Dear subscribers,

Over the past few months and about a year, I’ve made following and updating the REIT Healthpeak (NYSE:DOC) a “thing” – this has to do with a few factors. Most importantly, I own a significant portfolio stake in Healthpeak in both my commercial and personal portfolio.

Some subscribers and followers continue to be dubious about investing in a REIT like Healthpeak, which I have been purchasing for the past 6 months, at prices below $17/share, which has led me to my current cost basis for the company of well below $17.5/share and a yield of over 7% for this BBB-rated equivalent REIT.

While I cannot say that I was able to 100% forecast the company’s move to the current share price of over $20/share, which leads me to my current very positive RoR and a superb YoC, I can say that I was able to see, and communicate, the clear undervaluation of this REIT.

My last piece was communicated in May, which is now about 2 months back, but given that the company has moved further north since then, I think that an update on this thesis is now warranted.

With its diverse portfolio of life science properties, outpatient medical care facilities, and continuing care retirement communities, it has always had a very interesting mix of assets, and was, at the time of the last published article, one of the more interesting healthcare REIT plays that we can see here. That’s why it’s around 1% of each of my portfolios at a cost basis.

In this article, I’ll update on Healthpeak and perhaps for the first time insert a note of clear caution to would-be-buyers at this price.

Let me show you what I mean.

Healthpeak – The mix of assets and the growth estimates make for a very “clear” thesis

If you’ve been following my work on Healthpeak, you probably already know both the upside and the potential risks to this investment. But the reason why I update here is, if you recall, in my last article I said (bolding is mine):

Also, why this might be the last opportunity to buy the company at a 15%+ annualized upside while the price is below $20/share.

We now have a share price for Healthpeak above $20/share. Not far above by any means – but above.

I’m trying to find the best, undervalued, high-yielding safe businesses out there in order to construct, enhance, and maintain an income and growth stream that provides me with the best sort of annualized return as well as overall dividend/interest income.

Every single investment should be made with a focus on your investment goals.

By following me or following what I say, you also have a right and a responsibility to know and understand what my goals are and what I invest in. My goal is not typically to 10-20x my investment capital in a short time – and this isn’t the goal for my investment in Healthpeak.

This has to do with the fact that I have already made the capital I need to live life the way I want to. Instead, over 75% of my portfolio is aimed at providing me with qualitative and above-average/risk-free income, while also generating a potential capital appreciation from the valuation upside. This has averaged 15-25% per year for the past few years (around 96% on a 4-5-year basis), and it’s more than enough for me (even above my expectations). Only a very small portion of my portfolio is aimed at investments where I believe in 10x developments in a short timeframe and strictly want to “grow” my principal.

Why is this?

Growing your principal above market rates is connected with risk. The higher the growth you want, the higher your risk is probably going to be. So, knowing this, I want to state with clarity that Healthpeak is a yield/income-oriented investment with capital appreciation potential.

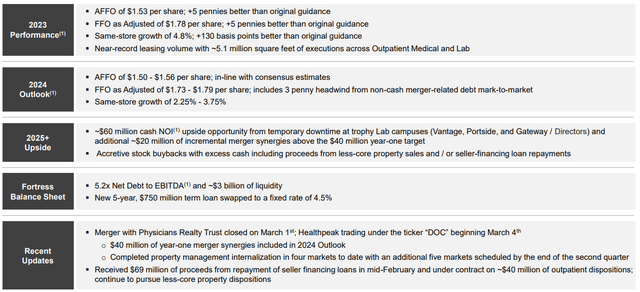

It’s not a “growth” potential – because growth in Healthpeak’s FFO/AFFO is not likely here. In fact, the company is very likely to not see growth on a forward basis, but be able to deliver “stable” results with perhaps, say 1-3% annually. This is confirmed by the latest set of outlooks for the company.

This is good enough for me – provided I get it at a good price. The variable ‘good price’ is what matters to me here.

Healthpeak IR (Healthpeak IR)

The above fundamentals and upside are still confirmed, and will act to at the very least give “some” growth to the company’s numbers, but will still be muted. Instead, the biggest advantages to the company are, as I consider them, very little floating rate debt, no 2024E maturities, and less than 5.3x net debt/EBITDA, which puts this company at an extremely conservative set of fundamentals.

It is this that I see in current investments. I tend to place a lot of value on most of the companies that I invest in having low leverage and “sorted” fundamentals. This is a different prioritization from how I had it before.

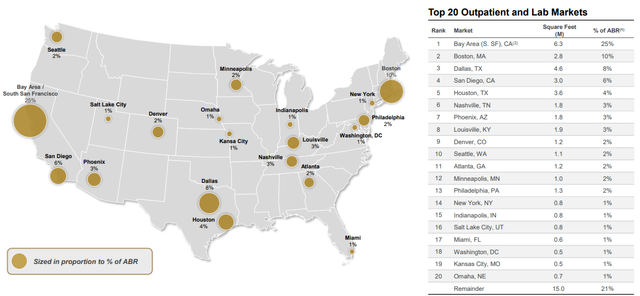

I also don’t want to give the impression that there’s no potential for outperformance here – there is. The company executed leases for 2023 above original expectations, with both Outpatient and Lab segments delivering superb results. Its scale is second really to almost none, with 13 markets containing 1 million square feet.

Healthpeak IR (Healthpeak IR)

Any risk from geographical exposure is mitigated, to my mind, by the company’s scale, expertise, and the types of properties they have. I like both the Outpatient medical and the lab space (just look at Alexandria (ARE), another company in this field I invest heavily in). When it comes to the former, we’re able to see a good concentration of high-growth markets with high local advantages that generate over 30,000,000 annual patient visits, with relationships with 10/10 of the top health systems. 60% of tenants are IG-rated, and the demand for services is growing.

