Investment thesis

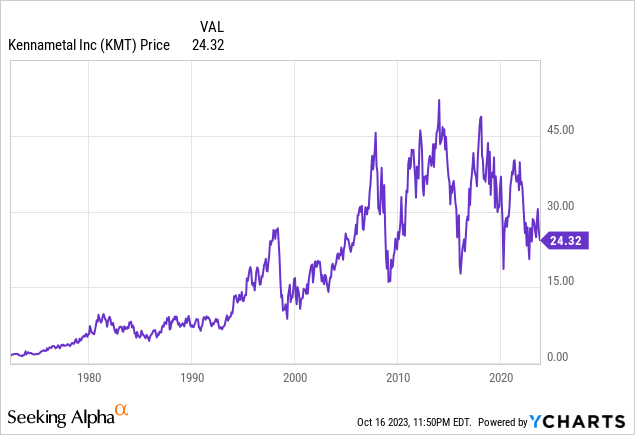

In May 2023, I wrote an article about Kennametal (NYSE:KMT) as weak demand due to weakening consumer purchasing power caused by inflation was spreading concerns among investors at a time marked by growing recessionary fears caused by interest rate hikes. Despite these headwinds, profit margins remained healthy (despite a slight negative impact), and the balance sheet was very strong as inventories and cash and equivalents together were higher than long-term debt, which is why a 49% drop in the share price from all-time highs seemed attractive for long-term dividend investors.

Since then, the share price has declined by a further 9.62% (while the S&P 500 has increased by 5.55%) as inflationary pressures persist while declining volumes have continued to negatively impact profit margins even further, and therefore, the accumulated share price decline from all-time highs is already 54%. Now, the management launched a multi-year strategy aimed at achieving modest revenue growth rates while improving margins in the long run, and a partial emptying of inventories has allowed the debt burden to be slightly reduced. Despite this, very modest revenue growth is expected for fiscal 2024 and 2025 as industrial and construction activity is slowing worldwide while the Chinese economy is not taking off as expected, and therefore, long-term dividend investors who want to enjoy a higher dividend yield on cost in the long term will need to be patient as the dividend remains frozen.

A brief overview of the company

Founded in 1938, Kennametal is a global provider of tungsten carbides, ceramics, super-hard materials, and solutions used in metal cutting and extreme wear applications. It currently enjoys a $1.9 billion market cap as it employs almost 9,000 workers worldwide.

The company is a long-term dividend payer, and a historically low cash payout ratio has allowed it to continuously launch new products on the market, invest in growth and optimization strategies, increase the dividend, and maintain a robust balance sheet, although in recent years it has allocated significant cash to pay down debt, which adds a great component of sustainability to the dividend in the long term.

In September 2023, the company launched its multi-year growth plan, which seeks to break the negative sales trend of recent years now that the debt is at healthier levels. This growth is expected to be achieved through market growth, market share gain, and increasing product prices through fiscal 2027, and the management is again open to the idea of making an acquisition if the opportunity arises. But despite this, recent weak operational performance has caused a significant drop in the share price as the company has a strong cyclical nature.

In this regard, shares are currently trading at $24.32, which represents a 43.49% decline from recent highs in April 2021, and a 53.69% decline from all-time highs of $52.52 reached in January 2018. Although sales have been weak in recent years, high-profit margins and the steady improvement of the balance sheet were drawing a brighter future on the horizon, but the coronavirus pandemic crisis in 2020 and the subsequent headwinds related to inflationary pressures, as well as the current weakening of industrial and construction activity, has forced investors to expect much more moderate growth rates in the short and medium term.

