By Garey J. Aitken, CFA & Michael Richmond, CFA

Materials Surge Creates Short-Term Headwinds

Market Overview

Despite periods of volatility in early August and September, North American equity markets continued their long-term upward trajectory during the third quarter of 2024. The S&P 500 (SP500, SPX) and S&P/TSX Composite Indexes delivered impressive total returns of 4.6% and 10.5% (in Canadian dollars), respectively, reaching new all-time highs during the quarter, despite meaningful drawdowns in early August.

The U.S. Federal Reserve added support to the bull market by cutting its key policy rate by 50 basis points, marking the start of its rate-easing cycle. The Fed seems to be achieving the elusive soft landing as the U.S. economy continues to demonstrate remarkable resilience despite a long expansion and previously restrictive monetary policy.

In contrast, the Canadian economy has been more uneven. Cracks in the labor market have widened, with unemployment rising steadily over the summer. In response, the Bank of Canada has implemented three 25-basis-point rate cuts since June, primarily due to softer inflation data, but also aimed at addressing challenges in the labor market, housing and capital formation.

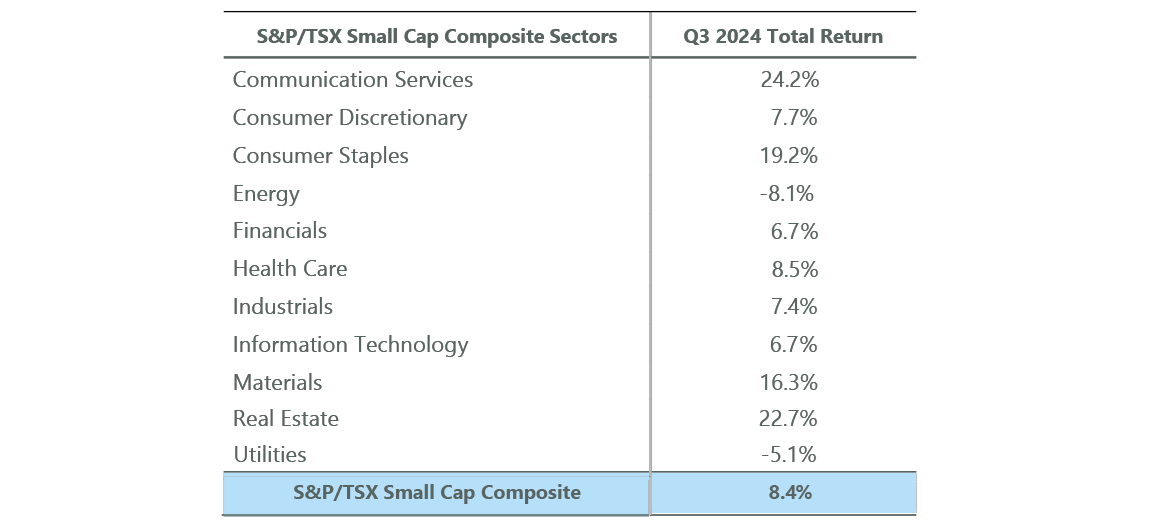

Despite the uneven economic backdrop, the S&P/TSX Small Cap Total Return Index had a strong quarter, advancing by 8.4%, with only energy (-8.1%) and utilities (-5.1%) lower during the quarter. Materials (+16.3%), consumer staples (+19.2%), and the interest rate sensitive real estate (+22.7%) and communication services (+24.2%) led the index higher.

Exhibit 1: S&P/TSX Small Cap Returns in the Third Quarter

As of Sept. 30, 2024. Source: ClearBridge Investments, FactSet.

The materials sector was the largest positive contributor to the small cap index in the third quarter, driven by rising gold and silver prices. The opportunity cost of holding non-yielding assets like gold and silver decreased as interest rates declined during the quarter. As a result, gold prices reached record highs in the quarter of US$2,694oz in late September, while silver hit its highest level since 2011, rising above US$33/oz. The small cap materials sector, heavily weighted toward precious metal producers and exploration companies, is now up 47.7% over the last 12 months.

Conversely, the energy sector was the largest detractor in the small cap index. Exploration and production (E&P) companies followed crude oil prices downward during the quarter. The West Texas Intermediate (‘WTI’) benchmark closed the quarter at US$68.20/bbl, down from US$81.54/bbl at the end of the second quarter. Concerns over increasing OPEC+ supply and tepid demand growth, especially from China, led many financial players to take net short positions in the crude market. Continued weakness in Canadian natural gas prices also contributed to the sector’s decline.

The ClearBridge Canadian Small Cap Strategy underperformed its benchmark during the quarter. Weakness primarily resulted from our exposure in the materials sector, as all-time highs for gold prices benefited small and mid cap gold exploration and production companies. Despite the strong quarter for materials, the Strategy continues to view these precious metal stocks as largely offering unattractive risk-reward.

Stock selection in industrials and health care also hampered relative results. In industrials, weakness stemmed from Boyd Group (OTCPK:BYDGF) and Calian (OTCPK:CLNFF). In both cases, we view the negative equity performances as overreactions to short-term challenges to their demand outlooks. Both companies remain well capitalized and are executing along their long-term strategic objectives. Meanwhile in health care, DRI Healthcare Trust (OTC:DHTRF) closed the quarter sharply lower after it was revealed that the CEO had inappropriately expensed certain fees to the Trust. DRI quickly suspended both the CEO and CFO, and after a board-directed investigation, dismissed them both and fully recovered the misused funds. While we still see significant value in DRI’s existing portfolio of drug royalties, there is uncertainty around its ability to access additional capital to fund future growth.

