Innovative Industrial Properties (NYSE:IIPR) has been a big winner and I can understand the temptation to sell. The company has executed strongly over the last several years, working through issues with troubled tenants and along the way dispelling fears about the true value of its real estate portfolio. The company continues to maintain significantly less leverage than traditional net lease peers, and still trades at some relative discount. That said, growth is likely to remain pressured in the near to medium term and the relative discount is not as large as it has been over the last two years. That can be justification for lightening any overweight positions, but I see continued upside ahead as pending regulatory reform may drastically improve the credit profile of its tenant roster – justifying more multiple expansion. I reiterate my buy rating for the stock but again acknowledge the impressive run that the stock has had lately.

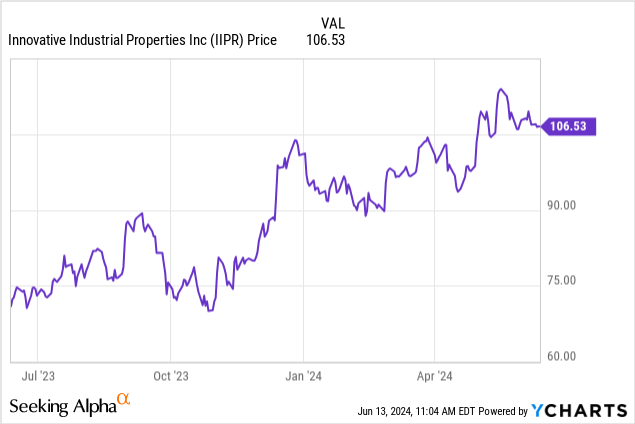

IIPR Stock Price

I last covered IIPR in April where I continued to rate the stock a buy and the stock has outperformed the market since then. I have stuck by the stock ever since it crashed alongside the cannabis sector, even when pessimism was peaking and the stock had a double-digit yield, but I also made my first bullish call on the stock prior to the crash, and it still has not recovered anywhere close to those levels.

That initial bullish call was based on a poor assessment of the tenant credit quality and forward growth prospects. But the stock does not have to return to those levels to allow for solid returns – I still see a solid blend between the dividend and multiple expansion potential.

