Summary

This post is to provide my thoughts on The Sage Group’s (OTCPK:SGGEF) business and stock. I am recommending a buy rating for Sage as the business is on track to accelerate growth and see margin expand back to historical levels.

Business overview

Sage Group is a very large business with leading solutions for accounting, payroll, and payments. Sage targeted customers include businesses of all sizes, from SME to large enterprises, albeit with a major focus on SMEs. As of the latest fiscal year (FY22), the business generated ~GBP2 billion in revenue and GBP250 million in net income. Of which, 42% come from North America, 28% from Central and Southern Europe, 22% from Northern Europe, and 8% from international regions. For most of its recent history, Sage has been a profitable company, generating a 10+% net margin and being FCF-positive. The strong cash flow generation capability has enabled Sage to conduct its M&A strategy without much worry about liquidity issues. For reference, Sage has conducted 30 known acquisitions since 2011.

Investment thesis

As the growth contribution from Sage Intacct increases over the next few years, I expect Sage to expand at a much faster rate than it has in the past (high single digits). As a result of the increased growth, margin expansion should once again reach historical highs and the Intuit (INTU) threshold. Firstly, since the transition from license to subscription has stopped being a drag on Sage’s growth, I anticipate an acceleration in organic growth beginning in FY21. When this obstacle is finally out of the way, the company’s cloud-native portfolio will finally begin to thrive, driving growth.

Sage’s North American exposure is growing from 30% of revenues in FY18 to 40% in FY22, and I expect it to continue rising over the next few years. Sage’s fastest growth is in North America, and as that region’s share of total revenues increases, the group as a whole experiences positive upward pressure on growth. Herein lies Sage’s crown jewel and primary growth driver: Sage Intacct’s share of revenue in North America is expanding, rising to over 30% from 20% three years ago. For those unaware, Sage Intacct is a competitor to Oracle NetSuite in the mid-market core financials software space. Growth in North America is being pushed upward as a result of Intacct becoming a larger part of the revenue mix.

Intacct’s growth prospects excite me greatly because of the compelling value it provides. Some of its most salient benefits include: To begin, the typical customer that needs Intacct will experience a complex finance function that is disjointed, which leads to unpaid bills, missed opportunities, and unrealized revenue. With Intacct’s robust accounting features and simple integration with third-party CRM software, users will easily solve these issues. Secondly, the use of Intacct will improve system automation and data accuracy, resulting in lower hiring costs. In other words, due to Intacct’s automated platform, fewer workers need to be hired and maintained. Thirdly, Intacct’s integration and synchronization with CRM software grants sales teams access to customer accounts and contract status, facilitating real-time contract renewal, billing oversight, and more precise upsells. When the sales and finance teams work together, automation rises and duplication of effort is reduced.

The latest trading update shows that Intacct’s growth is continuing on an encouraging trajectory, at 30% year over year, with a very strong NCA and renewal rate (by value). Sage Intacct in particular has a significantly higher renewal rate by value than 101% and has significantly higher NCA compared to competitors, and this is something that management has noticed across the portfolio but especially in cloud native in North America.

“Yes. Just in terms of Intacct. In North America, that’s still running around 30% growth in broad terms and strong — very strong NCA and also strong renewal rate by value.”

“But just to give you a feel for that, if Intacct North America is running at about 30%, we just reported cloud-native recurring revenue growing at 36%.”

“And so therefore, by definition, you’re seeing Intacct and other cloud-native products running way in excess of 40% growth outside of the U.S. And just to sort of — Intacct now is being rolled out.”

“But everything that we’ve seen in rolling out Intacct to the English-speaking territories 2 or three years ago for the first time, once that ramps up, it drives good strong growth.” 3Q23 earnings update call

If growth picks up speed, I think margin will improve to where it was before, reaching INTU’s level (Sage’s best direct peer). In comparison to its all-time high in the high 20s%, Sage’s current EBITDA margin of 21% is significantly lower. INTU, on the other hand, has an impressive EBITDA margin of 20%+ (near 28%) right now. These two metrics are a barometer of the potential for long-term growth in margins, which I anticipate occurring over the next few years. With a gross margin of 93%, I am confident that operating leverage will drive margin expansion.

