PERFORMANCE SUMMARY

|

Cumulative |

Annualized |

|||||

|

3 Month |

YTD |

1 Year |

3 Year |

5 Year |

10 Year/ LOF 1 |

|

|

Fidelity Floating Rate High Income Fund (MUTF:FFRHX) Gross Expense Ratio: 0.75% 2 |

2.02% |

5.85% |

8.81% |

6.14% |

5.29% |

4.48% |

|

Morningstar LSTA US Performing Loans |

2.09% |

6.70% |

9.87% |

6.66% |

6.00% |

5.14% |

|

Morningstar Fund Bank Loan |

2.03% |

6.12% |

9.29% |

5.21% |

4.51% |

3.82% |

|

% Rank in Morningstar Category (1% = Best) |

— |

— |

66% |

15% |

12% |

12% |

|

# of Funds in Morningstar Category |

— |

— |

221 |

209 |

204 |

166 |

|

1 Life of Fund (LOF) if performance is less than 10 years. Fund inception date: 08/16/2000. 2 This expense ratio is from the most recent prospectus and generally is based on amounts incurred during the most recent fiscal year, or estimated amounts for the current fiscal year in the case of a newly launched fund. It does not include any fee waivers or reimbursements, which would be reflected in the fund’s net expense ratio. Past performance is no guarantee of future results. Investment return and principal value of an investment will fluctuate; therefore, you may have a gain or loss when you sell your shares. Current performance may be higher or lower than the performance stated. Performance shown is that of the fund’s Retail Class shares (if multiclass). You may own another share class of the fund with a different expense structure and, thus, have different returns. To learn more or to obtain the most recent month-end or other share-class performance, visit Fidelity Funds | Mutual Funds from Fidelity Investments, Financial Professionals | Fidelity Institutional, or Fidelity NetBenefits | Employee Benefits. Total returns are historical and include change in share value and reinvestment of dividends and capital gains, if any. Cumulative total returns are reported as of the period indicated. For definitions and other important information, please see the Definitions and Important Information section of this Fund Review. Lower-quality bonds can be more volatile and have greater risk of default than higher-quality bonds. Floating rate loans may not be fully collateralized and therefore may decline significantly in value. Fixed income investments entail interest rate risk (as interest rates rise bond prices usually fall), the risk of issuer default, issuer credit risk and inflation risk. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks. Not FDIC Insured • May Lose Value • No Bank Guarantee |

Loan Market Review

Leveraged loans posted a modest, coupon-driven gain the past three months, but substantially lagged both investment-grade bonds and high-yield corporate credit, both of which were helped by declining interest rates. For the quarter, loans rose 2.09%, as measured by the Morningstar LSTA US Performing Loans Index.

The index rose 0.68% in July, as loan prices were steady but yields dropped sharply. Money continued to flow into retail funds and CLO origination remained strong. However, negligible net new loan supply and increasing expectations for the first interest rate cut since March 2020 by the Federal Reserve kept the asset class in check.

Loan prices remained steady in August, when the index rose 0.66%, and yields continued to decline, but retail fund flows reversed course and turned negative.

In September, the shift toward global monetary easing gained steam when the Fed lowered its benchmark federal funds rate by 0.50 percentage points. The central bank opted for a bolder start in pursuit of its stated goal to achieve a soft landing for the economy: bring down inflation amid a gradual cooling in the labor market while neither spurring nor slowing economic activity. Despite the Fed’s aggressive move, loans gained 0.73% for the month, aided by expectations that the goldilocks, not-too-hot/not-too-cold pace of economic growth would continue. Still-elevated coupons on many loans provided a floor under the asset class.

Within the index, all but one industry posted a gain for the three months, led by radio & television (+6%).

Cable & satellite television (+5%) and all telecom (+4%) also stood out. Additional outperformers among key groups included drugs, utilities and publishing (+3% each). Other major industries, including electronics/electrical, business equipment & services, insurance, health care, and financial intermediaries each rose roughly 2%, close to the index. In contrast, surface transport (-1%) was the lone negative cohort. Air transport, home furnishings, food products, food service, and aerospace & defense also trailed the index, with each returning about 1%.

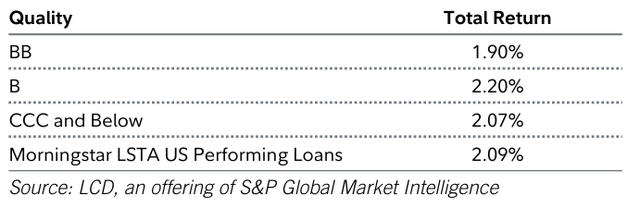

From a credit-rating perspective within the benchmark, loans rated CCC (+4.10%) fared best, reflecting investor demand for higher-risk/higher-yielding credits. Meanwhile, the B and BB tiers each gained about 2%.

Looking at supply and demand, issuance of new loans in Q3 totaled $205.6 billion, down from $381.7 billion in the second quarter. Consistent with the pattern that has persisted throughout the year, repricing/refinancing activity accounted for about 79% of the volume. On the demand side, loan funds reported $1.9 billion of outflows in Q3, compared with inflows of $6.6 billion in Q2.

Collateralized loan obligation volume totaled $130.3 billion in the third quarter, compared with $117.7 billion in the second quarter of 2024. Net of issuance for refinancing/repricing, CLO volume was $56.9 billion in Q3. CLOs bundle corporate loans and sell slices of the debt to institutional investors. CLOs represented roughly 60% of loan market assets as of September 30 and constitute an important source of demand.