IIPR Stock Key Metrics

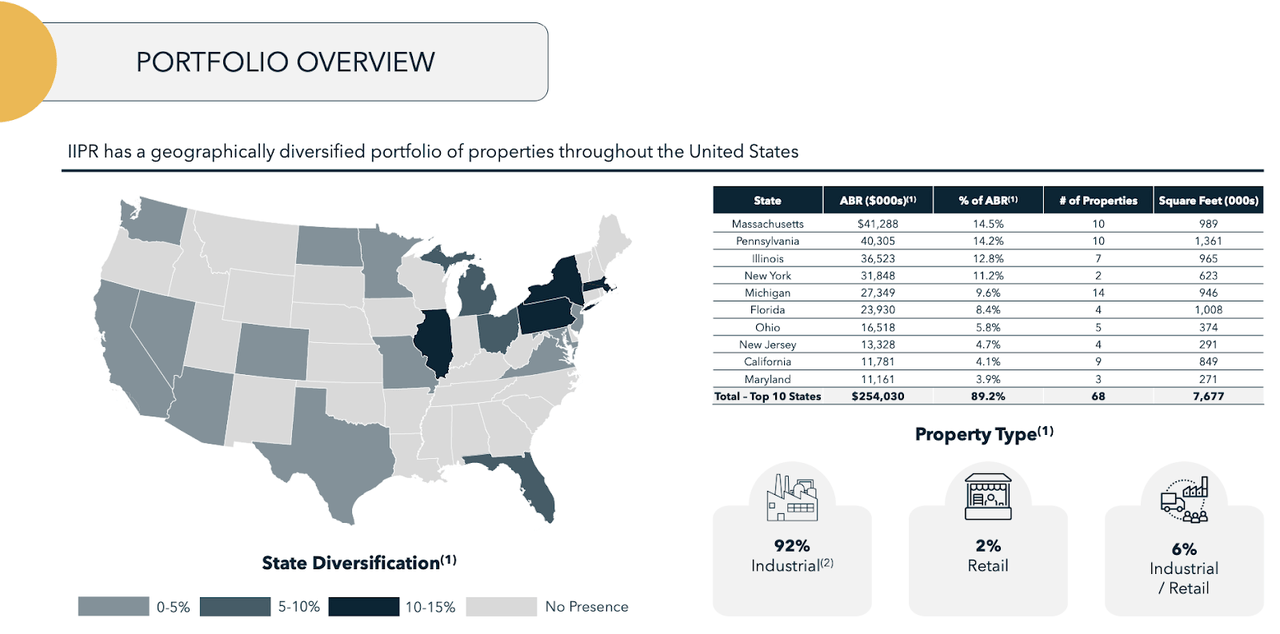

IIPR is the largest publicly traded landlord of cannabis net lease assets. The company is diversified across many states that have legalized the plant either on a recreational or medical use basis.

May 2024 Presentation

The portfolio was 95.2% leased as of the end of the quarter and carried a weighted average remaining lease term of 14.8 years. That latter point is important given that cannabis appears set to be rescheduled, which may improve the cost of capital for the operators. The long remaining lease term means that IIPR mainly stands to benefit from an improvement in tenant credit quality and does not face the near term risk of tenants trying to seek lower rental obligations.

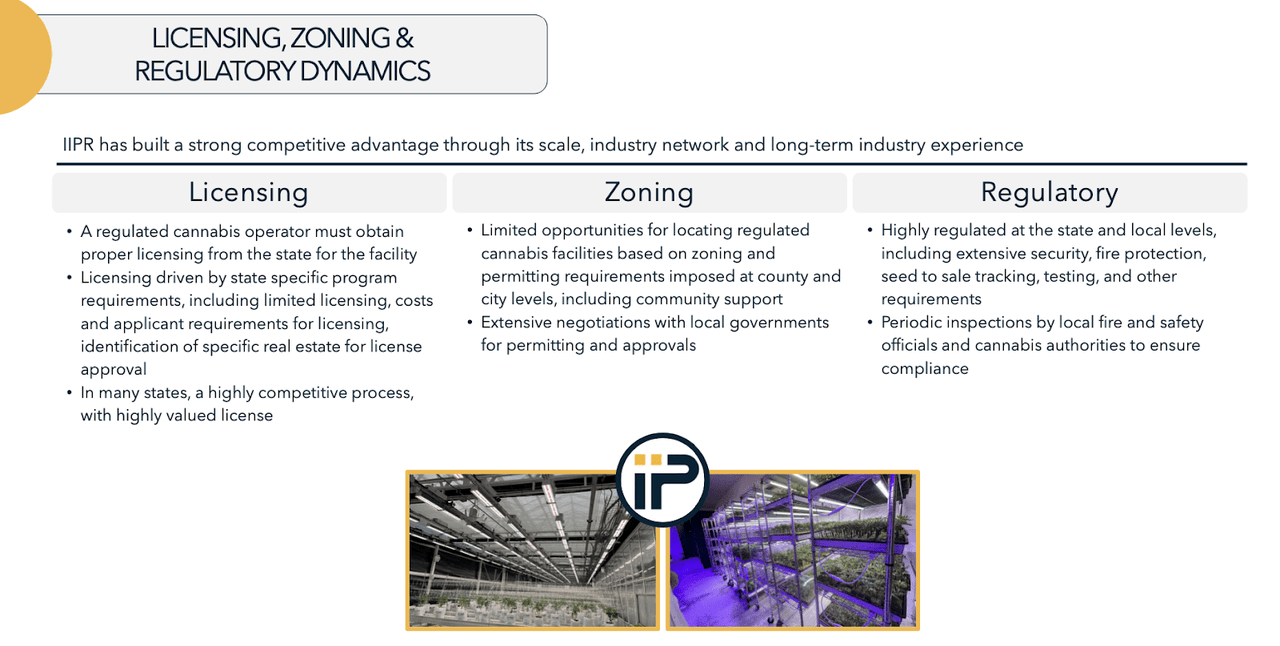

Moreover, it should be noted that cannabis cultivation properties are dissimilar from typical retail net lease properties given the greater amount of licensing, zoning, and regulatory restrictions. While the degree of this dynamic does vary state by state, in general cannabis operators are not able to relocate operations as easily as seen in typical net lease scenarios.

