Verastem, Inc. (NASDAQ:VSTM) is a clinical-stage biopharmaceutical company that develops cancer treatments targeting the RAS/MAPK pathway. This cell growth modulator is useful for pancreatic, lung, colorectal, and low-grade serous ovarian cancers (LGSOC). The company’s leading therapy combines Avutometinib and Defactinib, which offer complementary mechanisms of action to disrupt malignant cell growth and metastasis. Its leading indication is for recurrent LGSOC. This combination therapy is in a rolling NDA submission, expected to be finalized by 2H2024. VSTM is also working on additional potential indications for metastatic pancreatic cancer, as well as mKRAS G12C non-small cell lung cancer (NSCLC). In my view, VSTM’s relatively tight cash runway makes it a high-risk, high-reward proposition. Yet, its current valuation and concrete pathway to approval nudges me towards a bullish rating.

Avutometinib and Defactinib: Business Overview

Verastem develops oncology treatments using small-molecule inhibitors targeting specific cancer pathways. It was founded in 2010 and is headquartered in Needham, Massachusetts, USA. The company’s IP focuses on the RAS/MAPK pathway, which modulates the cells’ growth, multiplication, and survival. Mutations in its components are involved in several types of cancer, such as pancreatic, lung, colorectal, and low-grade serous ovarian. These mutations lead to over activation of the RAS/MAPK pathway. As a result, this causes uncontrolled cancerous cell proliferation. So, VSTM’s treatments try to suppress this mechanism and alleviate cancer progression.

Source: Corporate Presentation. August 2024.

