In my last Grayscale Bitcoin Trust ETF (NYSEARCA:GBTC) article from early-July, I noted the state of investment capital flows and what was a historically favorable seasonality story for the month of July:

July has actually been the second best month for GBTC after only October going back the last five years. Four of the five preceding Julys have resulted in a positive return for GBTC shareholders.

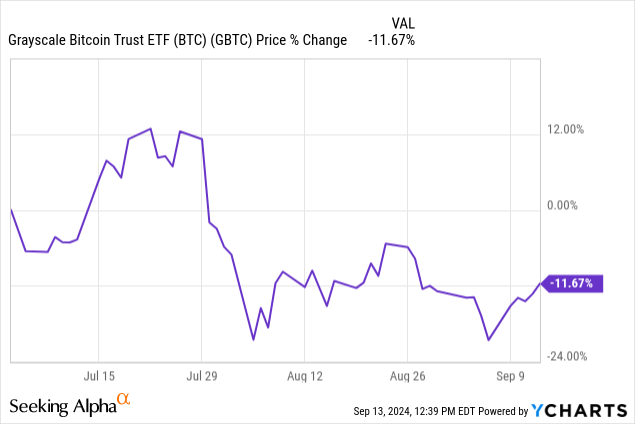

Following that article, Bitcoin (BTC-USD) rallied 30% from a July 5th low of $53.5k up to $70k on July 9th. Since then, price action has been highly disappointing to say the least with the coin now 12% under my buy call:

If July is generally good for BTC, August and September have held up to their historical norms as well so far. In this article, we’ll briefly look at what seasonality says about BTC through the fourth quarter of the year, gauge any signals that can be derived from capital flows, and assess key network metrics through August.

Bitcoin Seasonality

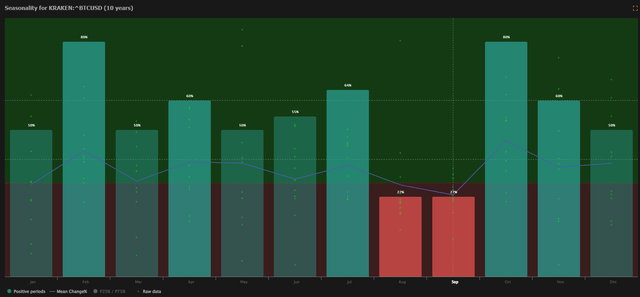

As of article submission, we’re just a couple of days from the halfway point of September. Though well off the lows of $52.5k, BTC is indeed still behind the August close near $59k per coin. This holds true to what we would generally expect from seasonality over the last decade. Looking ahead, we have a very favorable setup approaching with October:

BTC Monthly Seasonality (TrendSpider)

With an 80% win rate going back to 2014, October is historically one of the best months of the year for BTC. The mean change in the month is 19%. Q4 has generally been a good time to let BTC positions run. Mean change in November is 7% and December is 9%, though win rate is lower and returns are a bit more volatile to close the year.

Capital Flow Story

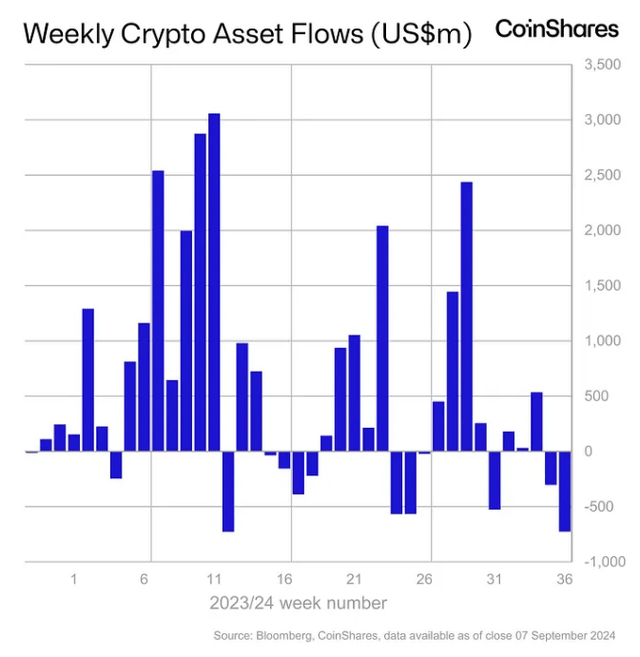

There are a couple different metrics we can observe to ascertain how capital is moving in or out of Bitcoin. First, investment product data from CoinShares shows September off to a very bad start for the broader digital asset investment landscape:

