Investment thesis

My previous bullish thesis about Enbridge (NYSE:ENB) (TSX:ENB:CA) aged well as the stock returned investors almost 15% over the last three months. Over the same period, the S&P 500 Index (SPX) delivered around 4% to investors.

Today, I want to explain why I remain very bullish about Enbridge’s stock. The company continues demonstrating strong financial performance, disciplined capital allocation, and the macro environment looks quite favorable for Enbridge. ENB’s compelling 6.75% forward dividend yield is safe, based on my fundamental analysis. There are also Enbridge’s Cumulative Redeemable Preferred Shares Series 1 (OTC:EBBGF) that offer even higher 7.37% forward dividend yield at the moment. ENB’s valuation is still compelling. All in all, I reiterate my “Strong buy” rating here.

Recent developments

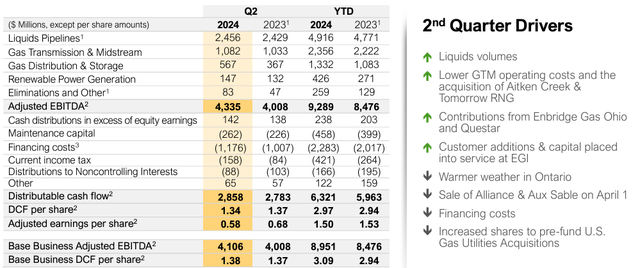

Enbridge released its latest quarterly earnings on August 2, surpassing both revenue and EPS consensus estimates. Revenue grew by around 5.2% on a YoY basis. I think that ENB’s performance was strong as the company demonstrated a solid 8% growth in adjusted EPS, outpacing the top line growth. This is a good trend, meaning that despite its massive scale, Enbridge still has the potential to expand profitability.

ENB’s latest earnings presentation

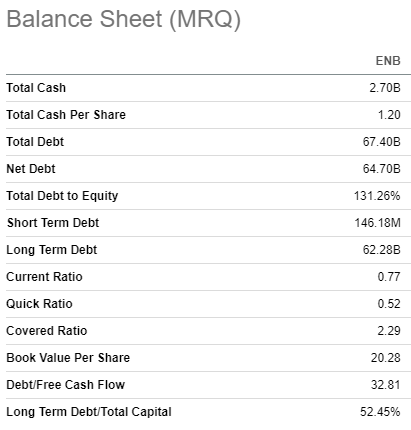

As shown above, the DCF per share slightly dipped on a YoY basis, but I consider this a temporary headwind. The dip in DCF per share is mostly explained by the elevated financing cost and higher income tax. Despite a slight dip in the DCF per share, Enbridge still improved its financial position. The company ended Q2 with a $2.7 billion cash reserve, with the total debt still notably lower than the company’s market cap.

Seeking Alpha

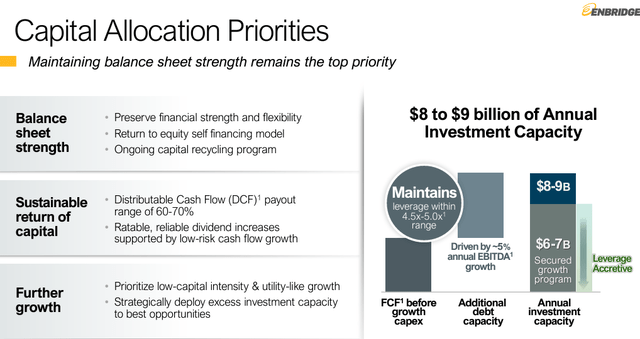

During the latest earnings call, the management once again reiterated its commitment to disciplined cost control and capital allocation. The management expects that the company’s financial position makes it well-equipped to balance between financing ambitious growth projects and maintaining sustainable return of capital to investors.

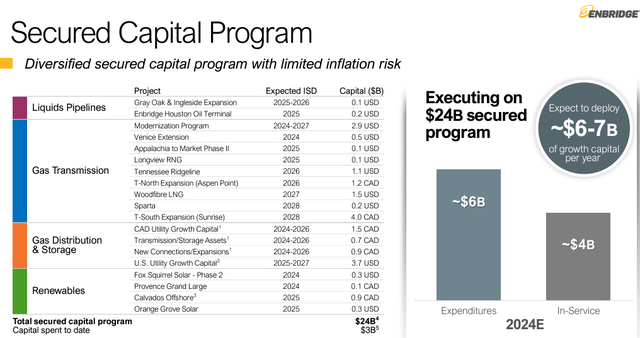

ENB’s latest earnings presentation

The management’s strong drive to pursue large capital projects appears well-founded, considering the macroeconomic environment and long-term trends. As the world is experiencing the digital revolution, it is obvious that energy demand growth is inevitable. According to Barclays, artificial intelligence will highly likely be a big catalyst to drive demand for natural gas. As the largest midstream company in North America, Enbridge is poised to benefit from this trend and the company’s ambitious backlog, where most of the budget is allocated to expansion of the company’s natural gas infrastructure, looks quite relevant.

