Red Robin Gourmet Burgers, Inc. (NASDAQ:RRGB) reported the company’s Q1 results in late May, not showing signs of improvements yet as the weak earnings have carried on. The company hinted at a more positive start to Q2, though, which could improve the investment case considerably. On the other hand, with the weak performance and high debt, the improvement is very critical and continued weakness could pose a real threat to the business’ ability to continue operating.

I previously wrote an article on the company, published on the 30th of April with the title “Red Robin: Margin Improvements Are Urgently Needed”. In the article, I initiated Red Robin at Sell due to the company’s high debt, continued weak financials, and a valuation pricing a too optimistic base scenario.

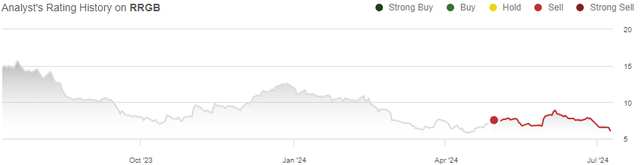

The stock has since lost -19% of its value compared to S&P 500’s appreciation of 11% as Q1 showed no signs yet of an improving bottom line.

My Rating History on RRGB (Seeking Alpha)

Red Robin’s Bleak Q1 Financials

The Q1 results didn’t show a good start to 2024. Comparable restaurant revenues declined by -6.5% year-over-year leading to revenues of $388.5 million, a -7.0% total decline. The weaker sales led to weakening profitability, as income from operations declined from $4.2 million in the prior Q1 into -$2.1 million – worryingly, Red Robin hasn’t yet showed any signs of improving demand through a renewed menu and other North Star initiatives. The cost savings that the plan targets have ultimately been countered by continued weak sales, and the recent sale-and-leasebacks further pressure operative income.

The weakness is in part related to industry weakness, as consumer spending continues to be pressured. The restaurant industry has seen the lower consumer spending’s effects, but Red Robin’s -6.5% comparable sales in Q1 still seem to be much weaker than the industry’s sales performance as a whole.

Hints of a Stronger Q2

Red Robin noted an improved performance at the start of Q2 – in the first five weeks of the quarter, comparable restaurant revenues managed to grow by 0.3% with the company’s renewed menu items including the Lava Queso Burger and Gold Medal Burger. The Q1 earnings call also shines some insights into the expected Q2, as the management expects the North Star plan to finally start reaping rewards as the operational improvements are expected to attract more customers. Red Robin’s loyalty program also continues to grow with updates made into the program.

A better same-restaurant sales performance is the most critical factor in Red Robin’s turnaround, and continued improvements could push forward the planned turnaround.

I still wouldn’t extrapolate the better start to Q2 too far – five weeks are still too short of a period to prove sustainably improved customer traffic, and Red Robin’s poor past doesn’t add faith. The 0.3% growth is also still below inflation, and an even more improved growth is needed. Red Robin continues guiding for revenues of $1250-1275 million for 2024, a mid-point decline of -3.1% from 2023, weakened by a 52-week fiscal year 2024 instead of 53 weeks in Red Robin’s fiscal 2023.

There’s A Real Mid-Term Threat of Going Under

Red Robin’s available liquidity of $55.6 million after Q1, still providing liquidity for the short-term future – short-term, the company’s operations should go on without an immediate liquidity risk.

The high remaining debt of $162.0 million poses a mid-term threat, still – a small amount of principal payments at a quarterly 1% of the principal amount must be made to the credit facility. Potential debt covenant breaches could even act as a short-term risk, as Red Robin has a covenant relating to the total net leverage ratio. Unless earnings improvements are made, paying off the debt is near impossible without a significant equity raise or refinancing.

The credit facility matures in March 2027. The maturity poses a mid-term risk to operations, as refinancing the debt with the current financial profile could turn out to be incredibly challenging, and an equity raise would be incredibly diluting and borderline inexecutable – in the mid-term, there’s a real threat of Red Robin going under if earnings improvements don’t start to show soon.

As such, I believe that the Q2 results weigh heavily on the investment. The quarter’s total same-restaurant sales growth likely affects the short- to mid-term outlook significantly due to Red Robin’s recent positive remarks raising faith in the turnaround. If the better performance doesn’t sustain, the investment quickly becomes bleak.

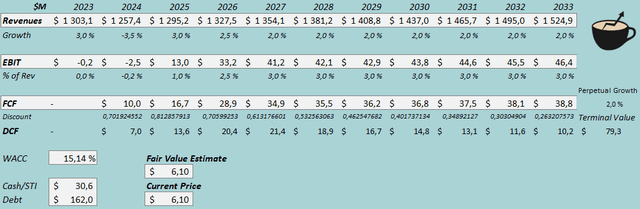

Updated Reverse DCF Valuation

I updated the reverse DCF model to show what markets are now pricing in for the stock. With the lower stock price, a more modest sales recovery is expected with some elevation in 2025 and 2026. The EBIT margin is expected to rise into 3.0%, down from the previous 4.0% estimate. The margin leverage still estimates very good improvements.

The cash flow conversion should still be good with capital expenditures largely being put on halt.

DCF Model (Author’s Calculation)

I still don’t think that such improvements should be held as the base scenario. The Q2 results will likely play quite a good part in determining the likelihood for such a turnaround, though – I suggest investors to watch the quarter’s performance very closely, as sustained better same-restaurant sales clearly improve the likelihood of a turnaround.

A greater-than-estimated turnaround would easily turn the investment attractive especially as the leveraged balance sheet leverages shareholders’ equity valuation.

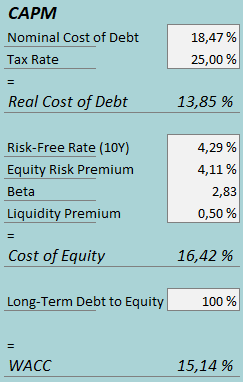

CAPM

A weighted average cost of capital of 15.14% is used in the DCF model. The used WACC is derived from a capital asset pricing model:

CAPM (Author’s Calculation)

In Q1, Red Robin had $7.5 million in interest expenses, making the company’s interest rate an incredibly high 18.47% with the current amount of interest-bearing debt. I continue estimating a long-term debt-to-equity ratio of 100% due to the company’s struggles in paying down the total debt.

To estimate the cost of equity, I use the 10-year bond yield of 4.29% as the risk-free rate. The equity risk premium of 4.11% is Professor Aswath Damodaran’s estimate for the US, updated in July. I continue estimating the beta at 2.83. With a liquidity premium of 0.5%, the cost of equity stands at 16.42% and the WACC at 15.14%.

While the beta will eventually recover into a dramatically lower level if a turnaround happens, I believe that the incredibly high cost of equity is justified for the time being with the current risk profile.

Takeaway

With Q1 continuing Red Robin’s poor performance, the company’s future looks bleak. Positive same-restaurant sales remarks were made with the Q1 report and earnings call, though, as the metric returned to growth during the first five weeks of Q2. I believe that the Q2 report plays a critical part in the investment, as a mid-term turnaround is likely needed for Red Robin to not go under, and as margin improvements are clearly needed.

I still believe a turnaround to not be the base scenario, as five weeks is too short of a period to extrapolate much further and the 0.3% growth doesn’t yet show the needed amount of growth. As such, I remain with a Sell rating for Red Robin.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here