May 2024 Presentation

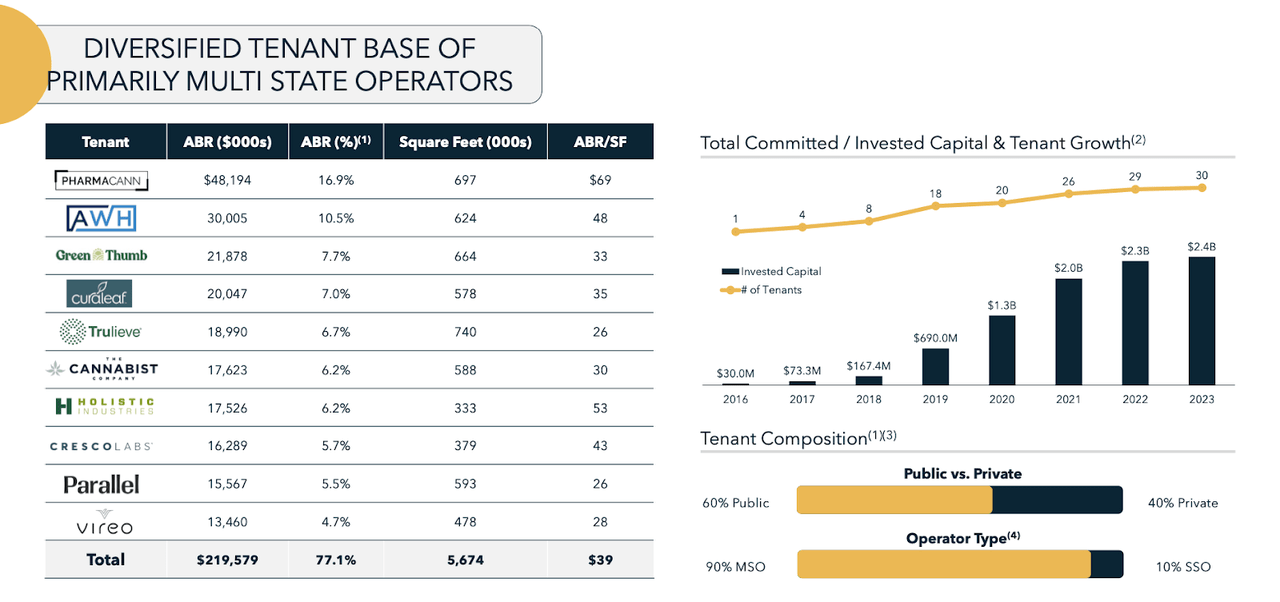

IIPR boasts a tenant roster filled with the most well known cannabis operators, the majority of which having operations across multiple states. IIPR has seen its asset growth come to a standstill over the last two years due to both the higher cost of capital (courtesy of a plunging stock price) as well as a lack of appetite for sale leaseback transactions (many operators had fully tapped-out their balance sheets).

May 2024 Presentation

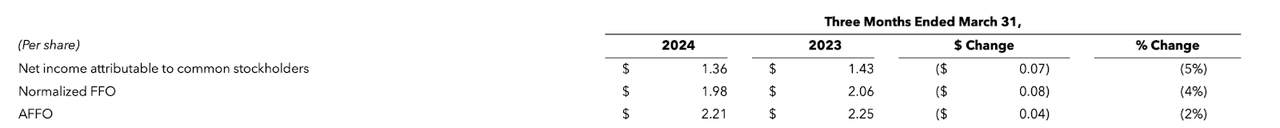

In its most recent quarter, IIPR saw revenues decline 1% YoY to $75.5 million. Management blamed the shortfall as being due to $5.6 million in revenue received in the prior year’s quarter that was related to vacant properties, as well as $1.5 million in rent related to leases that were converted to a sales basis as of the beginning of this year. That more than offset $6 million in growth related to annual lease escalators and lease amendments. While the revenue growth was disappointing, adjusted funds from operations (‘AFFO’) declined by only 2% to $2.21 per share.