Weekly Crypto Investment Flow (CoinShares)

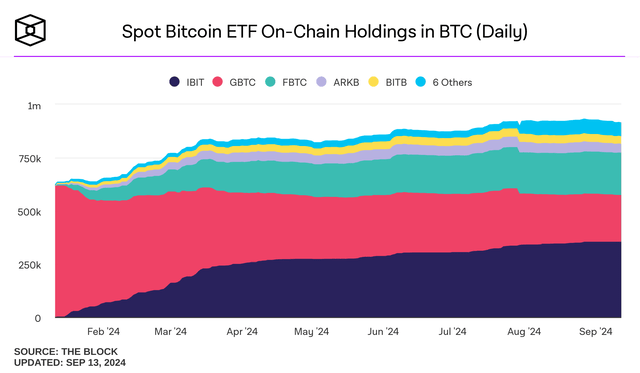

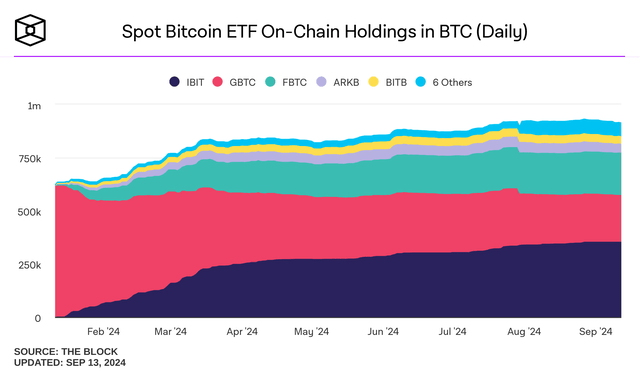

For the week ended September 7th, CoinShares data has $726 million worth of investment capital coming out of digital asset products, which matches the worst week of the year from March. 89% of that outflow was from Bitcoin products, making BTC investment flow negative so far through the first week of September by $640 million. If data from The Block is any indication, it seems that outflow from BTC products may perhaps continue in CoinShares’ next report:

US Spot ETF Supply (The Block)

On September 7th, there was 920.7k BTC held through US spot Bitcoin ETFs. As of September 12th, that figure was down to 913.3k BTC in those same funds. 7.4k BTC at an average price of $58k per coin would be nearly $430 million in additional outflow from spot Bitcoin ETFs a week following one of the coin’s worst capital flow weeks of the year. This is clearly not a great sign if you want to see higher BTC prices.

Network Metrics

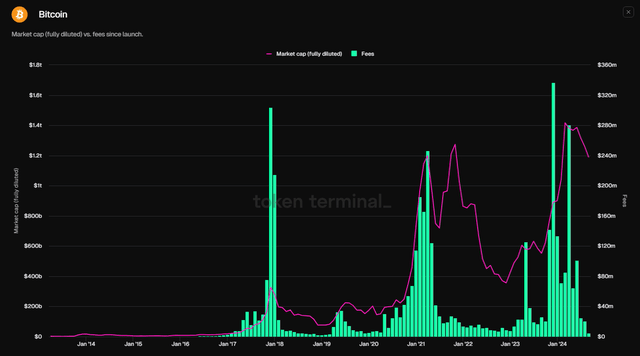

As each halving cycle progresses, Bitcoin’s network fees will become an increasingly more important part of transaction validation. While high fees price out lower value transactions, miner incentivization will ultimately require a robust fee market. Thus, monthly fees are an important metric to watch going forward:

Monthly Fees vs MC (Token Terminal)

In August, we observe total fees of $20.7 million. This was the lowest monthly fee total for Bitcoin of the year, but slightly ahead of the $17.2 million fee figure recorded from the same month last year. The larger takeaway here is Bitcoin is clearly experiencing summer doldrums from an activity standpoint, and we see that corroborated by usage numbers.