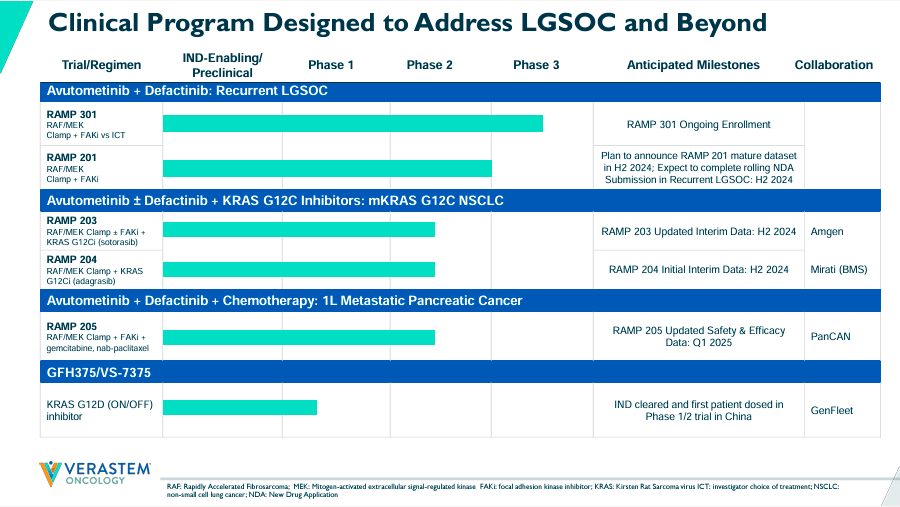

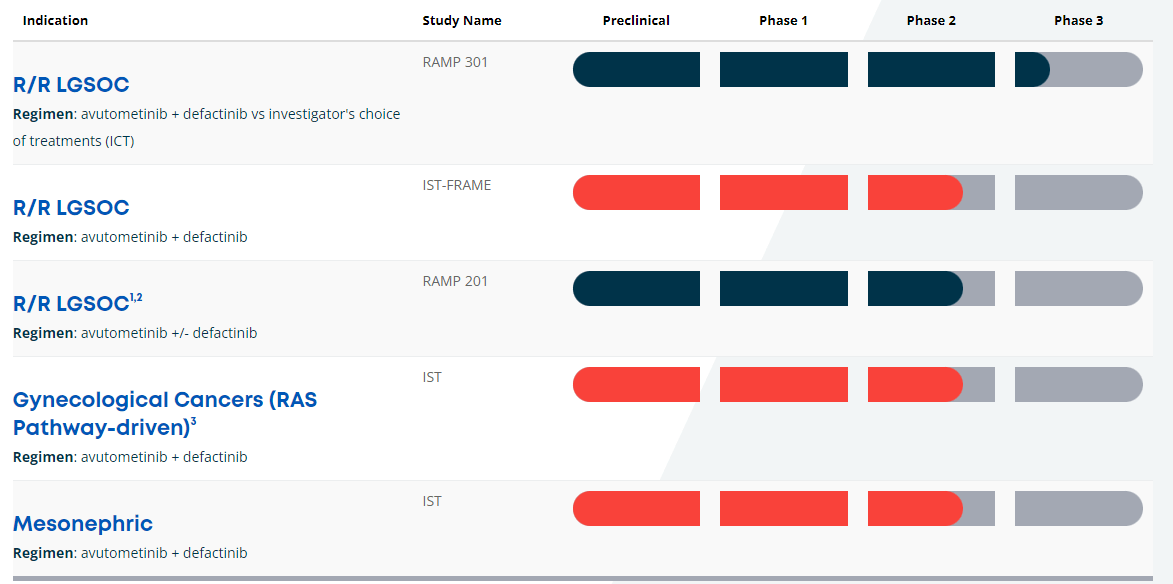

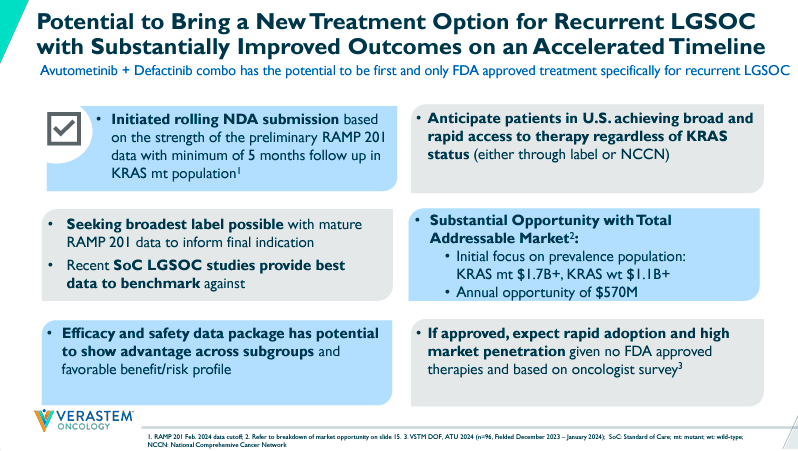

Currently, VSTM’s pipeline has a leading product candidate through the combination of Avutometinib and Defactinib. This combination therapy is indicated for recurrent Low-Grade Serous Ovarian Cancer [LGSOC]. Their complementary mechanism of action [MoA] seems particularly promising for LGSOC because Avutometinib targets RAS/MAPK while Defactinib inhibits focal adhesion kinase [FAK]. It’s worth mentioning that FAK is related to cancer cell metastasis and malignant cell evasion from the immune system. So, the mix of these drugs theoretically delivers a more complete anti-cancer treatment. VSTM’s RAMP 301 is enrolling patients in Phase 3. However, RAMP 201 was a Phase 2 registration-directed trial expected to provide mature data to finalize a rolling new drug application [NDA] in 2H2024.

Source: VSTM’s website.

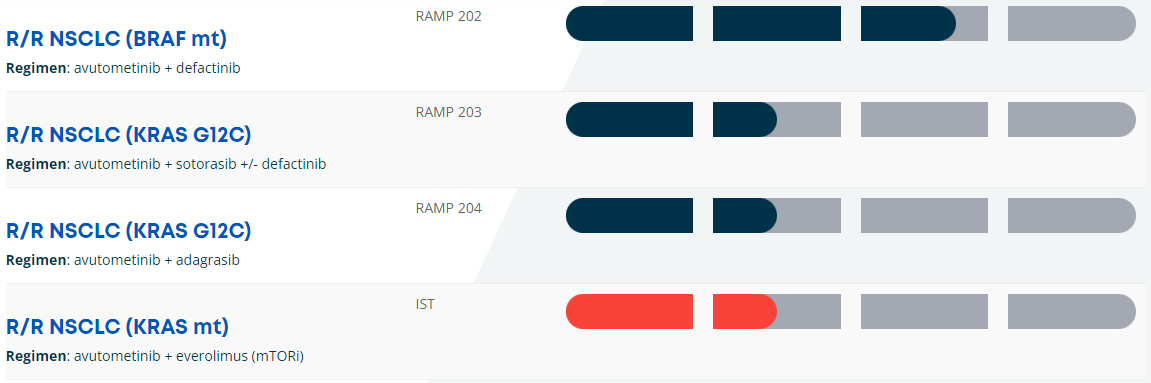

Furthermore, the combination of Avutometinib plus Defactinib with or without KRAS G12C inhibitors is in Phase 2 for KRAS G12C mutant non-small cell lung cancer [mKRAS G12C NSCLC]. Here, the combination therapy tries to overcome the resistance produced by KRAS G12C inhibitors. These inhibitors block the activity of the mutant KRAS protein related to cancer cell multiplication.

