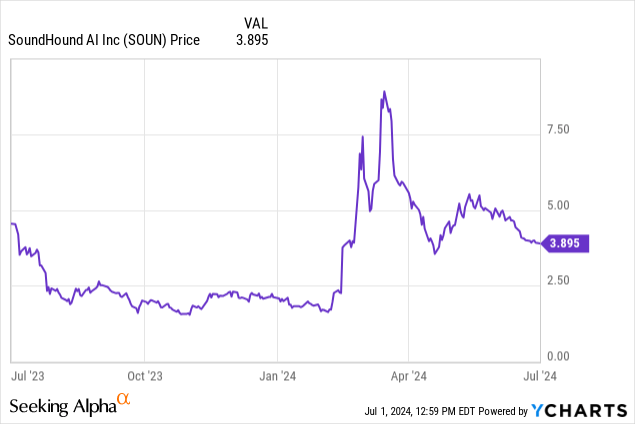

One of the biggest beneficiaries to the AI rally this year is a company most investors have hardly heard of: SoundHound AI (NASDAQ:SOUN), a company best recognized for using AI and automation technology to power restaurant drive-throughs. Secular tailwinds and a surge of interest in AI have driven a massive bona fide growth spurt for this company, which is now nearly doubling its revenue growth y/y. It’s capitalizing on this surge of interest as well to expand, acquiring rival SYNQ3 for an undisclosed sum.

Amid this fundamental moment, shares of SoundHound have surged nearly 90% year to date. As is always the case when stocks shoot up this far so quickly, it’s a great time to take a step back and assess whether it’s worth holding on for this rally.

At its new bloated valuation, SoundHound is a mixed bag

I last wrote a bullish article on SoundHound in November, when the stock was still trading well under $2 per share. I’ve enjoyed massive gains on my position since then, but owing to the sharpness of this year’s rally (even after fizzling out from even stronger gains seen since March), I’ve decided to de-risk my position and exit SoundHound. I’m now downgrading the stock to a neutral rating.

While I acknowledge the strength of SoundHound’s results (we’ll cover its Q1 update in more detail in the next section), I can no longer justify SoundHound’s valuation in the context of its longer term potential. To be sure, I still see a number of positive factors in the stock’s favor:

- Rapid and accelerating growth. Though admittedly small at a <$100 million annualized revenue scale, SoundHound is growing revenue at a rapid >70% y/y pace, which is a signal of strong execution and a largely greenfield market for its technology.

- Blue-chip customers. Though small, SoundHound has already amassed a nice and growing roster of premier customers, ranging from Oracle (ORCL), Toast, Square (SQ), Hyundai, and Jeep. A new partnership with Olo (which we’ll discuss in this article) also gives SoundHound the capacity to expand to many more restaurants.

- Secular tailwinds toward automation. Especially as wage labor costs rise in the service industries, more and more companies will be interested in deploying technology to bring down labor and increase margins as much as possible.

But at the same time, there are risks that have emerged that we must keep in mind:

- SoundHound is niche, and its specific verticals may be subject to sharp cyclicality. The majority of SoundHound’s business rests on quick-service restaurants, and particularly drive-throughs. We first have to ask whether drive-throughs, in the age of on-demand delivery, will run at the same volumes as in the past. SoundHound has additional exposure to the car manufacturing space, also volatile amid economic downturns.

- Weak gross margins. SoundHound’s sub-70% pro forma gross margins lag behind many of its software peers (an argument for the company to trade at a discount vis-a-vis similarly growing peers), and it’s nowhere near hitting break-even on adjusted EBITDA or pro forma operating income.

Above all, SoundHound’s rally has rendered the stock quite expensive – though we do have to give the stock some credit for a deserved premium owing to its recent growth spurt (the question is if that growth can be sustained).

At current share prices just under $4, SoundHound trades at a market cap of $1.29 billion. After we net off the $211.7 million of cash and $85.5 million of debt off SoundHound’s most recent balance sheet, the company’s resulting enterprise value is $1.16 billion.

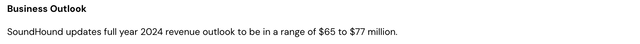

Meanwhile, for the current fiscal year, SoundHound has guided to a relatively wide revenue range of $65-$77 million, which represents 42-68% y/y growth (which to me indicates quite low visibility for this company, whereas many software peers guide to a much tighter range).

SoundHound outlook (SoundHound Q1 earnings release)

Meanwhile, for next year FY25, Wall Street consensus is calling for $103.5 million in revenue, or 46% growth versus the midpoint of FY24’s range: which we can consider quite aggressive if we consider the fact that the SYNQ3 acquisition will be fully comped after Q1 and that this year represented a significant growth spurt that may be difficult to grow another >40% on top of.