The dynamics at this time is a demand outstripping supply-sort of the picture, which results in good rent growth and improvements in occupancy. For Outpatient medical, occupancy is up more than 200 bps since COVID-19, and the rent on a mark-to-market perspective is increasing, again up 200 bps in 2-3 years. The IG-rated portion of tenants has also massively changed. 20 years ago, it was at 25% – now it’s almost 3x that.

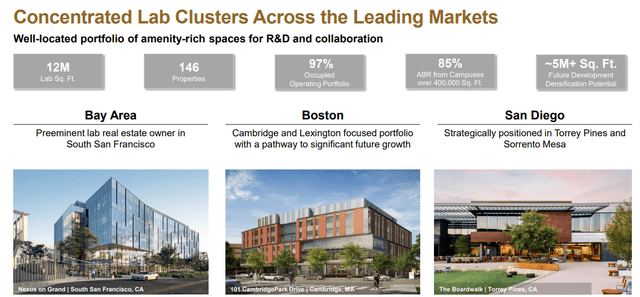

Over time, DOC has become, through both mergers and efficiencies, one of the safest players out there in this entire space. And that’s before even talking about the attractive lab segment.

Healthpeak IR (Healthpeak IR)

The lab segment continues to see positive demand drivers – an aging population, drug approvals, and growing global drug demand. I’ve personally somewhat moved out of the pharma space with certain low-valued exceptions, and would rather invest in the ancillary supply sectors, such as real estate or input, than in the company’s facing patent cliffs and other trends. While these companies remain attractive and funding seems to see no issue whatsoever, I view these investments as, Real Estate, as significantly less in terms of risk.

All of this comes together in a picture of “general appeal” for this company in these two sectors. The only real risk, except sector macro, that I can see here (because the payout is solid as well), is the valuation.

So let’s look at this.

Healthpeak Valuation – Unfortunately, now above $20/share

Don’t get me wrong. I’m thrilled that this company is above $20/share because it means that my thesis is starting to materialize. However, it also means that any of you who didn’t invest at or below $17/share, has somewhat missed the boat here – at least the “best upside” that was possible. 7.3% yield while getting 25% annualized? That’s a great RoR, and I believe I was clear from the get-go that this was my conviction.

So if you’re starting to warm up to Healthpeak now of all times, then I would sit down and consider why you didn’t invest at $17/share or below/close to this price.

Because fundamentally, nothing about Healthpeak has changed.

Value investing requires us to go against the grain and invest when most people are considering a company to be less valuable or have questions that, to our mind, are not based on reality or at least not a conservative reality. There were questioning articles at prices of less than $16.2/share, which now obviously have seen their theses blown up after more than 20% growth.

The fact that the yield is now less than 6% while I’m sitting on nearly 7.3%, that’s telling.

And I’m aware I’m “hammering” this home – but there’s a reason for this. I want to educate, and I want people to make well-informed investment choices. To me, and like-minded investors, this has always been a “no-brainer” at $16-$17 or below. And if you’re a subscriber, or you follow me, and you haven’t invested here, then I “want” an explanation of why.

Healthpeak maintains now a P/O ratio of 67.55%. It’s larger and far more stable than peers like Omega Healthcare (OHI), which I once invested in. Alexandria is larger and more qualitative with a pure lab-space focus but also yields only half that which DOC does. Ventas (VTR) is comparatively expensive here, Healthcare Realty (HR) is far less profitable, and CareTrust (CTRE) has some earnings issues as well.

DOC is still not “expensive” here. If you apply a range of premiums of positive assumptions to the stock, you’re still able to get some great rates of return at this price. It’s just that I’m fully invested at below $18/share.

By investing into the company at $19, or anything sub-$20/share, you’re actually buying this REIT on the very cheap side. I hope this clarifies beyond reason why the company is actually a very solid “BUY” here and why I was thrilled to purchase shares at sub-$17/share, back when DOC still yielded over 7%.

You can still “BUY” DOC – but if you buy it here, and your thesis hasn’t changed since $16-$17, ask yourself why you are doing it now and not then. Because you could have had this for $16-$17, and speaking for my own portfolio returns, you’ve missed out on almost 25-30% inclusive of dividends.

At least, that is my view.

I’m maintaining my thesis on Healthpeak here – I still believe it can be bought, but I wanted to highlight the importance of checking out that valuation and not “Missing out” on superb businesses such as this when they are cheap.

The thesis is as follows.

Thesis

-

Healthpeak is one of the better healthcare REITs out there. Its portfolio is sound, its fundamentals are safe, the yield is extremely well-covered, and the company has an attractive future prospect based on both stability and slight growth of its prospects. The next few years will be tough for REITs in the space, but I believe that DOC (new Symbol) will be one of the REITs that survive and thrive.

-

Based on this, I consider this company an attractive “BUY” at a good price, where we can see a conservative double-digit upside. Ever since selling off its senior portfolio, the company’s earnings capacity has been declining from 2015 levels – but it’s stabilizing, and I see a potential for growth in the next few years.

-

I give the company a conservative P/FFO of at least 15-17x, implying a long-term PT of $27/share, and an upside of at least 10-12% here. I maintain this as of this article.

Remember, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

-

This company is overall qualitative.

-

This company is fundamentally safe/conservative & well-run.

-

This company pays a well-covered dividend.

-

This company is currently cheap.

-

This company has a realistic upside based on earnings growth or multiple expansions/reversion.

This means that the company fulfills every single one of my criteria, except being cheap.

Read the full article here