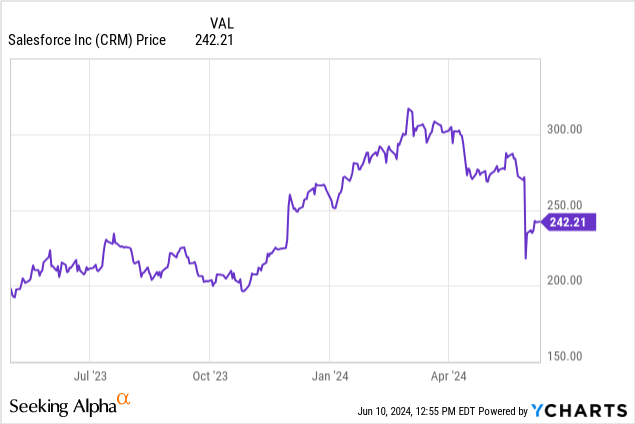

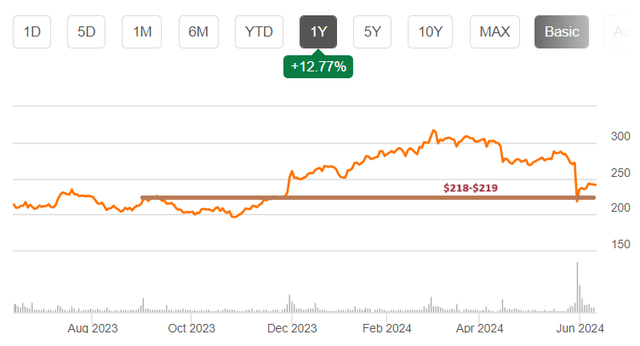

Since I last covered Salesforce (NYSE:CRM) in May last year in the article entitled “Key AI Additions, But Probably Too Late To Get Excited”, it has gained about 10%, including the recent 20% plunge as charted below.

This thesis aims to show that this is not a buy despite the drop to the $242 level because Salesforce has been unable to halt the deceleration in sales despite rapidly adopting artificial intelligence, while at the same time, as an enterprise software player, it is facing uncertainty and may lose market share due to the disruptive power of Gen AI.

First, since most analysts rate the stock as a buy with a $300 target and the share price seems to be recovering, it is important to show that this is not a buy-the-dip opportunity despite boasting some good metrics from the first quarter of 2025 (FQ1’25) results.

Understanding why the Share Price Plunged

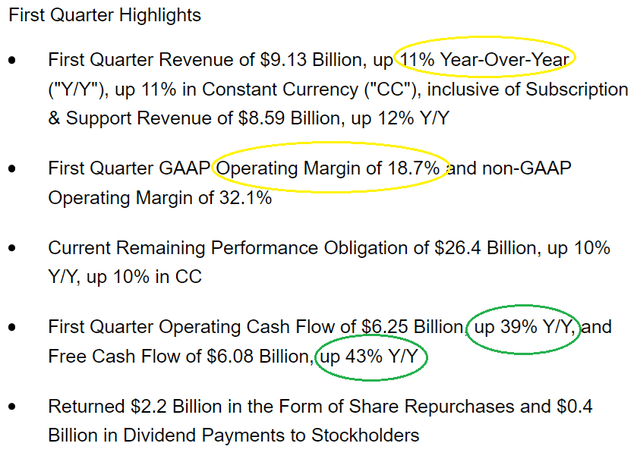

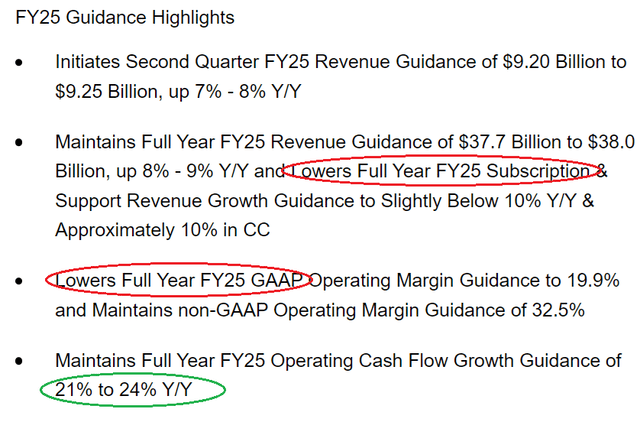

This is a company that generated an operating cash flow of $6.25 billion which is up by 39% YoY, a free cash flow of $6.08 billion, or an increase of 43% YoY as encircled below in green. Additionally, it returned $2.2 billion in the form of stock purchases while effecting $0.4 billion of dividend payments to stockholders.

seekingalpha.com

Equally important, revenues growing at double digits (11% YoY) and a GAAP operating margin of 18.7% indicates profitable growth at scale, something prioritized by the management. Along the same lines, the operating cash flow guidance for FY25 is guided to increase by 21% to 24% YoY which means continuous expansion for this matured CRM play focused on squeezing as much profitability as possible from sales.

