Introduction

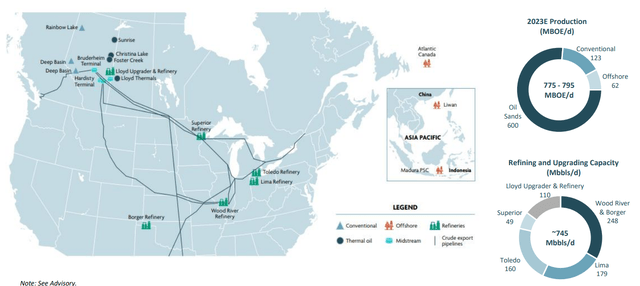

Cenovus Energy (NYSE:CVE) (TSX:CVE:CA) is a large integrated oil and gas producer in Canada. The company produced in excess of 700,000 barrels of oil-equivalent per day while its downstream throughput averaged in excess of half a million barrels per day. The total capacity is quite a bit higher but some of the facilities were down for maintenance.

Cenovus Investor Relations

In this article, I will explain why I think some of the preferred shares issued by Cenovus could be interesting to own. In Canada, most fix-to-float preferred shares lock in a preferred dividend for a period of five years and that makes some of the preferred share issues quite appealing.

The company is humming along nicely

I won’t go into too much detail on the financial results as the preferred equity is the main focus of this article and the two important elements are the preferred dividend coverage ratio and the asset coverage ratio. There are plenty of authors here on Seeking Alpha with good articles on Cenovus Energy and I’d encourage you to read some of their articles to get a better understanding of the company.

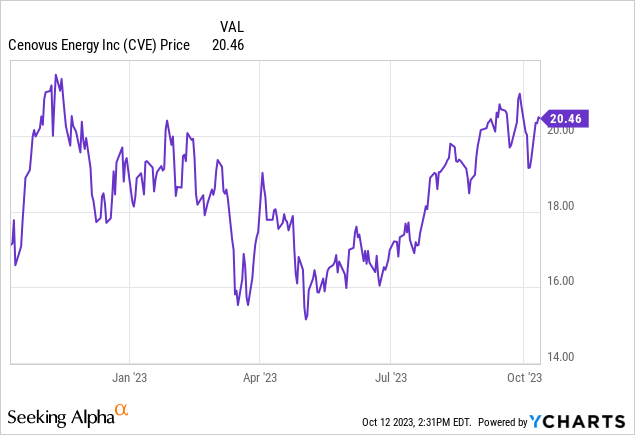

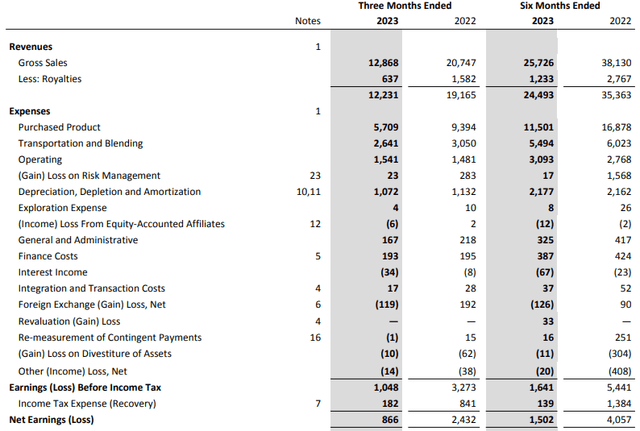

The company reported a total revenue of C$12.2B in the second quarter of the year – I will use the company’s Q2 results as these are based on a US$75 Brent and a C$74 WCS oil price. The oil and bitumen prices are substantially higher and were higher throughout the third quarter so while I’m expecting a strong result in the third quarter, I’m using the Q2 results for a more conservative approach.

Cenovus Investor Relations

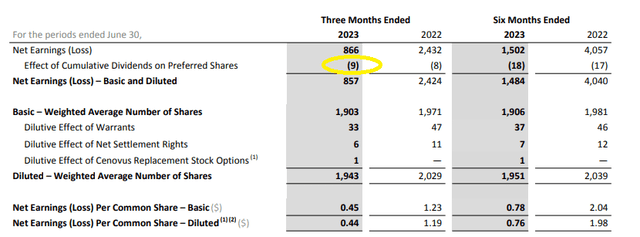

As you can see above, the company reported a net profit of C$866M which represented an EPS of C$0.45. Interestingly, Cenovus did not record any preferred share dividends from the reported net income, and after deducting the C$9M in preferred dividend payments, the net income attributable to the shareholders of Cenovus was C$857M, as you can see below.

Cenovus Investor Relations

That’s important: It means that, at US$75 WTI and C$75 WCS and the refineries not running at full capacity, the company needed just 1% of its net income to cover the preferred dividend payments. Expressed in a percentage, the preferred dividend coverage ratio was 9,600%.

