Investor sentiment with respect to Palantir Technologies Inc. (NYSE:PLTR) has substantially improved after the company reported better-than-expected second quarter results and raised its guidance for 2024 full-year sales.

Palantir Technologies’ sales skyrocketed 55% YoY in US commercial in 2Q24, leading the software/AI company to report its seventh consecutive GAAP profit.

Though Palantir Technologies is seeing robust interest in Palantir AIP and in 2Q24 secured a big contract win with the Department of Defense, I think that enthusiasm about the company’s growth prospects is not particularly justified and I see the stock as a value trap for investors.

Consequently, I need to reaffirm my previous Sell rating.

My Rating History

I voiced my concerns about Palantir Technologies’ valuation a few times in the past, but after a 48% increase in stock price since August 5, 2024, I think that the market’s present bullish sentiment is not sustainable.

The software/AI company had a robust second quarter and Palantir Technologies raised its sales forecast, but the stock has an unfavorable risk/reward relationship selling at 21x leading sales.

Robust Sales Growth, All The Momentum Is In US Commercial

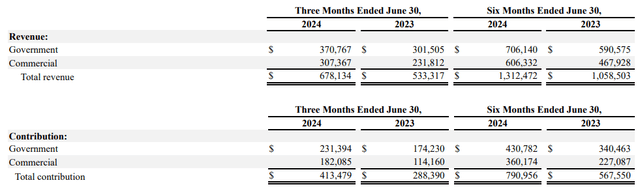

Palantir Technologies produced $678.1 million in sales in the second quarter with 55% of sales coming from government contracts. The remaining 45% came from private contracts, totaling $307.4 million.

Government-related sales rose 23% YoY whereas commercial-related sales were up 33% YoY. Palantir Technologies’ commercial sales volume was dominated by US companies paying for commercial services which accounted for 52% of all sales in 2Q24.

Revenue (Palantir Technologies)

US Commercial is doing really well for Palantir Technologies right now and Palantir AIP is the company’s secret sauce. With more companies investing in AI to leverage its strength, Palantir Technologies is seeing robust growth in both its governmental and commercial businesses. Though Commercial has the momentum, and particularly US Commercial, Palantir Technologies is still profiting from its deep ties to the national security community.

For instance, Palantir Technologies secured a $480 million contract with the Chief Digital and Artificial Intelligence Office of the Department of Defense to scale AI capabilities in the second quarter. This contract has a length of 5 years and was kicked off with a $153 million initial order.

Palantir Technologies and Microsoft are also expanding their collaboration in terms of bringing secure cloud, analytics and artificial intelligence capabilities to the Pentagon and other national security institutions. The leverage point for Palantir Technologies here is Palantir AIP which is, effectively, an analytics platform for companies and government institutions alike that support strategic, data-driven decision-making.

Though I acknowledge the importance of Palantir AIP for the company’s sales growth, I think that Palantir Technologies has reached an unsustainable valuation level and the stock has reached a very vulnerable point technically as well.

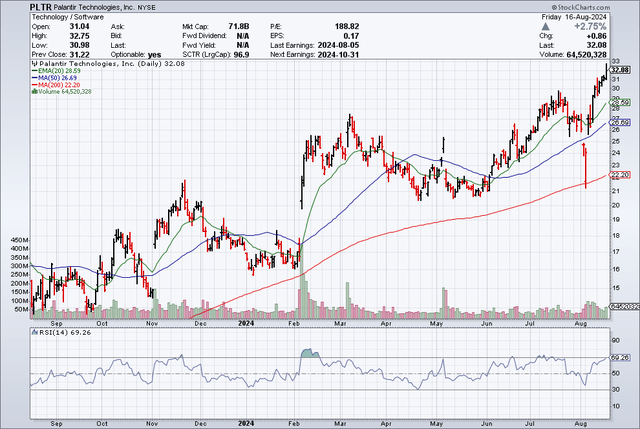

Technical Analysis Section

The stock price of Palantir Technologies reached a new 52-week high after the company’s earnings and is presently selling at $32.08. Since August 5, 2024 Palantir Technologies’ stock price increased roughly 48%.

According to the Relative Strength Index, the stock of Palantir Technologies is now just about to be overbought technically which creates a red flag from a sentiment perspective. After 2Q24 earnings, Palantir Technologies soared through both the 20-day and 50-day moving average lines, sending a short-term bullish signal for investors.

With that said, though, since the stock is overbought and has risen substantially in a very short period of time, I think that the sudden change in investor sentiment is a red flag, mainly because PLTR is so highly valued already.

