Investment Results(%) As of 30 June 2024

|

Average Annual Total Returns |

|||||||

|

QTD |

YTD |

1YR |

3YR |

5YR |

10YR |

INCEPTION |

|

|

Investor Class: ARTGX |

1.51 |

8.83 |

18.47 |

6.18 |

9.45 |

7.32 |

8.01 |

|

Advisor Class: APDGX |

1.56 |

8.90 |

18.69 |

6.35 |

9.61 |

7.47 |

8.10 |

|

Institutional Class: APHGX |

1.56 |

8.97 |

18.78 |

6.45 |

9.71 |

7.59 |

8.19 |

|

MSCI All Country World Index |

2.87 |

11.30 |

19.38 |

5.43 |

10.76 |

8.43 |

6.14 |

|

MSCI All Country World Value Index |

-0.59 |

6.22 |

13.92 |

4.79 |

7.03 |

5.39 |

4.08 |

| Source: Artisan Partners/MSCI. Returns for periods less than one year are not annualized. Class inception: Investor (10 December 2007); Advisor (1 April 2015); Institutional (17 July 2012). For the period prior to inception, each of Advisor Class and Institutional Class’s performance is the Investor Class’s return for that period (“Linked Performance”). Linked Performance has not been restated to reflect expenses of the Advisor or Institutional Class and each share’s respective returns during that period would be different if such expenses were reflected. |

| Expense Ratios | ARTGX | APDGX | APHGX |

| Semi-Annual Report 31 Mar 20241,2,3 | 1.26 | 1.10 | 1.01 |

| Prospectus 30 Sep 20233 | 1.32 | 1.17 | 1.08 |

|

1 Unaudited, annualized for the six-month period. 2 Excludes Acquired Fund Fees and Expenses as described in the prospectus. 3 See prospectus for further details. Past performance does not guarantee and is not a reliable indicator of future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Call 800.344.1770 for current to most recent month-end performance. Performance may reflect agreements to limit a Fund’s expenses, which would reduce performance if not in effect. |

Market Overview

“Prudence is the knowledge of things to be sought, and those to be shunned.”—Cicero

During Q2 2024, the Artisan Global Value Fund (MUTF:ARTGX, Investor Class) returned 1.5%. In comparison, the MSCI ACWI Index increased by 2.9%, while the MSCI ACWI Value Index decreased by 0.6%. Year-to- date, our portfolio has risen by 8.8%, whereas the MSCI ACWI Index is up 11.3% and the MSCI ACWI Value Index has grown by 6.2%.

These are great returns for a six-month period by any measure. But the delta between our return and that of the MSCI ACWI Index compels us to retread what has become familiar ground for us and our readers: IT sector concentration.

This is not a new phenomenon. Over the past 20 years, the IT sector represented almost 20% of the MSCI ACWI Index return. While much of this is justified by the industry’s earnings growth, the concentration has recently reached unprecedented levels, particularly in the US. In the four years since the onset of the pandemic, the IT sector represented 34% of the MSCI ACWI Index return and nearly 40% of the S&P 500® Index return.

What’s more, returns are increasingly concentrated in just a few names. Four companies—Nvidia (NVDA), Apple (AAPL), Alphabet (GOOG,GOOGL) and Microsoft (MSFT) — generated essentially all of the MSCI ACWI Index’s and S&P 500® Index’s Q2 return. Nvidia represented nearly 40% of the total return for the MSCI ACWI Index and 44% of the total return for the S&P 500® Index. Said another way, excluding Nvidia from these indices would have reduced the benchmark’s return by nearly half.

Lest this increase in Nvidia appear too abstract, consider this. Nvidia’s year-to-date dollar value increase is $1.8 trillion. That’s equivalent to the 2023 increase in US GDP, which is, of course, representative of the collective economic efforts of about 330 million people. Nvidia’s market cap is now $3 trillion. So is the GDP of France.