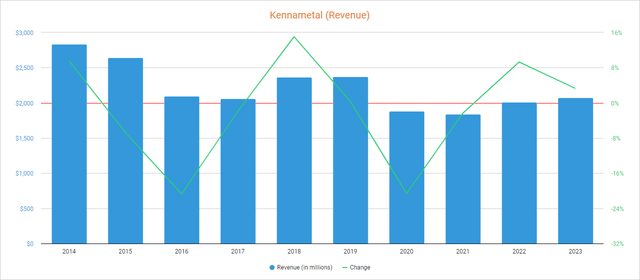

Revenue growth is expected to be modest in the foreseeable future

Certainly, sales performance has not been favorable in recent years, although this has so far been offset by a significant reduction in debt levels and high-profit margins. Furthermore, revenues declined by 20.63% in fiscal 2020 and by a further 2.33% in fiscal 2021 as a consequence of global disruptions derived from the coronavirus pandemic. After a slight recovery of 9.29% in fiscal 2022, sales have increased again by 3.27% in fiscal 2023, despite a 5% foreign exchange headwind, boosted by product price raises as both business segments achieved mid-to-double digit revenue growth rates.

Kennametal revenues (Seeking Alpha)

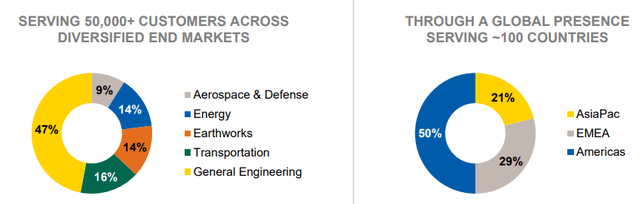

Actually, it is understandable that sales have been weak in recent years considering that the company has significantly deleveraged the balance sheet while focusing its efforts on optimizing operations in order to maintain positive profit margins. Also, another point in favor of the company is that it has a very diversified customer portfolio across different sectors, while sales in the Americas account for 50% and AsiaPac and EMEA account for the other half.

Kennametal diversification (Investor Day 2023 (Presentation))

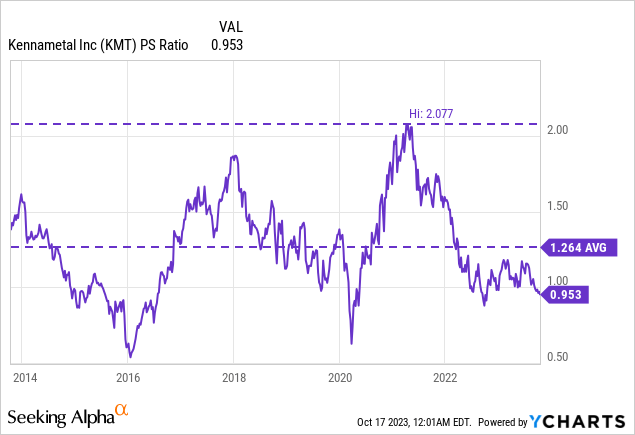

Now, the company’s goal is to deliver organic sales growth of 4-6% CAGR through fiscal 2027. But despite this, growing pessimism among investors coupled with the recent slight recovery in sales has driven the P/S ratio to historically low levels to 0.953, which means the company generates $1.05 in revenues for each dollar held in shares by investors each year.

This ratio is 24.60% lower than the average of the past 10 years and represents a 54.12% decline from 10-year highs of 2.077, which essentially reflects growing investor pessimism as revenue is expected to grow by a modest 2.40% in fiscal 2024 and by a further 3.30% in fiscal 2025 as the construction rate of new aircraft has not yet recovered pre-pandemic levels while the Chinese economy is resuming its activity at a slower pace than expected after coronavirus-related restrictions. Also, inflationary pressures continue to impact operations while declining volumes have added a new component of pressure to both revenues and margins.

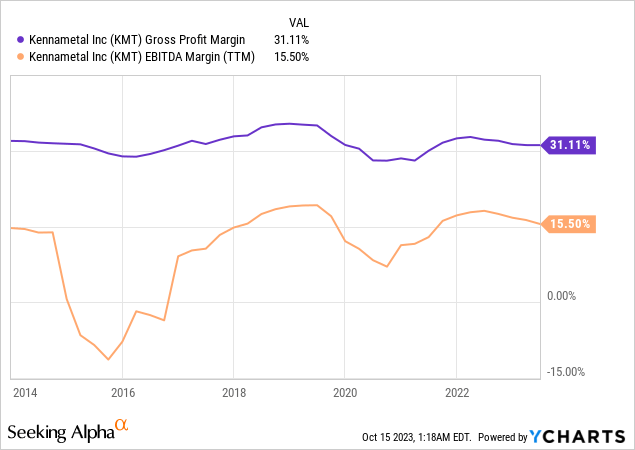

The company is profitable despite recent margin contraction

Despite having suffered significant impacts in fiscal 2020, 2021, and 2023, the company has generally managed to maintain high-profit margins as the trailing twelve months’ gross profit margin currently stands at 31.11% while the EBITDA margin stands at 15.50%, which means that the company is essentially profitable. Still, these margins are still partially contracted due to ongoing inflationary pressures and lower volumes.