Relative Strength Index (Stockcharts.com)

Palantir Technologies Is Probably Widely Overpriced

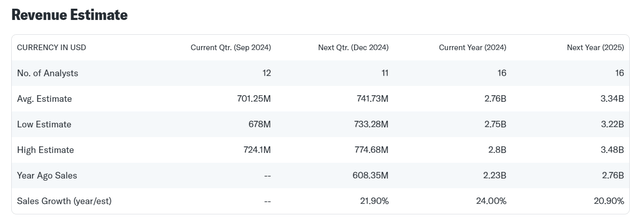

The forecast for the next quarter, 3Q24, calls for $697 – $701 million in sales which reflects a QoQ sales rise of 3%. For the full year, Palantir Technologies sees $2.742 – $2.750 billion in sales, up from a prior guidance of $2.677 – $2.689 billion. The new forecast implies 23% YoY sales growth.

The market currently models $3.34 billion in sales on average for next year which reflects 21% sales growth YoY. This year, sales are anticipated to go up 24% which is slightly better than Palantir Technologies’ guidance for 2024.

Based on a market valuation for the company’s equity, which stands at $72 billion, the stock of Palantir Technologies is selling at a 21.4x leading sales multiple.

This is an expensive price sticker, particularly when considering that one of biggest and most lucrative software companies in the world, Microsoft Corp. (MSFT), is selling for only about half this leading sales multiple, 10.8x.

Revenue Estimate (Yahoo Finance)

Palantir Technologies also anticipates to earn between $800 million and $1.0 billion in adjusted free cash flow in 2024 which reflects a free cash flow multiple of 80x. Previously, I arrived at an intrinsic value of $9 for Palantir Technologies’ stock, based on a more sensible 20x free cash flow multiple (which reflects a market valuation of $20 billion max).

I don’t see, specifically, what is so special about Palantir Technologies’ business proposition that would require investors to pay 80x free cash flow, particularly because the company’s growth is not that stunning.

Palantir Technologies is growing robustly, but not at the kinds of rates we have seen from Nvidia Corp. (NVDA), for example. Thus, I continue to see Palantir Technologies’ valuation as unjustifiably inflated and I reiterate my ‘Sell’ stock classification.

My expectation moving forward is for Palantir Technologies to try to scale AIP, particularly in US Commercial which is where the software/AI company sees its biggest customer demand.

From this angle, Palantir Technologies does have an opportunity to grow its sales and free cash flow and, therefore, its intrinsic value (which I presently peg at $9).

I think that Palantir Technologies market valuation is presently significantly inflated at $71 billion and the stock, as I indicated, is vulnerable to a correction, particularly if the AI spending boom came to an end.

Why The Investment Thesis Could Be More Bullish

Companies clearly are spending more money on AI/software solutions in order to leverage advances in artificial intelligence which promise productivity growth. Palantir Technologies is sitting at the heart of software/AI developments which could set up a compelling picture for long-term profit and sales growth.

With that being said, though, Palantir Technologies does not have a unique value proposition, in my view, as other companies like Splunk, Microsoft Corporation (MSFT) or C3.ai Inc. (AI) also offer analytics products.

Should this change moving forward, and Palantir Technologies’ growth sustainably accelerates beyond 25% per annum, then I would be willing to revisit my investment thesis with regard to PLTR.

Palantir Technologies not long ago guided for long-term growth of 25% per annum, but fell below this threshold in recent years as its government business slowed. A recapture of this sales growth level might create new excitement for the stock, as well as lead to higher operating margins/free cash flows for Palantir Technologies.

Upside risks include a substantial spending boom in the AI market that could benefit both hardware and software vendors. An acceleration of sales growth obviously is a risk, as investors might miss out on any AIP-driven gains in Palantir Technologies’ business.

My Conclusion

Palantir Technologies raised its forecast for full-year sales and produced a respectable amount of growth in the second quarter. New contracts with the Department of Defense in terms of scaling AI capabilities and a more extensive collaboration with Microsoft to leverage AI capabilities for national security agencies were two big wins for Palantir Technologies as of late.

With that said, though, I think the valuation remains a thorny issue as I don’t see upside left on the table at such big sales and free cash flow multiples (and a boatload of correction potential).

Though I appreciate the progress that Palantir Technologies has made in recent quarters, the valuation, in my view, is not defensible nor sustainable. Investors that pay 80x free cash flow and 21x leading sales are probably buying into a value trap here. Sell.

Read the full article here