A close-up of the world-famous Wall Street charging bull in New York City’s financial district.

Like most things in life, there is no one-size-fits-all approach to investing. Some people have the temperament to buy and hold wonderful growth stocks and become rich. Others could never stomach such an idea. These people may be interested more in income investing.

Because income stocks generally don’t carry the same level of growth potential as growth stocks, there is only one way that investors can turbocharge their returns with this perspective: That is by adding a deep value slant to their investing technique.

One stock that I believe combines outsized income with meaningful value is the big pharma titan, Pfizer (NYSE:PFE). The need to adapt to steep declines in its COVID-19 products revenue and surging interest rates has made the market sour on the stock in 2023: Shares have shed 37% of their value so far this year. In my opinion, these low expectations for Pfizer going forward set it up with a very low bar to clear. Let’s elaborate further on why I believe the stock is a solid buy for investors seeking a blend of viable dividends and undeniable value.

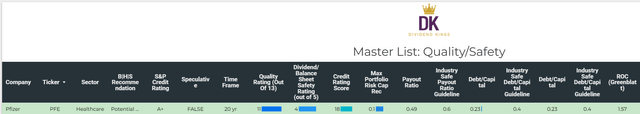

DK Research Terminal

For the last 12 years, Pfizer has raised its dividend each year. Even in this environment with elevated interest rates, the stock’s 5% dividend yield catches your attention. Better yet, Pfizer’s EPS payout ratio comes in at just 49%. This is below the pharmaceutical industry guideline of 60% which is considered to be safe by rating agencies.

The company’s balance sheet also makes it a smart pick for capital preservation. This is because Pfizer possesses an A+ credit rating from S&P, which means the 30-year risk of going under is just 0.6%. Put another way, there’s just a 1 in 167 chance of the company going out of business by 2053.

Pfizer also appears to be a superb business trading at a cheap valuation. As of October 13, 2023, the stock is priced at an approximate 27% discount to fair value and has a 36% upside from the current $32 share price. All told, Pfizer looks like it could at worst match the S&P 500 in the next 10 years. In a best-case scenario, the stock could beat the index by 2% annually.

- 5% yield + 2% to 4% annual earnings growth + 3.1% annual valuation multiple upside = 10.1% to 12.1% annual total return potential versus 10.1% annual total return from the S&P 500

Pfizer Can And Likely Will Return To Growth

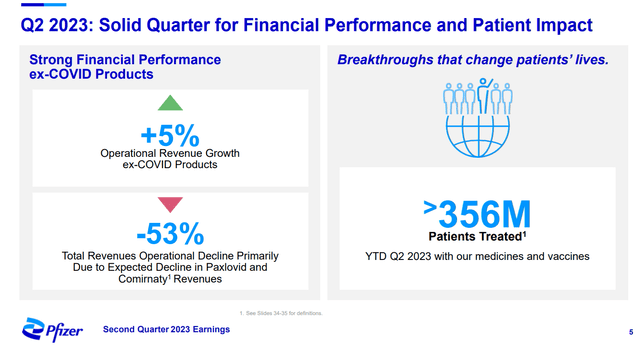

Pfizer Q2 2023 Earnings Presentation

Treating more than 356 million patients in the first half of 2023, Pfizer is a force to be reckoned with in its industry. Mostly thanks to its Comirnaty COVID-19 vaccine and Paxlovid anti-viral COVID treatment, it became the first pharmaceutical company in history to top $100 billion in revenue in 2022 (details sourced from Pfizer Q2 2023 Earnings Presentation and Pfizer Q4 2022 earnings press release).

The company’s revenue in the first half of 2023 plunged 41.9% year over year to $31 billion. This is very discouraging at first glance. But with demand for COVID-19 products nosediving, the revenue decline can be entirely attributed to these factors. Taking these two products out of the mix, Pfizer’s non-COVID revenue edged 2.3% higher over the year-ago period to $22.3 billion during the first half.

The focus on the company’s COVID-19 products has been intense over the last couple of years. So, it’s easy to lose sight of the fact that Pfizer is much more than just these products. The company has eight other medicines/vaccines on pace to surpass $1 billion in revenue in 2023, such as the blood thinner Eliquis, the Prevnar vaccine franchise, and the rare heart disease franchise Vyndaqel/Vyndamax. This explains how Pfizer’s non-COVID revenue continues to consistently grow.