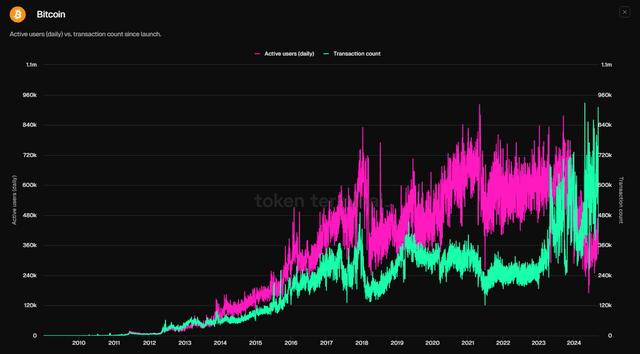

Users vs Transactions (Token Terminal)

DAUs – which Token Terminal defines as ‘distinct senders’ – in the month of August moved up slightly to 365.7k from 347.9k in July. The bad news is this figure was down 43% from 641.5k last August. However, even as users have declined, there were 18.5 million transactions in August. This is the second highest ever after July’s 19.5 million and a 28% year-over-year increase from 14.4 million in August last year. I won’t speculate as to the reason we’re seeing what we’re seeing. But I’ll sum it by saying more transactions from fewer users generating fewer fees is not a sustainable long-term trend.

Election-Related Weakness?

One headwind potentially plaguing crypto and, more specifically, Bitcoin is the uncertainty pertaining to what will happen in the November election in the US. I have explored some of the exuberant Bitcoin reserve proposals we saw from political figures at Bitcoin 2024 in an article from late-July. I’ll take some of my thinking a bit further for this section. In my personal view, it seems quite clear that one of the major political parties in the United States has taken a far more combative stance on cryptocurrencies and digital assets. We could certainly debate whether or not the other party is seizing the opportunity to pander to voters, but at the end of the day, we can only judge actions rather than words.

The United States Securities and Exchange Commission under the Biden administration, through its actions, has developed a reputation in the industry as being an agency that is regulating the space by enforcement, ignoring legitimate frauds, attacking the good actors in the space, and pushing entrepreneurs offshore. On the other hand, the former President running for the other party is actively using the technology through chains like Polygon (MATIC-USD). Thus, the industry believes a Harris/Walz administration is bad for crypto and a Trump/Vance administration would be good.

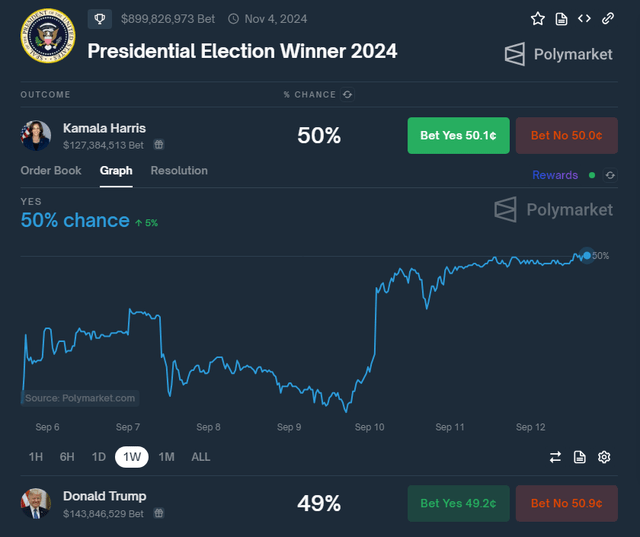

US President Betting Odds (Polymarket)

In response to the August 10th Presidential debate, the betting markets are currently giving the Harris/Walz ticket the edge over Trump/Vance. For this exercise, I’m using Polymarket data rather than ElectionBettingOdds.com. The latter of which aggregates data from Polymarket and three additional markets. The reason I’m choosing the Polymarket figure is because at $900 million in wagers, Polymarket’s betting action is 7x that of the other three markets combined. In my view, this is the better read on what the liquid market thinks – and the market thinks Vice President Harris has a slight edge. I suspect this is another key reason why we haven’t yet seen strong, sustainable rallies in the broader digital asset market.