2024 Q1 Press Release

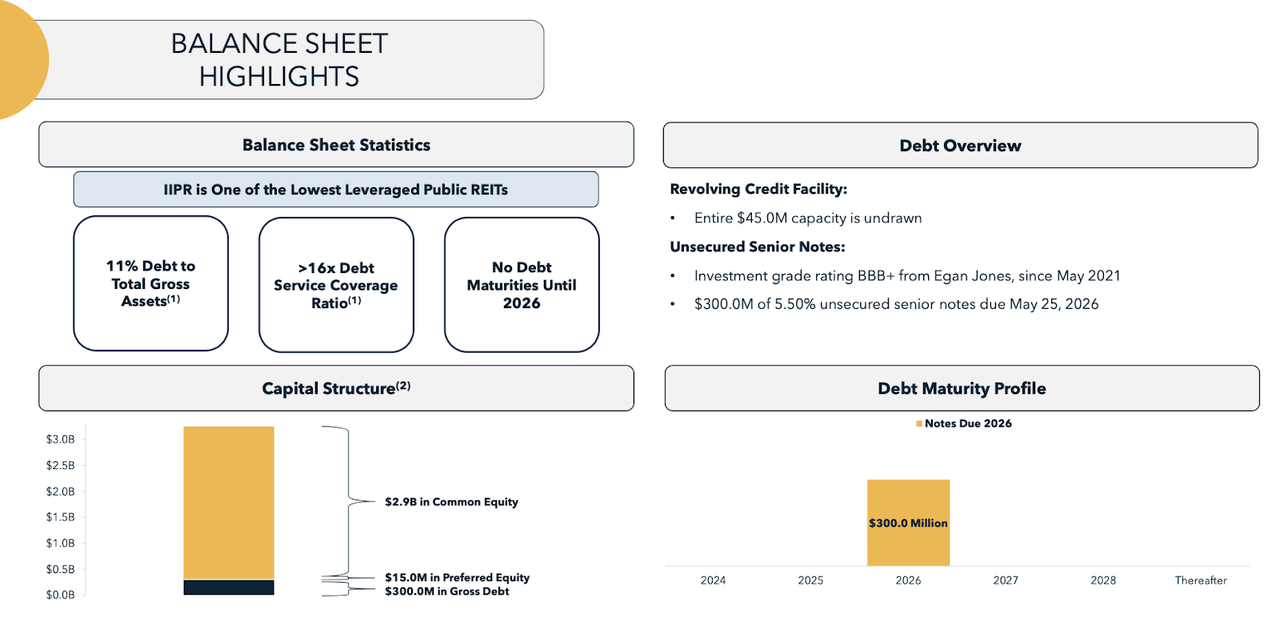

That is surprising given that many REITs across the board have shown much worse bottom-line results even while posting top-line growth. The reason for the discrepancy is that IIPR is dramatically under-leveraged as compared to net lease peers. IIPR ended the quarter with just $300 million in total debt, representing just around a 1x debt to EBITDA ratio. In contrast, many net lease REITs have debt to EBITDA ratios in the 5x to 6x range, which makes them more exposed to the higher interest rate environment.

May 2024 Presentation

On the conference call, management noted that certain leases executed in late 2023 may not “commence for some months” as these new tenants still need time to “obtain the requisite approvals to operate.” That might suggest some strength in the second half of the year as the company begins earning cash from those properties.

