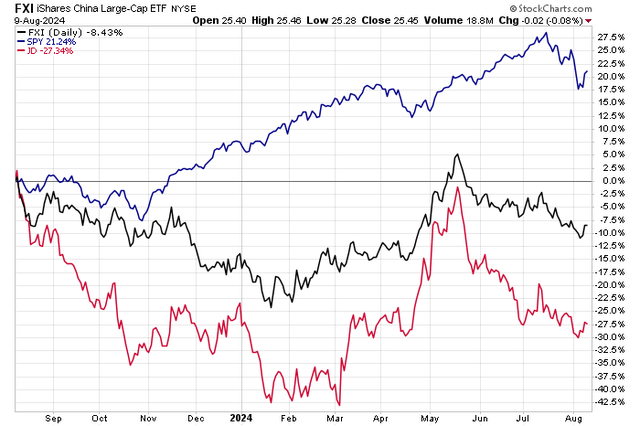

JD.com (NASDAQ:JD) (OTCPK:JDCMF) is among so many Chinese stocks that have struggled for much of the past three and a half years, despite a sizable rally that occurred from this past January through mid-May. The rise stalled, however, and investors quickly sold tech and consumer-related China stocks right toward the tail-end of the Q1 reporting season.

Today, we are in the later innings of Q2’s earnings period. I see the potential for a rebound in shares of JD, while it remains an unknown as to whether the iShares China Large-Cap ETF (FXI) can re-find its footing.

I have a buy rating on JD. I see positive earnings trends, a low valuation, and a mixed technical chart ahead of its second-quarter profit report.

China Stocks Sag YoY

StockCharts.com

According to Bank of America Global Research, JD is a leading eCommerce platform with both a direct sales model and a marketplace that supports third-party merchants. The company has been investing in logistics infrastructure and its logistics arm can serve both JD and third-party clients. It consolidated marketplaces formerly owned by Tencent (OTCPK:TCEHY) and launched a mobile store in Weixin and Mobile QQ in 2014. It retains stakes in the listed local O2O delivery service co. Dada, JD Logistics, and JD Health.

Back in May, JD reported a solid set of quarterly results. Q1 non-GAAP EPADS of $0.78 topped the Wall Street consensus estimate of $0.62 while revenue of $36 billion, up 7% from year-ago levels, was a material $320 million beat. The Beijing-based $39.5 billion market cap Consumer Discretionary company posted a non-GAAP EBITDA increase of 13.6% with a sequential margin jump of 0.2 percentage points from 3.9% to 4.1%.

JD is also in a solid liquidity position with close to $25 billion in cash and cash equivalents, though that was a 9.8% drop from the previous quarter. What I like, though, was that the firm’s debt level was consistent, and its gross leverage ratio was steady at 1.4x. For another gauge of JD’s health, its corporate bonds featured lower yields as the period progressed.

Digging further into the quarter, the management team’s investment into services appears to be reaping benefits – that segment contributed to a 7% year-on-year top-line rise as its retail segment expanded by 7%. JD could enjoy 7% overall revenue growth this year and next. Also encouraging was that the company bought $1.3 billion of stock during Q1, with $2.3 billion of potential repurchases through March of 2027.

Looking ahead to this week’s report, analysts expect $0.87 of operating EPS, which would be an impressive 18% rise from $0.74 reported in the same quarter last year. Sales are forecast to clock in at $40.8 billion. As for the expected stock move, data from Option Research & Technology Services (ORATS) show a 6.5% straddle, in line with pricing from previous quarters. Notably, JD has not missed on earnings going back to at least 2019 and shares have rallied post reporting in each of the past three instances.

Key risks include ongoing weakness in the Chinese economy, the threat of deflation in the world’s second-largest economy, a global growth slowdown, adverse currency moves, and unknowns regarding how the Chinese government maintains its grip on key industries. Growing competition in retail is another concern.