Coupled with what I’d call less than exciting network data, the election as a potential headwind likely explains some of the capital flight we’re seeing this month.

Grayscale Bitcoin Trust

At 1.5% annually, GBTC continues to have the largest expense ratio in the spot ETF market. Recently, Grayscale spun out the Grayscale Bitcoin Mini Trust (BTC) using a portion of the AUM that was previously held through GBTC. By comparison, the 0.15% fee with BTC is a far more palatable fee and, at this point, I don’t see much of a reason to hold GBTC at all. Revisiting this chart again from a prior section:

US Spot ETF Supply (The Block)

The fee flight from GBTC has clearly slowed down, but it is still happening. Each trading session that passes, more BTC-denominated AUM comes out of GBTC, and the fund has now lost more than 63% of its assets since it was converted to an ETF in January. If the price of Bitcoin goes up, GBTC will as well. It’s that simple. Other than that, I don’t think GBTC is worth holding for long-term Bitcoin exposure unless the expense ratio comes down to where the rest of the market is. In spite of what I view to be an uncompetitive product, I believe BTC is a buy and will maintain my buy rating on GBTC as an extension of that belief.

Closing Thoughts

Ultimately, this is really the reason why I’m still bullish BTC long term despite its flaws:

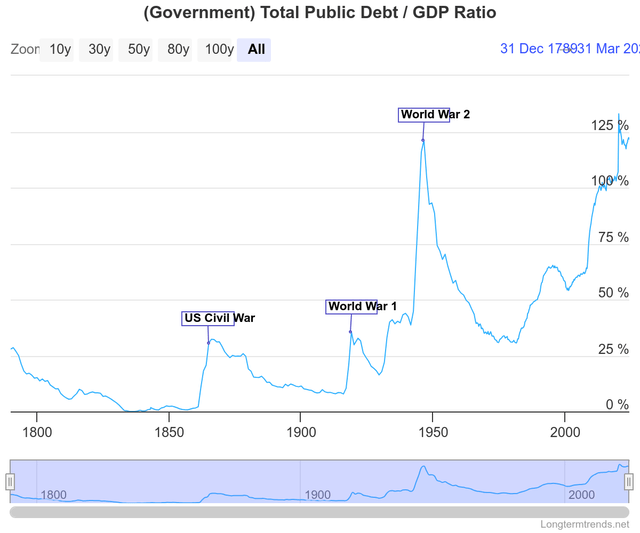

US Public Debt to GDP Ratio (LongTermTrends.net)

US debt to GDP is at WW2 levels. For years, we’ve been told this isn’t an issue because rates are so low. That’s no longer the case:

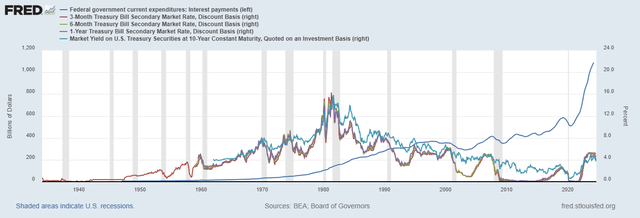

Rates vs Interest (FRED)

Rates are expected to come down soon. Where they ultimately end up is not a forecast I’m comfortable making today. But what is clear is at current levels, the interest expense on the debt is already exploding. This is essentially the only chart a Bitcoin bull really needs, in my opinion.

Just as much as Gold or Silver, Bitcoin is an asset that can be taken out of the traditional financial system. Each individual must decide for themselves what the right allocation to each of these assets is. From where I sit, zero percent is too low, and that’s true for all of them. We’re nearing the end of what has historically been poor seasonality for BTC and for risk assets in general. The election may still be a hurdle, but I suspect BTC wins long term no matter which candidate is elected because neither seem motivated to address the federal deficit.

Read the full article here