ENB’s latest earnings presentation

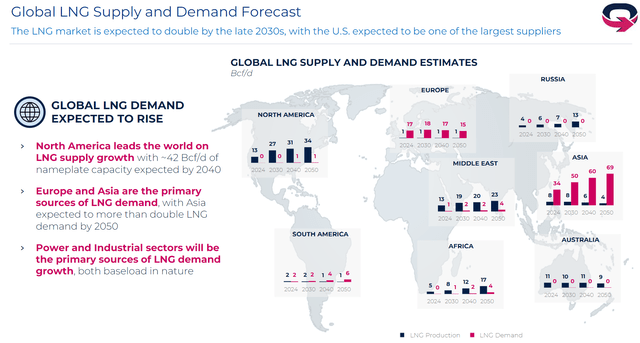

Another positive secular trend for Enbridge is a thriving LNG industry. EQT Corporation (EQT), one of the largest natural gas producers in the world, forecasts the global LNG market to double by the late 2030s and the U.S. to be one of the largest suppliers. As a company with a wide footprint in North America’s LNG exports, I think that ENB is also extremely well positioned to benefit from the expected surge in LNG demand in Asia.

EQT’s latest earnings presentation

To conclude this part, I think that recent developments and secular trends underscore Enbridge’s fundamental strength and bright prospects. Enbridge’s historical shareholder-friendly approach to dividend payouts together with the management’s acknowledgement of the importance of having disciplined capital allocation means that the compelling forward dividend yield is safe.

Last but not least, I think that the market’s sentiment is also quite favorable for ENB. As a reliable dividend player offering a compelling yield and strong fundamentals, ENB is poised to benefit from rapidly deteriorating sentiment around growth stocks. I have a conviction that growth stocks are likely losing their appeal since NVIDIA’s stock (NVDA) dipped last week even despite delivering another unbelievable quarter with strong guidance. All other largest tech companies also did not rally much during the Q2 earnings seasons, which means that the market likely sees no upside for these names at the moment.

I would also recommend my readers to pay attention to Enbridge’s preferred shares. There are twenty different series of preferred shares issued by Enbridge, and more information about each of them can be found here. The one that I found interesting is Cumulative Redeemable Preferred Shares Series 1 with an OTC:EBBGF ticker. This instrument currently trades at $22.85, offers an attractive investment opportunity with a quarterly dividend of $0.4189 per share, translating to a compelling 7.3% annual dividend yield. With the next reset date on June 1, 2028, these shares provide a stable income stream in the interim, especially appealing given the current U.S. 10-year Treasury yield of 3.84%. The anticipated interest rate cuts by the Federal Reserve, totaling 75 basis points by the end of 2024, could further enhance the attractiveness of these preferred shares by potentially increasing their relative yield advantage.

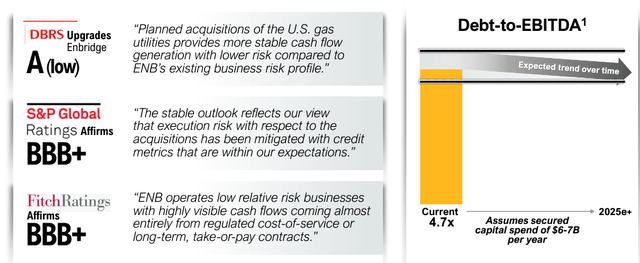

ENB’s latest earnings presentation

Moreover, Enbridge’s credit ratings from various reputable experts look robust and the management’s long-term goal is to steadily deleverage the balance sheet. This makes EBBGF a compelling choice for investors seeking reliable fixed income, backed by Enbridge’s strong financial foundation and strategic positioning in the energy sector.