The company’s adjusted diluted EPS dropped by 48.1% year-over-year to $1.90 in the first half of 2023. A diminished revenue base and drop in its profit margin accounted for decreased adjusted diluted EPS (info according to Pfizer Q2 2023 earnings press release).

Alongside a solid existing product lineup, Pfizer has been busy launching numerous new products or indications. This includes its RSV vaccine Abrysvo, Zavzpret nasal spray for acute migraine, and Elrexfio for relapsed or refractory multiple myeloma. Pfizer’s Velsipity also received approval from the U.S. Food and Drug Administration to treat patients with moderate-to-severe ulcerative colitis, which could be a multi-billion-dollar indication. With dozens of additional indications at various stages of clinical development within its pipeline, the company should launch plenty of new products in the months and years ahead to drive growth. That is why analysts expect Pfizer’s annual adjusted diluted EPS growth to come in at between 2% and 4% annually moving forward.

The company also has a tremendous balance sheet. Pfizer’s debt-to-capital ratio is 0.23, which is significantly less than the debt/capital guideline of 0.4. That is probably why bond investors had no problem lending the company $31 billion to finance its acquisition of oncology company Seagen (SGEN), with maturities ranging from 2025 to 2063.

Slow And Steady Dividend Growth Should Persist

Pfizer has averaged 6% annual dividend growth in the last five years, though I believe this won’t continue as the company revamps its business. Fortunately, the 5% dividend yield still makes it a reasonably enticing pick for income investors.

Pfizer will pay $1.64 in dividends per share in 2023. Even with the temporary drop in adjusted diluted EPS to $3.30 in 2023, this is a payout ratio of just 49.7%. That is why I would expect modest dividend growth to continue as Pfizer rebuilds itself.

Risks To Consider

Pfizer is a great business that is trying to recapture the success that it once had with the initial release of its COVID-19 products. However, the company isn’t a risk-free investment.

Pfizer’s top-10 products made up 82% of its total revenue in 2022. Because most products eventually face competition from biosimilars/generics or new products, this concentration risk poses a threat to the business. If the company’s new product launches don’t pan out as expected or its pipeline is weaker than anticipated, it could be difficult to generate growth moving forward.

Entities around the world like health plans and governments are taking measures to manage drug costs. This could also weigh on Pfizer’s financial results (additional risks can be found on pages 21-30 of 159 of Pfizer’s 10-K filing).

Summary: A Compelling Risk/Reward Dynamic

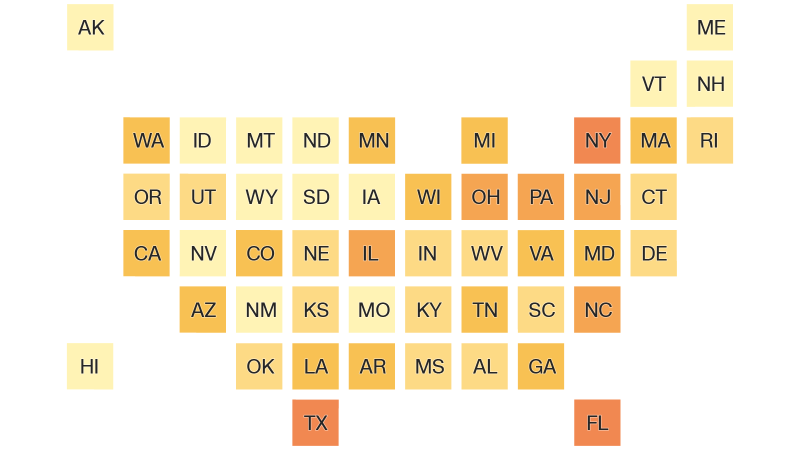

Zen Research Terminal

Pfizer is a reliable stock for income investors. Thanks to its low payout ratio and healthy balance sheet, the risk of a dividend cut in a severe recession stands at just 2.3%. In an average recession, it’s even less, at just 1%.

The stock is priced about 27% below its fair value. That also makes it an exceptional value pick with 36% total returns over the next 12 months justified by fundamentals.

Looking out over the long term, Pfizer should also do well. The stock’s 5% yield, 2% to 4% annual earnings growth, and 3.1% annual valuation multiple expansion could generate 10.1% to 12.1% annual total returns for the next decade. Pfizer’s market-matching to market-exceeding return potential is also coupled with lower volatility, which makes it a buy in my opinion.

Read the full article here