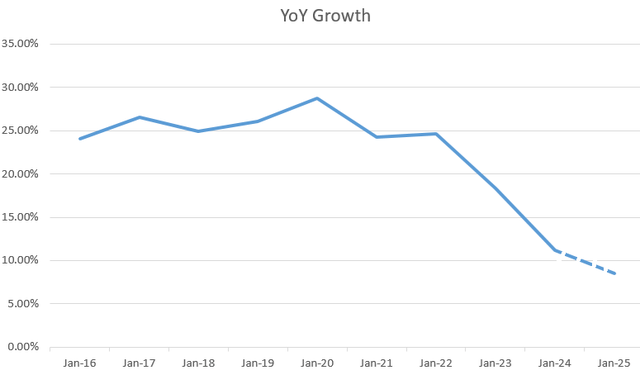

However, the plunge is not an overreaction by investors, as, looking deeper, the problem seems to lie in the annual revenue growth that has been decelerating since 2020 as shown in the chart below. Hence, for FY25 Salesforce is projecting 8% to 9% which not only falls below the 10% mark but will also be the lowest it has ever delivered as a public company.

Chart prepared using data from (www.seekingalpha.com)

Now, for a company that is spending money on research and marketing to harvest AI growth opportunities in a competitive marketplace, failure to accelerate growth may result in a decrease in operating income, eventually leading to a reduction in cash flow from operating activities. In addition, there is something more powerful at play here, and this has to do with the disruptive nature of Gen AI, a technology which in addition to opportunities, presents challenges.

Revenue Decelerating Despite Embedding Gen AI in Products as the Innovation Disrupts

In this respect, its inability to boost growth is harder to digest given the company has transformed itself into the number one AI CRM (according to the CEO) during the last year to take advantage of GPT (Generative Pre-trained Transformer) or giving to applications the human touch by making them converse in a friendly manner using text, images, and videos.

The foremost example was the launch of Gen AI-based Einstein GPT, for rapidly obtaining AI-driven insights which were supposed to “really drive growth”.

www.salesforce.com

Other examples are Tableau GPT which simplifies data analysis for customers to provide intelligence and automation features to manage the high volumes of data. In addition, with customers excited about anything to do with AI, the company got traction for existing products like Revenue Intelligence, an add-on that subscribers have been rapidly adopting since last year.

Therefore, the company does not seem able to generate enough sales to stem the growth trend, but, the problem is that Gen AI has also been disrupting the industry, and in a profound manner. One example is Microsoft’s (MSFT) integrating Gen AI into its office productivity tools and coming up with tools like GitHub Copilot which greatly facilitates the task of writing software codes. In this case, while not necessarily substituting a software developer, the technology allows companies to rethink the way they outsource tasks about customer functions like marketing or engagement. They now have the option to carry it in-house with existing IT resources instead of invariably outsourcing to enterprise software plays like Salesforce.

Along the same lines, researchers at McKinsey mention that software buyers are likely to scrutinize for ways to improve their legacy applications using Gen AI instead of continuing to outsource in the same way as before. As a result, total churn may increase by 1% to 3% which could translate into Salesforce losing as much market share.

Furthermore, the management consulting company adds that upstarts (new companies leveraging Gen AI could erode the competitive advantage of established players by providing out-of-the-box capabilities. Their task can be facilitated by data migration tasks which were traditionally time-consuming (manual) becoming more automated as GenAI algorithms excel at analyzing data relationships. This can counter one of Salesforce’s selling arguments which is customer data already present on their platform reducing the need for data migration.

Faces Risks of Losing Market Share as Subscriptions Guidance Has been Lowered

Therefore, the risks are real and the problem is that given additional options, potential clients may think twice before going to Salesforce, or existing customers may no longer automatically renew their subscriptions. This may be the reason why the company is facing “measured buying behavior” which has translated into elongated deal cycles and even deal compression as CFOs scrutinized budgets more than before. This could be the reason FY25 subscription and support revenue growth guidance were reduced to slightly below 10% YoY as shown below, compared to above 10% three months earlier.

seekingalpha.com

Now, one can argue that these are due to unfavorable macro since interest rates remain above 5% while the Fed is still struggling to bring inflation to 2%. Still, given Salesforce’s emphasis on delivering an unprecedented level of productivity and profitability to customers, its products should have gotten more traction whether it is for marketing, sales, or commerce. For this matter, Gen AI should bring productivity gains of around 9%, based on the time it takes to handle an issue due to a higher degree of automation.

