As is known, change does not come easy to Japanese corporations. But Subaru (OTCPK:FUJHY) (OTCPK:FUJHF) is trying, albeit somewhat belatedly. As chance would have it, the company’s commitment to “flexibility” in pursuing electrification alongside its alternatives is now a much more popular choice in the automotive world than it was not long ago.

Financially, Subaru looks capable of delivering that change. Like the previous couple of years, fiscal 2024 looked good, with revenue and margins up. The market, though, has not been appreciative of this growth. And things are likely to go downhill from here.

The forecast for fiscal 2025 is barely positive for revenue and negative for earnings. In the current transition phase, there is some uncertainty as to the outcome of Subaru’s development initiatives. That does not bode well for the performance outlook or the share price.

Financial update

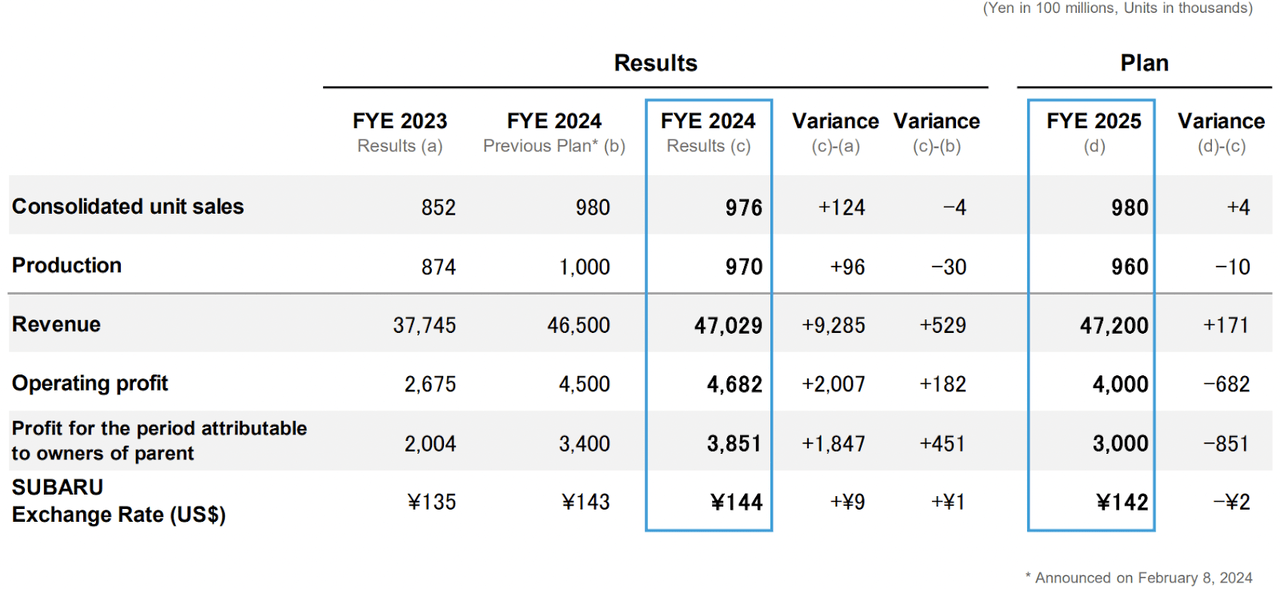

The year ending March 31 was positive for the automaker with increases in production, revenue, and profit. Global production went up by 11% to 970,000 units which boosted consolidated revenue by 25% to ¥4,703b ($31b).

Most of the sales, 78% of the total 976,000 units, were brought by the North American market, where volume increased by 20% during the year. That, and a ¥16b gain in the exchange rate, raised operating profit by 75% to ¥468b ($3b).

Subaru

However, next fiscal year is forecast to be more modest. Changes in unit sales and revenue will be barely positive, and profit may decrease for the first time in three years. One reason is the expected rise in R&D expenses — which brings us to the next point.