Also, VSTM’s RAMP 203 is conducted in partnership with Amgen (AMGN). As for RAMP 204, this is a collaboration with Mirati Therapeutics, which was previously acquired by Bristol-Myers Squibb (BMY). Similarly, RAMP 204 investigates Avutometinib in combination with Adagrasib, a KRAS G12C inhibitor. We should get RAMP 204’s initial interim data by 2H2024.

Source: VSTM’s website.

Moreover, the FDA granted a Fast Track Designation for the combination of Avutometinib and Sotorasib, another KRAS C blocker. This combination therapy is indicated for patients with mKRAS G12C NSCLC who received at least one previous systemic treatment and were not previously administered a KRAS G12C inhibitor. Additionally, VSTM’s pipeline included GFH375/VS-7375, as the FDA gave it an IND clearance. Since then, VSTM dosed its first patient in a Phase 1/2 trial in collaboration with GenFleet in China. It’s important to note that no FDA-approved KRAS G12D inhibitors currently exist, so GFH375/VS-7375 could become, over time, a potentially valuable asset.

Likewise, VSTM’s Avutometinib with Defactinib plus Chemotherapy is in Phase 2 for first-line metastatic pancreatic cancer. This research program collaborates with the Pancreatic Cancer Action Network [PanCAN]. On May 23, 2024, the company announced positive early interim safety and efficacy data from their RAMP 205 trials, showcasing an 83% partial response. We should also get updated safety and efficacy data by Q1 2025. Then, in July 2024, VSTM received the FDA’s orphan drug designation for Avutometinib with Defactinib in pancreatic cancer therapy. So, I think this particular combination of Avutometinib with Defactinib is quite flexible across several oncology applications, but naturally, LGSOC is the most advanced indication among the company’s IP portfolio.

Plunging Stock Price: Potential Opportunity

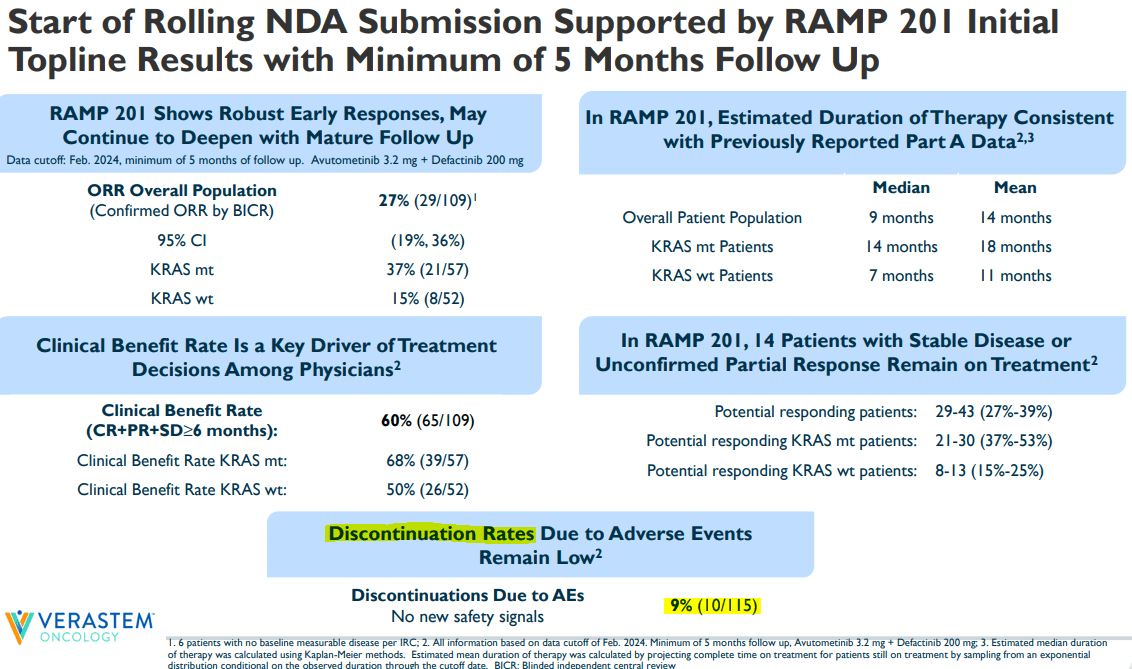

Nevertheless, in May 2024, VSTM’s stock fell 59% after announcing the results for the combination of Avutometinib and Defactinib in recurrent KRAS-mutant low-grade serous ovarian cancer (LGSOC) for patients who had previously undergone one line of treatment. Still, the company began its NDA rolling submission, submitting its primary efficacy analysis from RAMP 201’s one-year follow-up data. VSTM should complete its submission by 2H2024 when it presents clinical module outcomes.

