Introduction

I’ve been looking at companies that completed IPOs in 2024 and this is how renewable energy firm SolarMax Technology (NASDAQ:SMXT) popped on my radar screen. The latter raised $18 million in February, and its market capitalization doubled on the first day. However, the market valuation of SolarMax Technology eventually dropped to just $130.5 million as of the time of writing. Looking at the latest available financials, I doubt that the stock is likely to be trading near the $4.00 IPO price anytime soon. Let’s review.

Overview of the business and financials

SolarMax Technology was founded in 2008 and is a US-focused integrated solar and renewable energy company. It’s involved in the sale and installation of solar and battery backup systems as well as the sale of LED systems and its products are designed and assembled in the USA. The company also has investments in three solar power companies in China. In 2020, SolarMax Technology entered into a merger agreement with a special purpose acquisition company (SPAC) named Alberton Acquisition Corp. However, the transaction dragged on, and SolarMax Technology decided to walk away from this deal in 2022. In February 2024, it sold 4.5 million shares at $4.00 apiece and thus listed on NASDAQ.

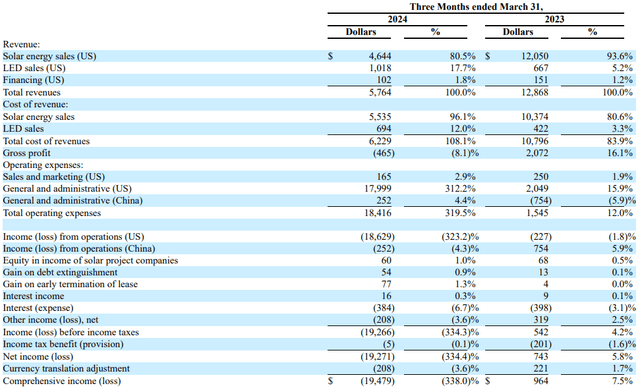

Turning our attention to the latest available financials results, we can see that revenues slumped by 55.2% year on year in Q1 2024 to just $5.8 million. The decrease can be traced to solar energy product sales (solar panels, home batteries, electric vehicle charging inverters) and the company blamed the introduction of a new net metering policy in California named net energy metering (NEM) 3.0 that took effect in April 2023. Under this new policy, net metering compensation rates for new solar customers in the state were reduced by around 75% and this resulted in a strong backlog of orders for SolarMax Technology which were filled in Q1 2023 (page 44 of the Q1 2024 financial report).

With the introduction of NEM 3.0, the number of systems completed went down by 65% while the wattages deployed slumped by 74% in Q1 2024. With orders drying up due to the lower net metering compensation rates, the company laid off around a quarter of its residential solar system design and installation team in January 2024, but these cost cuts were not enough to keep the gross profit margin in the black. In addition, general and administrative expenses for the quarter surpassed $18 million due to a one-time stock-based compensation expense of $15.9 million related to performance options vesting upon the IPO.

SolarMax Technology

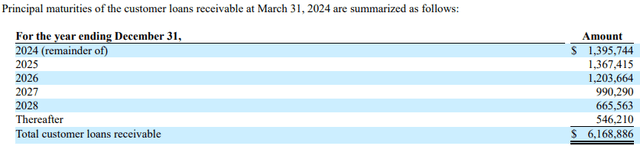

On a positive note, sales of LED products soared by 52.6% to $1 million thanks to an increased number of projects awarded. Unfortunately, the company’s LED revenue tends to fluctuate period to period. SolarMax Technology also booked $0.1 million of revenues from solar loans. The financing of solar customers was discontinued in early 2020 and revenues from this business should dry up in the near future. As of March 2024, the customer loan receivables stood at $6.2 million compared to $6.8 million a quarter earlier.

SolarMax Technology

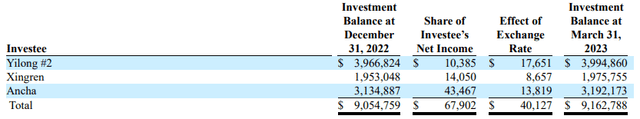

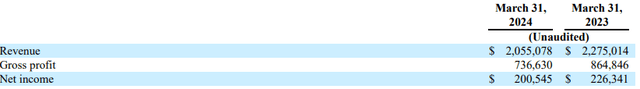

Looking at the Chinese solar energy investments, SolarMax Technology has 30% stakes in three companies that were project subsidiaries that performed EPC services. In 2021, 70% stakes were transferred to the customer which means SolarMax Technology does not book revenues from them due to having a minority stake. That being said, these three companies are profitable, and the stakes had a book value of $9.2 million as of March 2024.