Valuation update

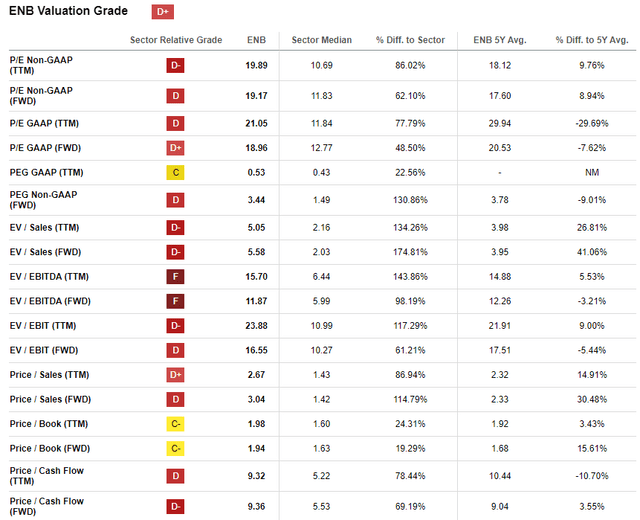

ENB rallied by around 14% over the last twelve months and by 12% YTD. Most of the valuation ratios are lower or approximately in line with ENB’s historical averages. This might indicate that the stock is fairly valued, however looking only at multiples is not sufficient. Therefore, I have to simulate the dividend discount model [DDM].

Seeking Alpha

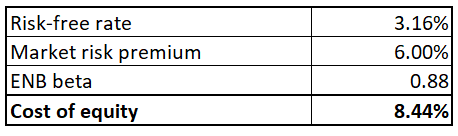

Cost of equity is the DDM’s discount rate, which is calculated using the capital-asset pricing model [CAPM]. Since Enbridge is a Canadian company, I take this country’s bonds’ 10-year yield of 3.16% and Canada’s 6% market risk premium. Enbridge’s 24-months beta is 0.88. Incorporating all these assumptions into the CAPM formula gives me an 8.44% cost of equity.

Author’s calculations

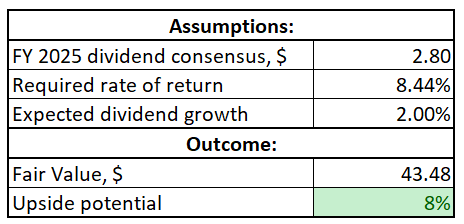

There was a three cent upgrade to FY 2025 dividend consensus estimate, compared to my previous DDM for ENB. After the downgrade, the FY 2025 dividend is $2.80. I reiterate my 2% dividend growth projection, in line with long-term inflation averages.

Author’s calculations

ENB’s fair value per share is $43.48, 8% higher than the last close. The upside potential is modest, but it also suggests that the downside risk is highly likely limited. This looks attractive given ENB’s compelling dividend yield.

Risks update

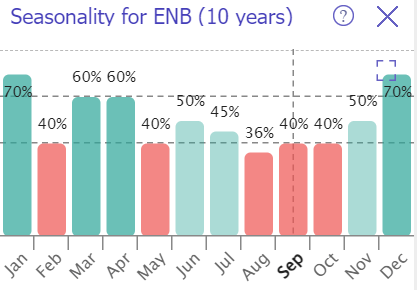

If we look at ENB’s historical seasonality patterns, September and October are not among the strongest months. On the other hand, ENB’s strong August performance with around 9% rally suggests that seasonality trends might not be working good in 2024.

TrendSpider

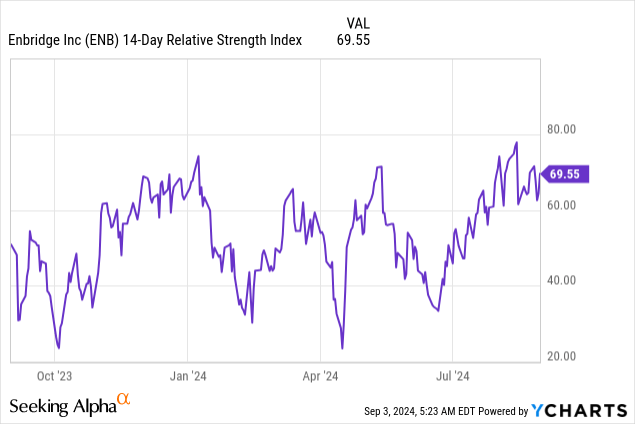

Another factor that might indicate a high probability of a potential temporary pullback is that the RSI indicator looks relatively high at almost 70. The blend of long-term seasonality trends together with a high RSI indicator might be a solid negative short-term catalyst for the share price. Moreover, the current around $40 per share looks like a psychological level, which might be a solid resistance.

As a company that operates in the fossil fuels industry, Enbridge inherently faces a myriad of environmental risks. The company’s extensive midstream infrastructure and headcount means that Enbridge faces challenges in terms of environmental and health stewardship.

Bottom line

To conclude, ENB is still a “Strong Buy”. Recent developments support my bullish outlook, and secular trends are still quite favorable for North America’s largest midstream player. The dividend yield is compelling and safe. Last but not least, my valuation analysis suggests that there is still solid upside potential left after this year’s rally.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here