The Cato Corporation (NYSE:CATO) operates as a value-based specialty retailer, operating primarily in the southeastern part of the United States. The company offers apparel and accessories such as sportswear, dresses, shoes, lingerie, and handbags with a focus on women’s products. Cato sells through brick-and-mortar stores and ecommerce stores. The company also provides credit cards for customers, representing a small finance segment.

Representative of the company’s financial performance in past years, the stock has lost four fifths of its value in the past decade. While investors are lured in by a great dividend at a current yield of 11.18%, investors should note that the dividend isn’t on a sustainable basis and isn’t funded by cash flows but rather the company’s strong remaining balance sheet that is declining with constant cash outflows.

Ten Year Stock Chart (Seeking Alpha)

An Asset Liquidation is Needed for Upside

It doesn’t seem that Cato’s retail brands and offering resonate with customers well enough. The value-based offering sees competitive pressure from rising competition in the form of brands such as H&M operated by Sweden-based H & M Hennes & Mauritz (OTCPK:HNNMY), Zara operated by Inditex with a portfolio of multiple low price-point brands, and Shein.

Due to low demand, the company has continued to close the most unprofitable retail stores. In Q1, Cato closed seven stores with 1171 remaining at the end of the quarter compared to 1264 a year earlier. The store closures should aid short-term profitability, but at the end of the day, store closures are a game of cat and mouse with fixed costs causing negative operating leverage and remaining stores losing remaining profitability by the day. With global powerhouses such as the mentioned H&M, Inditex, and Shein being able to produce incredibly cheap products at a large scale, a brand turnaround with a value-based branding seems nearly impossible for a company such as Cato.

Due to a brand turnaround being incredibly unlikely in my opinion, the only way to create shareholder value seems to be a company liquidation. Cash and short-term investments are worth $105.4 million after Q1, and the current market cap of $117.2 million assumes slight additional value from other assets.

Current inventories are worth $101.3 million, and the company also has receivables worth $31.7 million at a combined $133.0 million in operative assets that I consider Cato to be potentially able to liquidate. On the other side, the company has $87.0 million in payables and $40.5 million in accrued expenses worth $127.5 million combined, though – working capital doesn’t seem to provide potential for notable excess capital even when excluding lease liabilities. Cato’s brands don’t seem to be worth very much either, and a larger company buying the retail chain seems to be unlikely, considering negative earnings and bad demand making the assets worth very little.

To summarize, a company liquidation creating upside for current shareholders seems unlikely, as assets don’t provide sufficient capital alone. A company acquiring the retail stores could still happen, creating significant upside, but I don’t expect the assets to attract a great offer as a base scenario considering the weak performance.

Cato’s Earnings Profile is Ugly

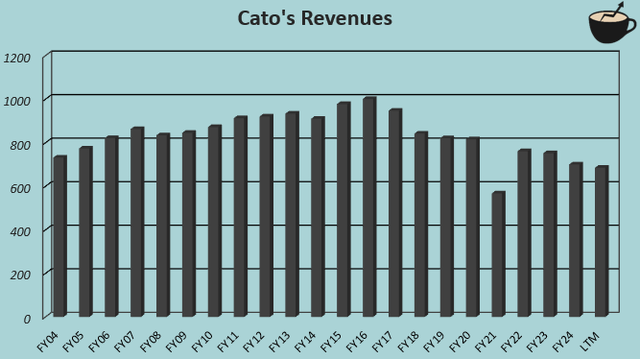

Cato’s revenue profile has turned down from the peak achieved in FY2016 – since, revenues have shrunk at a CAGR of -4.5% with no end in sight as Q1 revenues continued with a -7.8% decline. The company’s current CEO, John Cato, related the weakness partly to pressure on discretionary spending in the quarter, but the underlying brand performance still clearly continues to be incredibly weak.

Author’s Calculation Using TIKR Data

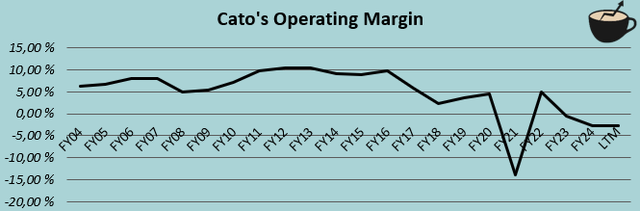

Store closures haven’t helped profitability enough, as the current operating margin trails at -2.7%. The company still managed to generate positive income prior to the pandemic and in FY2022, but continued revenue declines have pushed the operating margin into negative territory. Ultimately, an improved sales performance is needed to sustainably hold positive earnings, as a shrinking organization only provides negative operating leverage.

