BlackSky Technology (NYSE:BKSY) is a geospatial imagery company that is still in the process of building out its space infrastructure. While the company has a large market opportunity, there are questions around capital requirements and competition. Defense and government applications should support near-term growth, but BlackSky’s lack of scale could be an issue if competition creates a race to the bottom on pricing. Even if BlackSky is successful, a highly dilutionary capital raise is a possibility given CapEx requirements. The stock isn’t necessarily overvalued on an absolute basis, but BlackSky looks expensive relative to Planet Labs (PL) based on the fundamentals of the two companies.

Market

BlackSky offers real-time space-based intelligence, which is a relatively mature market that has historically been dominated by a small number of companies leveraging large and expensive satellites in geosynchronous orbit. Growing smallsat capabilities, along with a rapid decline in launch costs, has opened the market to new entrants which could dramatically change competitive dynamics in coming years. Increased smallsat functionality has been enabled by microelectronics and innovative management approaches. There are still limitations though, primarily related to power budgets, payload capacity, and lifespan.

In addition, there are considerations around image resolution, spectrum, revisit frequency and data transmission capabilities. The cost of imagery is dependent on resolution, with sub-meter imagery generally extremely expensive. While small satellites are often relatively cheap, their instrumentation and small size limits resolution and quality. Synthetic-Aperture Radar aids with this by using the satellites motion to synthetically create a larger aperture and improve image resolution.

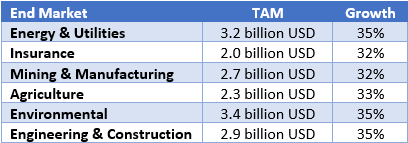

Increased competition and declining data acquisition costs are also helping to foster demand. BlackSky expects its TAM to reach 40 billion USD in 2025. In comparison, Euroconsult estimates that the market for Earth observation data and value add services will be 7.9 billion USD in 2031, with around half of this coming from defense.

Within the commercial market, use cases include:

- Pipeline monitoring (leaks, theft, hazards, etc.)

- Insurance claims processing

- Surveying

- Crop yield forecasting

- Monitoring deforestation

- Monitoring construction progress

BlackSky’s satellites are also capable of looking up, a feature that is already available to the government. This functionality could be used for things like imaging other satellites, which BlackSky believes is an emerging opportunity.

Table 1: BlackSky TAM Estimate (source: Created by author using data from BlackSky)

BlackSky’s business could also eventually see a boost from the US Space Force’s recently announced commercial space strategy. The US Space Force wants to integrate commercial space solutions to supplement government capabilities in a hybrid architecture. This aims to improve capabilities while reducing cost and deployment timelines. The strategy is focused on national security and other military requirements, with priorities including Tactical Surveillance, Reconnaissance, and Tracking; Space-Based Environmental Monitoring; Positioning, Navigation, and Timing; Space Access, Mobility and Logistics; and Space Domain Awareness. BlackSky believes it is well positioned to capitalize on this with its growing constellation of high-resolution satellites.

BlackSky faces a range of competitors, primary of which are Planet Labs and Maxar. Planet Labs is a satellite imagery vendor that has leveraged the opportunity created by small satellites to create a constellation of satellites capable of capturing medium to high resolution data. Planet Labs has improved the capabilities of its satellites over time, with its SkySats capable of 50cm resolution. The company is also about to introduce new satellites capable of capturing hyperspectral data and imagery with 30cm resolution. Planet Labs is more focused on commercial and civil government applications that BlackSky, although this could change with the launch of its higher resolution satellites.