On the other hand, the Strategy was boosted by stock selection in the utilities and financials sectors, led by electricity and natural gas utility Atco (OTCPK:ACLLF). Canadian Western Bank (OTCPK:CBWBF) also performed well, continuing to benefit from the takeout news announced in the previous quarter. Brookfield Wealth Solutions (BNT), EQB (EQB:CA) and Propel Holdings (OTCPK:PRLPF) also contributed to the solid performance of financials.

Portfolio Positioning

Volatility and idiosyncratic moves allowed us to remain active during the quarter. We eliminated one position and, while we did not initiate any new names to the portfolio, we actively added to existing positions when volatility created opportunities and trimmed positions where appropriate.

We eliminated our position in Sleep Country Canada in the consumer discretionary prior to the completion of its take-private offer by Fairfax Financial (OTCPK:FRFHF). Sleep Country’s equity had traded up to the all-cash deal price throughout the quarter and we eliminated the position ahead of the final closing of the transaction to reallocate toward better opportunities.

We continued to trim positions in energy and materials that approached our estimate of fair value. These included Topaz Energy (OTCPK:TPZEF), Trican Well Services (OTCPK:TOLWF), Secure Energy Services (OTCPK:SECYF), Transcontinental (OTCPK:TCLAF) and Dexterra Group (OTCPK:HZNOF, in industrials). While we view many of these as high-quality companies, we remain committed to our views on valuation and trimmed where appropriate.

We added to existing industrial positions in ATS Corp (ATS), Boyd Group, Calian and Element Fleet (OTCPK:ELEEF). ATS Automation and Element Fleet were added to the portfolio during the second quarter, and we grew those positions at attractive levels during the third quarter. Calian and Boyd Group were weaker on uneven operational and financial results. In both cases, we view the market as overly discounting the long-term value of the equities and took the opportunity to add to positions in two quality small cap industrial companies.

We participated in the September subscription receipt offering for Propel Holdings in financials. Propel announced the acquisition of QuidMarket, a U.K.-based digital direct lending platform, and a corresponding secondary offering in late September. The acquisition expands Propel’s geographic footprint into Europe, is expected to be immediately accretive to per share metrics and was completed at an attractive valuation. We view the acquisition as a successful execution of Propel’s strategy and viewed the secondary as a compelling price to add to our position.

We added to Parex Resources (OTCPK:PARXF) in the energy sector following a series of operational updates in 2024, reflecting disappointing production levels in the Arauca basin, a key growth asset for the company, and ongoing production disruptions related to social unrest in Colombia. A material revision to guidance weighed on the share price during the quarter, which we view as no longer reflecting the existing reserve value and its clean balance sheet. Nonetheless, a recovery for Parex shares will depend on successful execution on lower-risk exploration and management’s ability to regain confidence.

Outlook

Our investment approach is a bottom-up strategy that prioritizes identifying and capitalizing on market inefficiencies, using our proprietary research and taking advantage of the time arbitrage that comes with our long-term investment horizon. This approach is supported by our patient culture, enabling us to make well-informed decisions when there are discrepancies between expectations and underlying fundamentals. We remain steadfast in our commitment to our investment style, diligently seeking out businesses that exhibit wise capital allocation practices, enjoy structural competitive advantages, can generate high-quality growth, and do all of these things under appropriate capital structures.

Our long-term, bottom-up investment approach can perform well under various regimes of market leadership, but as valuations in more cyclical sectors become stretched, we have remained biased towards more defensive equities. That said, the third quarter produced certain opportunities to add to cyclical industrial stocks at attractive valuations and we accelerated into them.

Portfolio Highlights

The ClearBridge Canadian Small Cap Strategy underperformed its S&P/TSX Small Cap Index benchmark in the third quarter. On absolute basis, the Strategy delivered gains across seven of the 10 sectors (out of 11 total) in which it was invested. Real estate and financials were the primary contributors while energy and health care detracted the most.

On a relative basis, overall sector allocation and stock selection detracted from performance. In particular, stock selection in the industrials, materials and health care sectors as well as an underweight to materials and an overweight to the utilities sector were the primary drags on results. On the positive side, stock selection in the utilities, financials and consumer discretionary sectors contributed to results, as did an overweight to consumer staples.

Among individual securities, the leading absolute contributors were Atco in utilities, Canadian Western Bank (OTCPK:CBWBF) in financials, Real Matters (OTCPK:RLLMF) and FirstService (FSV) in real estate and Empire (OTCPK:EMLAF) in consumer staples. Individual detractors included Parex Resources and Headwater Exploration (OTCPK:CDDRF) in the energy sector, Boyd Group and Calian in industrials and DRI Healthcare Trust.

Garey J. Aitken, CFA, Head of Canadian Equities

Michael Richmond, CFA, Director, Portfolio Manager

|

Past performance is no guarantee of future results. Copyright © 2024 ClearBridge Investments. All opinions and data included in this commentary are as of the publication date and are subject to change. The opinions and views expressed herein are of the author and may differ from other portfolio managers or the firm as a whole, and are not intended to be a forecast of future events, a guarantee of future results or investment advice. This information should not be used as the sole basis to make any investment decision. The statistics have been obtained from sources believed to be reliable, but the accuracy and completeness of this information cannot be guaranteed. Neither ClearBridge Investments, LLC nor its information providers are responsible for any damages or losses arising from any use of this information. Performance source: Internal. Benchmark source: Standard & Poor’s. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here