. I believe that this massive selloff could be justified due to the high expectations on Generative AI leading into the earnings, as the stock had rallied 170% in February from CY2023’s low. In my previous article, I initiated a buy rating and discussed the company’s sustainable path to achieving the “40-rule” as its top-line growth slowed down. Since then, the stock has risen by over 40%.

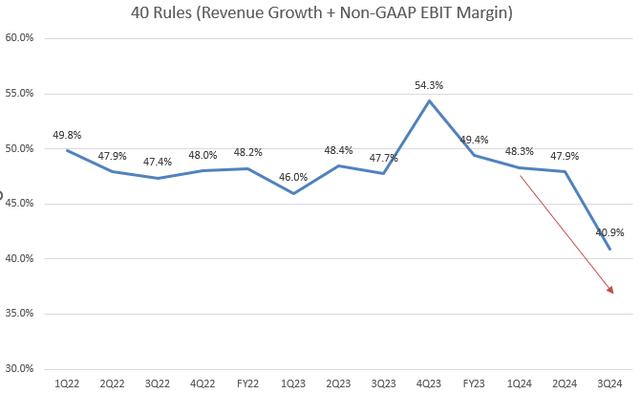

While the company still maintains the 40 rules in the last quarter, it’s close to the edge of 40%, despite resilient underlying demand. My major concern is that the sluggish billings outlook and mid-teen revenue growth will significantly hinder FCF growth. Meanwhile, the stock continues to trade as if it were a high-growth software company in the past. Therefore, I downgrade the stock to neutral from a buy rating due to premium valuation amid a growth slowdown. Particularly, the P/E multiple is becoming more expensive compared to a year ago.

40-Rules Still Hold Up

The company model

While PANW still achieved the 40 Rules with a combined rate of 40.9% (revenue growth + non-GAAP EBIT margin) in the last quarter, we notice that the trend line has turned downwards, falling below the 45% threshold for the first time since 1Q FY2022. I believe that this decline is primarily attributed to weakened top-line growth. Specifically, its Subscription & Support revenue grew by 20% YoY, down from 29% YoY in 3Q FY2023. However, it’s encouraging to see that the growth in the subscription revenue segment has relatively held up well, increasing by 25% YoY.

In the press release, the company forecasts total revenue growth of 10%-11% YoY in 4Q FY2024, edging closer to the ‘single-digit club.’ Given last week’s initial price reaction for CRM earnings results, I believe there’s anecdotal evidence that it could tear down investors’ psychological thresholds, potentially leading to increased volatility ahead.

Continued Margins Expansion

The company model

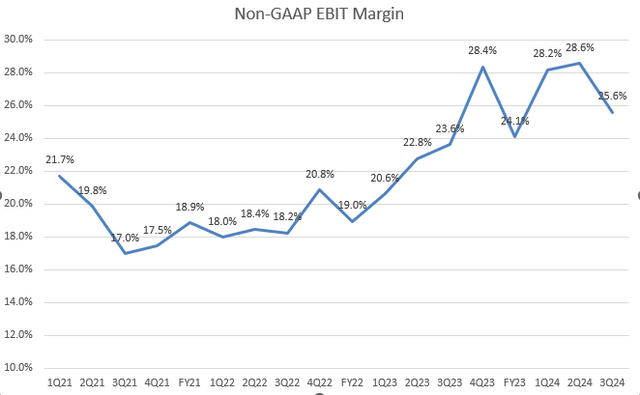

Additionally, the company’s margins remain resilient, which is a positive sign. It’s typical for a company’s margins to expand when top-line growth slows down. However, we should be mindful that some investors may no longer view PANW as a high-growth stock, potentially impacting its current premium valuation. With many SaaS companies positioning themselves as beneficiaries of Generative AI, investors are eager to see growth reacceleration and increased demand reflected in the earnings reports. However, some of these software companies have disappointed investors in the latest earnings season.

