RCI Hospitality Holdings (NASDAQ:RICK), the nightclub and restaurant operator, has reported the company’s Q2 results after my previous article on the stock, and shared other recent company developments related to club and restaurant expansion. The growth has come in at a weak level, especially as Bombshells continues to underperform, but RCI Hospitality’s mid-term growth outlook still stands strong with aggressive new location development.

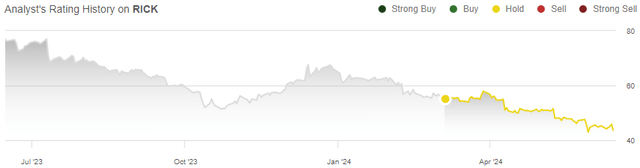

I previously published an article on the company titled “RCI Hospitality: An Opportunistic Capital Allocation Strategy”. In the article, published on the 5th of March 2024, I reviewed the company’s opportunistic capital allocation strategy and its long-term successful implementation. Due to slim short-term upside with the valuation at the time, I initiated the stock at a Hold rating. Since the article’s publishing, RCI Hospitality’s stock has lost -21% of its value. In the same period, the S&P 500 has returned a positive 7%.

My Rating History on RICK (Seeking Alpha)

Short-Term Revenue Outlook has Weakened

Before announcing the Q2 financial results on the 9th of May, RCI Hospitality published the quarter’s sales and other company developments on the 9th of April after market close. Club & Restaurant sales came in at a combined $71.7 million, compared to revenue estimates of $74.5 million. The stock reacted with -7% the following day. The final revenues came in at $72.3 million on the 9th of May with nightclubs recording $0.4 million better revenues than the initial update showed, and with $0.1 million in other sales, though.

The final revenues show year-over-year growth of 1.1%, down from 5.6% in Q1 – sales growth seems to be slowing down with weak same-store sales shown in Q2. No specific reason for the underperformance in same-store sales was mentioned, but I expect that the decline is at least partly attributable to a turbulent macroeconomic backdrop.

RCI Hospitality continues to open new locations and continues to acquire new locations, offsetting weak same-store sales – revenues grew in Q2 despite weak same-store sales, and the press release on the 9th of April shares developments of a high amount of new planned locations – four new nightclubs have either opened in March-April or received permits for construction or a liquor license, two nightclubs are being converted, and a letter of intent for a nightclub acquisition has been signed. Three new Bombshells locations are expected to open in late summer.

I expect that soft growth will continue into the next couple of quarters, especially as the two constructed casinos are still waiting for their gaming licenses. Still, revenues should eventually bounce back aggressively with the rapid expansion, and the long-term growth story stands.

Bombshells Segment Shows Continued Weakness, But Has Started Significant Initiatives For Improvements

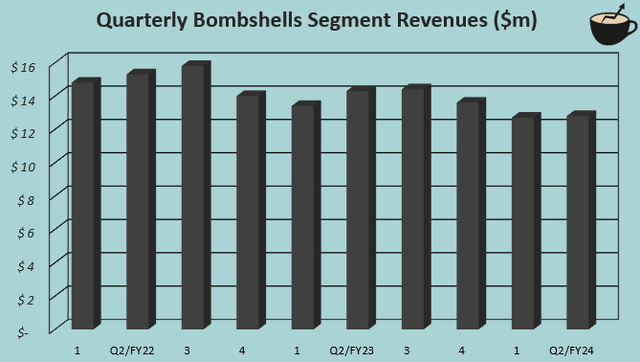

The Bombshells restaurant chain’s revenues have performed incredibly weakly – despite the total restaurant count growing from 11 in Q1/FY2022 into 14 at the end of Q2/FY2024, total revenues have fallen with incredibly high same-store sales declines. In Q2, same-store sales came in -20.5% worse than in Q2/FY2023, showing an absurdly large fall that macroeconomic pressures alone can’t explain. The sequentially stable sales still show some relative strength in light of historical declines, but one quarter of stability for Bombshells’ sales can’t be extrapolated as prior performance shows.

Author’s Calculation Using Q1/FY24 Presentation & Q2/FY24 Financial Report Data

RCI Hospitality has started cost-cutting initiatives in the segment, along with management changes and a shift in marketing. The initiatives were started to be implemented in mid-February, and large results weren’t yet seen in Q2 due to the timing. Operating income for the segment came in at $0.7 million in Q2, down from $1.8 million in Q2/FY2023 – in a couple of quarters, improvements in the performance are hopefully seen as the improvements are implemented, but I don’t suggest to get hopes up for a significant turnaround yet.

