There’s never been anything wrong, at least at the top level, with AngioDynamics’ (NASDAQ:ANGO) plan to pivot towards and refocus on higher-growth opportunities in the business like AngioVac, AlphaVac, Auryon, and NanoKnife and essentially “farm” the slower-growing legacy peripheral, vascular, and oncology/surgical businesses for cash flow to fund further growth. Unfortunately, what has been wrong is a long track record of iffy execution, and those concerns remain front and center with this business.

The shares are down another third or so since my last write-up in June, and while it’s true that med-tech in general has been weak and that AngioDynamics’ performance has largely “followed the curve” (and Teleflex (TFX)) over the last few months, the underlying performance is still pretty lackluster. At this point I think there are still valid concerns as to whether this company can achieve its goals, and while the stock looks cheap under 1x forward revenue, cheapness without execution isn’t value.

Growth In FQ1, But Also Some Trouble Below The Surface

AngioDynamics reported 6% pro-forma revenue growth in the fiscal first quarter (for the quarter that ended with the end of August), with over 13% growth in the fast-growing Medical Technologies business and a little more than 2% growth in the slower-growing Medical Devices.

Gross margin declined 20bp (to 50.8%) on a pro forma basis, while adjusted pro forma EBITDA improved by $2M to a small profit of $0.4M.

Within the Medical Technologies business, AngioVac was down almost 8%, while the much smaller AlphaVac business grew just 2%. Auryon posted strong 26% growth, and NanoKnife was strong as well, with disposable growth of over 34% and capital growth of over 41%. Within Medical Devices, core peripheral was down slightly, PICCs were down 10%, Midlines were up 10%, and ports were up over 22%.