Electrification strategy

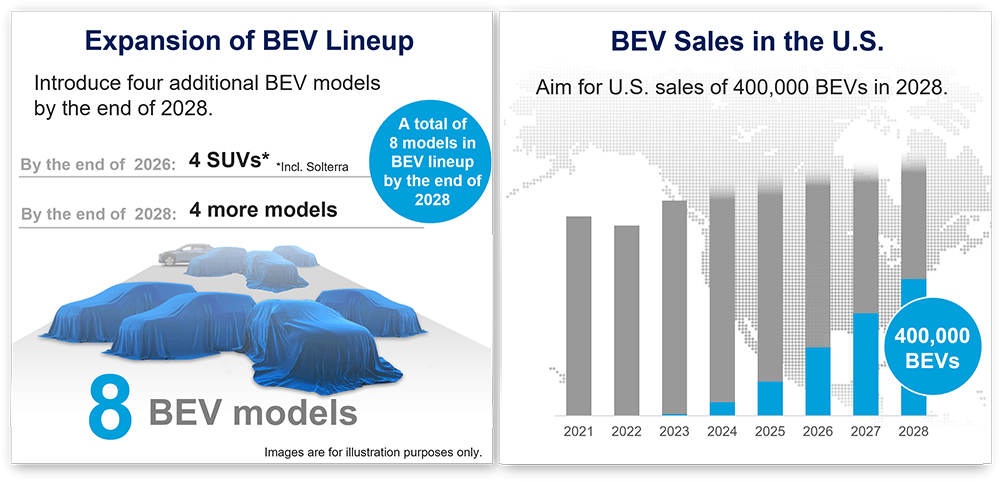

Subaru has long been seen as a laggard in electric vehicles. That is about to change, somewhat. Under pressure to adapt, the Japanese company has upgraded its earlier target to electrify 40% of sales including hybrids to 50% from battery electric vehicles alone by 2030 — which by then could equal 600,000 units of 1.2m per year. More than half is projected to be sold in the US, from a lineup of eight new BEV models to be released by 2028.

Subaru

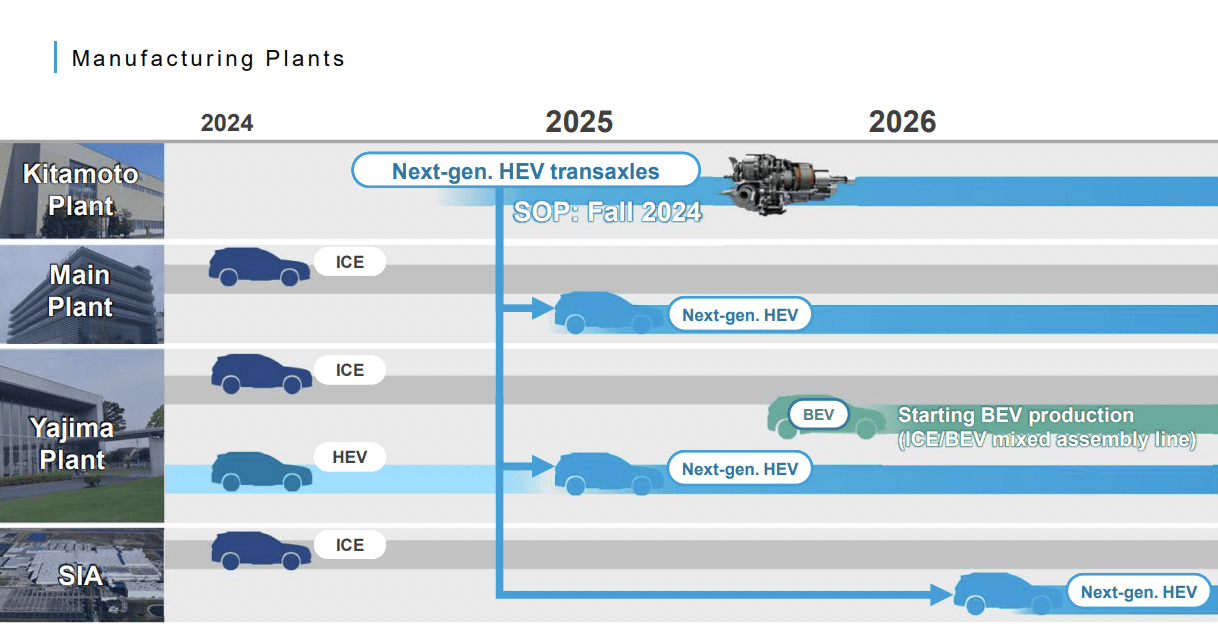

While in-house EV production in Japan is scheduled to start as soon as next year, dedicated assembly lines are expected to come online only in 2027, one of them in the US. In the meantime, the focus will be on improving ICE and hybrid technology. And on that front things look promising.

Led by Toyota (NYSE:TM) and joined by another Japanese peer Mazda (OTCPK:MZDAY), Subaru is embarking on a quest to decarbonize engines as part of a multi-pronged approach to sustainable personal transportation. That means further optimizing the carmaker’s Symmetrical All-Wheel Drive system, built upon the Boxer engine, for hybrid and other alternative fuel vehicles.

Management update

Coincidentally, falling back on hybrids seems to have become a bit of a trend among automakers outside of Japan as well. Recently, major brands have grown much quieter about electrification, with a number of them promoting hybrids in the interim — as an additional way to conform to emission standards while simultaneously meeting the demand from EV hesitant consumers.

Subaru, for its part, is firming up its lineups of BEVs and HEVs, both in joint development with Toyota. Two out of three new BEVs to be introduced in “the early phase of the transition” to end-2026 will be co-developed SUVs, one to be manufactured at Toyota’s US plant and another at Subaru’s Yajima plant. Next-gen hybrids will include a Forester receiving Toyota’s hybrid system, made first in Japan and later at Subaru of Indiana Automotive too.

