My previous article on CONSOL Energy Inc. (NYSE:CEIX) was circulated March this year, when I outlined a very bullish thesis on this stock. The investment thesis was simple and consisted of the following building blocks:

- Extremely depressed valuation at a level that is indicative of a business closure in a near to medium-term.

- Negative financial leverage, meaning that the Company’s financial risk (stemming from the debt side) is almost non-existent.

- Positive growth in the underlying cash generation, with clear prospects of experiencing further strengthening of this component.

The only material negative that I saw was related to the fact that CEIX’s share price had gone up quite significantly since the start of 2023. As an additional headwind, I underscored the overall pessimism against the coal sector in general, which creates a consistent risk for these companies of being subject to unfavorable policymaking, increased tariffs and restricted access to financing.

However, considering the aforementioned drivers of the investment case, it was clear that the positives were strong enough to outweigh these risks.

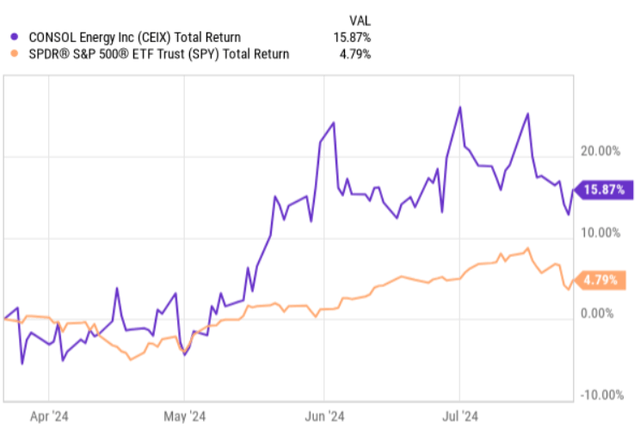

Now, in the chart below, we can nicely see how CEIX has continued to deliver strong returns, outperforming the S&P 500.

YCharts

Against this backdrop and taking into account the quarterly earnings dynamics, let’s review whether the bull investment thesis still remains intact.

Thesis review

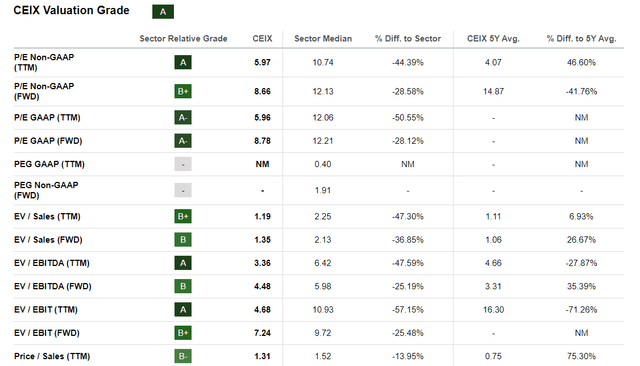

First and foremost, from the valuation perspective, CEIX continues to remain very cheap trading at depressed multiples across almost every measure we take. For example, EV/EBITDA of 4.4x or P/CF of 4.2x clearly implies that the Company currently trades in a deep-value territory, where theoretically the risks of a structural value impairment are high.

Seeking Alpha

Performance wise (based on the Q1, 2024 results) has kept registering solid results despite the numerous headwinds from the collapse of the Francis Scott Key Bridge in Baltimore in late March.

For example, CEIX generated net income of $102 million or $3.39 per dilutive share and adjusted EBITDA of $182 million, which are solid levels given the prevailing multiples. Even if we annualize, say, the recorded EPS figure, we would arrive at a FWD P/E of 7.2x, which is still very low.

However, we have to really contextualize these results against the one-offs associated with, primarily, the bridge collapse. This event significantly limited CEIX’s ability to export coal into and introduced additional costs for the business to find solutions for shipping the coal out to its customers. For instance, CEIX did a great job by working with domestic customers to enhance their volumes (in the process offering some motivating features for the domestic customers to buy more – e.g., price discounts). Furthermore, CEIX assumed higher logistic costs by redirecting the shipments from a cheaper port solution in Baltimore to a more expensive route using rail and Virginia port.

On top of this, CEIX experienced some challenges on the equipment delivery front, which caused the idling of several production shifts during the Q1, 2024 period.