Maxar is a provider of space infrastructure and geospatial intelligence. It obtains high resolution Earth imagery and other geospatial data from its own satellite constellation and third-party providers. The company’s space-based infrastructure includes robotics, subsystems and information solutions with a focus on geosynchronous Earth orbit communications. Maxar has been performing imaging since 1999 and currently operates a four satellite Earth observation constellation. It was acquired by a private equity company for 6.4 billion USD cash in 2023. Maxar’s satellites are relatively large, expensive and operate in geosynchronous orbit, collecting imagery at a 30cm resolution. Maxar is also capable of collecting non-Earth imaging of space objects between 200 and 1,000 kilometers in altitude. Companies like BlackSky and Planet Labs can potentially undercut Maxar on pricing, with a modest decrease in resolution as a tradeoff. Maxar’s satellites have a relatively long life though, and limited operating costs, which could contribute to a race to the bottom on pricing.

BlackSky and Planet Labs are an interesting contrast. Planet Labs built out a large constellation of cheaper but less capable satellites. It now has a reasonably large revenue base though and is introducing more advanced satellites. Planet Labs approach has also given it economies of scale in manufacturing and experience operating a large constellation. With the introduction of hyperspectral and high-resolution satellites, I tend to think Planet Labs will be better positioned than BlackSky.

There are also alternatives means of collecting geospatial data, like aerial imagery from planes or drones. The aerial imagery market is evolving over time due to the forces of new technologies like cameras, processing methods, acquisition platforms and cloud storage, as well as advances in analytics increasing the value of aerial data. Aerial imagery collected using planes provides more detail than satellite imagery and more consistency and spatial coverage than drone photography. This comes at a higher cost though, which limits aerial imagery to niche use cases requiring high quality data.

Black Sky Technology

BlackSky operates a constellation of 16 electro-optical imaging satellites. The company’s current constellation is made up of Gen-2 satellites that provide 1-meter resolution imagery. The Gen-3 version will produce sharper 50-centimeter resolution imagery. The Gen-3 satellites also have dual optical-infrared sensors that allow for imaging at night and in low-light conditions and high-speed communication to improve timeliness. BlackSky’s Gen-3 satellite is already in production and remains on track for launch in 2024. The company’s initial focus likely to be on expanding its constellation, before adding new sensor data over time, both of which will be capital intensive.

Manufacturing capacity is provided by the LeoStella JV, a smallsat manufacturer that BlackSky has a 50% interest in. LeoStella was formed in 2018 to build satellites for BlackSky’s constellation. The company initially manufactured the LS-100 bus but has since introduced the larger LS-200 to support BlackSky’s Gen-3 satellite. LeoStella is also developing an LS-300 bus which will be large enough to incorporate a xenon ion propulsion system, built by Astra. This will enhance the LS-300’s ability to perform orbital maneuvering and precision pointing, opening up new use cases. While LeoStella is a non-core part of BlackSky’s business, surging demand for satellites could make it a reasonably attractive asset. Around 18,500 smallsats are expected to be launched between 2022 and 2031 and Euroconsult projects that the manufacturing market will be worth 56 billion USD in the next decade. Demand is shifting to somewhat larger satellites though, which can entail dramatically different manufacturing capabilities. LeoStella believes that its bespoke model can accommodate this.

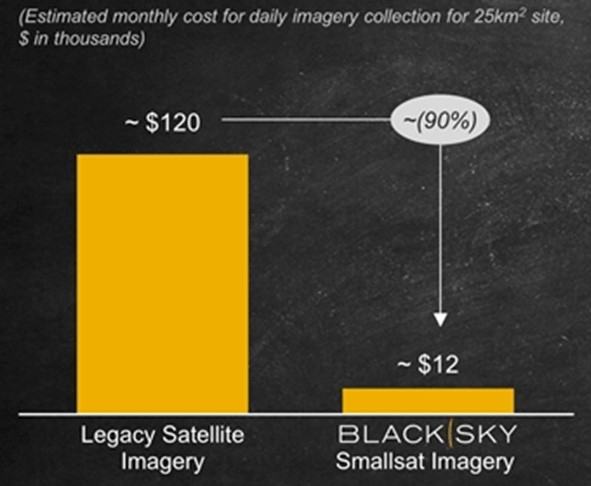

BlackSky gives developers access to a data lake through APIs and also offers machine learning on top of its own data and third-party data. While images can be differentiated along metrics like resolution, revisit frequency and latency, BlackSky is offering a relatively undifferentiated product. This makes cost extremely important and, in this regard, BlackSky has a large advantage over legacy vendors.