Author’s Calculation Using TIKR Data

Balance Sheet is Likely the Only Form of Value

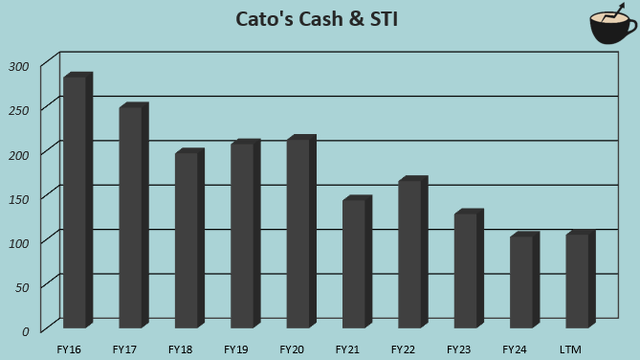

Cato’s balance sheet still has remains of cash and short-term investments, with $39.1 in cash and equivalents and $66.3 million in short-term investments, adding up to a total of $105.4 million in unrestricted capital. Compared to the market cap of $117.2 million, the amount is very significant.

Author’s Calculation Using TIKR Data

The strong balance sheet is dwindling as Cato continues to pay out a high dividend and free cash flow has been negative at a current trailing -$14.6 million. With $14.0 million spent on dividends in the past twelve months, the cash position doesn’t provide capital for the current dividend level for much longer. Short-term investments provide some interest income to make the balance sheet last longer, but the current trailing $5.8 million in interest income doesn’t help much with deeply negative free cash flow. Investors shouldn’t get caught up trying to achieve a high dividend yield, as Cato’s dividend is very likely unsustainable.

Negative Cash Flows Devalue Balance Sheet

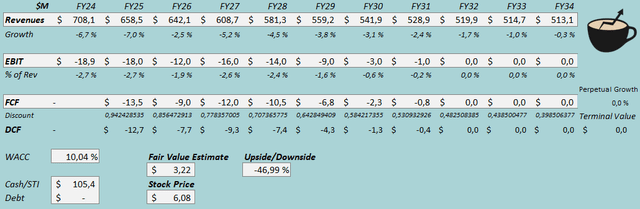

I constructed a discounted cash flow model (DCF model) with financial estimates that I deem as slightly optimistic – after a FY2025 growth of -7.0%, I estimate revenue declines to gradually fade into eventually stable revenues. Combined with great cost management, I estimate EBIT and cash flows to stabilize into a breakeven level in the model in the long term.

DCF Model (Author’s Calculation)

The estimates put Cato’s fair value estimate at $3.22, 47% below the stock price at the time of writing. While the company has $105.4 million in liquid assets, I only estimate a fair equity valuation of $62.1 million due to negative cash flows. If a brand turnaround happens and Cato starts achieving positive cash flows, the current valuation could be incredibly undervalued, but I don’t see such a scenario to happen at a likelihood above a few percentages.

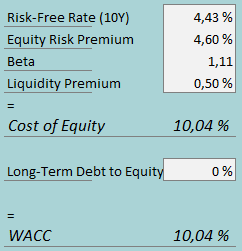

A weighted average cost of capital of 10.04% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

Cato doesn’t have interest-bearing debt and is unlikely to draw any, leading to a 0% debt-to-equity estimate. To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.43% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. Yahoo Finance estimates Cato’s beta at 1.11. Finally, I add a liquidity premium of 0.5%, creating a cost of equity and WACC of 10.04%.

Takeaway

Cato’s performance has started to crumble in the past decade as global powerhouses have started to provide clothes at an incredibly affordable price. The company posts consistent revenue declines, and with weakness in stores’ performance, earnings have been pushed negative despite Cato’s efforts to close the most unprofitable stores. I see a continuous declining earnings profile as a base scenario. The company still has a very great balance sheet that has allowed an excessively high dividend yield, but with negative cash flows from operations, the dividend isn’t sustainable, and the value of Cato’s cash dwindles. There is a very unlikely deep value play available in case of a buyout of Cato’s operative assets or an unlikely brand turnaround, but with the current performance, I don’t expect such events. As such, I see the investment to have a very weak risk-to-reward and initiate the stock at Strong Sell.

Read the full article here