Despite all of these constraints, CEIX managed to not only deliver relatively solid financial performance (that allowed the Management to repurchase 440,000 of the common shares purely from the Q1 FCF generation), but also grow its export component to 65% of the total sales – way above the 2024 target of 50%.

Now, if we turn to the future financial dynamics of CEIX, the picture looks promising – and there are multiple reasons for that. First, in May, the Company has finally resumed its coal shipments from Baltimore, which should bring back part of the margins as well as sales in absolute figures. Second, in July news came out that an explosion had occurred in at Anglo American’s Grosvenor steelmaking coal mine in Australia (the largest met coal project in Australia), which is expected to completely halt the met coal production for several months ahead. Third, and this relates more to the long-term prospects, the energy generation is indeed increasingly becoming a global issue in the context of the expected growth in the AI, batteries, EVs and other energy intensive economic activities. Here Mitesh Thakkar – President and CFO – provided a nice color in the recent earnings call, capturing the key details (or rather opportunities for CEIX) from this issue:

The Wall Street Journal reports that AI servers could consume 6% of total U.S. electricity generation by 2026, up from 4% in 2022. The Journal also points out that a recent scientific study estimates that AI servers worldwide could consume as much power as a mid-sized economy like Sweden or the Philippines as early as 2027. Domestically, it has been reported that Samsung will double its semiconductor investments in Texas to $44 billion. Furthermore, a Southeastern domestic utility has recently made the decision to build new power plants in order to serve the increased demand from new data center load. This new data center load will be serviced exclusively by natural gas, coal and a small amount of batteries. The same utility has also delayed the retirement of some of its coal-fired power plants in order to service this increased demand.

A clear testament of the durable demand for coal products is, for example, the fact that CEIX has already managed to secure a fixed-price three-year deal in the U.S. market for 950,000 tons for the 2026-2028 period. During the same conference call, the Management also indicated that it is in the negotiations with another domestic (U.S. based) utility for a long-term fixed-price deal, which would again introduce incremental predictability to CEIX’s cash generation ahead.

Having said that, we have to calibrate our expectations on the upcoming earnings report (Q2, 2024) in a bit of conservative manner. On the one hand, there should be many positives coming from the resumption of coal shipment via Baltimore port, higher coal price related to the mine shutdown in Australia, and even the fact that CEIX itself is operating under a constrained capacity. All of this should render a positive impact on the average selling price as well as the bottom line (i.e., enhancing the margins). On the other hand, reduced production volumes at CEIX end will inevitably introduce a headwind on the top-line dynamics, which considering the notable portion of fixed costs in the business could put a downward pressure on the margins. In addition, one of the main advantages in CEIX’s business is its exposure to long-term coal delivery contracts that usually come with a fixed price range. This, in turn, could limit the potential benefit of taking advantage of the elevated coal prices. Now, here is a commentary in the recent earnings call by Mitesh Thakkar – President and CFO – on the continued struggles to run Itmann Mining Complex (which is a meaningful driver of the total sales) at its full capacity:

On the cash cost front, we are suspending our average cash cost of coal sold per ton guidance at the Itmann Mining Complex due to the continued significant equipment delivery delays, reduced manpower and the evolving mix of mined, purchased and processed coal at the complex.

As a result of this, I would not necessarily enter CEIX to profit from positive share price response after the release of Q2, 2024 earnings report, but much rather count on experiencing strong returns over the medium to long horizon.

The bottom line

All in all, both the prevailing market dynamics and Q1, 2024 financial performance prove that CEIX’s business is inherently durable and able to generate notable amounts of cash even under difficult circumstances such as the collapse of Baltimore bridge and forced production shutdowns due to the constrained supply chain. If we, for example, assume that CEIX will not be able to recover from these pressures annualized the financials, we would still arrive at a very attractive P/E multiple of ~ 7.2x.

However, it is very unlikely that CEIX stagnates as the shipments from Baltimore port have already resumed and the massively strengthened demand prospects have and will do their thing by allowing the Company to secure favorable and long-term contracts.

All of this goes directly against the notion of CONSOL Energy going out of business soon (as one might imply from the deep-value multiple). Instead, I would argue that CEIX business has become stronger, where there is a sufficient base to start factoring in meaningful growth trajectory.

In my opinion, CEIX is poised to deliver strong total returns over the medium to long-run.

Read the full article here