The strategy shift around profitability seems to have been done with a very late reaction. Bombshells has continuously slipped deeper in same-store sales, and RCI Hospitality still continues to open up new locations for the chain with three new Bombshells locations expected to be opened in late summer of 2024, with the concept currently still clearly underperforming. In the Q2 earnings call, a target for returning Bombshells to $60 million in annual sales with a 15% operating margin was mentioned, but I take the target with high skepticism until a better performance is shown.

Back in February, RCI Hospitality focused extensively on Bombshells’ weakness in the Q1 earnings call, and flashed the option of potentially selling the poorly performing segment.

The Valuation Is Getting More Attractive

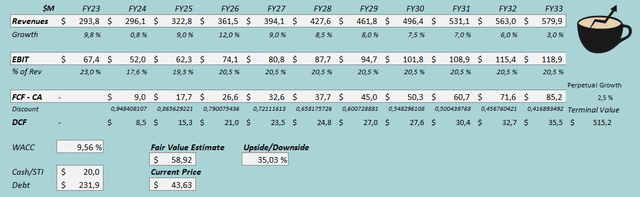

I updated my discounted cash flow [DCF] model estimates to account for slightly softer revenues than previously in the short term. I now estimate a growth of 0.8% in FY2024, down from 6% previously. Afterwards, I estimate a slower growth of 9% in FY2025 but an accelerated 12% growth in FY2026. From FY2027 forward, I estimate the same revenue growth as previously, with revenues ending up at $579.9 million in FY2033 compared to $609.9 million previously.

Due to Bombshells weakness and slightly weaker same-store sales in nightclubs than could be expected, I lowered the eventual EBIT margin estimate from 21% into 20.5% and made a larger adjustment downwards in FY2024 and FY2025.

With slower growth in absolute revenues, I estimate the cash flow conversion to be a bit better than previously in upcoming years, especially as many heavy investments have already been made upfront.

DCF Model (Author’s Calculation)

The estimates put RCI Hospitality’s fair value estimate at $58.92, 35% above the stock price at the time of writing. The stock price’s trajectory has reflected weaker revenues in the short term, but now represents a more attractive long-term entry point, as the long-term investment case remains quite similar. The fair value estimate is down from $61.69 previously.

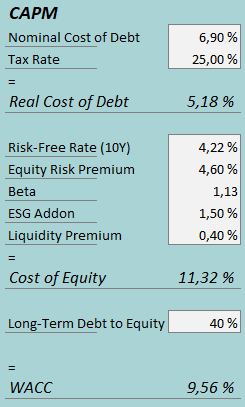

A weighted average cost of capital of 9.56% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q2, RCI Hospitality had $4.0 million in interest expenses, making the company’s interest rate 6.90% with the current amount of interest-bearing debt. I have kept the long-term debt-to-equity ratio estimate the same, at 40%.

To estimate the cost of equity, I use the United States’ 10-year bond yield of 4.22% as the risk-free rate. The equity risk premium of 4.60% is Professor Aswath Damodaran’s latest estimate for the United States, updated on the 5th of January. I kept the beta estimate, ESG addon, and liquidity premium the same at 1.13, 1.5% and 0.4% respectively, creating a cost of equity of 11.32% and a WACC of 9.56%. The WACC has stayed nearly the same from 9.62% previously.

Takeaway

RCI Hospitality’s recent developments have pushed the short-term growth outlook downwards as Q2 showed poor same-store sales, and as the two developed casinos continue to wait for their gaming licenses. Bombshells has also continued to perform incredibly poorly, with stable sequential revenues in Q2 being a too short period to extrapolate the stability.

Still, the investment case is now more attractive than before. RCI Hospitality’s aggressive expansion continues with many new locations expected to ramp up revenues soon, and initiatives have been taken from mid-February to improve the weakly performing segment. The Bombshells improvements should be taken skeptically for the time being, but the company’s overall growth outlook still looks incredibly good in the mid-term. With a lower valuation than previously, the current stock price reflects a more attractive entry point – I upgrade RCI Hospitality into a Buy rating.

Read the full article here