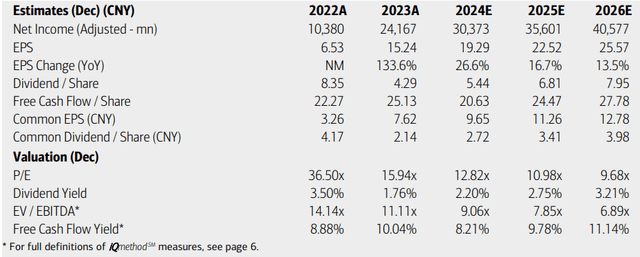

On the earnings outlook, analysts at BofA see operating EPS summing to $2.70 (currency-adjusted) this year, with decent growth looking ahead to 2025. By FY 2026, per-share profits could approach $4. The current Seeking Alpha consensus numbers are more sanguine, however, with current-year EPS of $3.45 and a solid 10% growth rate through 2026.

JD’s top line is forecast to increase at a steady mid-single-digit pace, too. Dividends, meanwhile, may grow over the quarters to come, but JD has already paid its annual dividend for 2024, which was $0.76.

JD: Earnings, Valuation, Dividend Yield, Free Cash Flow Yield Forecasts

BofA Global Research

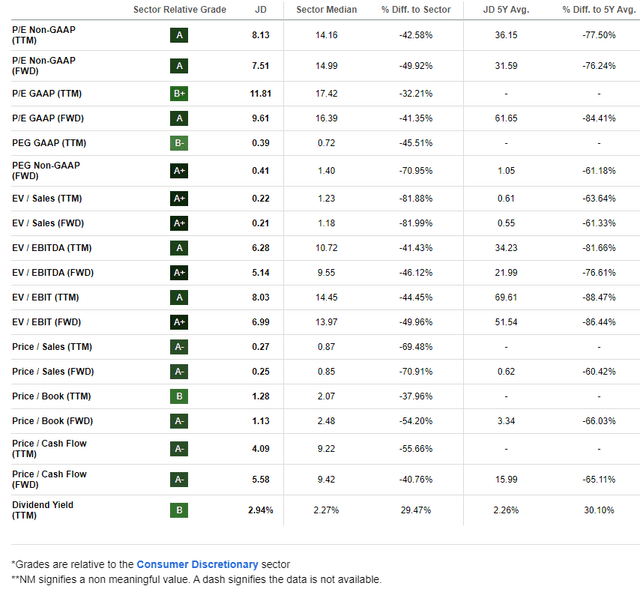

On valuation, JD sports a very low price-to-earnings multiple and high free cash flow. Currently trading just 7.5 times earnings, well below the stock’s 5-year average P/E, I see significant upside if there is a positive sentiment turn regarding the Chinese market.

Consider that EPS growth is forecast to average about 10% over the next few years. If that materializes, then a PEG ratio of just 1, a significant discount to the S&P 500 PEG and below the Consumer Discretionary sector’s rating, should warrant a 10x multiple. Assuming $3.70 of NTM EPS, then shares should trade in the mid to high $30s.

JD: Compelling Valuation Metrics, High Yield Versus History

Seeking Alpha

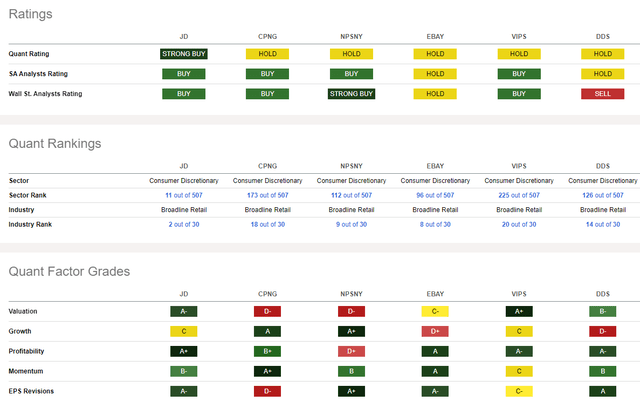

Compared to its peers, JD sports a top-notch valuation rating while its growth trajectory has been lukewarm (but is also expected to improve with consistency). Profitability trends are very robust, evidenced by $4.10 of trailing 12-month free cash flow per share, while its technical momentum grade is decent.