Does this make any sense? We wish that we could definitively say that it doesn’t, given that we don’t own Nvidia. But the answer is more complicated. The growth in revenue and profits at Nvidia has been stunning. In the calendar year 2020, its revenue was about $17 billion. Estimates for 2024 are around $120 billion. Operating profit is projected to reach about $80 billion in 2024 versus $4.5 billion in 2020. Nvidia’s revenue essentially represents the capital spending of a small number of very profitable, very cash-rich technology companies buying up the processors necessary to power artificial intelligence (‘AI’) software programs. It’s an AI landgrab. In order for Nvidia to sustain these levels of revenue or grow them from here, these AI investments must start to generate an ROI for those splashing out $120 billion a year. And if not generating an ROI in the near term, those companies must at least see the prospect of an ROI, a clear sustainable competitive advantage or a moat of some kind.

We are watching this unfold in real time through our holdings in Alphabet and Meta. Both are spending very heavily on Nvidia processors. The returns from these investments are an abstraction at this point. Said another way, we don’t see and are unable to calculate a near-term return from these investments. But we do believe that AI will increase the engagement levels for both consumers of their respective platforms and advertisers on the platforms. And given that enormous levels of capital spending are required for these investments, we also believe that the barriers to entry will be further raised for both Alphabet and Meta. A couple of Stanford MBAs in their garage trying to create the next search engine or social media platform are engaged in a hopeless task, given the dollars required.

That being said, meaningful dollar returns for buyers of Nvidia chips must start to materialize in order to justify the company’s market value. At this point, it appears to us to be mostly on the come.

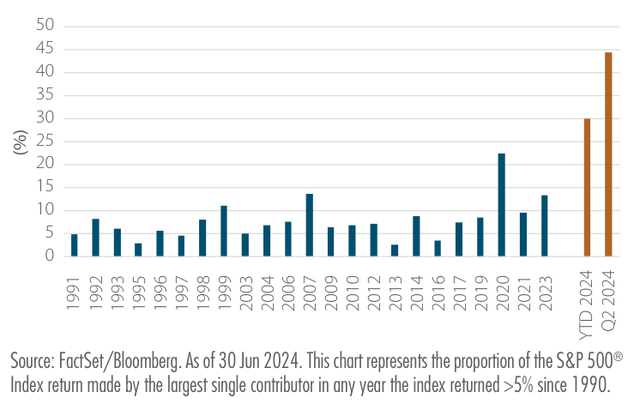

But let us zoom back out to the market at a higher level. Instances of a Nvidia concentration effect such as we have just seen are extremely rare. For instance, over the past 33 years, in periods where the market was up more than 5%, no single company represented more than 10% of the S&P 500® Index’s total return until the late 1990s. Prior to the pandemic in 2020, this threshold was breached only twice—once during the dotcom bubble in 1999 when Microsoft accounted for 11% of the index’s total return and again in 2007 by Exxon (XOM). Since 2020, overall market returns have become more concentrated, with a single company comprising over 10% of the market return in three of the past four years. The situation has become even more extreme this year, with Nvidia alone contributing ~45% of the market return in Q2 and ~30% of the market return in the first six months.

Exhibit 1: Largest Single Stock Contribution to S&P 500® Index Total Return (in up markets >5%)

Has this material crowding effect changed the nature of passive investing? As with the Nvidia issue, the answer is complicated. The attraction of index investing has always been twofold: low cost and broad diversification. The low-cost component remains unchanged, and it is meaningful. The diversification issue is where it gets messy. Broad indices now represent a level of concentration, at least in terms of sector- and stock-specific exposure, comparable to or even exceeding what we might typically find in active portfolios. The top five positions in the S&P 500® Index now represent 27% of the index— arguably all in a single industry. For context, the top five investments in Global Value—an intentionally concentrated investment strategy— represent just 23% of our portfolio and are spread across four industries. If you buy an index fund, chances are you are buying a lot of Nvidia and a lot of tech. Of course, this means index returns are now far more idiosyncratic than perhaps many investors understand. So far, it has been an excellent experience, but investing should be a forward-looking exercise.

To put an even finer point on it, the index (either the S&P 500® Index or the MSCI ACWI Index) arguably no longer provides broad exposure to the economy or the broader market. It’s a lot of tech. A lot of quite expensive tech. Is this the bogey that the industry should be aspiring to match every quarter and every year? What is the greater risk— underperforming a benchmark or taking excess risk to keep up with a benchmark concentrated in a group of investments that you don’t necessarily find attractive?