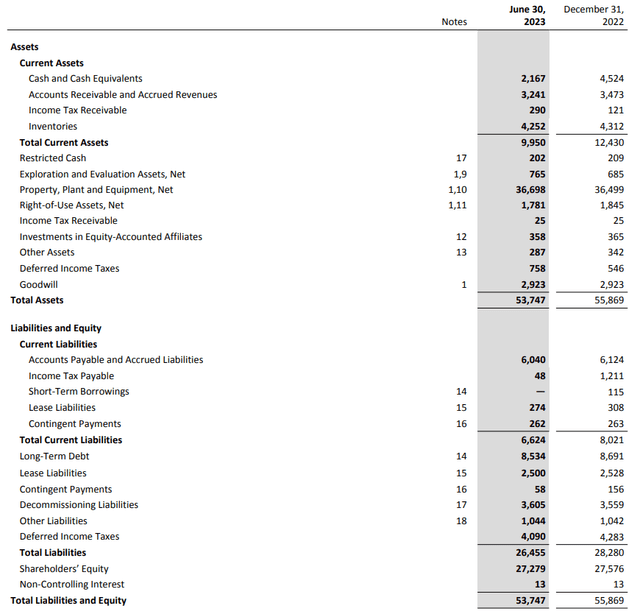

A second element I like to check is the asset coverage ratio. As of the end of June, Cenovus had almost C$54B in assets and the equity component of the balance sheet was C$27.3B. The company also had C$2.2B in cash while its long-term debt totalled C$8.5B for a net debt position of C$6.4B (rounded).

Cenovus Investor Relations

As of the end of June, the company also had 36 million preferred shares outstanding. All preferred shares have a principal value of C$25 per share, which means Cenovus had about C$900M in preferred equity on the balance sheet. This means that there’s about C$26.3B in equity ranked junior to the preferred shares and even if you would exclude the C$2.9B in goodwill on the balance sheet, there’s in excess of C$23B in tangible equity on the balance sheet that ranks junior to the preferred shares.

Long story short, I’m very happy with the preferred dividend coverage ratio and the asset coverage ratio.

A closer look at the preferred shares

I used to keep track of the preferred shares of Husky Energy, but those shares had pretty low yields when the interest rates on the financial markets were low. This has obviously changed and although the underlying company is now much larger (when Cenovus acquired Husky Energy, the preferred shares simply remained outstanding) and the higher interest rates on the financial markets create opportunities.

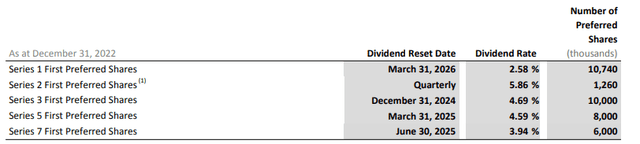

I’m keeping a close tab on the Series 1 (OTC:CNVEF) (TSX:CVE.PR.A:CA) and Series 3 preferred shares (TSX:CVE.PR.C:CA) issued by Cenovus. Both issues currently have relatively low preferred dividends but the next reset dates are coming close. As the image below shows, the Series 3 will reset first, at the end of next year, while the Series 1 will reset in Q1 2026.

Cenovus Investor Relations

Looking at the Series 3, those preferred shares are trading at C$19.25 (the principal value is C$25 per preferred share) and that series currently yields 4.69% or C$1.1725 per share per year. And based on the current share price, the current yield is approximately 6.1%. Not bad, but also not great.

However, at the end of 2024, the preferred dividend rate of those preferred shares will reset to the five-year Canada government bond yield plus a mark-up of 313 basis points. The five-year Canada government bond yield is currently trading at 4.15% which means that in the current situation, the preferred dividend on the Series 3 would reset to 4.15% + 3.13% = 7.28%. This represents C$1.82 per year and would result in a yield of 9.5% based on the current preferred share price.

Marketwatch.com

We also can run the numbers from a different angle. The question could be “how high should the five-year Canada bond yield be to generate 7% on my investment after the reset date?.” That’s an easy one. The required preferred dividend is C$1.3475 per share per year (7% of C$19.25). That represents 5.39% of the C$25 principal value and considering we know the mark-up is 313 bp, as long as the five-year Canada government bond yield exceeds 2.26%, you will earn at least 7% on your investment in the 2025-2030 period. And that’s a bet I’m willing to take. Even if the 5Y bond yield drops to 3%, you would achieve an 8% preferred dividend yield based on a cost basis of C$19.25.

We see a similar outcome for the Series 1 preferred shares although that one could be trickier because of the lower mark-up. While the mark-up is 313 bp for the Series 3, the Series 1 has a mark-up of only 173 bp. Those preferred shares are currently trading at C$11.78 for a yield of 5.5%.

We can now run the numbers based on similar assumptions. The current five-year government bond yield is 4.15%. But let’s assume a long-term yield of 3%. This means that in Q1 2026, the preferred dividend yield would reset to 3% + 1.73% = 4.73% or C$1.18/share. Which would mean that based on the current share price, you could actually lock in a yield of 10% for the five-year period starting in 2026. Applying the current five-year bond yield would result in a yield of close to 12.5%.

And due to the low mark-up, the odds of Cenovus calling this specific series are pretty low. As all other series of preferred shares have higher mark-ups, it would make more sense for Cenovus to call the more expensive preferred shares first.

Investment thesis

And that’s why income-focused investors should most definitely have a closer look at the preferred shares issued by Cenovus. I do like the Series 1 because I’m locking in a 5.5% yield until Q1 2026 and the interest rates would have to collapse completely before I would not see a substantial yield increase. If I’m aiming for a 7% yield from Q1 2026 on, all I need is a 5 year government bond yield of 1.57%. And I like those odds.

Additionally, even if the company would see its preferred dividend payments increase by 50%, it would still be paying less than C$15M per quarter and less than C$60M per year on preferred dividends. At the same time, the total face value of the preferred shares is C$900M while the current market value is less than C$650M. And perhaps Cenovus Energy should try to buy back some of its preferred shares before their respective reset dates.

I currently have no position in Cenovus Energy nor in its preferred shares but I may initiate a long position in the Series 1 preferred shares in anticipation of a preferred dividend reset in 2026.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here