Significant Slowdown in Billings Growth

The company model

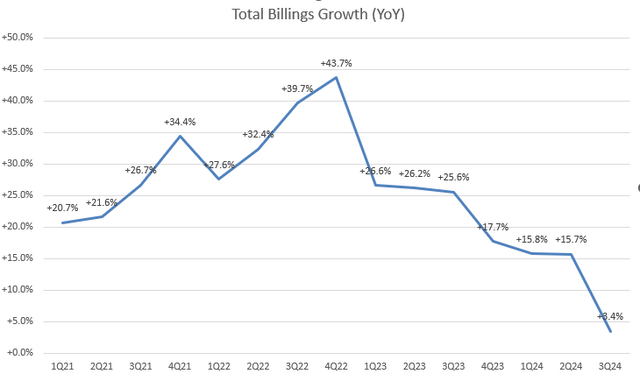

Let’s look at the chart. Billings play a crucial role as a key growth driver for FCF, reflecting the actual cash inflow a company receives within a given period, unlike revenue. In my last article, I highlighted the impressive billings growth of the company. However, in 3Q FY2024, total billings growth decelerated to 3.4% YoY. Notably, current billing growth has slowed to single digits, growing 8% YoY for the first time in the company’s history.

As for the guidance, the company is expected to grow the mid-range of 9.5% YoY in 4Q FY2024 and 10.5% YoY in FY2024, which is significantly below the +20% YoY growth in the prior fiscal years. The management in the earnings call explained, “we saw a greater volume of large deals with some of these customers opting for deferred payments over the term of their purchase, instead of paying upfront as they grapple with the higher cost of money”. They also predicted that this trend would persist in the future. I think that a continuation of deferred billings will create a significant headwind on cash flow generation and FCF margin in the future. Typically, we have seen a sharp decline in FCF growth to 14% YoY in 3Q FY2024 from 40% YoY in 3Q FY2023. Therefore, I predict that the company may suffer from a negative growth in FCF in the coming quarters.

However, PANW’s bookings remain on track. This suggests that its AI products are experiencing increased demand, evidenced by a 20% YoY in current bookings growth in 3Q FY2024 compared to 15% YoY in 3Q FY2023, largely driven by a 20% YoY growth in current Remaining Performance Obligations (cRPO). RPO shows the commitments from contracts the company needs to fulfill later on. These backlogs can turn into future billings and, eventually, help generate revenue. While management emphasizes the importance of focusing on RPO and bookings, I consider it a red flag for PANW if we see a deceleration in both revenue and FCF growth.

Valuation

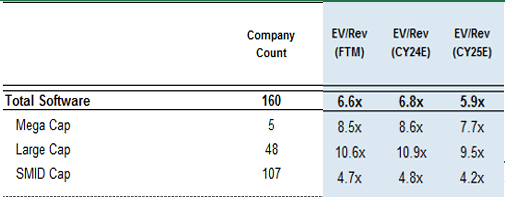

JP Morgan

PANW is currently trading at 53x of non-GAAP P/E FTM even after a 20% drawdown from the February peak. This is almost double the Nasdaq 100 index P/E FTM of 27.5x. Meanwhile, its EV/Sales FTM is currently at 11.7x, which is higher than the large-cap software average of 9.5x. I know it’s not a perfect comparison, but many investors are surprised by NVIDIA’s (NVDA) “to the moon” rally over the past 12 months. However, NVDA’s non-GAAP P/E FTM is only 41x, which is still cheaper than PANW.

Furthermore, PANW’s current non-GAAP P/E FTM is almost in-line with its 5-year average of 54.3x. Despite a significant slowdown in its top-line growth, from +25% in FY2023 to a projected 16% in FY2024, the multiple almost remains the same. I think this explains an optimistic outlook for growth reacceleration under Generative AI trends. Therefore, I prefer to stay on the sidelines until there’s more clarity on revenue growth from AI security services.

Conclusion

The bottom line is that buying the dip on PANW after its recent selloff may not be advisable as the company’s recent earnings results have not met the high expectations surrounding generative AI and its earlier rally. While PANW has maintained its backlog growth, there are concerns about a continued downward trend in revenue growth, which could potentially remove PANW from the 40 Rule club in the coming quarters. The significant slowdown in billings growth and conservative forward guidance also raise doubts about future FCF growth. Although margins and bookings remain healthy, I believe that the slowdown in revenue and FCF growth raise concerns regarding the current valuation multiple. Furthermore, PANW’s multiples, compared to industry average and companies like NVDA, still appear expensive. Therefore, I’m downgrading the stock to neutral to reflect these concerns. I believe the current valuation has already factored in the potential AI growth tailwinds.

Read the full article here