We will leave others to provide the answers. Our investment approach is (and has always been) benchmark agnostic. We have never paid any attention to the index, and clients shouldn’t expect our portfolio to look anything like it. We do not seek to participate in every exciting investment theme but rather emphasize building a portfolio of sensible investments and avoiding losses. This involves investing in a diversified group of companies that grow their business value per share over time, have quality characteristics that allow them to perform in a variety of economic environments, have reasonable leverage and are available for purchase at reasonable prices.

This is easy to write and hard to implement. Investing is often about controlling your emotions and making sensible decisions. There is a clear distinction between prudent investing and the fear of missing out (‘FOMO’). There are many agency risks and other biases that cause people to make suboptimal decisions. But while the current market concentration presents some unique challenges, we would argue that maintaining prudent investing principles and focusing on reasonable diversification, business quality, financial strength and valuation remain the best strategies for building resilient portfolios. As Cicero said, prudence is knowing what to seek and knowing what to shun. In our view, at some point holding an overly concentrated index where gains are driven by a few dominant stocks might become—dare we say—imprudent.

In our view, our portfolio is more attractive on all these metrics than what is currently represented by the benchmark, and we are very content with our large personal investments in the strategy that sit alongside our clients. But we encourage clients to scrutinize our top holdings and compare them to any of the broader indices and come to their own conclusions.

Portfolio Discussion

The top contributors to performance for the quarter were Alphabet, Philips (PHG) and Novartis (NVS).

Alphabet shares rose by 21% during the quarter, making it the largest contributor to our performance. The company reported excellent Q1 earnings, highlighting accelerating revenue growth, strong profitability and effective capital allocation. Alphabet’s core search business is growing at a mid-teens rate—the fastest growth rate in nearly two years. Importantly, its non-search businesses have reached significant scale, with its cloud and YouTube businesses expected to reach a combined run-rate of $100 billion by the end of 2024.

During the quarter, Alphabet also displayed meaningful progress in its AI initiatives, and we believe it is well positioned to be a leader in this field. The capital allocation is solid. It is returning all the free cash flow to shareholders and announced that it will start paying a dividend.

Alphabet’s shares are trading at just over 20X next year’s earnings, which is a very reasonable valuation for a business with such high- quality characteristics and growth potential.

Philips was the second-largest contributor to performance this quarter. The shares rose 30% after the company announced a favorable resolution to the litigation involving its sleep apnea business. In April, the company announced a $1 billion master settlement agreement for the personal injury mass tort litigation without having to admit any wrongdoing. The settlement’s structure creates a strong protection against future personal injury claims, which effectively puts this entire issue behind it. This litigation has been a major overhang on Philips shares since it announced a voluntary recall in June 2021. We estimate the total cost, which includes the settlement, recall costs, economic loss payments to customers, compliance with the FDA consent decree and other costs, are in the €3 billion–€4 billion range.

Following the settlement announcement, we believe the shares are actually more attractive, and we have added to our position. Philips’ market cap has declined €25 billion–€30 billion since the recall was announced—far greater than our estimated total costs. Part of this disconnect is that many investors simply avoid companies with litigation overhangs, and we anticipate a renewed interest in Philips now that the litigation issue is resolved. What they will find is a leading health care equipment business with solid market shares in several attractive and growing end markets. The new CEO is already in the middle of restructuring and portfolio optimization efforts that should result in better growth and profitability levels. The recent settlement removes a major distraction for management and allows it to focus on executing this improvement plan. Shares of Philips are trading at around 12X normalized earnings, which makes it attractive both on an absolute basis and compared to peers, which trade in the high teens to low 20s.

Novartis was also a meaningful contributor during the quarter. Its shares rose 11% after reporting solid Q1 earnings and increasing its full-year outlook. The business is performing well, with double-digit revenue growth and improving margins during the quarter. The company now expects revenues to grow 9%–10% for the full year and underlying operating profits to grow 11%–15%. Novartis shares trade at 13X–14X earnings, and the business is expected to continue growing at a healthy rate for the foreseeable future.

The biggest detractors from performance during the quarter were Expedia (EXPE), Compass and Henry Schein (HSIC).

