Introduction

Sally Beauty Holdings (NYSE:SBH) is a small-cap stock, noted for providing beauty products across the globe to both DIY customers as well as professional stylists/salons (in North America, they serve as the largest distributors of professional hair color and care); the bulk of these beauty products include hair color and hair care-related products, with both categories accounting for well over 80% of group sales (besides hair-related material, SBH also provides styling tools and nail products).

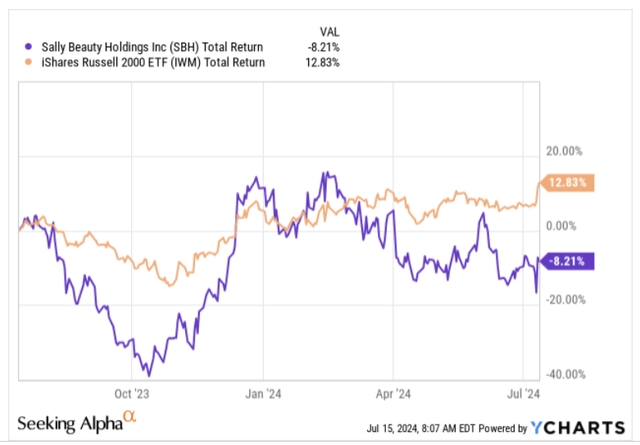

Over the past year, the market hasn’t quite taken a fancy to this small-cap discretionary stock, and it has ended up losing 8% of its value, even as other small-caps have delivered positive returns within the early teens.

YCharts

Looking ahead, we feel there could be a change in the narrative, on account of the following reasons.

Financial Outlook Looks Better And Forward Valuations Look Cheap

Over the last four quarters, SBH has continued to face dwindling topline growth on a YoY basis, and by the looks of it they could close the current fiscal slightly lower (by – 0.5% YoY). Yet considering the H1 performance, where the topline was down by -2% on average, the FY expected growth decline would suggest positive YoY growth of 1% in H2.

SBH’s BSG (Beauty Systems Group) segment which provides omnichannel distribution services for hair salon professionals across North America, has already started seeing positive momentum for two quarters (in Q2, comparable transaction sales were up by 2%), and could benefit from easier comps as the hair care headwinds from the previous years won’t be present in H2.

Then, SBH’s Sally Beauty Segment [SBS], which accounts for 56% of group revenue, 64% of operating earnings, and has a better margin profile ( 16.8% operating margin vs BSG’s margin of 11.4%) has been facing some challenges on account of the macro environment. Essentially this segment caters more to the DIY low-income customer, and here, on account of inflationary pressures, these customers have been leaning more towards promotions, thus impacting the average unit prices. SBS too has been contributing less to the sales mix in H1 and this has ended up impacting the overall group margin.

However last week’s inflation report was very encouraging, with the CPI seeing its first drop since May 2020, following an unchanged stance in the following month. Also in the 12 months through June, the CPI witnessed its smallest gain since June 2023; broadly the key takeaway here is that inflation pressures are well and truly abating, and we could also see some interest rate cuts in September, which would improve household budgets, and prompt some of the low-income segment to engage in more discretionary sales.

Even if topline dynamics could be slow to pick up (SBH follows a September year-ending calendar), note that management has put in place a “ Fuel for Growth” program to generate cost savings in distribution and shipping, which will result in $20m worth of benefits in the current fiscal and even an even higher run rate of $50m p.a. during FY25 and FY26, taking the aggregate total to $120m.

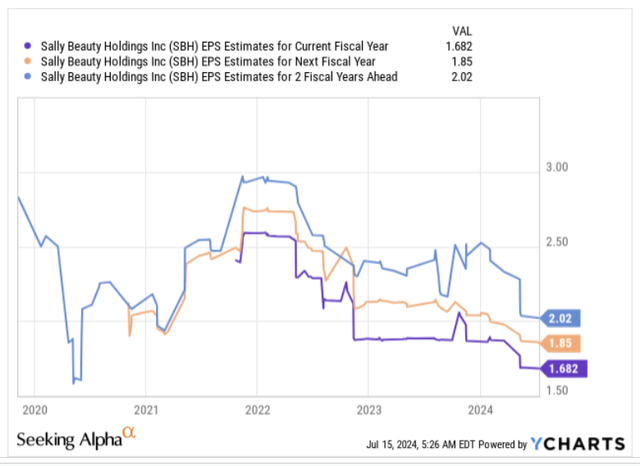

YCharts

All these factors could result in very solid bottom-line growth of double-digit CAGR for the next two years (based on consensus estimates above). Given that this is a business that could generate double-digit earnings growth, we feel the current forward P/E multiple of less than 6x looks very alluring.