However, Salesforce has not been able to transform the traction for its AI products into sales growth one year after they were launched, but on the contrary, expects further deceleration in FY25, which is not aligned with Gartner’s expectation for spending on software to accelerate by 13.9% in 2024, thus exceeding the 12.6% achieved in 2023 as technology providers integrate Gen AI in existing products. This reinforces the idea that it may lose market share to competitors.

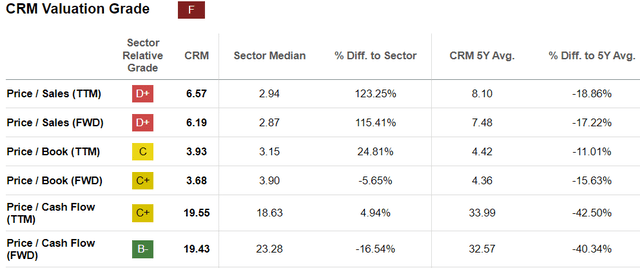

In this case, with stock trading at a hefty six times sales, it may again face the wrath of the market in case it misses topline guidance of 7%-8% growth for FQ2’25. By the way, this is a low target which is less than half the average of 16.6% achieved in the past eleven quarters, and could be another reason why the stock was punished.

seekingalpha.com

Therefore with its higher valuations, the stock could fall further. To identify a bottom, I consider that the stock started its ascent from the $218-$219 range at the end of November last year after analysts upgraded their projections based on the company integrating Gen AI into its platforms and related monetization prospects. The stock briefly touched the $219 level again on May 30 as illustrated in the chart below, and this was the price when I published my previous thesis in May 2023.

Wait For an AI-specific Pipeline as the Enterprise Software Industry Faces Real Risks

Therefore, considering $219 as the support level, the stock could shed about $22 to $23 from the current $241-$242 range, and this is the reason why despite the stock trading at 19.55x forward cash flow which seems pretty low compared to the five-year historical average, I believe the shares have limited upside potential. This is especially so because investors are increasingly likely to scrutinize sales targets for concrete dollar-based prospects (pipeline) instead of relying on strong rhetoric during forthcoming earnings calls.

Chart prepared using data from (www.seekingalpha.com)

In conclusion, this thesis has shown that Salesforce is a highly profitable business that generates a fairly decent amount of cash. It also generates a lot of free cash flow mainly because its investment level has remained relatively low except for last fiscal year when it acquired Spiff which specializes in incentive-based compensation schemes for $419 million. Thus, it disposes of $17.7 billion of cash and equivalents, or sufficient for making a more sizeable acquisition sufficient enough to boost revenue growth. Also, given the quantity of enterprise data coexisting on its platforms, which are essential for feeding AI models, Salesforce must quantify opportunities for Data Cloud, which has been seeing traction with 25% of its above one million dollar deals signing for it.

However, in the meantime, it faces risks of losing market share in case the revenue deceleration persists. Thus, after having embedded Gen AI across its product offerings, Salesforce may have to alter its go-to-market strategy, possibly by offering discounts to drive product sales, or freeze plans to charge additional subscription fees for AI. However, such measures may impact profitability and may be why its GAAP operating profit margins for FY25 have been revised downward as shown in the guidance above.

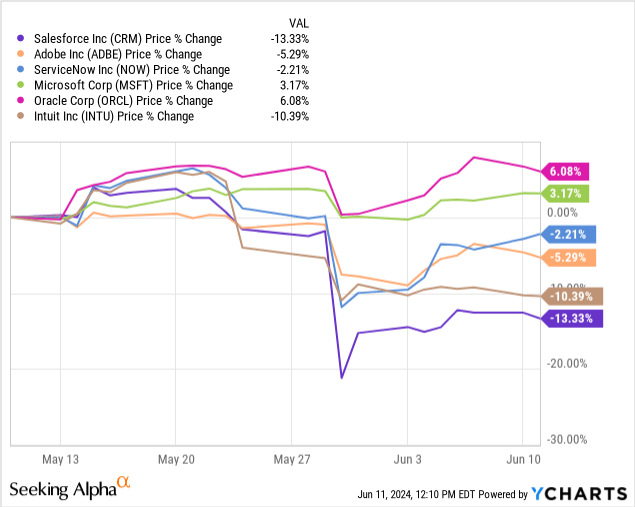

Consequently, I have a Hold position, a cautionary posture also due to the enterprise software industry likely to be massively disrupted by Gen AI according to McKinsey as the technology is likely to be adopted at least three times faster than SaaS (Software-as-a-Service), thereby significantly changing industry dynamics. This is the reason why, in addition to Salesforce, other software players including Microsoft and Adobe (ADBE) also suffered at the time the CRM specialist reported financial results as charted below.

However, they did not suffer as much as Intuit (INTU) and Salesforce since they have already recouped their losses which hints that the market sees more challenges than opportunities from Gen AI for these two companies.

Read the full article here