All the while, the sellside has turned more bullish on JD’s earnings prospects, highlighted by a whopping 28 EPS upgrades in the past 90 days compared to just a lone downgrade.

Competitor Analysis

Seeking Alpha

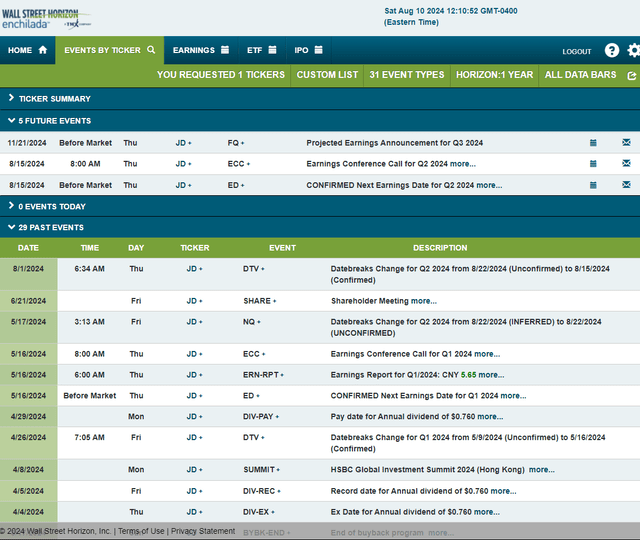

Looking ahead, corporate event data provided by Wall Street Horizon show a confirmed Q2 2024 earnings date of Thursday, August 15 BMO with a conference call immediately after the numbers cross the wires. You can listen live here. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

Wall Street Horizon

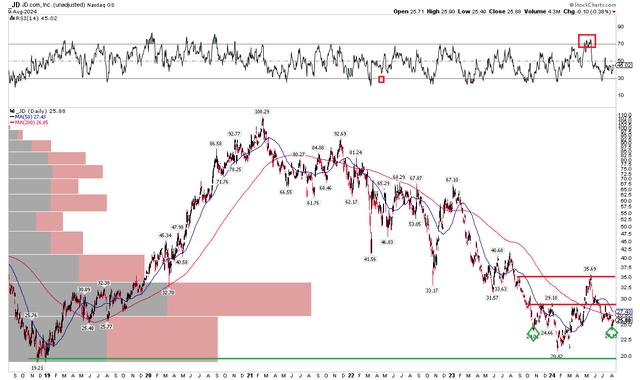

The Technical Take

With a low valuation, improving earnings trends, and a history of topping EPS estimates, JD’s chart has some work for the bulls to take care of. Notice in the graph below that shares attempted to bottom earlier this year at key long-term support in the $19 to $20 range. That’s obviously an important level to hold, but I’m also concerned with upside resistance. $29 is the first point, while the 2024 high just shy of $36 is another likely area of future selling if we see a prolonged rally.

Also, take a look at the RSI momentum oscillator at the top of the chart – it hit overbought conditions, and then failed to hold a high momentum situation. The bear went on to shave more than one-third off the stock price, with $24 emerging as near-term support. I’d like to see the long-term 200-day moving average turn positive in its slope, with price trading above that, to lend credence to the narrative that the bulls have grabbed control from the bears.

Overall, JD’s chart is not all that encouraging after failing to continue the January through May rally. Expectations are likely low heading into Thursday’s report.

JD: Shares Hold Long-Term Support, Eyeing Upside Resistance Levels

StockCharts.com

The Bottom Line

I have a buy rating on JD.com. I see this China Broadline Retail industry company as undervalued with healthy profit trends. While it may take some time for sentiment to inflect positive, I see strong returns for shareholders who can stomach near-term volatility.

Read the full article here