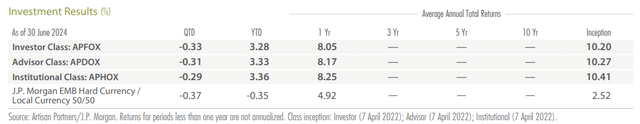

Investment Results (%)

Past performance does not guarantee and is not a reliable indicator of future results. Investment returns and principal values will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than that shown. Call 800.344.1770 for current to most recent month-end performance. The performance information shown does not reflect the deduction of a 2% redemption fee on shares held by an investor for 90 days or less and, if reflected, the fee would reduce the performance quoted.

Performance Discussion

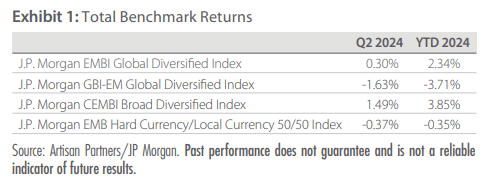

The portfolio outperformed the J.P. Morgan EMB Hard Currency/Local Currency 50/50 Index in Q2 and remains ahead of the index year to date. The portfolio outperformed the J.P. Morgan GBI-EM Global Diversified Index for Q2 but trailed the J.P. Morgan EMBI Global Diversified Index and J.P. Morgan CEMBI Broad Diversified Index for the period. The portfolio outperformed all indices year to date except for the J.P. Morgan CEMBI Broad Diversified Index.

Investing Environment

As emerging and developed countries continue to grapple with ongoing inflation and challenges to growth, differentiation in the market and variations in performance are becoming more pronounced. Corporates outperformed all other emerging markets debt (EMD) sectors in Q2 as corporate credit spreads tightened on the back of stable fundamentals and supportive technicals. Local currency bonds were the worst performing EMD sector for the period, as emerging markets currencies continued to weaken against a stronger US dollar. Hard currency sovereigns were flat for the quarter as spreads widened moderately.

Lingering inflationary pressures across the globe have led to stalls in the disinflation process in some countries and regions. As policymakers continue to evaluate financial conditions, central banks are finding themselves at varying stages of the monetary policy cycle. Countries such as Hungary, Mexico and Brazil have seen the disinflation process slow and inflation reaccelerate. Many of these countries were early movers in 2021 to raise rates, but now their central banks are being forced to pause or slow the pace of rate cuts. Meanwhile, countries that have remained prudent and held rates steady for longer continue to see robust disinflation, such as Serbia, which just began cutting rates in June.

Developed markets have remained in sync through this cycle, but they are now beginning to diverge from one another. The Fed and BOE kept rates unchanged during Q2, while the ECB cut rates by 25bps in June, its first interest rate cut in almost five years and a notable divergence from peers. The ECB stopped short of indicating future rate cuts are expected, and it even raised its inflation forecasts for 2024 and 2025. The Fed continues to assess fluctuating signals from both inflation and the labor market, and revised its rate cut forecast down to only one cut for this year. US inflation topped forecasts at the beginning of Q2 but has since slowed to its lowest pace in three years. Conversely, the labor market showed signs of cooling at the beginning of the quarter but demonstrated resilience toward the end of the period. After the BOJ ended its era of negative interest rates in Q1, the interest rate differential between Japan and its developed market peers continued to widen as the BOJ left rates unchanged throughout the quarter.

Emerging markets issuance slowed in Q2 relative to Q1 but has remained robust, reaching 85% of the 2023 total by the end of the first half. Corporate issuance ticked up slightly in Q2, while sovereign issuance declined but remains well above its average quarterly issuance seen in the past five years. Several countries took advantage of the healthy new issue market to issue for the first time in a long time, such as El Salvador. El Salvador’s unique issuance included a conventional amortizing bond as well as a warrant that will pay an adjusted payout to investors if the country agrees to a deal with the International Monetary Fund, or it receives a credit rating upgrade.