Valuation

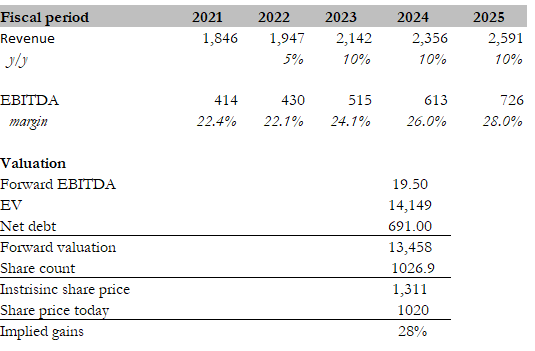

Own calculation

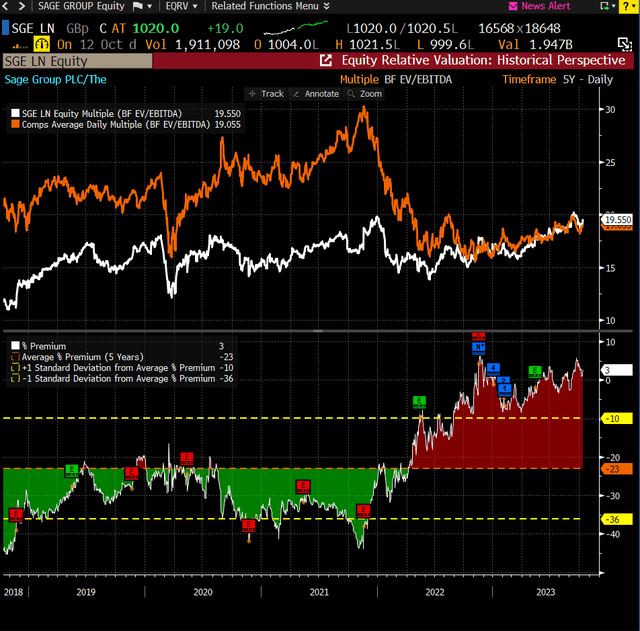

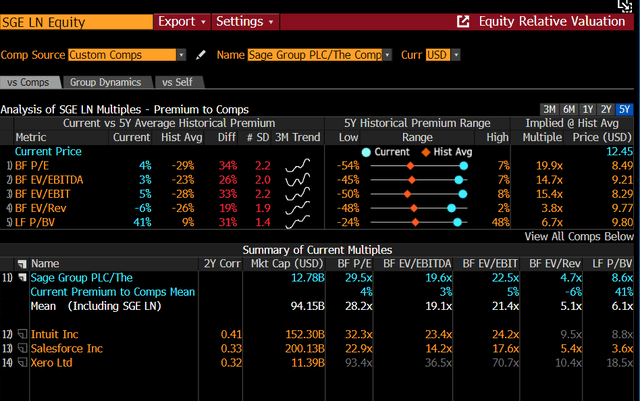

I believe the fair value for Sage based on my model is 1311 pence. My model assumptions are that Sage will grow the business at double digits for the foreseeable future, driven by the strong growth from Intacct. The strong growth will drive margin expansion back to historical levels and be on par with INTU. Historically, SGE has always traded at a discount to peers, given its lower growth profile. However, things have started to turn recently as the market realizes that Sage is on track to accelerate growth, as evident by the closure of the valuation gap. I expect Sage to continue trading at this multiple as it grows.

Bloomberg Bloomberg

Risk

While growth in North America is encouraging, I am worried about Sage’s exposure to small and medium-sized businesses in the United Kingdom in light of recent macroeconomic developments there. Sage receives 20% of its revenue from the UK and Ireland, where 80% of its customers fall into the small segment and 20% fall into the medium segment. If the economy continues to decline, my projected growth rate of 10% or more will be jeopardized.

Conclusion

I recommend a buy rating for SAGE based on the anticipated acceleration of growth and margin expansion. Sage, a leader in accounting, payroll, and payment solutions, is poised to drive higher growth, with a particular focus on North America and its crown jewel, Sage Intacct. The transition from license to subscription models is no longer a growth impediment, and Sage’s cloud-native portfolio is set to flourish, fostering organic growth. The growing share of revenue in North America, with Sage Intacct at the forefront, is a significant driver of growth. Sage Intacct offers compelling benefits, including improved financial processes, automation, and integration with CRM software, enhancing customer engagement. Recent trading updates affirm Intacct’s robust growth trajectory, solidifying its place in Sage’s success.

As growth gains momentum, margin expansion to INTU’s level is expected, leading to long-term margin growth prospects. With a strong gross margin of 93%, operating leverage will drive this margin expansion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here