Management noted that they have closed on the sale of their Los Angeles property, which was sold for $9.1 million alongside a lease termination fee of $3.9 million. Notably, the amount received from this property disposition exceeded the carrying value of the property on the balance sheet. A common bearish argument has been that IIPR (and other cannabis landlords) have overpaid for their assets, but transactions such as this seem to fight back against such notions, especially considering that California is typically viewed as being one of the most difficult states for cannabis operators in the nation. Management noted that they have also executed new leases spanning $69 million of invested capital just this year. These properties are located in California and Michigan and IIPR was able to bring in strong tenants such as Gold Flora and Lume Cannabis Company. IIPR faced a great test over the last two years as it finally had to deal with a seemingly never ending slate of troubled tenants. The common bearish fear was that it would be expensive from a time and financial perspective to re-tenant these vacant properties, if ever. But management has shown that such fears were overblown, as cannabis properties remain in high demand (pun intended).

Is IIPR Stock A Buy, Sell, or Hold?

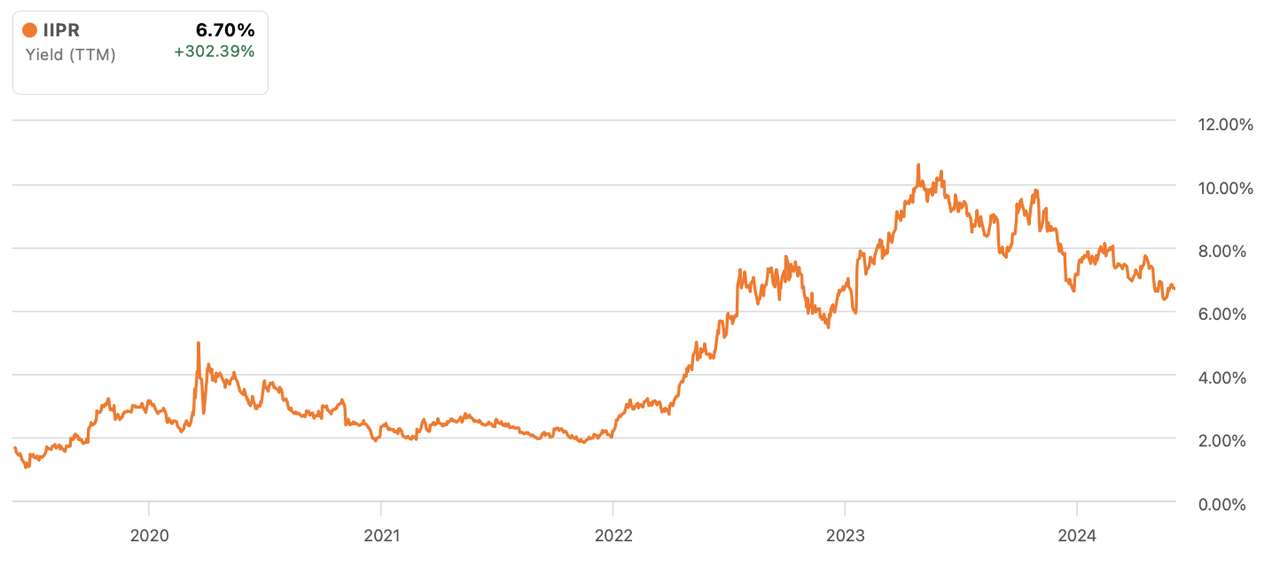

As happens so often on Wall Street, IIPR stock has performed quite strongly, in no small part due to the company effectively crushing the bearish thesis. The stock still trades at an elevated dividend yield relative to pre-2022 levels, but the stock arguably traded at extremely rich valuations back then.