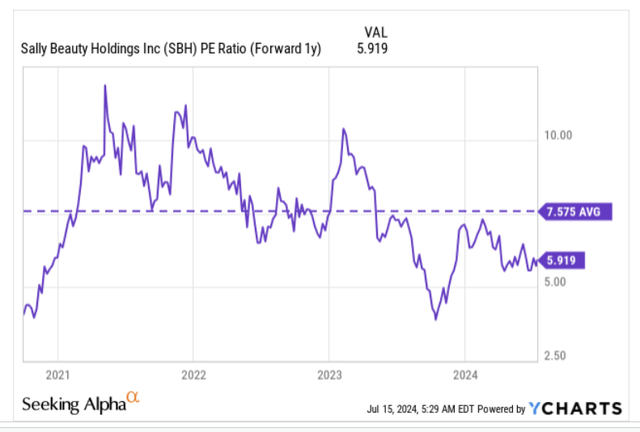

YCharts

Note also that the current P/E multiple translates to a 22% discount to its rolling 5-year average of 7.57x

Improving Cash-Generation Prospects Bode Well For Leverage Decline And A Potential Pick Up in Buybacks

One of the more commendable characteristics of the SBH operating model is that it has been able to consistently facilitate positive free cash flow every year (although the EBITDA to FCF conversion has dipped in recent years from a previous 6-year average of 48% to 23% over the last couple of years).

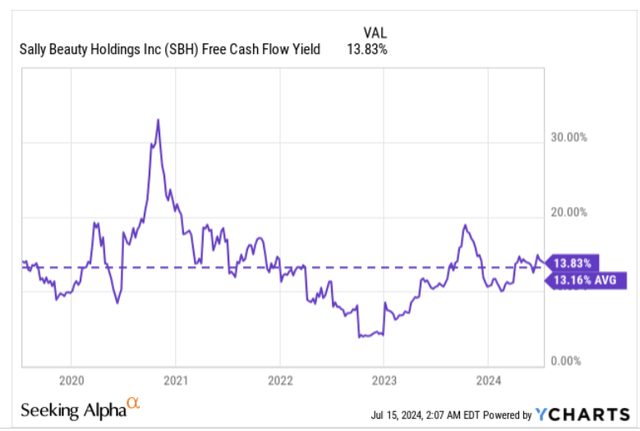

At the current market-cap, note that the SBH stock already yields quite a compelling FCF yield of nearly 14%, which is also marginally better than its 5-year average multiple. With two more quarters of results to go before SBH wraps up its fiscal, we believe upside risks to the FCF are looking even more probable.

YCharts

As inflationary conditions dip and purchasing momentum pick up, this is expected to leave a favorable impact on the inventory buildup in the retail channels, which could prompt SBH’s own inventory position to start making southbound moves.

Note that SBH’s inventory takes up a huge chunk of its assets at 36%, and some of this is driven by the high inventory it needs to consistently maintain, to cater to the BSG segment. Clients here mainly consist of salon professionals across North America who have to deal with capital constraints and limited warehouse and shelf space, thus prompting them to follow a JIT (Just-In-Time) inventory policy.

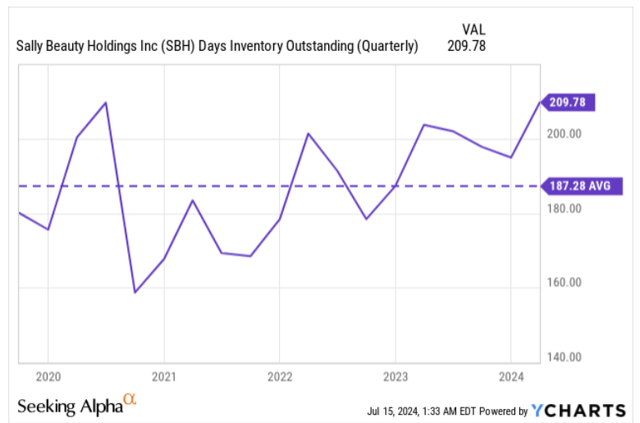

Yet still, we feel there’s plenty of scope for SBH to rightsize its inventory position, particularly with the SBS side of the business, as the overall current days in inventory outstanding is at 5-year highs and around 12% more than its 5-year average.

YCharts

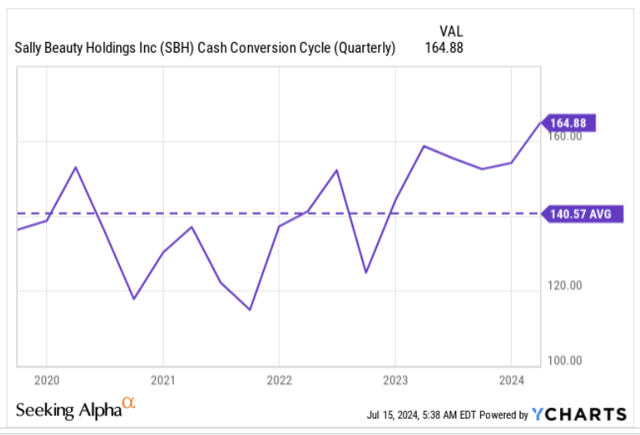

It isn’t just the inventory side of things that offers the potential for improvement; SBH’s overall cash conversion cycle, which measures the number of days that cash is tied up with working capital, currently stands at almost 165 days, and at 5-year highs. Even this could mean revert as it is currently 17% more than its long-term average.