Sovereign spreads widened during Q2 due to a combination of increased issuance in the first half of the year and a more challenged global growth outlook. Despite the widening, spreads remain below their 15-year average levels. The re-inclusion of defaulted Venezuela and PDVSA bonds in sovereign indices contributed to an outsized one-day adjustment in spreads, resulting in the index widening by ~50bps in Q2. Yet, sovereign indices that exclude defaulted bonds widened by only ~5bps in Q2.

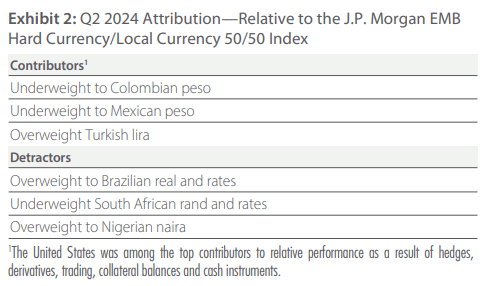

Emerging markets currencies were broadly weaker as the US dollar appreciated, driven by market expectations of prolonged higher interest rates in the US. Political events spurred fluctuations in local currency markets.

For example, after the presidential elections in Mexico, where Claudia Sheinbaum and the ruling Morena party secured a congressional majority, the Mexican peso plummeted by more than 7%, local interest rates surged, and credit spreads widened. The South African rand and bonds rallied following the nation’s elections in May where the ruling Africa National Congress (ANC) party lost its majority for the first time since independence and was forced to form a “Government of National Unity” with other parties, including the Democratic Alliance (DA).

While emerging markets debt remains at the mercy of an increasingly uncertain global macroeconomic backdrop, local events across the globe continue to shape idiosyncratic returns. In Bolivia, the top military commander led military units that stormed the government palace in a failed coup attempt, sending sovereign bonds weaker. Argentina bonds rallied after Congress approved President Milei’s omnibus bill that includes proposals to slash state spending and reforms expected to attract foreign investments, ease labor laws, and facilitate privatization. Zambia’s multiyear default concluded after the government successfully secured a deal with bondholders, boosting dollar bond returns. Georgian sovereign bonds declined after the government reintroduced and passed a Russian-style Transparency Law, resulting in large protests.

Portfolio Positioning

In our view, the portfolio remains conservatively positioned as geopolitical uncertainty persists and valuations have become less attractive. The team took advantage of certain sovereign credit opportunities in Africa and Latin America that remain attractive despite tight spread levels. These countries continue to demonstrate robust fundamentals, healthy growth outlooks and attractive valuations. The portfolio remains overweight duration in emerging markets and underweight duration in developed markets relative to the J.P. Morgan EMB Hard Currency/Local Currency 50/50 Index, translating to an overall underweight duration positioning relative to the index. The team reduced its local rates exposure in Asia as the disinflation process has stalled in many countries. Elsewhere, the portfolio remains overweight local rates in Latin America, where fiscal and political reforms continue to enhance fundamentals in certain countries. The team reduced the portfolio’s currency exposure during Q2 as inflationary and geopolitical uncertainties grew, especially in Eastern Europe and Latin America, but remains overweight relative to the index.

The EMsights Capital Group continues to search for countries with improving storylines where market prices are not fully reflecting fundamentals. Overall, valuations in EMD are fuller, warranting a more conservative approach for now. We continue to seek out idiosyncratic events in the corporate and sovereign space that shape the market landscape and drive divergence between the regions and countries. The global economy continues to face challenges, many of which are serving as tailwinds that keep the emerging markets debt outlook strong. With one of the busiest election cycles on record, growing geopolitical tensions and fiscal consolidation continue to present exploitable volatility events.

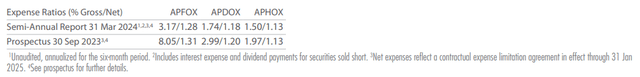

Carefully consider the Fund’s investment objective, risks and charges and expenses. This and other important information are contained in the Fund’s prospectus and summary prospectus, which can be obtained by calling 800.344.1770. Read carefully before investing.