Expedia shares declined 18% during the quarter after reducing its full- year outlook. It lowered its revenue growth forecast to mid- to high- single digits for 2024 and said margins will stay flat. On the surface, a business growing in the high-single digits while maintaining profitability isn’t bad. The issue is the company just completed a major restructuring that was supposed to result in accelerated revenue growth and significant margin expansion. Neither is happening. The company continues to underperform the industry and its peers. Importantly, management will not share with us the important metrics and disclosures that might give us the ability to understand why. It continues to just tell us that improvement is coming. That is not enough for us, and we have lost confidence that the changes will have the intended impact on the company’s financial performance. As a result, we made the decision to exit the investment at a modest profit.

Compass Group was the second-largest detractor from performance this quarter. There was no fundamental reason for the 6% decline in the shares. Compass ended the prior quarter at an all-time high and simply faded a bit from that high watermark. The business reported good first-half results and increased its full-year outlook. It expects ~10% organic growth and ~15% growth in operating profits. Longer term, there is still a significant penetration opportunity for outsourced catering, which creates a favorable market backdrop and should drive solid organic growth and margin improvement. Compass shares have performed well, but they remain reasonably valued at 20X earnings.

Henry Schein declined 15% during the quarter due primarily to weak traffic trends in the overall dental market. In our view, the concerns around near-term traffic trends are misplaced. The long-term trends in the dental industry are favorable. Around 90% of US dentists are currently operating at full capacity, and 50% of the US population still isn’t regularly seeing a dentist. We see penetration opportunities and demographic tailwinds in the US and internationally. And while there will be puts and takes, the dental market should grow nicely over time.

Schein’s business is performing well. It seems to have recovered from the cyberattack in late 2023. Most importantly, it is making good progress on its strategy to shift its business mix toward its own branded products, which have higher growth and margins. This shift benefits Schein by improving its margins, increasing its value to customers, and giving it more leverage with suppliers. This year it expects to grow earnings 10%–15%. As it transforms from a pure distributor of third-party products into a hybrid distributor/manufacturer, we believe it will have more control over its financial model and ability to drive attractive profit growth in a variety of market environments. We find this combination very attractive for a company trading at 11X–12X earnings.

During the quarter, we added a small investment in Aon Plc (AON) to the portfolio.

Aon is a global leader in the insurance broking and consulting industry. It’s the world’s second-largest insurance brokerage, which is an attractive industry that we know well. The industry is relatively consolidated and characterized by recurring revenue streams and steady growth. Over the years, we have owned all three of the major companies in this industry—Marsh & McLennan (MMC), Aon and Willis Towers Watson (WTW).

In the course of our careers, we have developed a deep appreciation for the insurance broking business. These businesses have a resilient business model with many underlying growth drivers. Commercial clients face many risks that they would prefer to mitigate with insurance and risk management strategies. Property and casualty risks, the cost of reinsurance, director and officer risks, and workers’ compensation are likely to keep growing as asset values and social inflation (i.e., litigation and lawsuit costs) are likely to keep rising.

Climate and cyber risks must also be managed. Insurance brokers benefit from these trends as they are paid fees and commissions to help clients craft the appropriate blend of insurance coverage. The beauty of this business is that insurance carriers bear the risk of loss, not brokers like Aon.

Aon’s stock has declined 13% over the past year for two related reasons. First, Aon’s business has been growing more slowly than its primary competitor, Marsh & McLennan. Second, it announced a relatively large and expensive acquisition of middle market insurance broker NFP. Based on our analysis, we believe the recent growth slowdown is mostly due to a business mix that will likely normalize over time. Specifically, Aon has less exposure to the middle-market (which has been growing faster) and more exposure to financial service lines (which have been weak due to the lack of capital markets activity). Aon’s growth rate should normalize as IPO and M&A activity normalizes and as it integrates the acquisition of NFP to give it more exposure to the growing middle market. The price it paid for NFP was high, but we have reason to believe the synergies are understated, so the post-synergy valuation will look more reasonable.

Aon is trading at 17X forward earnings, which is a significant discount to peers and a reasonable price for a high-quality business in a fantastic industry that should deliver high single-digit profit and free cash flow growth for a very long time.

During the quarter, we exited our investments in Expedia and Nintendo (OTCPK:NTDOY). Expedia is discussed in detail earlier in this section. Nintendo shares hit our estimate of intrinsic value.

Read the full article here