Seeking Alpha

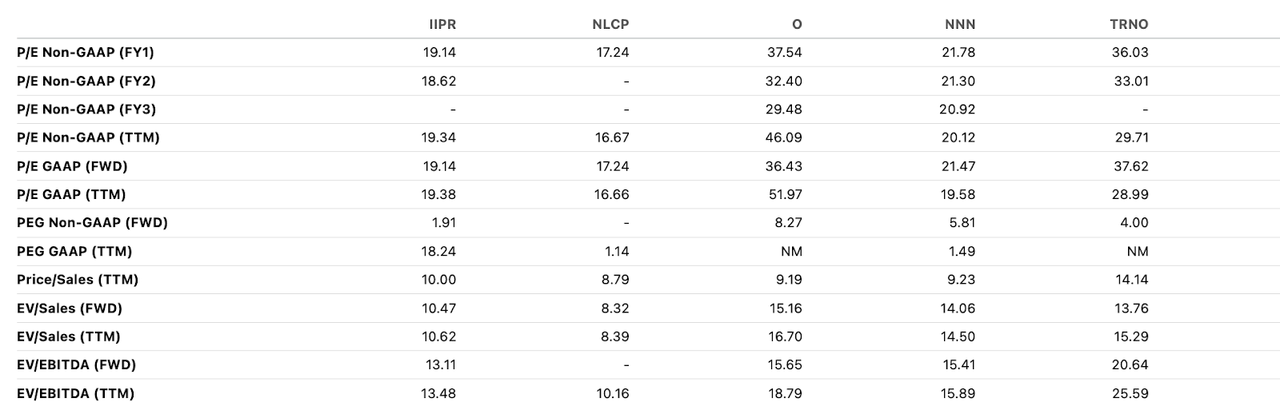

Even after the run-up, IIPR continues to trade at a discount to traditional net lease peers like Realty Income (O) and National Retail Properties (NNN), and an even larger discount to industrial names like Terreno (TRNO). I note that the key valuation metric to use is EV/EBITDA given that IIPR has substantially less leverage than peers, but IIPR’s 13.2x FFO ratio is still highly competitive.

Seeking Alpha

At this point, it is more difficult to pound the table on the basis of relative valuation given that the discount has narrowed considerably from the lows. However, I see IIPR as being a prime beneficiary of the government following through on plans to reschedule cannabis to Schedule III, as its operators would no longer be subject to “280e taxes.” Cannabis operators have historically had to pay income taxes based on gross profits, leading to elevated corporate tax rates, with some operators paying substantial tax burdens in spite of generating negative taxable income. Normalizing this tax burden would greatly improve the credit profile of IIPR’s tenant roster, and therefore justify further multiple expansion. I could see that allowing shares to trade up to a 6% yield, which would equate to a $120 share price and 14.8x FFO multiple. That would place it at some premium to peers like O and NNN, but I reiterate that this looks justified given the differing leverage profiles. In comparison with the last two years, that prospective upside is quite modest and implies that much more of the returns might come from the elevated dividend yield. It is possible that growth might also accelerate if IIPR is able to return to the typical net lease playbook of issuing stock to acquire new properties (but I have seen little indication of cannabis operators being open to such transactions).

IIPR Stock Risks

The main near term risk is an inability of the government to reschedule cannabis to Schedule III. While one could make an argument that IIPR can support its current stock price on the basis of its conservatively leveraged balance sheet and higher annual lease escalators, in reality Wall Street might return to its intense focus on the potential for new troubled tenants, leading to a greater relative discount to peers. Over the long term, the main risk continues to be a breakdown of the legal cannabis business model. Perhaps legal operators are unable to compete against the illicit market or even amongst themselves – price compression has been incessant in the sector over the last few years. As a medical user myself, I see demand for the plant growing solidly over the long term, but it is possible that this payoff happens too far down the line with IIPR’s tenants not making it through in one piece. IIPR is less exposed to such price fluctuations given that it is a landlord, but may need to reduce rental payments in the event of any reorganizations. With the stock much higher than the lows, the current stock price is not offering as large of a margin of safety for such scenarios.

IIPR Stock Conclusion

I see far less upside for IIPR than I have in the last two years, but I still view the stock as offering solid value when compared against traditional net lease peers. The company remains under-leveraged and rescheduling prospects represent an important near term catalyst. The stock offers robust double-digit upside from its dividend yield and a moderate re-rating, which is typically more than enough to make it an appealing REIT investment. I reiterate my buy rating for the stock.

Read the full article here