Nevertheless, taking guidance and consensus at face value, we arrive at valuation multiples of:

- 16.3x EV/FY24 revenue

- 11.2x EV/FY25 revenue

Owing to my concerns on SoundHound’s ability to execute at a larger scale, I’m not keen on paying a double-digit revenue multiple on a company that has only recently accelerated growth beyond the ~20% range. I’d take advantage of this year’s rally to lock in any gains and move to the sidelines until the company provides better clarity on its growth trajectory.

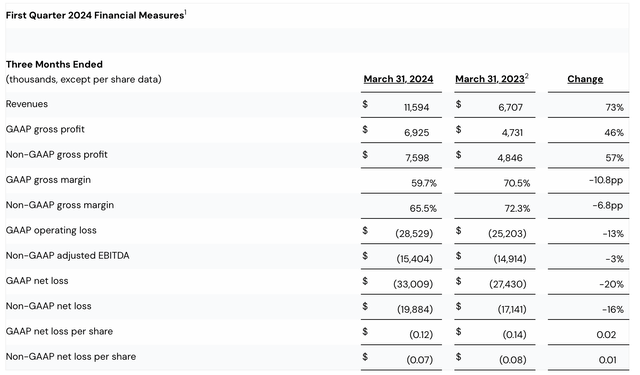

Q1 download

SoundHound shocked and awed the markets with its tremendous growth this year. In Q1, as shown in the chart below, revenue grew 73% y/y to $11.6 million, substantially outperforming Wall Street’s $10.1 million (+51% y/y) expectations.

SoundHound Q1 results (SoundHound Q1 earnings release)

The company has noted a few key restaurant vertical wins as one of the core drivers of outperformance. The company has signed new agreements and pilots with Church’s Chicken (a Georgia-based chicken chain with over 1,000 locations) and Jersey Mike’s, while one of its long-time customers, White Castle, has expanded its usage; alongside Applebee’s.

The core thing we like to see, however, is SoundHound’s expansion beyond restaurant voice AI. SoundHound refers to these use cases such as automated voice call assistants as its “pillar two”, and it did note some significant wins in Q1, with over 100,000 locations in its pipeline compared to 10,000 in the existing base. Per CEO Keyvan Mohajer’s remarks on the Q1 earnings call:

This quarter was a special quarter for our pillar two, where we offer AI customer service solutions for businesses. About 30% of our revenue was from pillar two with over 10,000 locations laid in production and over 100,000 in our pipeline. Just a year ago, these numbers were negligible […]

Last year, we expanded our AI customer service offering beyond restaurants with Smart Answering, a product that handles multiple calls at once 24/7, conveniently filtering out spam calls, providing verbal and SMS responses, taking configurable actions, capturing leads with intelligent messaging and answering questions about policies, hours, products, services, pricing and more. Smart Answering is showing rapid growth within pillar two and already has hundreds of locations signed up from single-location small businesses to brands such as Planet Fitness.

We estimate our pillar two total addressable market to be over $100 billion with over 1 million restaurants and approximately 30 million businesses in North America alone that we can offer our solutions to. And with dozens of languages we already provide to our pillar one customers, we plan to also go international in pillar two. We believe with large language models and generative AI and most importantly, the data science and machine learning behind our proprietary software, the time is now.”

The expansion of this segment to 30% of revenue is what keeps me positive on SoundHound’s prospects. We note as well that the company reported cumulative subscription and bookings backlog growing 80% y/y to $682 million, with an average duration of 7 years: which gives us some confidence in the company’s ability to build its revenue base with long-term contracts that have potential for customer expansion.

We should keep in mind, however, some red flags on profitability in the Q1 earnings print. In particular, pro forma gross margins fell 680bps y/y to 65.5% (which as I pointed out earlier lags behind most software companies in the mid-70s). The company attributed the gross margin weakness to the inclusion of SYNQ3’s results as well as poorer margins from a higher “pillar two” / contact center business revenue mix. The company is hoping for margin improvement back to pre-acquisition levels throughout this year as this business scales.

Adjusted EBITDA losses also widened slightly, 3% higher y/y at -$15.4 million, or a -132% adjusted EBITDA margin. This is something we should keep a close eye on, as SoundHound is nowhere near profitability.

Key takeaways

In my view, SoundHound has become a classic tech investment in the late cycles of a market rally: hypergrowth at all costs, big losses, and a big valuation. As my priority is to de-risk my portfolio in anticipation of a near-term correction, I’d prefer to move to the sidelines here until SoundHound returns to a better, safer price.

Read the full article here