With hopes of a rate cut around the corner, stock markets have recovered to near all-time highs, and many tech stocks are up sharply for the year: reflecting tremendous risk should sentiment turn south. Amid the possibility that optimism may break in the last quarter of the year driven by election uncertainty and macroeconomic malaise, investors should be prudent to trim big winners out of our portfolios and reinvest into more value-oriented names.

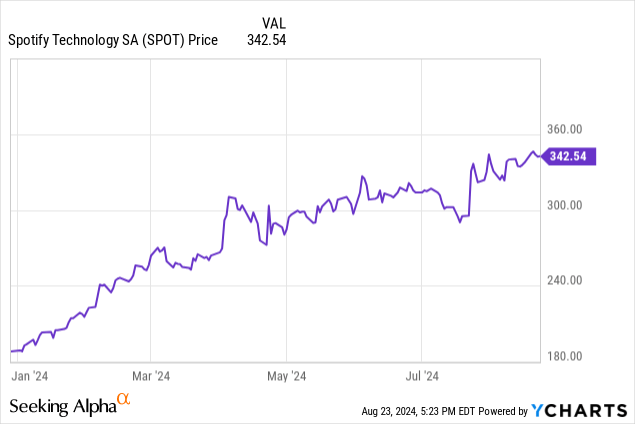

Spotify (NYSE:SPOT), in particular, is a stock worth trimming. Year to date, the music streamer has gained more than 80%, with investors cheering the success of the company’s price increases (a U.S. monthly plan for a single subscriber now costs $11.99, $1 more than previously since the start of June).

I last wrote a neutral opinion on Spotify in June, when the stock was trading in the low $300s. Now, as the stock has skyrocketed further following its Q2 earnings print, I’ve turned much more cautious on this name and am downgrading Spotify to a sell rating.

To me, the following risks are core red flags for Spotify:

- Slowing user growth. Despite strong increases in Premium subscribers, Spotify has been missing on overall MAU (monthly active user) counts. The company has relied more and more on promotional windows (like Q4’s “Wrapped” campaign to bring in the bulk of its new subscribers, whereas non-promotional periods have seen quieter trends. Will these types of subscribers stay on when promotional rates and discounts expire?

- Lumpy user trends. Spotify investors fixate tremendously on the company’s subscriber counts, subjecting it to the same quarterly volatility as Netflix (NFLX). Adds have been very volatile over the past several quarters, with some quarters (like Q1 of 2024) adding very few users at all.

- We can’t yet predict churn impacts. Spotify’s latest round of price increases to $11.99/month for the base single-subscriber plan now puts the company $1 ahead of competitor Apple Music at $10.99/month. Amid a potential U.S. recession where consumers are increasingly pinching their budgets, the churn fallout from these price increases may still emerge.

- Huge content costs. Spotify pays a tremendous amount of content licensing across its music and audiobook offerings, and to date it has been able to push its adjusted EBITDA meaningfully beyond a measly ~30% margin.

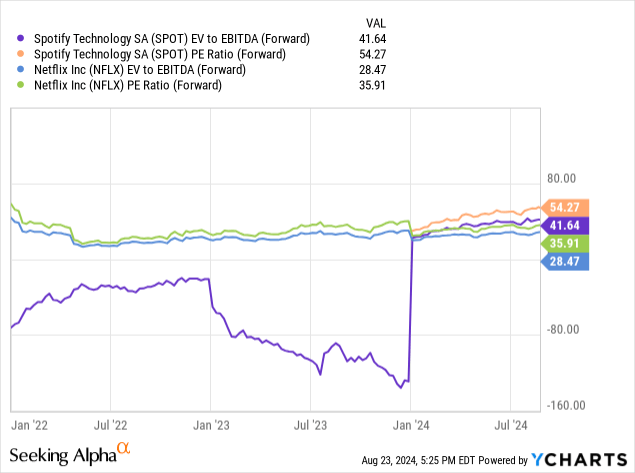

We should also consider the fact that with Spotify’s sharp YTD surge, the company now sits at inflated valuation multiples. Though there are few perfect peers for Spotify, its closest comp is Netflix, which operates a very similar subscription-oriented business model with high content costs, a similar gross margin profile and a mid-teens/~20% revenue growth trajectory.

Both stocks have rallied this year, but Spotify’s performance has nearly doubled Netflix’s ~40% gains, and its P/E and EV/EBITDA ratios now sit considerably above Netflix (not to mention the broader S&P 500):

In my view, it’s a great time to lock in gains on Spotify and invest elsewhere.