Figure 1: Satellite Imagery Capture Cost (source: BlackSky)

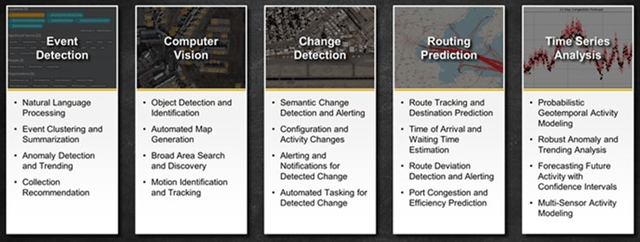

Through its Spectra AI software platform, BlackSky delivers a range of insights based on its satellite data.

Figure 2: Applications Enabled by Machine Learning (source: BlackSky)

Government agencies appear to be driving growth at the moment, including the National Reconnaissance Office, Army, Air Force, National Geospatial Intelligence Agency and IARPA.

BlackSky was awarded 30 million USD in new contracts and renewal agreements in the first quarter, primarily by US and international government agencies. Most of this appears to have been from a 24 million USD contract for advanced AI technology by the Air Force Research Laboratory to provide moving target engagement services.

The National Geospatial-Intelligence Agency’s Luno program could also provide upside in the near-term. The NGA has an RFP out for commercial satellite Earth observation data. Luno builds on the Economic Indicator Monitoring contract that commenced in 2021. EIM only involved around 30 million USD of orders from 5 vendors, whereas Luno is expected to have a 60 million USD ceiling.

Much of BlackSky’s current business appears to be underpinned by EOCL, which could run for 10 years. The Electro-Optical Commercial Layer is a National Reconnaissance Office initiative. The NRO is responsible for all satellite intelligence for the US government. Maxar, Planet Labs and BlackSky were all awarded EOCL contracts in 2022. Maxar’s deal is worth more than 3.2 billion USD over the decade. BlackSky’s contract could be worth over 1 billion USD but only has an initial 85 million USD value, with 72 million USD of that expected in the first 2 years of the contract.

Financial Analysis

BlackSky generated 24.2 million USD in Q1, an increase of 32% YoY. Imagery and analytics revenue only increased 13% YoY though, with growth coming from customers placing incremental orders for high-frequency imaging services. Professional and engineering services revenue was 6.4 million USD, up 146% YoY. The increase in professional and engineering services revenue was driven by new wins and execution step up of multiple major international contracts. This revenue is lumpy though and may not be repeated in future quarters.

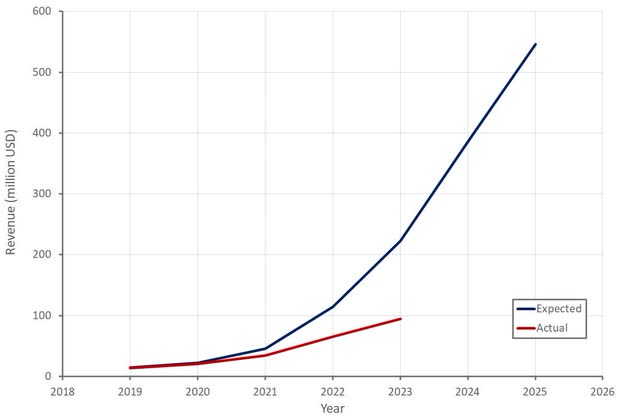

BlackSky expects 102-118 million USD revenue in 2024, representing a 16% growth rate at the midpoint. While this growth is reasonable, it falls well short of BlackSky’s expectations from a few years earlier. Given the infrastructure investments that BlackSky is making, the company likely needs stronger growth to support its cash flow needs.