Subaru

To meet the target for electrification, the company has set aside an investment sum of roughly ¥1.5t to be allocated by 2030. The caveat is their direction on batteries, which is yet to be determined. Though some preliminary steps have already been taken, like Subaru’s agreement with Panasonic on the supply of cylindrical lithium-ion batteries.

Whatever they decide, the company is in a solid financial position to execute. It has more than enough cash (¥1.9t), debt (¥400b) is used very sparingly and is covered amply by operating cash flow (192%). There is also dependable growth in the cash balance: free cash flow reached 94% of EBIT in the last three years.

Valuation

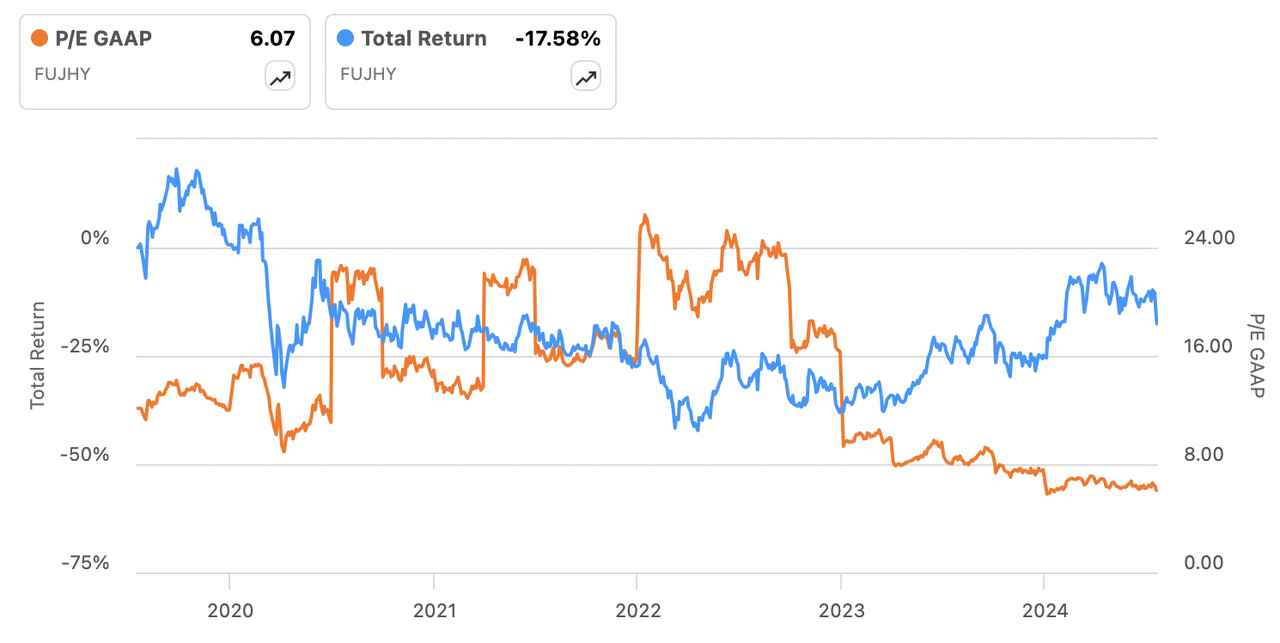

Subaru (TSE:7270) has had middling results for the past year, returning 25% in total and 32% in three years, underperforming the Japanese automotive industry. FUJHY has done even more poorly, producing just 8.8% and 7.9% in overall returns.

Valuation wise, with a P/E of 6.1x, it stands between Toyota’s (TSE:7203) 8.5x and Mazda’s (TSE:7261) 4.3x. (All three are now forecasting a negative earnings growth ahead.) Historically, the earnings multiple is the lowest it has been in five years, except for a brief episode in December 2023.

Seeking Alpha

Conclusion

Ahead of Quarter 1 results to be announced beginning of August, Subaru looks stable. Though expanding the capacity for BEVs as well as new ICE and hybrid projects will require significant investment, the company is sufficiently financially endowed to deliver. Having a development partner in Toyota is going to help.

The risk is that earnings, which are forecast to decline this year, do not recover over a longer period. That will affect shareholder returns — and for the US listing those have not been impressive to begin with. Dividend payments, currently yielding 2.3%, could also be impacted, although the payout ratio so far is a very conservative 17%.

Ultimately, it is a Hold because despite inexpensive valuation, there is uncertainty about how well future vehicles will be received by the market and hence the longer-term performance of the company. The initial foray into EV space with Solterra has not been an unqualified success, but if it manages to combine new technology with safety features that are distinctly Subaru, it is not unreasonable to assume that the models to follow will be an improvement.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here