Q2 download: despite good subscriber results, the MAU pipeline is slowing down

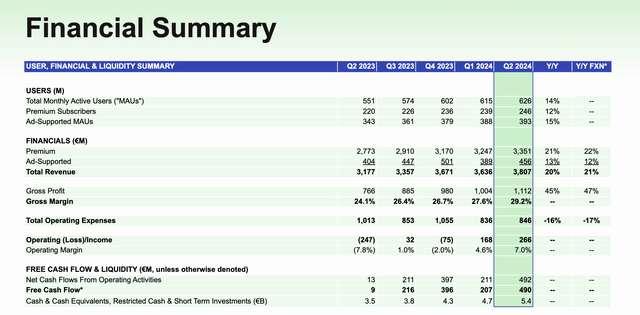

Admittedly, Spotify’s latest Q2 results show tremendous revenue growth, boosted by the June price increases (which will see a full quarter of impact in Q3). Take a look at the core results in the snapshot below:

Spotify Q2 results (Spotify Q2 earnings deck)

Revenue grew 20% y/y to €3.81 billion, which was just under Wall Street’s expectations for €3.83 billion (+21% y/y) – one of the first red flags. Premium revenue grew 21% y/y driven by price increases, while ad revenue growth of 13% y/y was much slower, and decelerated versus 18% y/y growth in Q1.

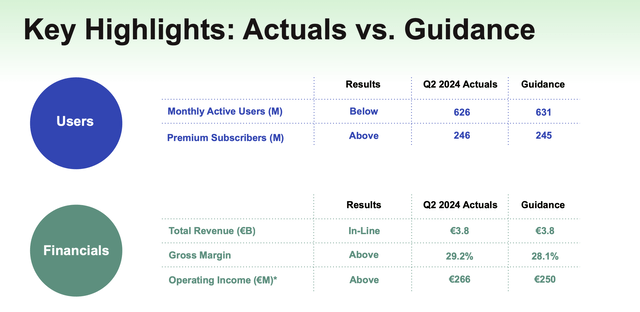

Highly correlated with the company’s slowing ad revenue growth was a miss in expectations for MAUs. As shown below, the company had expected to end Q2 with 631 million MAUs, but came in 5 million light at 626 million, adding only 11 million net-new MAUs in the quarter (versus 13 million in Q1, which typically sees a seasonal slowdown). The company made up for this miss with slightly better-than-expected Premium subscription adds (7 million net new subscribers in the quarter) than the company had guided to.

Spotify user trends (Spotify Q2 earnings deck)

The slowdown in MAUs isn’t concerning only for the immediate impact to advertising revenue, but also because free user additions typically form the biggest pipeline for future Premium subscribers. Speaking to the MAU miss in the Q2 earnings call, CEO Daniel Ek noted that marketing efforts have been less efficient at attracting new users in developed markets:

On the flipside, we have significant potential to attract a large number of new users in developing markets; however, these users can be a little bit more inconsistent. Engagement looks different in these markets, as do the channels to acquire them and conversion to paid can be a bit slower. This makes it difficult to get the same level of ROI effectiveness from our marketing spend.

To tackle our MAU challenge, we’re doing two things. First, we’re intensifying our efforts to improve the impact of our marketing, and we believe there are a number of levers to pull over the upcoming quarters. Second, we are prioritizing enhancements in our free product pipeline that, based on existing performance in certain markets, should boost engagement and retention, especially in our developing markets. Further additional improvements will be integrated into our free experience in the coming months.

While I am disappointed with our MAU miss, I see the reversal as more of a when rather than an if. The reason I feel so confident is that overall, we’re seeing healthy MAU engagement trends year-over-year, so the users we are now acquiring we’re also retaining, which is a great leading indicator for value and future monetizations.”

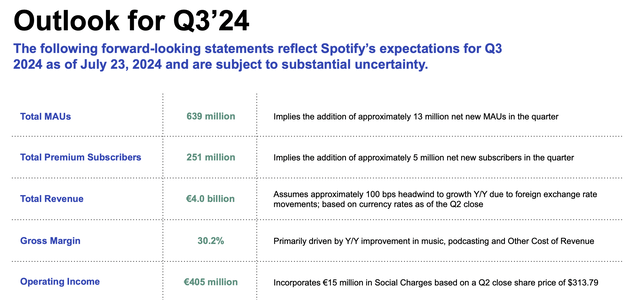

Looking ahead to Q3, the company is expecting to add 13 million net-new MAUs, which is much slower than the 23 million net-new MAUs that the company added in the prior-year Q3:

Spotify Q3 outlook (Spotify Q2 earnings deck)

Note as well that this guidance already reflects the “number of levers” that the company expects to execute on the marketing front, after learning from this quarter’s misses.

Key takeaways

On the fundamental front, investors have two major worries: the possibility of heightened Premium subscriber churn after recent June price increases (now pushing Spotify prices above its competition), and a slowdown in MAU additions that are significantly below the prior year. On top of that, we should also consider Spotify’s valuation premium above the S&P 500 and peers like Netflix. All in all, I see more downside risk here than opportunity: lock in gains and sell.

Read the full article here