Source: Corporate Presentation. August 2024.

The interim results showed an overall response rate [ORR] of 45%, with an ORR of 60% for KRAS-mutated patients. Also, 86% showed tumor regression. For context, current LGSOC treatments typically have ORRs ranging from 0% to 26%. These are relatively impressive results. However, it’s possible that investors had safety concerns based on that data, which may have contributed to the stock’s sharp decline. Notably, 19 grade 3 or higher treatment-emergent adverse events [TEAEs] were reported in 12 patients. Those TEAEs include nausea, diarrhea, and dermatitis.

Source: Corporate Presentation. August 2024.

Yet, overall, the discontinuation rate was relatively low at just 9%. Also, while these side effects require medical intervention, they aren’t life-threatening. So, I think it’s a manageable safety profile, especially after considering LGSOC’s critically unmet needs. I believe the equity offering of $55.0 million was likely the main cause for the stock’s decline. In fact, VSTM might be a compelling speculative “buy” opportunity at these low prices.

Below Cash Value: Valuation Analysis

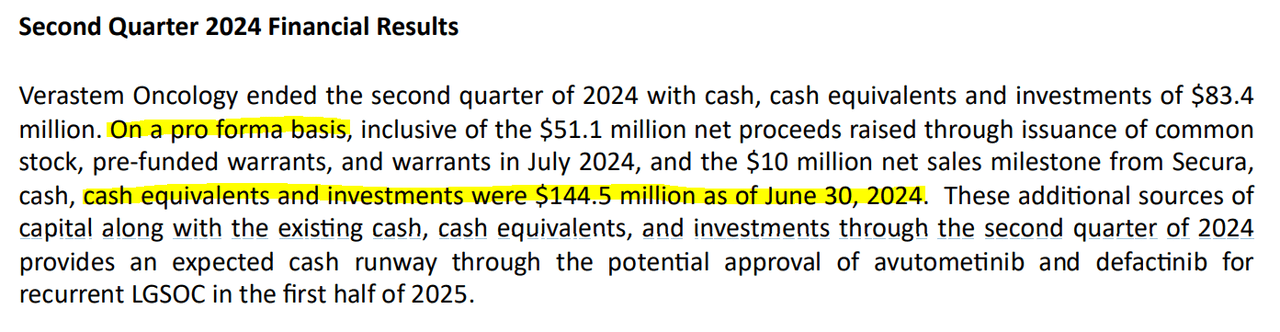

From a valuation perspective, VSTM currently trades at a $98.2 million market cap, making it a microcap in the sector. Its balance sheet shows $83.4 million in cash and equivalents against $40.8 million in financial debt. VSTM’s book value stands at $18.9 million, giving it a P/B multiple of 5.2. Compared to the sector’s median P/B of 2.5, VSTM does appear somewhat expensive. However, it’s important to consider that a significant portion of the company’s valuation lies in its cash reserves and the potential of Avutometinib in combination with Defactinib, particularly for LGSOC.

Source: VSTM’s Q2 2024 10-Q report.

Moreover, on a pro forma basis, VSTM’s cash balance is actually $144.5 million. This includes the $51.1 million net proceeds from the capital raise and the $10 million milestone from COPIKTRA sales. I also estimate their latest quarterly cash burn at $27.6 million, factoring in CFO and Net CAPEX, which implies a yearly burn rate of $110.4 million. This gives VSTM a 1.3-year cash runway, which should be enough to carry them through the anticipated FDA approval decision by 1H2025. It also means that VSTM actually trades below its cash value if we use their pro forma figures, which is self-evidently cheap.

In my view, VSTM’s combination therapy is a promising late-stage treatment with impressive partial response rates from Phase 2 trials. While I accept it’s still not an overwhelmingly effective drug, it’s also important to consider that LGSOC is a notoriously resistant condition and a critically unmet need. So, I believe the FDA may still approve it despite its limitations.