Current and future portfolio holdings are subject to risk. The value of portfolio securities selected by the investment team may rise or fall in response to company, market, economic, political, regulatory, or other news, at times greater than the market or benchmark index. A portfolio’s environmental, social and governance (“ESG”) considerations may limit the investment opportunities available and, as a result, the portfolio may forgo certain investment opportunities and underperform portfolios that do not consider ESG factors. Non-diversified portfolios may invest larger portions of assets in securities of a smaller number of issuers and performance of a single issuer may have a greater impact on the portfolio’s returns. International investments involve special risks, including currency fluctuation, lower liquidity, different accounting methods and economic and political systems, and higher transaction costs. These risks typically are greater in emerging and less developed markets, including frontier markets, and include new and rapidly changing political and economic structures, which may cause instability; underdeveloped securities markets; and higher likelihood of high levels of inflation, deflation or currency devaluations. Fixed income securities carry interest rate risk and credit risk for both the issuer and counterparty, and investors may lose principal value. In general, when interest rates rise, fixed income values fall. High-yield securities (junk bonds) are speculative, experience greater price volatility, and have a higher degree of credit and liquidity risk than bonds with a higher credit rating. Use of derivatives may create investment leverage and increase the likelihood of volatility and risk of loss in excess of the amount invested.

The J.P. Morgan (JPM) EMB Hard Currency/Local currency 50-50 is an unmanaged, blended index consisting of 50% JPM Government Bond Index-Emerging Market Global Diversified (GBIEMGD), an index of local-currency bonds with maturities of more than one year issued by EM governments; 25% JPM Emerging Markets Bond Index-Global Diversified (EMBIGD), an index of USD-denominated bonds with maturities of more than one year issued by EM governments; and 25% JPM Corporate Emerging Market Bond Index-Broad Diversified (CEMBIBD), an index of USD-denominated EM corporate bonds. The index(es) are unmanaged; include net reinvested dividends; do not reflect fees or expenses; and are not available for direct investment.

Information has been obtained from sources believed to be reliable, but J.P. Morgan does not warrant its completeness or accuracy. The Index is used with permission. The Index may not be copied, used, or distributed without J.P. Morgan’s prior written approval. Copyright 2024, J.P. Morgan Chase & Co. All rights reserved.

This summary represents the views of the portfolio managers as of 30 Jun 2024. Those views may change, and the Fund disclaims any obligation to advise investors of such changes. Securities named in the Commentary, but not listed here, are not held in the Fund as of the date of this report. Portfolio holdings are subject to change without notice and are not intended as recommendations of individual securities. All information in this report, unless otherwise indicated, includes all classes of shares (except performance and expense ratio information) and is as of the date shown in the upper right-hand corner. This material does not constitute investment advice.

Attribution is used to evaluate the investment management decisions which affected the portfolio’s performance when compared to a benchmark index. Attribution is not exact, but should be considered an approximation of the relative contribution of each of the factors considered.

This material is provided for informational purposes without regard to your particular investment needs, and shall not be construed as investment or tax advice on which you may rely for your investment decisions. Investors should consult their financial and tax adviser before making investments in order to determine the appropriateness of any investment product discussed herein.

Notional value adjusts for derivatives’ exposures to the market value of a contract’s underlying security, rather than the market value of the contract itself, and represents an approximation of the portfolio’s economic and risk exposures at a point in time. Delta measures the sensitivity of a derivative contract to changes in price of its underlying security; the derivatives contract’s value may be overstated or understated without delta-adjustment.

Artisan Partners Funds offered through Artisan Partners Distributors LLC (APDLLC), member FINRA. APDLLC is a wholly owned broker/dealer subsidiary of Artisan Partners Holdings LP. Artisan Partners Limited Partnership, an investment advisory firm and adviser to Artisan Partners Funds, is wholly owned by Artisan Partners Holdings LP.

© 2024 Artisan Partners. All rights reserved.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here