As for the fourth quarter of fiscal 2023, profit margins have shown a significant improvement to 31.93% and the EBITDA margin to 15.82% as the company keeps increasing the price of its products in order to offset inflationary pressures, and during the recent multi-year growth plan announcement, the management announced its plan to aggressively cut costs by closing 3 to 5 facilities while optimizing the remainder. From a macroeconomic perspective, although inflationary pressures are expected to ease significantly in fiscal 2024, volumes will likely remain weak due to the recent slowing of industrial, energy, and construction activity, but despite the weaker operational performance, the company keeps improving its balance sheet, which shows that after all, it is a profitable company.

Debt should keep declining as inventories are high

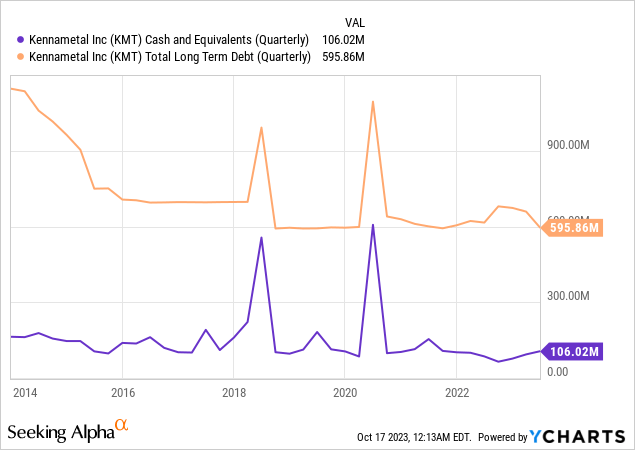

The stagnation of sales in recent years is understandable if we consider that long-term debt has been reduced by 48% to $596 million in the past 10 years, and now that debt levels are more manageable, the management is open to continuing to expand operations through further acquisitions in case the opportunity arises. In fact, net debt would be significantly lower if the company had not repurchased $135 million worth of shares in fiscal 2022 and 2023, which reflects the company has a strong debt reduction capacity.

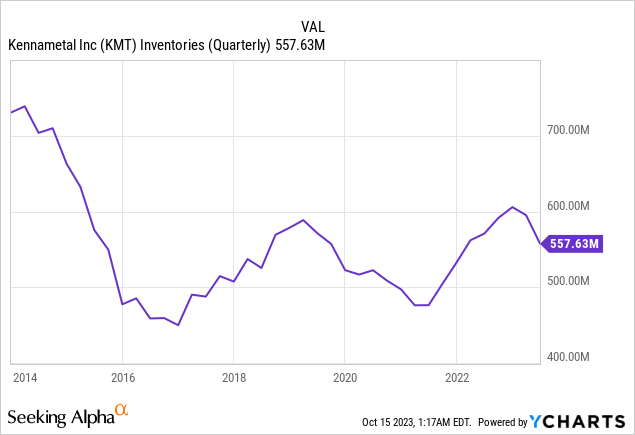

Additionally, inventories have increased significantly since 2016 and are currently high at $558 million, and the management plans to keep converting part of these inventories into cash, therefore, long-term debt is poised to keep declining as long as new acquisitions do not take place.

