Introduction

In January, I analyzed the iShares MSCI Mexico ETF (NYSEARCA:EWW) with a BUY rating given the county’s various key drivers, such as nearshoring, rate cuts, and solid corporate earnings expectations. I am now downgrading the ETF to Sell based on political risks that are only partly priced in. The Morena Party’s control of both houses may result in constitutional “reforms” that undermine checks and balances, while a second Trump term can further lead to selling pressure.

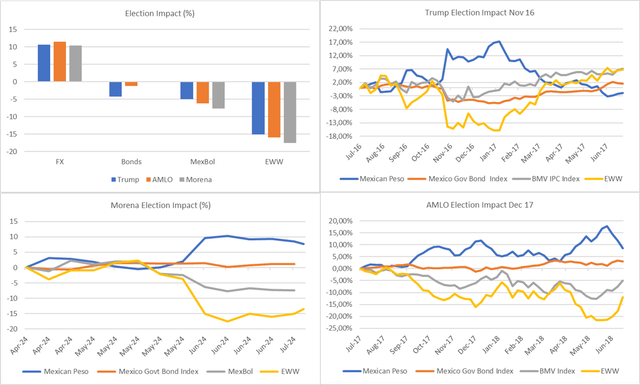

Performance during political shocks

The Mexican market: equity, debt, and currency have been impacted by political events perceived to offer unpredictable changes to macroeconomic policy. In the recent past, the markets sold off on the Trump election in 2016, on the AMLO election in 2017, and now when Morena gained control of Congress. In the three events, the currency fell 10% and the EWW 15% at their peak. While the markets eventually recuperate the time frames vary and, in my view, the next 5 months pose significant risks that may not yet be reflected in asset values, which calls for caution.

In September, the new congress commences while Claudia Sheinbaum, the new president, commences in October. This means that AMLO will be in power with full control of both houses for a month, and this has the market worried. Combine that with the US election that may result in a second Trump term with both houses in Republican control, which could lead to a Mexico asset sell-off given the border, immigration, and trade pressure points.

Created by author with data from Capital IQ

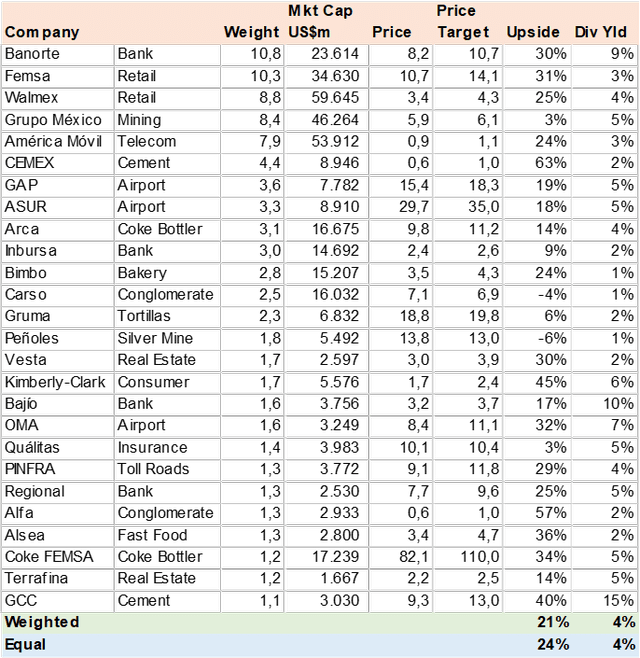

Portfolio Update

I gathered consensus data for 90% of the ETFs AUM or 26 holdings. In the first table, I calculated the weighted average upside potential for the EWW by using consensus price targets. However, since the June election, analysts have begun to reduce valuation citing higher risk-free rates, thus the 21% upside potential may suffer a correction, as we head into 2Q24 earnings season in August.

