Elevator Pitch

My Buy rating for Wyndham Hotels & Resorts, Inc. (NYSE:WH) shares remains intact.

I wrote about potential corporate actions for Wyndham Hotels in my earlier July 10, 2023 article. In this new article, I share why I am bullish on WH’s capital allocation approach and the access to capital for the company’s franchisees.

Wyndham Hotels’ franchisees typically work with community banks (rather than larger national banks) for their funding needs, and this gives me confidence that WH can grow its total number of rooms at a decent rate in the future. Separately, WH is allocating capital well, considering its prudence associated with M&As and the company’s willingness to return excess capital. Taking into account the above-mentioned factors, I stay bullish on WH.

Access To Capital

Many companies in the hospitality industry are struggling to expand in the current financing environment, because it is difficult to secure funding for new hotel developments at a reasonable funding cost. This is an area where WH stands out from its rivals and competitors.

In its Q2 2023 earnings presentation, Wyndham Hotels shared that “70% of our new construction starts (for franchisees) are financed with community banks” and highlighted that community banks usually offer “higher LTVs (Loan-To-Value ratios) and fixed interest rate loans” as compared to “regional/national lenders.” As an example, one of the franchisees for WH’s extended stay brand, ECHO, recently obtained a new fixed-rate debt financing with a 75% LTV ratio that matures in five years from a community bank as per Wyndham Hotels’ disclosures at the Q2 2023 results call.

Wyndham Hotels explained at the company’s most recent quarterly earnings briefing that the key “difference between us and some of the peers is the smaller loan size.” It is natural to assume that WH’s larger peers in the hospitality industry will be more reliant on bigger national or regional banks with regards to financing needs for them or their franchisees.

As per a September 7, 2023 speech made by the chairman of the Federal Deposit Insurance Corporation or FDIC, “community banks reported stronger loan growth than the industry” with YoY and QoQ growth rates of +12.5% and +2.6%, respectively in Q2 2023. Community banks are relatively less regulated as compared to their bigger counterparts, which explains why they have managed to achieve above-average loan expansion. This serves as an illustration of the advantage that WH enjoys over its competitors, because of its focus on community banks as opposed to regional or national financial institutions.

WH noted in its second quarter results presentation that the company is targeting to generate a bottom line CAGR of between +8% and +14% for the long run. The two major drivers for Wyndham Hotels are room growth and cash flow deployment, which are each expected to account for +3%-5% earnings growth for the company in the long term. RevPAR (Revenue Per Available Room) growth, greater scale, ancillary revenues are the other drivers for Wyndham Hotels.

In this section, I have highlighted that WH and its franchisees have an edge in terms of access to capital, which provides support for the company’s future room growth potential. In the next section, I draw attention to Wyndham Hotels’ deployment or allocation of capital, which is the other key driver for WH.

Allocation Of Capital

I am of the opinion that Wyndham Hotels’ capital allocation approach is prudent and balanced.

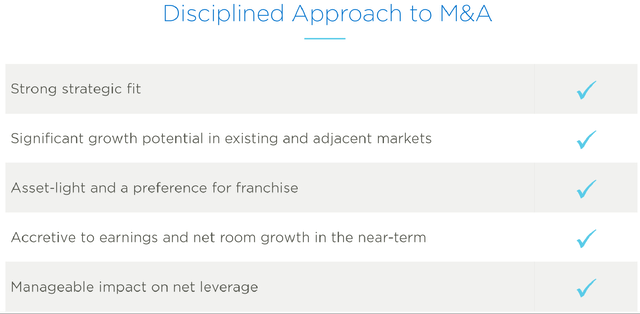

WH emphasized at its second quarter earnings briefing that “we don’t need to acquire, unless it comes across a potential M&A transaction that is “immediately accretive”.

Wyndham Hotels’ M&A Checklist

WH’s Q2 2023 Earnings Presentation Slides

WH will only consider engaging in acquisitions if they meet multiple criteria as presented in the chart above. This shows that the company is very cautious about overpaying for M&A deals that are dilutive and have little synergies with its existing brands and assets. Instead, Wyndham Hotels will always look into the possibility of introducing new brands into the market on its own or with partners as a cheaper alternative to acquisitions. Notably, WH has no specific quantitative targets or guidance relating to inorganic growth or M&A, which ensures that the company isn’t compelled to execute on M&As so as to meet its financial goals.

Separately, WH maintains a good balance between (organic and inorganic) investments and shareholder capital return.

Wyndham Hotels distributed 40% and 32% of the company’s earnings as dividends to shareholders in FY 2021 and FY 2022, respectively. The company is aiming to achieve a dividend payout ratio of 35% for the current fiscal year. These numbers imply that WH has managed to return a reasonably high 30%-40% of its annual net profit to shareholders in recent years, which is an impressive feat.

WH spent $56 million and $109 million on share repurchases in the first and second quarters of 2023, respectively. Wyndham Hotels mentioned at its Q2 results briefing that it executed on a larger amount of share buybacks in the second quarter of this year, because “the stock was trading at a significant unwarranted discount.” Looking ahead, WH stressed at the recent quarterly results call that “it’s fair to expect us to lean in on share repurchases”, assuming that the stock continues to be valued at “a significant unwarranted discount.”

The stock is now trading at 16.3 times consensus forward next twelve months’ EV/EBITDA as per S&P Capital IQ data. In the past three years, WH traded at a mean EV/EBITDA multiple of 23.7 times, and the stock’s peak EV/EBITDA ratio during this period was 37.4 times. Wyndham Hotels disclosed at the company’s second quarter earnings call that it has at least $300 million of headroom that can be allocated to buybacks, before the company comes close to exceeding its financial leverage target. In a nutshell, Wyndham Hotels has the financial flexibility to carry out value-accretive buybacks.

Concluding Thoughts

I retain a Buy rating for Wyndham Hotels. I am impressed by WH’s capital allocation approach and the favorable access to capital for its franchisees, and these key investment merits support my Buy rating for WH.

Read the full article here