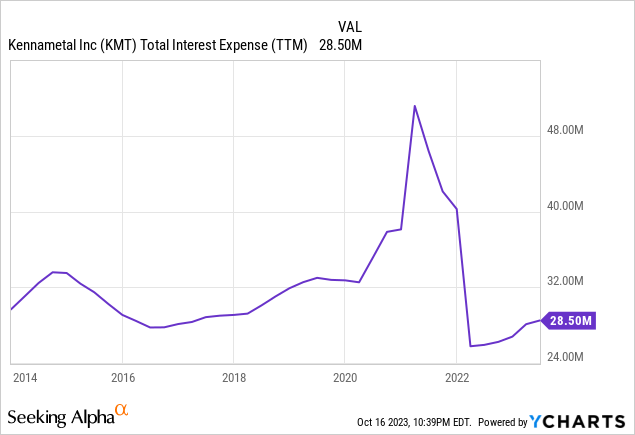

This should allow for a gradual reduction in interest expenses, which are currently at $28 to $29 million per year.

Therefore, some cash is expected to be released in the foreseeable future (in the form of lower interest expenses) as the company keeps converting its inventories into current cash and uses it to pay its debt, although a new acquisition would certainly reverse the long-term debt downward trend in exchange for a growth boost.

The dividend is safe, but will likely remain frozen

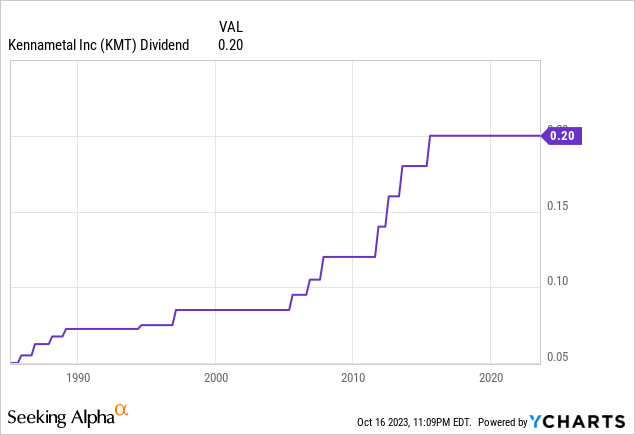

Certainly, Kennametal shareholders have enjoyed growing dividends over the years, although this has always been susceptible to freezes despite a total increase of 135.3% in the past 20 years. The last increase took place in 2015 when the company raised the quarterly dividend from $0.18 per share to $0.20, the point from which the dividend has remained static as the company has been deleveraging the balance sheet and repurchasing shares in recent years.

But even though the dividend remains frozen, the drop in the share price has left a historically high dividend yield at 3.29%, which means that dividend investors with enough patience should enjoy a higher dividend yield on cost in the long term. In my opinion, this dividend yield is quite generous if we take into account that the cash payout ratio has remained relatively low in recent years. In the table below, I have calculated the sustainability of the dividend in recent quarters by calculating what percentage of the trailing twelve months’ cash from operations has been allocated to dividends paid and to cover interest expenses.

| Quarter | Q4 2021 | Q1 2022 | Q2 2022 | Q3 2022 | Q4 2022 | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 |

| Cash from operations (TTM, in millions) | $235.7 | $241.9 | $226.1 | $189.5 | $181.4 | $154.9 | $176.1 | $214.6 | $257.9 |

| Dividends paid (TTM, in millions) | $66.7 | $66.8 | $66.9 | $66.8 | $66.6 | $66.1 | $65.5 | $65.0 | $64.5 |

| Interest expense (TTM, in millions) | $46.4 | $42.1 | $40.3 | $25.8 | $25.9 | $26.2 | $26.8 | $28.1 | $28.5 |

| Cash payout ratio | 48% | 45% | 47% | 49% | 51% | 60% | 52% | 43% | 36% |

As one can see, the company has maintained a fairly conservative dividend approach despite slight declines in dividends paid (boosted by share buybacks) and significant declines in interest expenses. As for the fourth quarter of fiscal 2023, the company reported cash from operations of $131.8 million boosted by an inventory reduction of $37.5 million and an accounts receivable reduction of $6.6 million, while accounts payable also increased by $6.1 million. Without these changes in working capital, the company would have still been profitable enough to cover dividends and interest expenses and generate enough excess cash to cover capital expenditures, which reflects the recent margin improvement. This has allowed the repurchase of $12 million worth of shares as the total number of shares outstanding has declined by 6% since the beginning of the share repurchase program. In this regard, the company spent $85.5 million in share buybacks in fiscal 2022 and $49.3 million in fiscal 2023 in light of recent declines in share prices, which means the dividend could have been raised but the management opted for buying back the company’s shares.