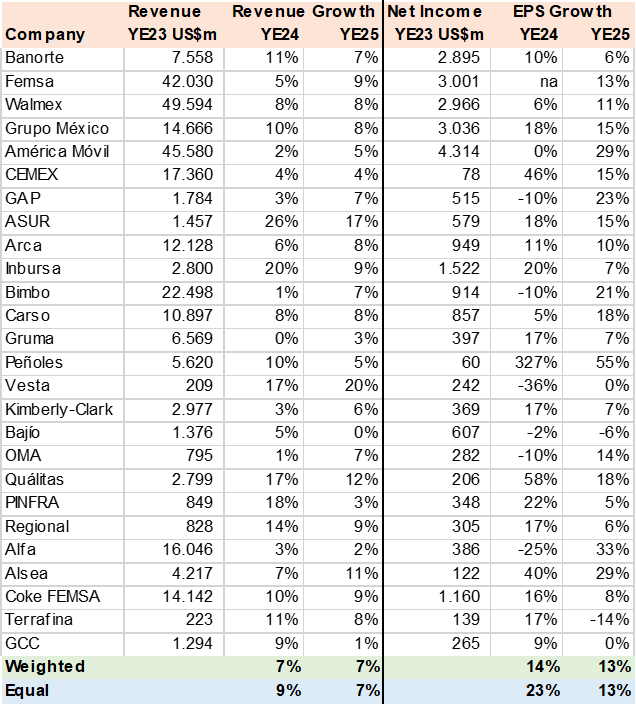

The second table has consensus revenue and earnings data for the portfolio holdings that have seen a modest increase vs the January update, which may also suffer downgrades given the higher FX rate. The data is in USD and while many Mexican companies have operations in the US or outside of Mexico, the prevailing operations are in Mexican pesos.

Consensus Price Targets (Created by author with data from Capital IQ)

Consensus Estimates (Created by author with data from Capital IQ)

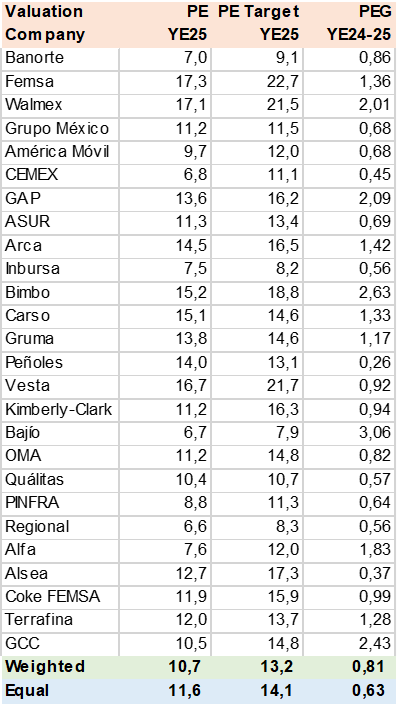

Valuation

The EWW is now apparently cheap post-sell-off, with the PE dipping from 15x in January to 11x today with a PEG at 0.8x. However, as discussed earlier, analysts have begun to reduce price targets and earnings in light of the weaker FX, fear of a slowing economy, and lack of rate cuts. The 2Q24 earnings season may see a significant review of many of the EWW’s holdings. Additionally, it has been my experience that a risk-off mindset can lead to selling pressure that ignores fundamentals in the medium term.

Consensus Valuation (Created by author with data from Capital IQ)

Risk

The main risk to sell rating is if the Morena party and new president do not alter the constitution enough to negatively impact Mexico’s rule of law and increase the country’s risk profile. The second risk factor is if Trump is not elected, but this needs to be evident months before, i.e., in voter polls.

Conclusion

I downgrade EWW from Buy to Sell: The political risk internally, changes to the constitution, and externally, a second Trump term, can lead to further selling pressure that ignores fundamentals. The market does not like uncertainty and is far more likely to sell or underweight assets that are in danger of significant risk.

Read the full article here