Figure 3: BlackSky Revenue Guidance at Time of its SPAC (source: Created by author using data from BlackSky)

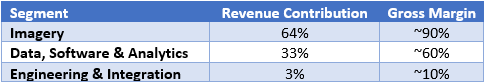

BlackSky’s gross profit margins are currently fairly strong. Imagery and Software Analytical Service revenue continues to increase, while cost of sales declined YoY in Q1. The reduction was driven by cost savings in satellite and software operations. Engineering and Integration margin strength was likely the result of the recognition of milestone payments. There is probably not much potential upside for BlackSky’s gross margins, but increased competition could pressure pricing, creating downside.

Table 2: BlackSky Gross Profit Margins (source: Created by author using data from BlackSky) Table 3: BlackSky Gross Margin Guidance at Time of SPAC (source: Created by author using data from BlackSky)

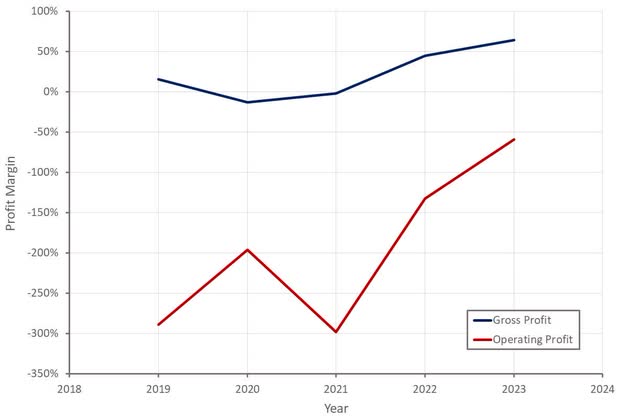

BlackSky’s adjusted EBITA margin was approximately 6% in the first quarter. Margins were likely boosted by elevated Engineering and Integration revenue. BlackSky’s GAAP losses are still large, and BlackSky’s cash flows from operating activities are also negative. Margins are rapidly improving on the back of the operating leverage inherent in the company’s business model though. BlackSky is guiding to 8-16 million USD adjusted EBITDA in 2024.

Figure 4: BlackSky Profit Margins (source: Created by author using data from BlackSky)

While BlackSky’s losses are rapidly declining, CapEx makes the company’s cash position a critical concern. CapEx totaled 14.6 million USD in Q1, driven by milestone payments for Gen-3 satellite production and software development. Full year CapEx is expected to be between 55 and 65 million USD.

At the end of Q1, BlackSky had 35.8 million USD of cash and short-term investments on its balance sheet. The company also has a 20 million USD commercial bank line, providing it with 55.5 million USD of liquidity. BlackSky also expects approximately 24 million USD from a few major customer contracts where revenue and costs have already been recognized but customers are yet to be billed. This could be sufficient for the company to achieve sustainable positive free cash flow, but this will depend on growth and the company’s ability to maintain cost discipline.

Conclusion

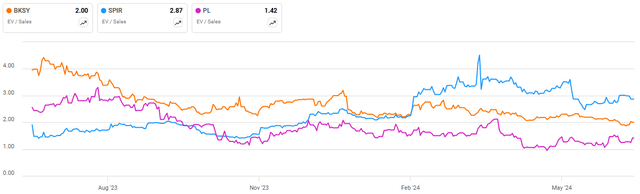

BlackSky’s exposure to civil government, defense and intelligence customers could create upside in coming years. Competition in the high-resolution satellite imagery space is increasing though and it is not clear how vendors will create and maintain differentiation. This is reflected in BlackSky’s valuation, which is relatively low given the company’s growth and the size of the opportunity ahead of it. I tend to think that Planet Labs is better positioned, making the discrepancy in valuation between them difficult to understand.

Figure 5: BlackSky EV/S Ratio (source: Seeking Alpha)

Read the full article here