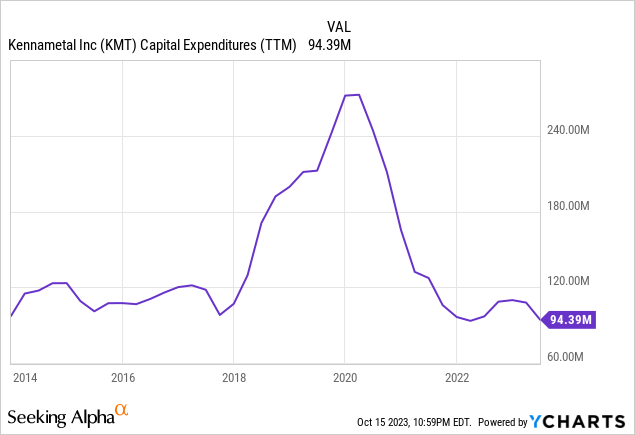

Apart from $64.5 million in annual dividends and $28.5 million in interest expenses, the company also has to cover annual capital expenditures of over $90 million as it has been modernizing its manufacturing facilities in recent years while expanding its portfolio.

Capital expenditures are expected to be in the $100 million to $110 million range in fiscal 2024, which means the company needs to cover a total of $193 million to $203 million in dividends, interest expenses, and capital expenditures during the year. In this regard, the cash from operations that the company has generated in years prior to the coronavirus pandemic, which usually ranged between $200 million and $300 million, along with high inventories and planned reductions in production capacity to improve profit margins, suggests that the company will be able to cover these expenses with relative ease and generate excess cash with which to keep reducing debt and/or continue repurchasing shares.

Risks worth mentioning

While it is true that Kennametal’s long-term risk profile is, in my opinion, quite low thanks to a robust balance sheet with more inventories and cash and equivalents than long-term debt, as well as positive profit margins that allow constant cash generation, there are certain risks in the short and medium term that I would like to highlight.

- The company has a high cyclical component, so any change in the macroeconomic context or any new headwind taking place in the company’s operational landscape could have a significant impact on the share price.

- If inflationary pressures remain for longer than expected or intensify, profit margins could continue to deteriorate even further, and demand could also be negatively affected as a consequence of further weakening in consumer purchasing power.

- Recent interest rate hikes could cause a global recession, which would likely have a significant impact on the company’s operations not only regarding sales but also profit margins due to lower volumes.

- The dividend runs the risk of remaining frozen for more years if operations do not show strong signs of improvement in the short and medium term as the management could (and should) preserve as much cash as possible as long as headwinds continue to impact the company’s operations.

Conclusion

Although the situation for Kennametal is not easy due to the ~$200 million it will have to spend in fiscal 2024 (and beyond) to cover the dividend, interest expenses, and capital expenditures, the company continues to be highly profitable while high inventories are allowing for unusually high cash from operations, which should enable further debt reductions in the coming quarters. Inflationary pressures are expected to ease in fiscal 2024, and the company is planning to significantly cut production capacity in order to improve profit margins, but the risk of a global industrial slowdown is now worsening the company’s prospects as volumes have begun to decline in recent quarters, which explains the total 54% share price decline from all-time highs. Since I wrote the last article, the share price declined by a further 9.62%, which raised the dividend yield to 3.29%, but long-term debt has decreased from $659 million to $596 million, the gross profit margin has increased from 31.33% to 31.93% despite a slight decline in the EBITDA margin from 15.94% to 15.82%, and sales have increased by 2.65% quarter over quarter boosted by price raises. For these reasons, and considering the management is reacting fast to adapt to an environment of lower demand, I strongly believe this represents a good opportunity to add shares to a long-term dividend growth portfolio in order to enjoy a higher dividend yield on cost in the long run.

Read the full article here