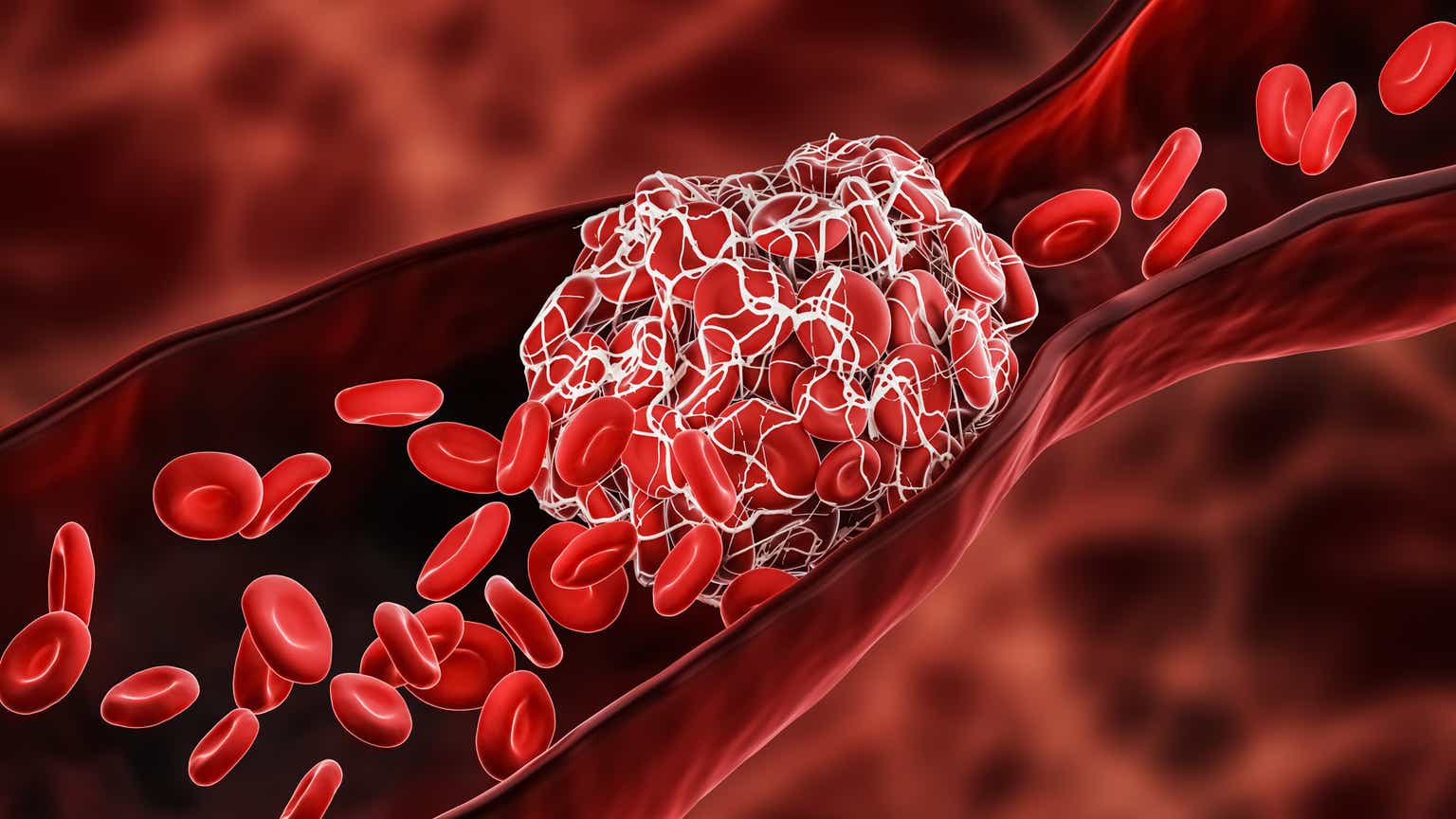

A 6% decline in the thrombectomy business just isn’t good enough, not when Penumbra’s (PEN) vascular business is growing over 20% and Inari (NARI) is growing close to 30%. Are those entirely fair comparisons? No, given that AngioDynamics doesn’t have the same breadth of product approvals/labeling, but the fact remains that a growth business shouldn’t be shrinking, particularly when issues like staffing are no longer as limiting as they were.

I feel better about Auryon. Benchmarking this company is a lot harder now given that most peripheral atherectomy businesses are buried within larger companies, but Shockwave (SWAV) continues to grow strongly (well ahead of Angio, but again not an entirely fair comparison) and Philips (PHG) did mention double-digit growth in its image-guided therapies business (which houses its laser atherectomy business).

The legacy core operations are not so impressive either. The 10% decline in PICCs came against an easy comp (down 7% in the prior year) and it seems as though Becton, Dickinson (BDX) and Teleflex continue to take share here. Likewise, the midline and port growth came on easier comps (down 13% and 8%, respectively, in the prior year), and I just don’t see a lot of core strength here despite a healthier overall environment for procedure counts.

… And Now What?

Unfortunately I don’t see a lot of near-term drivers for the business.

Whatever is bedeviling the thrombectomy business isn’t going to improve right away, and the launch of AlphaVac into the pulmonary embolism market (a large, growing market worth perhaps more than $2B) won’t occur until summer of 2024 at the earliest – and then the company has to prove it has the data and sales acumen to drive procedures to its platform.

Likewise, NanoKnife needs clinical data to take the next step. The company has completed the enrollment of the PRESERVE study, but the primary endpoint requires one-year follow-up, so we’re likely at least 18 months from a potential FDA event that could drive meaningful acceleration.

I’m not as concerned about Auryon in the near term – peripheral vascular disease remains a significant market opportunity and this is a credible solution, but I don’t think the company will keep pace with Shockwave and I’m concerned that Abbott (ABT) could make Cardiovascular Systems a more meaningful competitor. I’d also note that part of the growth plan for Auryon involves moving into markets like small-vessel deep vein thrombosis where a laser atherectomy approach may be a tougher sell against Penumbra/Inari’s aspiration-based approach.

Meanwhile, the core business isn’t exactly replete with drivers. Underlying procedure volumes should be positive, but if the company is losing share to larger players in access products, that’s going to be a challenging headwind.

The Outlook

I think the bullish thesis on AngioDynamics is that thrombectomy (particularly AlphaVac) is going to accelerate meaningfully from here in 2024-2026 with new approved indications, and likewise with Auryon and NanoKnife. On top of that, the company will use its clean balance sheet to pursue more growth-based M&A.

Okay, that’s all fine as it stands. The trouble is that investors have heard this before, with many products under AngioDynamics’ roof having a bright future in their past. That slowdown in thrombectomy dredges up some unpleasant memories of former would-be growth drivers, and it’s incumbent upon management to return these businesses to growth while also continuing to drive the growth of Auryon and NanoKnife (particularly if the NanoKnife clinical studies are supportive).

Even here, though, I see risk. I’m bullish on the prospects for NanoKnife’s PRESERVE study to show good outcomes, but the study was contemplated before improved radiation oncology technologies really started ramping up, and I’m concerned that a prostate cancer indication will struggle to gain traction unless the data are really compelling.

I’m still looking for around 4% to 5% long-term revenue growth from AngioDynamics. I’ve kept my FY’24 revenue estimate where it was (a bit below management’s guidance range) as FY’23 was basically in line with my expectations and the recent quarters haven’t argued for a big upgrade. Likewise, management’s guidance largely captures the margin improvement I was already modeling; I’m looking for low single-digit EBITDA margin in FY’24 improving toward the high single-digits over the next five years.

I’ve cut back my longer-term free cash flow margin estimates, as I really need to see evidence of sustained improvement (including double-digit adjusted EBITDA margin) before thinking that low-to-mid double-digit FCF margins are really a viable target.

AngioDynamics looks reasonably valued on discounted cash flow, but that’s a tricky valuation approach for what should be a growth med-tech story. Using a multiples-based approach is likewise problematic. With revenue growth where it is, the margins are a limiting issue and it will be tough to break out much beyond 1.0x to 1.5x revenue until better growth and margins are established. That still leaves a fair value in the $9.50 to $13.50 range, though.

The Bottom Line

As undemanding as the valuation appears, I still have real concerns that AngioDynamics could be a value trap. High single-digit pro forma revenue growth in FY’24 could be enough to change sentiment in a few quarters if margins continue to improve, but this is a stock thesis that really needs execution. I’d be happy to be proven wrong and have to upgrade my estimates in the coming months, but until I see beat-and-raises, it’s tough to get bullish even with the apparently low valuation today.

Read the full article here