YCharts

All in all, note that despite only averaging less than $45 of operating cash flow (OCF) per quarter in H1-24, SBH management believes they can still deliver $240m of OCF for the whole year; this would imply a sizeable uplift in the OCF run rate per quarter to well over $75m, giving a useful fillip to free cash flow prospects.

With $100m of CAPEX budgeted for the year, SBH could be on course to generate $140m of positive FCF for this year, implying a massive step up in FCF generation for H2 to the tune of $97m (which is more than double the run rate seen in H1 of $43.2m). What this means is that SBH’s current FCF yield which is already above average could see a meaningful uplift.

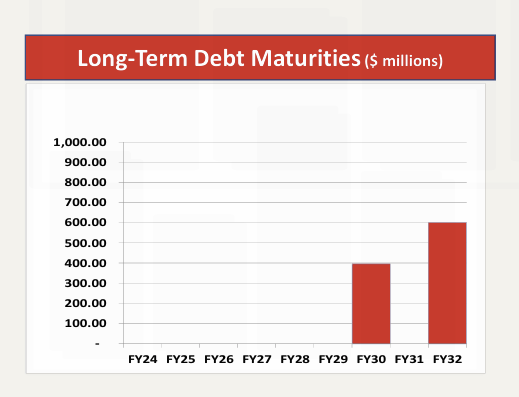

With healthy FCF generation on the cards, SBH is well-positioned to bring down its leverage levels to its target range of 1.5x-2x. At the end of H1 it stood at 2.2x; even, otherwise, SBH is not under any pressing need to do so as it recently re-financed it debt and stretched the overall maturity profile of its debt ($680m of senior unsecured notes with a coupon of 5.58%, which were due in 2025, were replaced by 6.75% senior notes due only in 2032). As a result, SBH does not have any major debt maturities for the next 6 years.

March 24 Presentation

So even if FCF is not meaningfully used to reduce the level of gearing, SBH can also step up the pace of its share repurchases, as it still has around $540m of share repurchase authorization remaining, which essentially represents around 5% of the current market-cap.

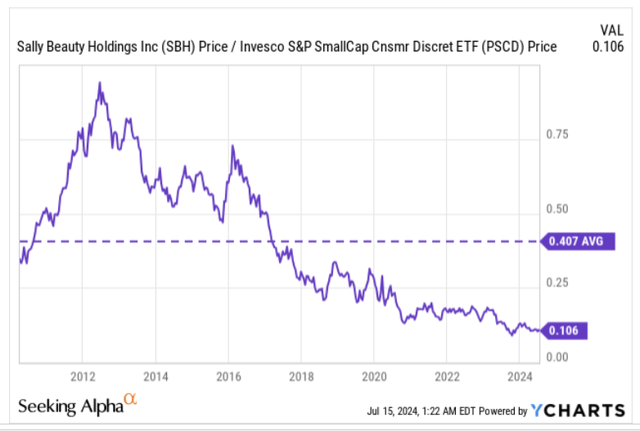

Closing Thoughts- Good Risk-Reward On The Charts

We’ve mentioned earlier, how SBH’s valuations look dirt cheap, and this should pique the interest of bargain-hunters, particularly those who believe in the concept of mean-reversion in the markets. The image below measures SBH’s relative strength (RS) versus its peers from the small-cap discretionary space, and right now, the RS ratio is at inordinately low levels, or only about one-fifth its long-term average. Given SBH’s favorable valuation quotient, we would expect funds from some over overbought counters of small-cap discretionary to flow into SBH going forward.

YCharts

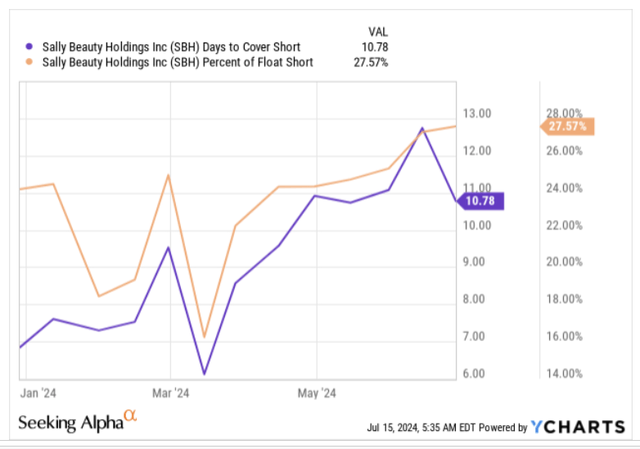

SBH is also one of those names that could benefit from a strong short squeeze, as not only is the percentage of float quite heightened at 27%, but you also have a very high days-to-cover ratio within the double-digit threshold, which won’t make the exit of short-sellers easy to facilitate.

YCharts Investing

Finally, if we look at SBH’s monthly movements over the last decade or so, note that it can be encapsulated within the two black lines; essentially a downward sloping resistance which is currently at around the $15.5 levels, and a flattish support at around the $8.4 levels. Given where the price is currently perched ($11 levels), the risk-reward for a long position looks rather attractive at over 1.7x.

Read the full article here