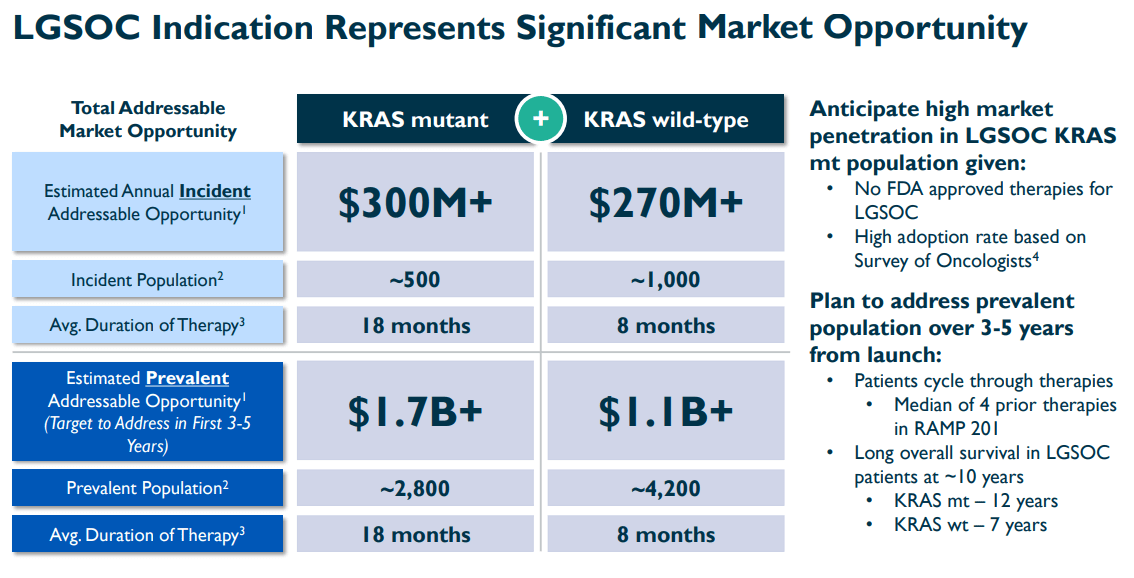

Source: Corporate Presentation. August 2024.

Furthermore, FDA approval would be a major milestone for the company. For context, VSTM’s investor presentation states that the incident market opportunity for LGSOC is estimated at $270 million for KRAS mutant and $300 million for KRAS wild-type. Also, the prevalent TAM could be as high as $1.7 billion for KRAS mutant and $1.1 billion for KRAS wild-type. These are substantial TAMs that VSTM could tap into if they gain FDA approval by 1H2025. However, it’s worth highlighting that response rates are higher in KRAS-mutated patients, so their combination therapy might be more effective in that population subset.

Investment Caveats: Risk Analysis

Therefore, I believe VSTM’s relatively low market cap compared to its TAM is key to my bullish thesis. Naturally, this is highly speculative, but I think the market has already priced in the recent $55.0 million equity offering. So, we likely won’t see more near-term dilution. It’s true that after VSTM gets the FDA approval, another capital raise is likely to occur. However, an approved therapy drastically improves VSTM’s prospects. Thus, I expect the stock would trade much higher at that stage, mitigating the impact of future dilutive events at that point.

Given this, I think VSTM is a reasonable speculative buy for investors willing to bet on the company’s combination therapy. That said, this thesis comes with risks. If VSTM faces regulatory delays or rejection, shareholders could see substantial losses. If their IP is rejected, it would deal a significant blow to the company as a going concern. Even regulatory delays would likely lead to further dilution. Moreover, without an approved drug, they would likely raise funds at unfavorable terms again, translating into considerable shareholder losses.

Source: TradingView.

Nevertheless, based on today’s data, I believe there’s a tangible path to regulatory approval considering LGSOC’s unmet needs. Also, VSTM has enough resources to fund its research until it receives an FDA response. So, for these reasons, I lean bullish on VSTM, rating it a reasonable speculative “buy” in LGSOC and oncology.

Speculative “Buy”: Conclusion

Overall, VSTM has ample research and data on its leading combination therapy of Avutometinib with Defactinib. It seems this is a potentially applicable treatment across several oncology indications, but LGSOC is the most promising. VSTM does seem to have a viable regulatory approval pathway by 1H2025 for this indication. However, this is inherently speculative because the FDA has a rigorous approval process. Moreover, VTSM’s financials show it has enough resources to take its leading therapy toward an FDA decision. However, if VSTM faces regulatory delays or an outright rejection, it could lead to substantial shareholder losses. This makes it a high-risk, high-reward proposition. Yet, its current valuation and concrete pathway to approval nudges me towards a bullish rating. Thus, I rate VSTM a speculative “buy” for investors who understand the inherent biotech risks and cash runway concerns.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here