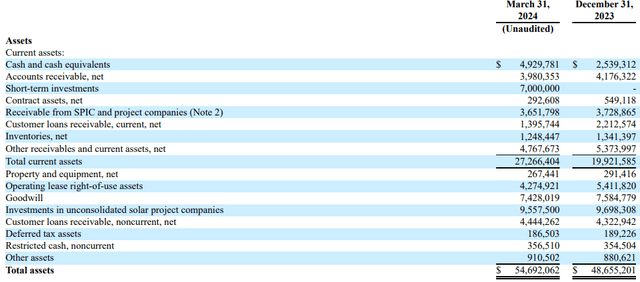

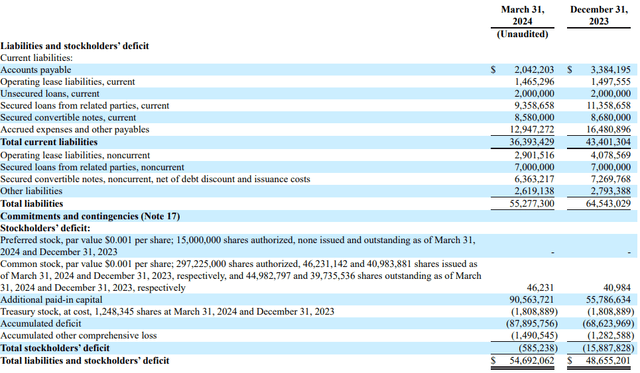

SolarMax Technology SolarMax Technology

Looking at the balance sheet of SolarMax Technology, I think the situation looks grim as shareholders’ equity remained negative despite the proceeds from the IPO. Some $7 million of the fresh funds were invested into 8% promissory notes of a Hong Kong-based company named Webao and they were due June 1. With cash and cash equivalents and short term investments (the notes) at $11.9 million, I’m concerned that SolarMax Technology could require a significant capital increase or a restructuring before the end of 2024 as operating cash flow was negative $6.4 million in Q1 alone.

SolarMax Technology SolarMax Technology

Future of the company and valuation

Overall, it seems the introduction of NEM 3.0 in California has shrunk the orders for solar panels of SolarMax Technology significantly and I doubt that quarterly revenues will surpass the $10 million mark in the next few quarters. The company is struggling to cut expenses as compensation costs per employee rose by 19% year on year in Q1 2024 and I think the gross margin is likely to remain in the red for the remainder of the year. With shareholders’ equity in negative territory and operating cash flow of minus more than $6 million for Q1, I think that a significant capital increase by the end of 2024 could be inevitable.

In my view, the business of SolarMax Technology could be close to worthless in its current state. That being said, short selling doesn’t look like a viable idea at the moment as data from Fintel shows that the short borrow free rate is 49.5% as of the time of writing. While the short squeeze risk seems low considering the short interest is just 0.71% of the float, there are no options available for SolarMax Technology. This means that the risk can’t be hedged through call options here and I think risk-averse investors should avoid this stock.

Looking at the upside risks, the major one seems to be that the share prices of microcap companies can soar for spurious and unknown reasons. In addition, I could be over-pessimistic about the future effects of NEM 3.0 on the sales of SolarMax Technology or its ability to implement cost-saving measures in the coming months.

Investor takeaway

SolarMax Technology managed to raise $18 million in an IPO during a tough period for its business due to the effects of NEM 3.0 in California, and I think that the company is likely to run out of liquidity by the end of the year. In my view, the launch of a significant capital increase or a restructuring over the coming months looks inevitable. That being said, short selling seems dangerous due to a short borrow free rate of almost 50% as well as the lack of options. If the short borrow fee rate drops to single digit percentages, I think there could be a good short selling opportunity here. For now, it could be best for risk-averse investors to avoid this stock.

Read the full article here