I initiated a ‘Buy’ rating for Marvell Technology (NASDAQ:MRVL) in June 2024, based on the thesis of fast growth in AI revenues from optics and custom ASIC. Marvell announced their Q2 result on August 29th after the bell, with an upbeat outlook for Q3. Notably, their data center business grew by 92% year-over-year. I reiterate a ‘Buy’ rating with a one-year price target of $90 per share.

Ramping Up Electro-Optics & Custom Silicon

My biggest takeaway from the quarter is Marvell’s strong growth in electro-optic and custom silicon businesses. As analyzed in my previous article, electro-optic and custom silicon are poised to become major growth drivers for Marvell’s data center business in the future.

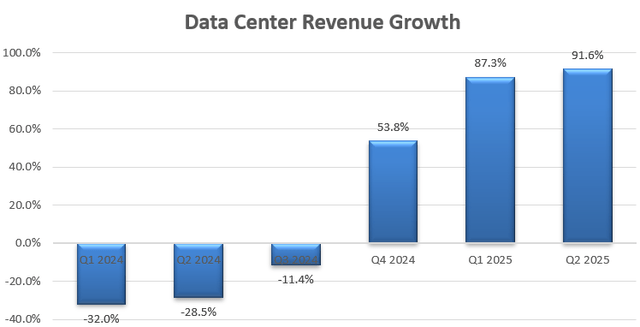

As depicted in the chart below, Marvell’s data center business grew by 91.6% year-over-year in Q2 FY25.

Marvell Technology Quarterly Earnings

The strong growth in data center is likely to sustain in the near future for the following reasons:

- As communicated over the earnings call, Marvell has been ramping up their electro-optics products and custom silicon. The management anticipates an acceleration in productions during the second half of this year. Marvell has experienced strong demand for their PAM4 DSPs for high-bandwidth AI applications, as well as COLORZ II 400ZR Modules for Data Center Interconnects, primarily driven by increasing AI workloads.

- Marvell unveiled their 1.6T Nova optical DSPs with 100 Gbps electrical and 200 Gbps optical interfaces in March 2024. The company anticipates shipping the product starting in Q3 FY25. Due to the increasing demand for high performance computing, their 200 giga per lane and 1.6T DSPs are likely to be favored by both hyperscalers and enterprise customers.

- The management anticipates the total addressable market (TAM) for critical interconnect market will grow at a 27% CAGR to $14 billion by calendar 2028. Considering Marvell’s leading technology in critical interconnects for data centers, I am confident that Marvell’s data center will grow rapidly over the next few years.

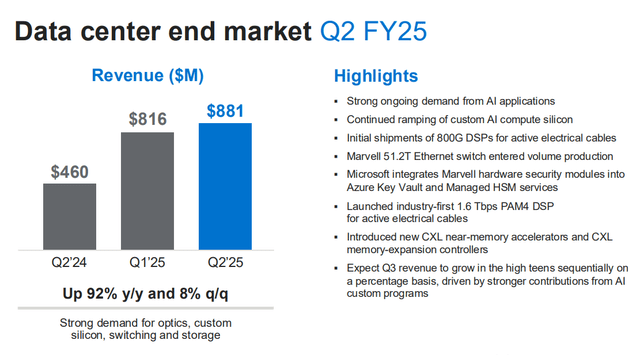

As a result, Marvell is guiding for high-teens sequential growth for Q3, as presented in the slide below.

Marvell Technology Investor Presentation

Outlook and Valuation

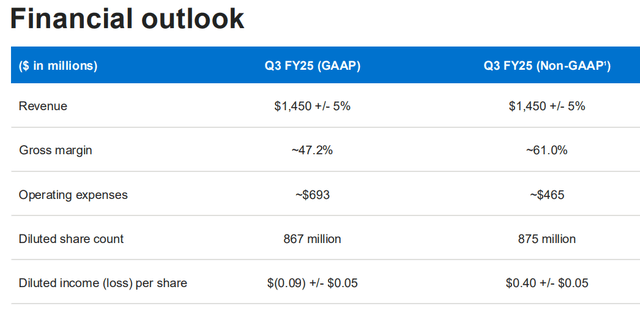

Marvell is guiding for around $1.45 billion in revenue for Q3 FY25, as detailed in the table below:

Marvell Technology Investor Presentation

I estimate Marvell will deliver $1.48 billion in revenue for Q3, and $5.65 billion in total for FY25, implying a 2.6% year-over-year growth for FY25. Key assumptions include:

- Data Center: As indicated in my previous article, interconnectivity and custom silicon will drive Marvell’s revenue growth in the future. With the production ramp-up accelerating in the second half of FY25, I estimate that data center business will grow by 20% sequentially in Q3 and Q4, reaching around $4 billion in total for FY25.

- Enterprise Networking: The management indicated that their Enterprise Networking business has already reached its growth bottom in the first half of the year. After several quarters of inventory destocking, Marvell is likely to experience a moderate recovery in the end markets. As such, I assume the segment will grow by 3% sequentially for Q3 and Q4.

- Other Businesses: I assume flat sequential growth for their Carrie Infrastructure and Automotive/industrial businesses, and 3% growth for Consumer business. Since these businesses represent a small portion of total revenue, the combined revenue growth is not highly sensitive to these segments’ growth.

For FY26 onwards, I estimate that Marvell’s revenue will grow by 16% assuming: Data Center will grow by 20% annually driven by AI workloads and custom silicon; enterprise networking/ Carrie Infrastructure/Consumer businesses will grow by 5%, aligned with historical average; Automotive/Industrial will grow by 10%, in line with the industry growth.

Due to the operating leverage, I estimate Marvell will expand their margin by 360bps per year, driven by:

- As Marvell has been working with major hyperscalers to provide custom silicon solutions, it has incurred significant up-front costs for Marvell. With the production ramping up, I estimate Marvell’s gross profit and R&D costs will start to improve.

- I calculate Marvell will deliver 50bps margin expansion in gross profits, 50bps from SG&A leverage and 160bps improvement from R&D expenses.

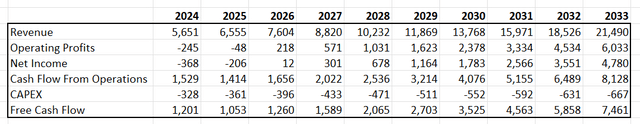

The DCF model can be summarized as follows:

Marvell Technology DCF

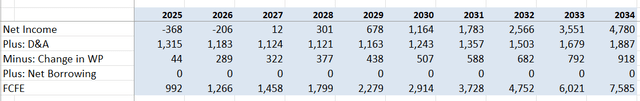

I calculate the free cash flow from equity as follows:

Marvell Technology DCF

The cost of equity is estimated to be 15% assuming: risk-free rate 3.8%; beta 1.8; equity risk premium 6%. Discounting all the FCFE, the one-year target price is calculated to be $90 per share.

Key Risks

Marvell exited the quarter with a gross debt to EBITDA ratio of 2.39x and a net debt to EBITDA ratio of 1.84x. While I am not concerned about their balance sheet, the current debt leverage is relatively high compared to other semiconductor companies. The company is actively working on their inventory management aiming to improve working capital and having lowered their inventory level by 20% year-over-year. I would feel more comfortable if the company repaid a portion of their $4.13 billion in debts in the future.

End Note

The production acceleration of interconnectivity and custom silicon in the 2H is likely to propel Marvell’s data center business growth in the near future. I reiterate a ‘Buy’ rating with a one-year price target of $90 per share.

Read the full article here