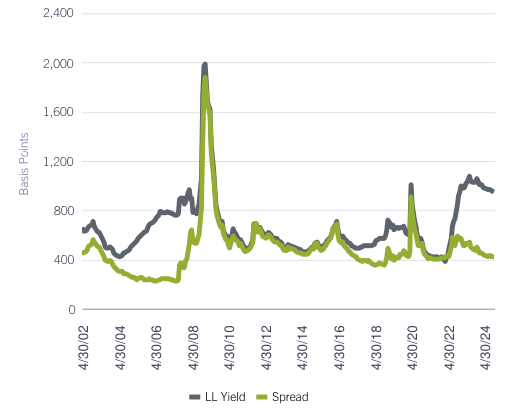

LEVERAGED-LOAN SPREAD AND AVERAGE YIELDS (BASIS POINTS*)

|

*1 basis point = 0.01%. Source: LCD, an offering of S&P Global Market Intelligence, as of 9/30/24. Yield spread is represented by the discounted spread of the Morningstar LSTA US Performing Loans. The average spread is calculated from 3/31/02 through the most recent period. |

THREE-MONTH LOAN RETURNS

Performance Review

For the quarter, the fund’s Retail Class shares gained 2.02%, versus 2.09% for the benchmark, the Morningstar LSTA US Performing Loans Index.

The fund’s core bank-loan portfolio, which represented about 90% of assets, on average, in Q3, gained 1.87%, slightly trailing the benchmark. The fund’s much smaller stakes in stocks and corporate bonds of loan issuers outperformed the benchmark for the quarter.

An out-of-benchmark equity stake in JoAnn Stores (OTC:JOANQ) was the top individual relative contributor. The crafts and fabrics retailer emerged from bankruptcy in May. Despite posting weaker-than-expected year-to-date financial results, investors expressed optimism that the company could achieve its original earnings estimates in the second half of its 2026 fiscal year.

Another non-benchmark position, Securus Technologies, the second-largest provider of inmate communications systems to the U.S. corrections industry, also aided the fund’s relative result this quarter. The company achieved respectable Q2 earnings, with satisfactory operating fundamentals driven by new customers and a favorable revenue mix.

An overweight in radio and TV station operator Cox Media Group also helped. The loan held by the fund rose by roughly 17% for the quarter, rising on price recovery from earlier credit-rating downgrades. Despite industry challenges, we believe the firm’s liquidity position is stable for now.

Not owning telecommunications provider and benchmark member CenturyLink – now known as Lumen Technologies (LUMN) – was the primary relative detractor in Q3. In July, the company agreed to a deal with Microsoft (MSFT) to help the software giant increase the network capacity of its AI datacenters by providing dedicated fiber optic lines.

An overweight in Del Monte Foods (FDP) also dampened the fund’s relative performance. In July, its credit rating was downgraded by both Moody’s and Standard & Poor’s. Moody’s cited rising indebtedness and weakening liquidity, while S&P noted the risk of default or restructuring due to reduced sales and high inventory.

An above-benchmark investment in liquefied natural gas producer New Fortress Energy (NFE) trailed when S&P cut the firm’s credit rating by one notch to B+. We continue to have high conviction in the company’s long-term prospects.

Outlook and Positioning

As of September 30, we consider overall market fundamentals as reasonable. That said, in our view, the market is bifurcated. On the one hand, loans from issuers that are fundamentally sound have generally performed well and are trading near par, or face value. On the other, loans from issuers with weak fundamentals are trading at much lower prices. Speculative-grade credit quality has deteriorated amid slowing revenue growth and high costs. In the event of bankruptcy, the range of loan recovery rates is much broader than in the past, from zero to more than 80%. The average has also dropped, from the mid-70% range to around 50%.

Financial maintenance covenants, which require borrowers to maintain certain financial performance measures throughout the life of the loan, are weaker now. Moreover, many companies entering the loan market today are more highly indebted than in the past. We think these market realities play to Fidelity’s strengths. Today’s loan market requires a level of in-depth research that a large and experienced analyst team can deliver more effectively than firms with limited resources. The market also requires more-effective active management of risk related to issuer restructuring or distress. We think a larger team with a broader array of expertise, such as we have at Fidelity, is in a better position to handle such challenges.

We’ll note that seven of the fund’s top-20 relative contributors this quarter were benchmark members we did not own. This group includes companies that are grappling with a large debt load and distressed financials. There have been periods where this number is even larger. In our view, helping the fund steer clear of these types of issuer situations is a testament to the skill of our research team.

Exposure to loans increased slightly this quarter, rising from 89% of the portfolio to about 90% as of September 30, as we put more of the fund’s cash to work. The fund’s minimal allocation to equities was essentially unchanged from midyear. The fund does not actively buy stocks, but may acquire equities as part of bankruptcy filings and restructurings. Our cash allocation modestly decreased the past three months, to about 3%. This is lower than the low end of our target range of 5% to 7%, reflecting our active approach to new deals coming to market. Given the range of opportunities in the market, we are reevaluating the target for the fund’s cash allocation, and expect it to be somewhat lower going forward.

As of September 30, the largest industry overweights were in lodging & casinos and retailers. Underweights were most pronounced in business equipment & services and health care.

Read the full article here